Summary:

- Before its last stock split in 2022, there were talks of Tesla, Inc. possibly paying a dividend.

- Although paying a dividend does not seem to be a priority for Tesla, this could be a possibility in the future.

- Tesla’s balance sheet is healthy, with a strong cash balance and low debt, which could support future dividend payments.

- If the EV giant does conduct another stock split, maybe shareholders could finally see a dividend come to fruition.

- The company has managed positive cash flow and decreased its debt significantly over the last four years.

Gearstd/iStock via Getty Images

Introduction

I know what everyone is going to say. Tesla, Inc. (NASDAQ:TSLA) is a growth stock, not a dividend stock. Similar to two other popular stocks amongst investors, Amazon (AMZN) and Apple (AAPL). Along with Meta Platforms (META), these are some of the most recognizable businesses in the world. And for good reason. In my opinion they all offer investors high growth, and I view them as long-term holds. But as solely a dividend investor, which you can tell by my name, I don’t hold any of these in my portfolio.

Out of the big four, only one pays a dividend, and that’s AAPL. I wrote an article on them last month stating that the dividend yield was too low for a stock that generates the kind of cash flow the tech giant does. I understand many investors don’t hold AAPL for the dividend but for the growth. Some say it’s not even considered a dividend stock. While I agree many investors don’t hold them for the dividend, it is indeed a dividend stock. It pays a quarterly dividend so by definition it’s exactly that.

But enough about Apple. I’m not sure if many readers remember when billionaire Elon Musk stated he wanted to pay Tesla shareholders a dividend. But I do! I was once a shareholder in the electric vehicle (“EV”) company, but sold to focus on building a stream of income to live off within the next several years. And I know although some companies do not pay a dividend, investors often create their own synthetic dividend.

I’m well aware of this strategy, and even though it may work for some, I’m not a fan. I buy my stocks with the purpose of holding them forever unless the fundamentals change or the stock is severely underperforming in my portfolio and I see a better opportunity elsewhere. If the EV giant does indeed decide to pay shareholders a dividend, I might reconsider buying.

Where’s The Dividend?

In March of 2022, there were talks that Tesla would ask at its annual shareholder meeting for an increase in the number of authorized shares in order to enable a stock split of the company. This would be the second time in 2 years, only this time so the EV maker could possibly pay a dividend. In August of the same year, Tesla completed a 3-for-1 stock split and after the dividend talks went silent.

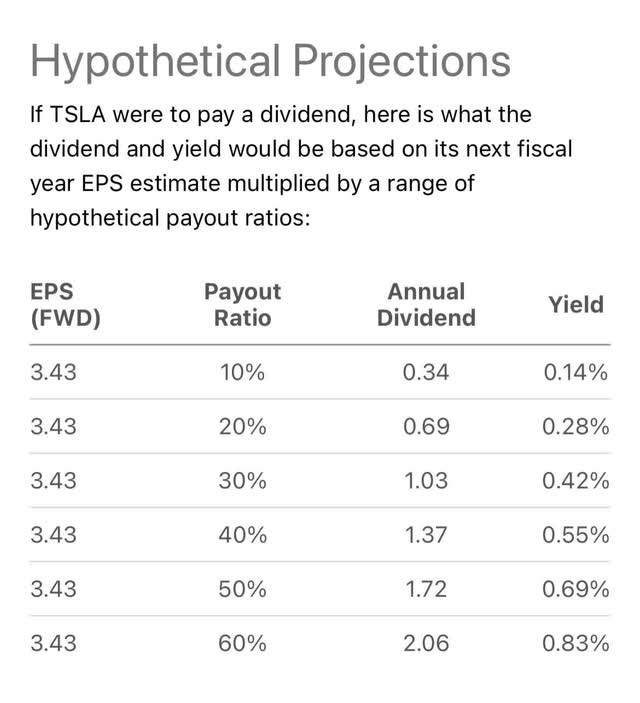

Little more than a year a half later, still no dividend. And it doesn’t seem like paying a dividend is a priority for the company, either. To be fair, Tesla is still in its growth stages, so a dividend in the near future doesn’t seem all that likely. See below for Seeking Alpha’s dividend estimates. As you can see, the stock would have a very low yield, similar to that of Apple’s.

