Summary:

- Visa’s financials are solid, making it a good contender for long-term investment, but the current price is too high.

- Revenue growth in international markets, particularly in Latin America, is expected to be sustained and benefit Visa.

- Proposed legislation could negatively impact Visa’s dominance in the transaction world, but the company’s financial position is strong.

Justin Sullivan

Investment Thesis

I wanted to take a look at Visa Inc (NYSE:V) to see if right now it would be a good time to add it to my portfolio. The company’s about to report FY23 numbers also. Visa’s financials are very solid and is a good contender for a long-term investment, however, the price for me right now is a bit too high, and I would be looking for a pull-back before starting a position here. A decent contender for some options plays while waiting for the price to come to me and lower my cost basis.

Outlook

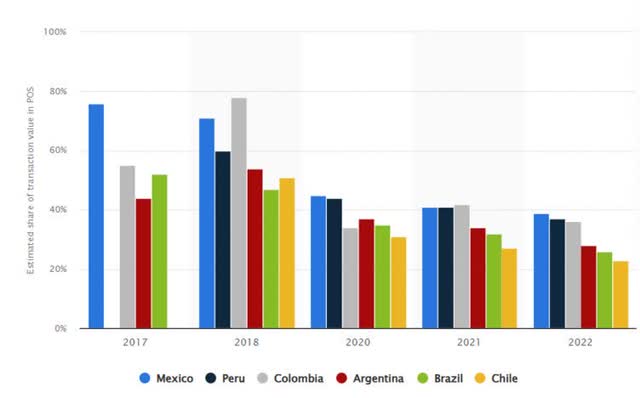

I believe that the revenue growth in international markets is going to be sustained for a long time and will be in the double digits. A lot of countries in Latin America still rely on cash transactions. That is starting to change quite a bit, however, there is still a long way to go, which is a positive for a market leader like Visa.

Reliance on cash transactions (Statista)

According to Statista, Latin American countries Like Mexico and Brazil are fighting for the lead when it comes to the E-Commerce market in the region. All the countries above will make up around 20% of total retail by ’26. MercadoLibre (MELI) has played a significant role in digitizing transactions in the region. The region has been growing very quickly in recent years and the pandemic has fueled the transformation even further, with the transaction value of digital commerce expected to increase by 75% by 2025. How many of those transactions are going to be routed through Visa is another question, but I would venture a guess it’ll be a substantial share.

Another not-so-positive outlook I found is the proposed Big-Box Bill or the Card Competition Act, which would force big banks to offer merchants credit-card processing alternatives to Visa or Mastercard (MA), which supposedly will lower transaction fees for consumers. In theory, this sounds all good, however, a lot of the time, like in the past, merchants never actually passed on the savings to consumers and just raked in profits. The reintroduced bill has not passed yet, and it may never be passed, however, if it does somehow, this will affect companies like Visa which dominates the transaction world quite negatively. The bill also means that merchants will be able to hunt for the lowest fees, no matter the reputation of the network, while the consumer may think that their transaction is going through a well-established, trusted network like Visa, and that exposes these transactions to more fraud risk. I would rather use Visa than rely on some bill that supposedly lowers my fees when in reality, the merchant will probably keep the savings to themselves.

Financials

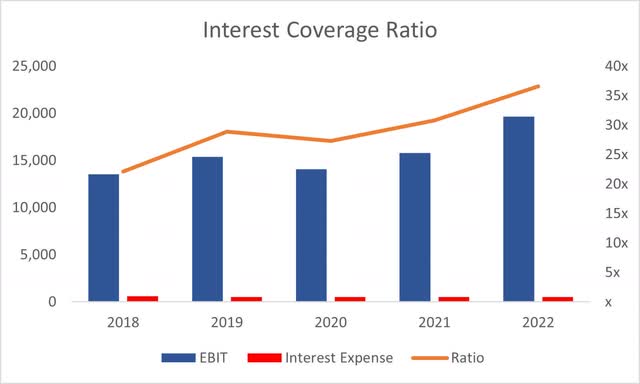

As of Q3 ’23, the company had around $15.5B in cash, which hasn’t changed much since FY22, against $20.5B in long-term debt. For a company that makes over $18B in cash from operations and around $20B in EBIT, debt is not an issue in my opinion. The interest coverage ratio has been at around 30x in the past, which means that EBIT can cover the interest expense on debt 30 times over. I think it’s safe to say Visa is at no risk of insolvency.

