Summary:

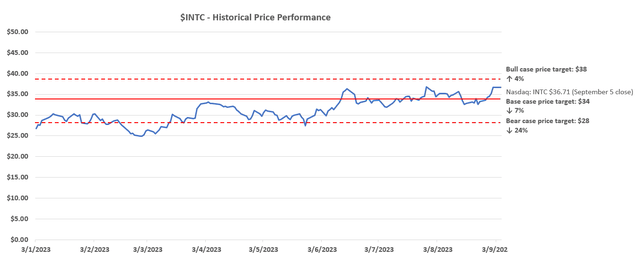

- The Intel stock has struggled to rally past the $36 range this year, reflecting investor wariness over the company’s capital-intensive turnaround strategy.

- The demand environment in Intel’s core end markets remains mixed, which clouds prospects over growth reacceleration and margin expansion.

- Intel’s accelerated computing portfolio also faces roadblocks to adoption, which could limit its participation in AI tailwinds.

Justin Sullivan

Despite outperforming expectations during the second quarter, the Intel stock (NASDAQ:INTC) has struggled to rally out of the high $30 range. Even CEO Pat Gelsinger’s recent optimism – including an update on Q3 revenue surpassing midpoint of guidance, and securing prepayment for 18A foundry capacity from a notable chipmaker (or “whale”, as management calls it) – has been a modest needle-mover. This likely continues to reflect investors’ wariness over the prospects of Intel’s capital-intensive turnaround strategy.

Although the company’s fundamental performance and market share gains have been gradually trending in the right direction, they remain a far cry from the level of progress needed to bolster its competitive advantage against peers – especially considering the increasing capital intensity on IDM 2.0 as previously discussed. We believe IDM 2.0 remains the bigger risk piece weighing on the stock’s prospects that near-term fundamental outperformance can do little to compensate for in our opinion.

In the following analysis, we provide a quarterly refresh on our views over Intel’s near-term outlook – including consideration of its Q3 performance to date as shared through CEO Pat Gelsinger’s optimistic commentary in late August. We remain cautious of risks to Intel’s second half optimism, considering a mixed PC demand outlook reflected by end-market observations, as well as a rapid shift to accelerated computing that might derail its data center roadmap. Looking ahead, incremental upside potential over the next 12 months will likely be limited by a mixed demand environment in Intel’s core end markets, as well as a modest pace of margin expansion that lacks durability from growth at scale.

Mixed Demand Outlook

Despite Intel’s strong Q2 outperformance and current period sales that have already exceeded the midpoint of guidance (+3% q/q; -13% y/y), the company still faces a largely mixed demand environment in its core end markets.

Uncertain PC Market Recovery

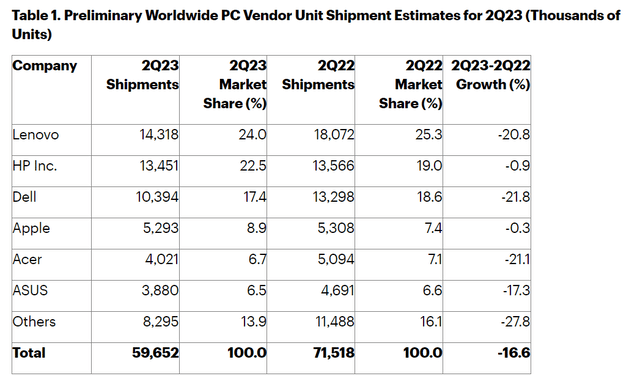

While Intel management has repeatedly expressed optimism for a 2H recovery play in the PC market, industry feedback remains mixed. Although market data that tracks PC shipments, as well as Intel and peers’ client computing hardware sales are pointing to sequential improvements in Q2 that indicate a slump that has troughed, the reacceleration of end market demand has largely been slower than expected.

Market leading PC makers spanning HP (HPQ) and Dell (DELL) – which are also some of Intel’s largest client computing customers – have cited job cuts and the broadly cautious consumer and enterprise spending environment as key challenges to demand recovery and, inadvertently, the inventory normalization timeline, tempering market expectations for a 2H turnaround. Similarly, key Intel customer and PC operating system leader Microsoft (MSFT) also sees “no significant changes to the PC demand environment” over the next 12 months due to adverse impacts on hiring in the enterprise spending segment. The Windows operator also cited “earlier back-to-school [PC] inventory builds that were pulled into the [June] quarter” this year, which potentially means modest seasonal-driven demand for hardware from Intel heading into the second half. This offers little respite in the near term for a structural shift away from the industry’s cyclical downturn.