Can Tesla Support Paying A Dividend?

To be honest, I don’t think CEO’s like Warren Buffett and Elon Musk are fond of their companies paying dividends. Berkshire Hathaway (BRK.B) is another company with a huge cash flow that doesn’t pay a dividend. But one thing for sure is that they love collecting them! Warren Buffett is an avid dividend collector like myself. Only difference besides the spelling of the name is the amount he collects. The amount I collect in comparison is minuscule. He has many decades of collecting dividends ahead of me. But enough about that.

There are many companies that pay dividends and many that do not. In the current macro environment, dividend collecting has seemingly become more attractive. With the FED still battling inflation and food & gas prices still soaring, collecting a check every week or month can help soften the blow.

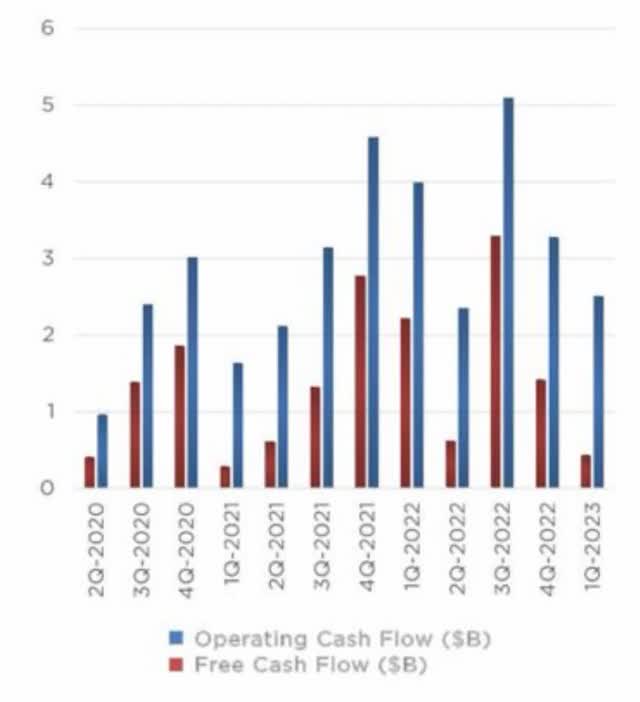

As big as TSLA is, it still had its fair share of problems in 2022. From high interest rates to forced shutdowns. Additionally, the EV maker saw its operating cash flow decrease Q3 ’22 to Q1 ’23. But despite that, Tesla delivered over 1.3 million cars and achieved a 17% operating margin, the highest among any volume carmaker. They also generated $12.5 billion in net income and $7.5 billion in free cash flow.

And while CAPEX has doubled over the last two years, the company has managed to triple its cash from operations during the same time. Tesla grew its CFO from $5.9 billion in 2020 to $14.7 billion at the end of 2022. In 2021 the EV maker’s free cash flow (“FCF”) was roughly $5 billion. This is a testament to Tesla as a company, because having positive free cash flow in a capital-intensive business, that also invests massive amount of its money into new technology, isn’t easy. Especially in the current environment, so it’s obvious they’re doing something right.

Dividend Forecast

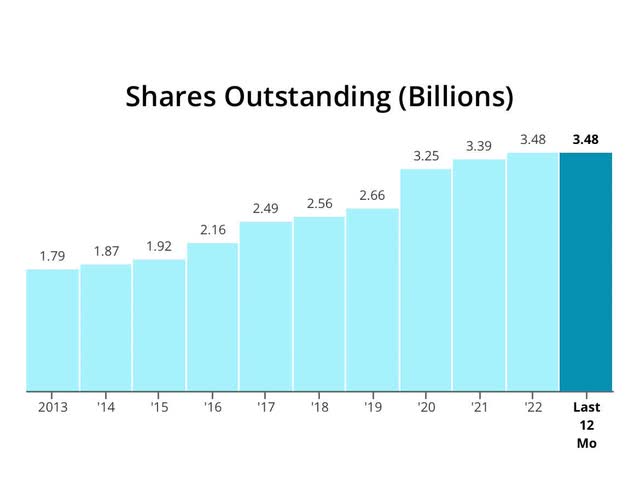

Hypothetically speaking, using the middle of Seeking Alpha’s projection, and giving them a dividend yield similar to AAPL, if TSLA did decide to pay an annual dividend of $1.37, that would equal a quarterly dividend of $0.3425 a share. With 3.48 billion current shares outstanding, this would equal a payout of almost $1.192 billion a quarter.