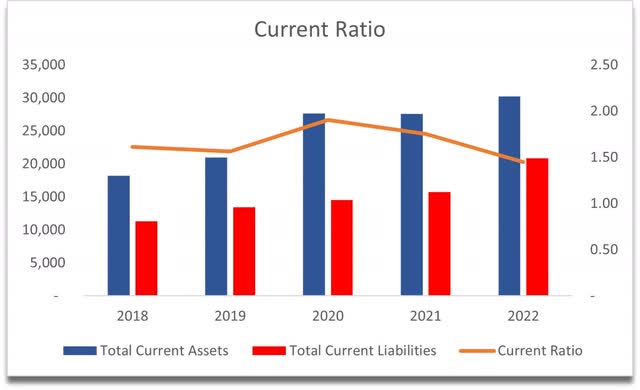

Visa’s current ratio has been right at around what I call an efficient range, which is 1.5-2.0, which tells me that the company is utilizing its cash pile efficiently and not hoarding it for no reason and still has the ability to pay off its short-term obligations easily. Visa has no liquidity issues.

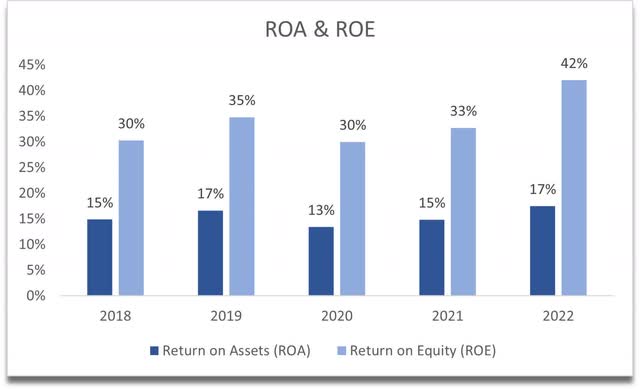

In terms of efficiency and profitability, ROA and ROE have been fantastic over the years, and it doesn’t look like it’s getting any worse with time. The management is utilizing the company’s assets and shareholder capital very efficiently, and the returns are well above my minimums of 5% for ROA and 10% for ROE.

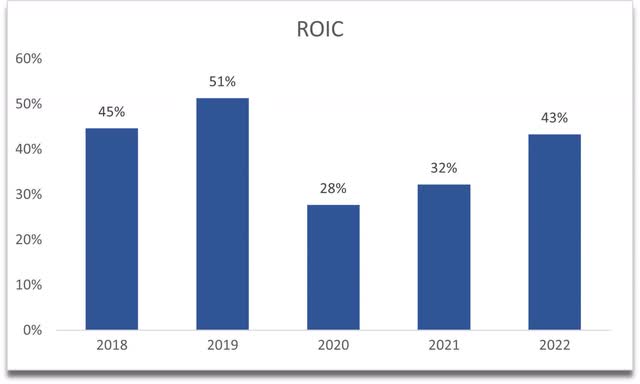

The company also has a very good return on invested capital and well above my minimum of 10%. This is what I would pay a premium for because it tells me the company has a strong moat and a competitive edge in the business. Even during the pandemic, the company managed to achieve strong returns.

Visa has impressive margins, and it is very hard to imagine how it could improve on them in the future. But from looking at the analysts’ estimates, the company is going to be even more efficient going forward.