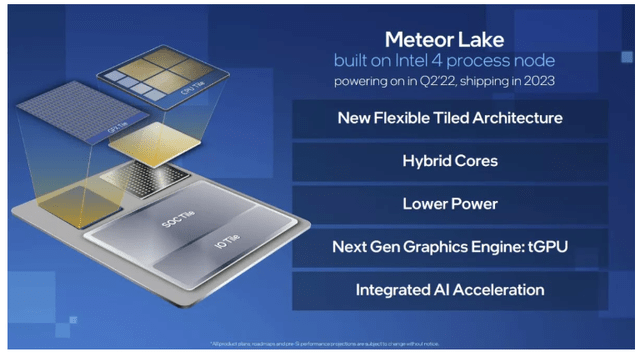

Looking ahead, we view the timely shipment of Meteor Lake expected later this year as critical for Intel’s client computing segment. Meteor Lake, which marks the 14th generation of Intel Core processors and the first to be manufactured on the Intel 4 process, is already ramping up production, with product release qualification slated for later in the current quarter and initial shipments to follow. On time shipment will be crucial for Intel to capitalize on the early PC market recovery window, complemented by an upgrade cycle that will likely pickup its pace next year.

Markets are also expecting additional details on the performance of Meteor Lake – particularly on what “integrated AI acceleration” entails – heading into Intel’s annual Innovation conference later this month. With industry participants highlighting the latest surge of AI interest as a key driver for the impending upgrade cycle, further detail on Meteor Lake’s AI capabilities will make it a competitive offering. It will also be a key differentiating factor amid intensifying competition, as rivals like AMD (AMD) have already rolled out next-generation PC hardware like the Ryzen 7040 CPU series, which features Ryzen AI optimized for AI tasks.

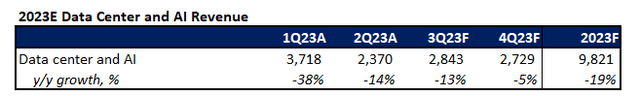

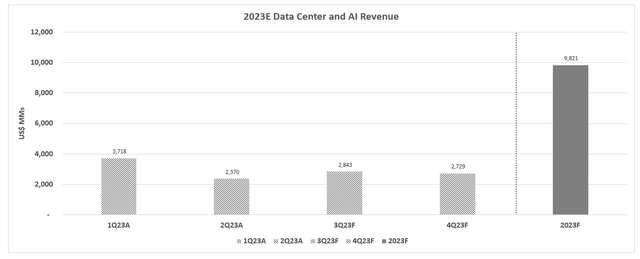

Data Center Demand is Ceding Resilience

In addition to the PC market, the previously resilient data center server processor market is also losing ground to increased spend allocation towards AI accelerators. This is largely in line with Intel’s caution over data center inventory indigestion during the Q2 earnings call, which is likely to persist through the remainder of 2023. Management has also highlighted in a recent interview that Sapphire Rapids’ TCO is not as competitive from a TCO perspective, which is currently a top priority for optimization-focused customers (e.g. hyperscalers). And the company is not expecting a meaningful shift from this setback until Granite Rapids and Sierra Forest based on the Intel 3 node launches next year. This means the ensuing revenue benefit likely will not materialize until late 2024 to 2025.

I don’t think we’re out of the woods yet in data center. Sapphire is a good part but it doesn’t address customers’ needs in all cases from a TCO perspective…Emerald will come out later this year, that will be a good step in the right direction. But really, it’s when Sierra Forest and Granite come out in ’24 on Intel 3 that we think can really start turning the corner on a product performance basis. And then I think we have a real opportunity to improve our market position from here on.

The emerging headwind to Intel Xeon Scalable take-rates is also consistent with AI leader Nvidia’s (NVDA) recent warning that “demand related to general purpose CPU infrastructure [will] remain soft” given the rapid transition to accelerated computing to facilitate increasingly complex and massive AI workloads.