To put this into perspective, TSLA’s FCF for the last two quarters were $0.4 billion in Q1 and $1.0 billion in Q2. Now, I’m not saying that TSLA would pay a dividend that high if they did decide to pay one, I just used the annual $1.37 hypothetically because it was similar to AAPL and both are considered high-growth businesses. I assume that they would start with a very small dividend of $0.25 or less if they did decide on rewarding shareholders due to the capital-intensive nature of the business.

Growth Ahead

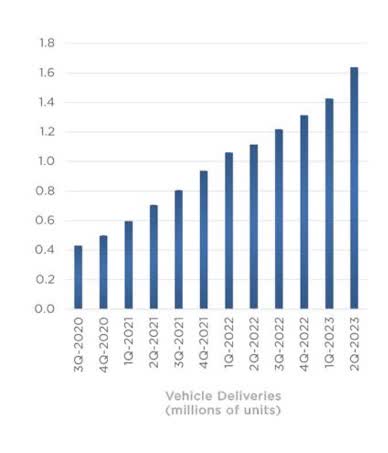

During Q2 earnings their CEO Elon Musk stated that the company achieved record vehicle production and deliveries, and record revenue of about $25 billion in a single quarter. Additionally, the Model Y became the best-selling vehicle globally of any kind in Q1, surpassing the Toyota (TM) Corolla. They are also expecting to deliver the highly anticipated Cybertruck in Q3. And although they are expecting Q3 production to be down due to factory upgrades, they’re still expecting to deliver 1.8 million vehicles this year.

This is an increase of 38.46% year-over-year. As you can see, TSLA has continued to increase its production and vehicles quarter-over-quarter since Q3 of 2020, and I see this moving forward. Due to rising costs in gas and the demand for electric cars, I see Tesla continuing to dominate the EV space for many years to come. By 2030 it is expected EV’s will omit the need for 5 million barrels of oil a day. This trend also has a positive effect on battery production and supply chains. And with investments into artificial intelligence and the Tesla Megapack, these will continue to be profitable contributors for the company.

TSLA investor presentation

Healthy Balance Sheet

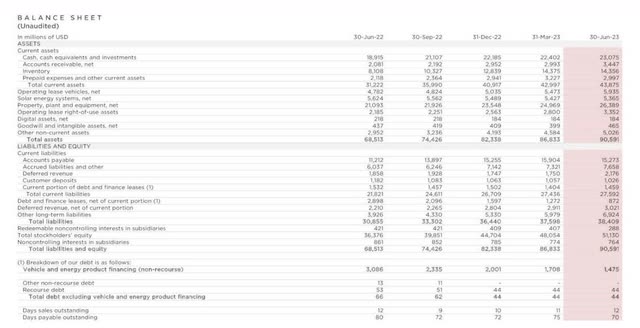

One thing I don’t believe gets talked about enough with Tesla is their balance sheet. The amount of debt a company has can be a huge factor in dividend payments and growth. A high-quality company with too much debt on its balance sheet will most likely focus on paying it down before committing to a dividend.

Tesla’s balance sheet further affirms its quality, especially in the current high interest rate environment. A lot of fast-growing companies will often take on a lot of debt to fund their growth, but TSLA has avoided this which speaks volumes to their CEO Elon Musk and his team.