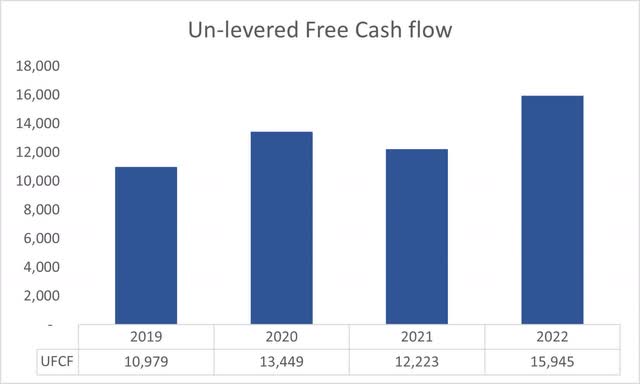

Visa also generates very strong unlevered free cash flow, which is the cash flow that is available to all stakeholders. Debt holders and equity holders. The figure seems to be gradually rising also, which is good.

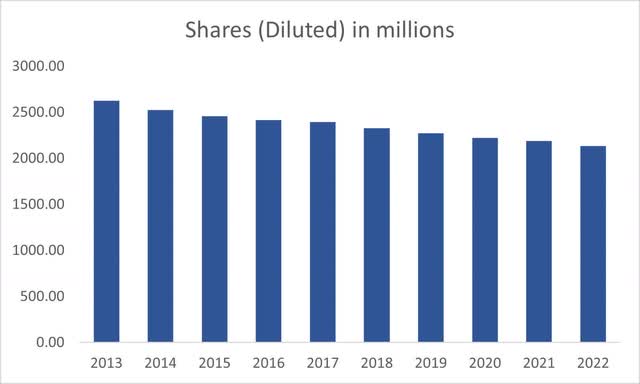

The company has been steadily decreasing shares outstanding over the last decade also, however, if the shares are not cheap this isn’t necessarily a good thing because the cash used to buy back the shares may have been used to pay a dividend or to expand operations.

Overall, the company has a very clean balance sheet and is in a very good position financially. I did not see any red flags. Solid liquidity, competitive advantage, and a strong moat call for a premium on shares in my opinion, so let’s look at what I would be willing to pay.

Valuation

The company has been around for quite a while now; however, I don’t see how it cannot maintain the same growth momentum as it has experienced in the last decade, especially since more and more countries are becoming more advanced and rely on cashless transactions than ever before.

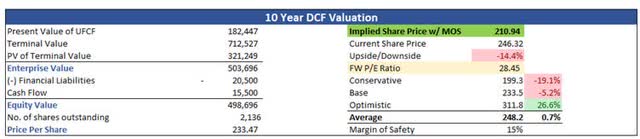

I still decided to be on a conservative end with my assumptions, so for the base case, I went with around 8% CAGR for the decade. For the optimistic case, I went with around 12% CAGR, while for the conservative case, I went with around 6% CAGR to give myself some possible outcomes.

In terms of EPS, I decided to grow these by around 9% a year, from $8.66 in FY23 as Seeking Alpha estimates, to around $19.2 by FY32.

On top of these estimates, I will add a 15% margin of safety for extra cushion. With that said, I believe a good risk/reward price is around $210 a share, which implies the current stock price is a little expensive for me.

Closing Comments

The company is a leader in transactions and is a company that should be in many people’s portfolios at one point or another. Right now, I believe a 15% pullback would be ideal and not out of the realm of possibilities if we are going to see further volatility in the markets. It is very close to my desired risk/reward profile, and I will be waiting patiently for it to come to me.

I may be looking at selling some put options at around 210 or 215 strike price and around 40 days out and collecting some money while waiting. The credit received is not that much, however, it is still money, and you get paid while waiting for your PT at which you are comfortable owning the stock for the long run. This also lowers your cost basis a little bit. Sounds like a win-win.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in V over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.