Intel’s answer to the looming challenges over server processor demand, which could become structural in the transformational shift to accelerated computing, is the Gaudi series. The company currently markets its Gaudi2 accelerator as the “only viable alternative to H100 for training large language models” – with H100 referring to Nvidia’s best-selling and hard to come by AI processor in the market right now. Gaudi2 demand has also dominated Intel’s other offerings such as the Flex Series GPU and Max Series processors (CPUs and GPUs) optimized for high-performance computing and AI workloads. Intel has indicated optimized Gaudi2 performance and TCO when paired with its Sapphire Rapids server processor, pushing to drive complementary demand amid the accelerating build-out of AI infrastructure.

However, we remain skeptical over Gaudi2’s prospects as a viable substitute for Nvidia’s data center GPUs, even in the supply-constrained environment. This is corroborated by tepid demand marked by Gaudi2 “driving the lion’s share” of $1+ billion in accelerated computing opportunities through 2024 – a relatively modest number when compared to the likes of Nvidia. Gaudi2 is also not a popular choice in public instances, with limited availability on AWS (AMZN) and other AI names such as Hugging Face and Stability AI.

The slow take rates on Intel’s Gaudi2 underscores several roadblocks to Intel’s ambitions in accelerated computing, which also clouds prospects for Gaudi3 shipping next year. This includes a software disadvantage relative to Nvidia’s expansive and exclusive CUDA ecosystem embraced by the developer community. This comes despite Gaudi’s compatibility with open-source AI training frameworks PyTorch and TensorFlow, which can be integrated with Intel’s own SynapseAI software for optimized training and inferencing on Gaudi2. SynapseAI is also inferior to AMD’s ROCm open-source software ecosystem, which currently buoys prospects for the next-generation AMD Instinct MI300 Series accelerator as a viable replacement for the Nvidia H100 in accelerated computing. This could potentially lower Gaudi’s performance and TCO appeal relative to existing collaborations in the ROCm and CUDA ecosystems among developers and hyperscalers.

Meanwhile, limited details over the performance of next-generation Intel Falcon Shores chips due to succeed the Gaudi series in 2025 also clouds Intel’s outlook in competing against close rival AMD in accelerated computing. AMD’s MI300 series accelerator, which will start shipping later this year, is already comparable to some of the performance specs and TCO of Nvidia’s latest GH200 superchip shipping next year.

Roadblocks to Gaudi adoption is likely to do little in compensating for weak Sapphire Rapids demand amid restrained spending on CPU infrastructures, despite them being complementary in the broader industry shift to accelerated computing. Meanwhile, the close roll-out of next-generation Xeon Scalable processors in Q4 (Emerald Rapids based on Intel 7) and 1H24 (Sierra Forest based on intel 3) – less than a year after Sapphire Rapids started shipping in January – also risks complicating the situation. Considering the cautious IT spending environment and a structural demand for optimization, prospective customers may be incentivized to hold out for the latest technology to capitalize on performance and TCO improvements, risking take-rates on Emerald Rapids later this year.

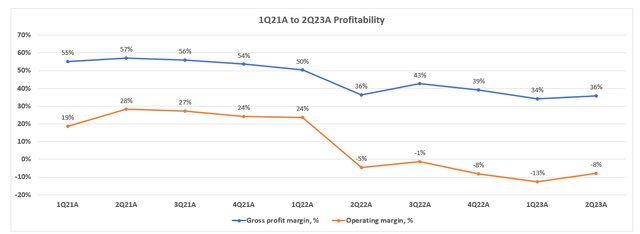

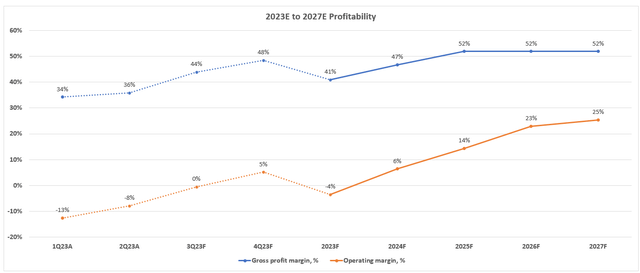

Margins Lack Operating Leverage

Regarding Intel’s bottom line, management has reiterated confidence in achieving $3 billion in annualized cost-savings by year-end, with the figure rising to $8 billion to $10 billion exiting 2025. The results are corroborated by a modest margin improvement in Q2, and another gradual uptick slated for the current quarter. Management has guided gross margin of 43% for Q3, up from 36% in Q2. This compares to management’s long-term goals to return gross margins back to the 50% to 60% range, in line with broader industry and Intel’s historical profit levels.