One thing that’s impressive is how the company has managed to increase their cash balance while simultaneously decreasing their debt load over the last year. This time frame includes the fastest rate hike in history and production of the Cybertruck. At the end of Q2 TSLA had over $23 billion in cash with just $872 million in debt. To put this in perspective, this has decreased from $2.8 billion year-over-year and from $11.6 billion in 2019. The company has essentially become debt-free over the last 4 years while maintaining positive cash flow during the same period. So if the company did decide to surprise shareholders with a dividend, one thing they wouldn’t have to worry about paying back is debt.

Risks

Although the company doesn’t have to worry about refinancing a huge debt load at higher rates like many other companies, the current macro environment has affected them. High interest rates and the threat of a recession take a toll on consumer spending as seen by the high credit card debt. Recent data from the Federal Reserve showed American credit card debt soared to $1.3 trillion in Q2 of this year. Furthermore, the average credit card interest rate was 22.16% in May. And while most consumers don’t buy cars with their credit cards, this does show that many are allocating their funds elsewhere, which leaves less room for spending on items like Tesla cars in the near-term.

So in short this reduces the affordability of cars. And this has forced Tesla to lower its cost because the interest payments actually increase the price of the car. All the while things such as production costs and the price of raw materials continue to rise. Then there’s the expected Q3 volume decline due to factory upgrades. All of these I consider short to medium-term headwinds but headwinds nonetheless. As the economy stabilizes over the next several quarters I expect production to pick back up and the highly anticipated Cybertruck to become a massive hit with customers.

Valuation

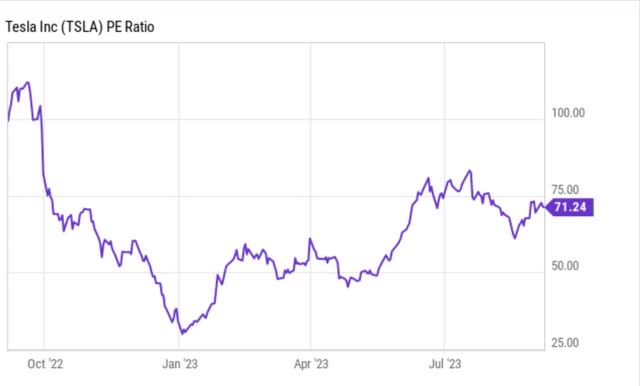

One thing that has always been associated with Tesla was the word overvalued. I honestly don’t remember a time when it wasn’t. The stock currently has a P/E ratio of 71.24 at time of writing making it extremely overvalued. Exactly a year ago on September 8th, the stock was trading at $289 and has since seen its price decline by roughly 8.2%. The time to buy this stock was at the beginning of the year when it reached a price of nearly $100. With an average price target of $252 I just don’t think it offers investors enough margin of safety at the current price.

With tax-loss harvesting season coming soon investors may just get a chance add on a pullback in price, although I can’t see the price dropping that low. With its recent stock split history who knows, maybe the company will split its stock again in 2024. In the last 3 years the company has done two stock splits, once in 2020 and once in 2022. Known for its overvaluation, I wouldn’t be surprised to see another in the near-future.

Conclusion

Although many don’t invest in Tesla with hopes of the stock paying a dividend, in 2022 there were brief talks of the company paying one. Since then I haven’t heard talks of any kind in reference to this. It could still be a part of the EV giant’s future plans, I don’t see this happening anytime soon as the stock is focused on growth.

Although TSLA is a capital-intensive business, the company has managed to grow its free cash flow and decrease its debt over the last several years, which is impressive. With two stock splits in the last three years and the continued growth of the company, maybe investors could potentially see the dividend talks come to fruition over the next few years.

For those looking for growth, I think TSLA is a great addition on a pullback closer to the $200 price range or with another stock split. With tax-loss harvesting season approaching soon and a looming recession, investors could see the stock’s price fall over these next several weeks potentially offering a more attractive entry price for those looking to invest. Although quality normally trades at a premium, TSLA’s P/E of 71 is unjustifiable. As previously mentioned the stock is normally always overvalued since it is very popular amongst investors. I do see the company continuing its dominance in the EV space for many years to come.

If Tesla, Inc. does decide to conduct another stock split and implement a dividend, I will most likely open a position. Until then, I rate TSLA a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.