However, we are concerned over the fact that there is still little contribution from growth at scale. This accordingly reduces the durability of recent margin improvements, which brings execution risks pertaining to IDM 2.0 back into focus.

Despite doubling revenues at Intel Foundry Services during the second quarter, and potentially a similar pace of growth in the current period based on the company’s Q3 revenue guidance, the ensuing gross margin expansion has been modest. Management has acknowledged that the start-up costs pertaining to the build-out of IFS alongside Intel’s investment in new process nodes will “hit gross margins that will affect [Intel] for a couple of years”.

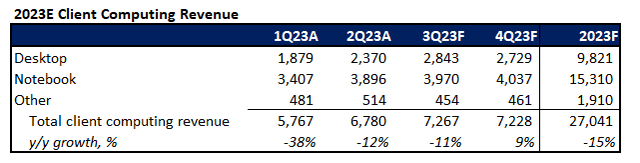

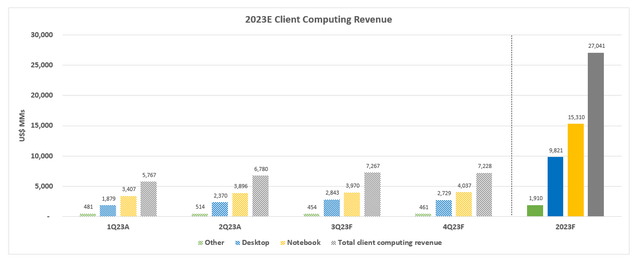

Although Gelsinger’s recent announcement on the receipt of a prepayment aimed at speeding up Intel’s 18A foundry capacity build-out is a positive, there are still immediate roadblocks to solve. Taken together, IFS is unlikely to be a needle-mover for Intel in the near term (management forecasts 2026-2027 timeline). The extended duration continues to underscore the challenging and capital-intensive IDM 2.0 turnaround that Intel seeks to pull off, which remains in early stages. There is also incremental bottom-line pressure from near-term weakness in the high-margin data center and AI segment, underscoring a likely unfavourable mix shift through 2023.

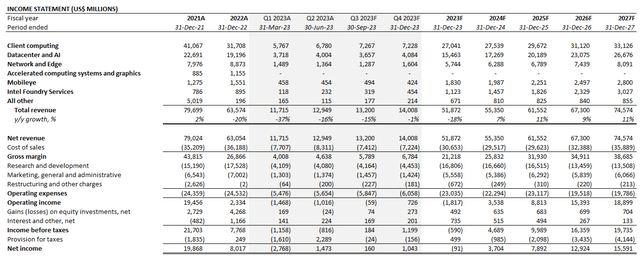

Intel_-_Forecasted_Financial_Information.pdf

Valuation Considerations

Net-net, things have been progressing in the right direction for Intel, nonetheless. Both sales and margins have improved, though at a slow pace, indicating the trough may have passed. Yet, concerns remain over the durability of this recovery and whether it would yield sufficient returns to offset the high capital intensity of IDM 2.0. This is likely in line with the market’s fairly cautious sentiment on the stock, which we believe is what is keeping Intel’s price at the mid- to high-$30 range.

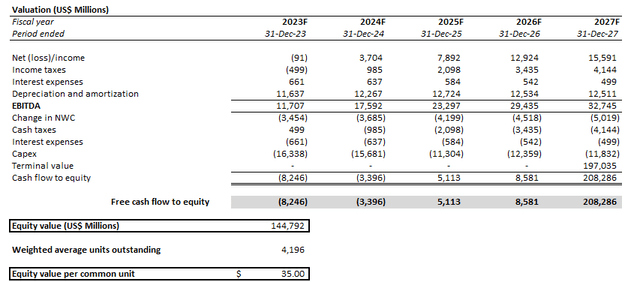

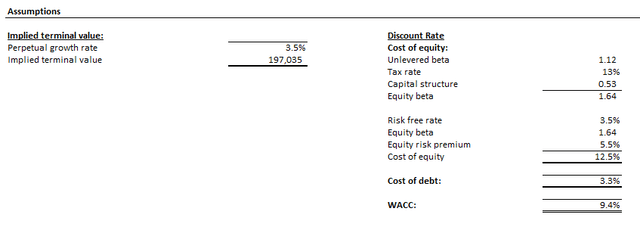

Under the discounted cash flow valuation approach, which takes projections in conjunction with the foregoing fundamental considerations, we estimate Intel’s intrinsic value at about $35 per share. We expect Intel’s projected cash flows to be primarily weighted by its heavy capex spend towards the build-out of its global foundry footprint and process nodes through mid-decade, offset by contributions from its Semiconductor Co-Investment Program (“SCIP“). The key valuation assumptions applied include a 9.4% WACC in line with the company’s risk profile and capital structure, as well as a 3.5% perpetual growth rate to reflect Intel’s prospects in the economy-driving semiconductor industry.

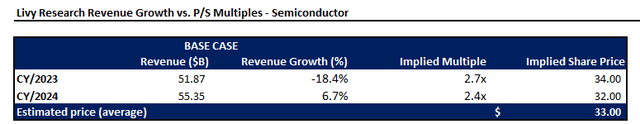

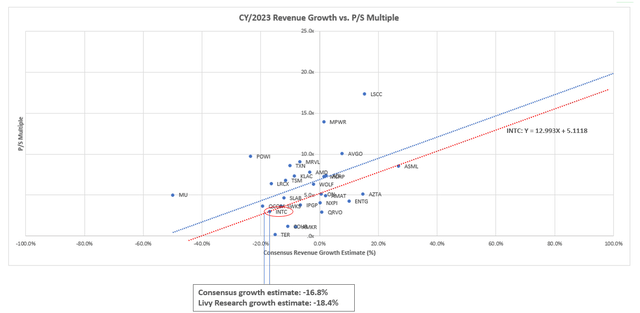

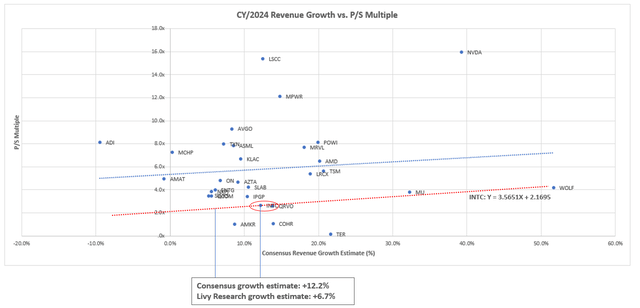

This is further corroborated by the consideration of peer valuation multiples, which we believe to be a fair representation of current market sentiment over the stock and Intel’s underlying business performance.

Data from Seeking Alpha Data from Seeking Alpha

Considering Intel’s valuation multiple trend line (dotted red) in parallel to the broader semiconductor peer group’s (dotted blue) through calendar 2024, and applying them to our base case growth estimates, the stock is expected to trade at about $33 apiece.

Our base case price target is set at $34, which equally weighs results from both valuation considerations.

Final Thoughts

Intel has benefitted from a string of good news through 1H23, with top and bottom-line consistently outperforming expectations, despite a lowly-set bar. Looking ahead, the second half will likely entail incremental sequential improvements, but the key focus area – which is Intel’s capital-intensive turnaround strategy – remains an overhanging risk.

Spending on improving its production technology have yet to materialize into a directly growth impact on P&L, with Intel’s next-generation processors based on the advanced nodes likely shipping into another modest demand environment. Although Intel’s prepayment received on its 18A foundry capacity is a step in the right direction, significant risks remain between now and when related revenue start to materialize.

But foundry wafer customers don’t materialize for several years, right? Because you got to win their design, they got to get their designs done, and then they ramp the wafer. So that really starts contributing on a multiyear basis, but that’s on track.

We believe investors’ cautious optimism is reflected through the stock’s limited upsides from current levels, which has stayed capped in the mid- to high-$30 range. This is in line with our valuation considerations for the next 12 months based on industry and Intel’s outlook through the second half.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!