Summary:

- American Airlines has faced challenges due to the Covid-19 pandemic but has been able to rebuild and achieve record quarterly revenue.

- The company has been focusing on debt reduction and aims to reduce its debt by $15 billion by 2025.

- American Airlines looks undervalued compared to its competitors and has a fair value per share of $20.37, implying an upside of 45.81%.

miglagoa

Introduction

American Airlines Group (NASDAQ:AAL) has faced significant turbulence in recent years, facing significant challenges such as the Covid-19 pandemic’s devastating impact on the airline industry. Despite these challenges, American Airlines has weathered the storm and has been able to rebuild and soar to new heights. Despite this, the shares have only risen 0.61% in the past year despite record revenue in quarter two.

With global air travel continuing to rebound, let’s investigate American Airlines and why I believe it’s undervalued at this price.

Company Overview

American Airlines is one of the world’s largest airlines, and its roots can be traced back to the 1930s. Today it operates an extensive network of domestic and international flights, connecting passengers worldwide on its fleet of over 800 aircraft. Headquartered, in Fort Worth, Texas, the company operates 10 hubs and serves over 350 destinations.

Covid has Gone

During the Covid-19 pandemic, many companies struggled, and American Airlines was no exception. Passenger numbers fell to a fraction of their pre-covid levels as restrictions were enforced to prevent travel. Even when these restrictions were lifted, many passengers were still apprehensive to travel and there were fears that business passengers may never return in their pre-covid numbers as they switched to remote working.

These fears were overblown, with record air passenger travel predicted this summer, and business travel set to surpass pre-Covid levels.

This rebound has been reflected in American Airlines’ results, with them achieving record quarterly revenue of $14.1 billion in the latest quarter.

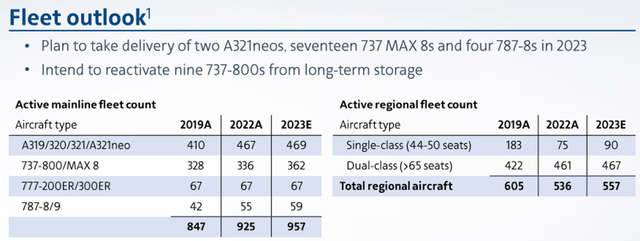

To meet this growing demand for travel, American Airlines continues to grow its fleet in 2023 with aircraft being taken out of long-term storage and by taking delivery of new, more fuel-efficient aircraft.

American Airlines 2022 Full Year Results Investor Presentation

Cutting the Debt

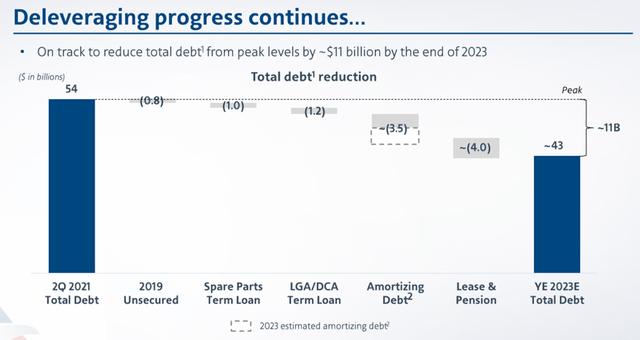

Like all its peers, during the pandemic, American Airlines took on significant amounts of debt, which was necessary as passenger travel plummeted. With rising interest rates, the need to service this debt would add a considerable strain to the balance sheet. As such, management has been focusing on debt reduction with an initial target to reduce its debt balance by $15 billion by 2025.

American Airlines Q2 Earnings Call

Given the airline has already reduced its debt by $9.4 billion, so far, this implies that only another $5.5 billion reduction is required for the airline to reach its target.

This falling debt corresponding with strong earnings resulted in the net debt to EBITDA ratio being 3.8x at the end of 2Q 2023, which was the lowest ratio since the end of 2019. This debt reduction, falling debt ratio, and strong earnings will help the company reach its long-term target of a BBB credit rating.

Q2 Results

American Airlines announced its earnings on July 20th and demonstrated an exceptional performance. Earnings surpassed expectations with non-GAAP earnings per share of $1.92, beating estimates by $0.33. This was on the back of record quarterly revenue of $14.1 billion, reinforcing the strong demand for air travel.

Load factor was 86% against 80% in the first quarter, indicating better usage of aircraft. Additionally, total debt was reduced by $387 million in the quarter, continuing the company’s goal of debt reduction and helping to strengthen the balance sheet.

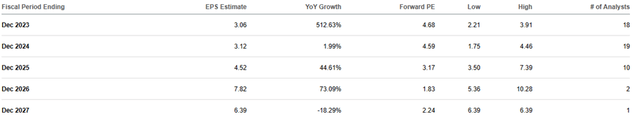

The impressive results for the quarter led management to raise its full-year guidance for adjusted earnings per share to between $3.00 and $3.75 from $2.50 to $3.50.

Valuation

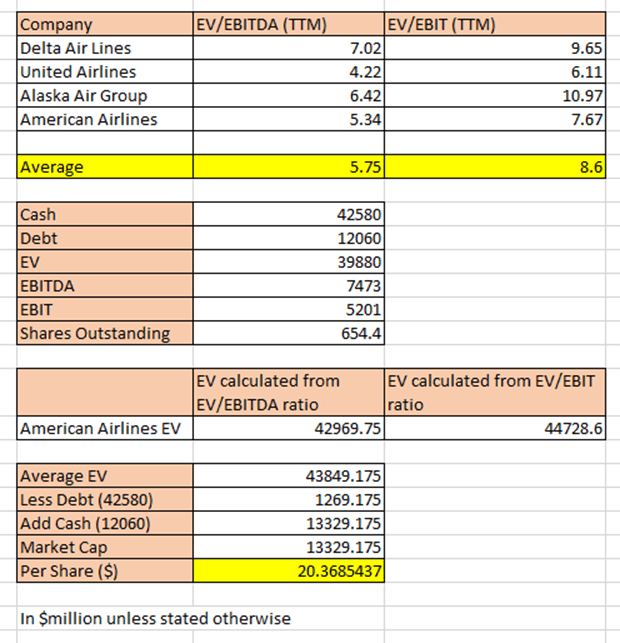

American Airlines looks undervalued at its current share price. It currently trades at 4.68x forward earnings and 5.34x EV-to-EBITDA. This is a lower ratio than competitors such as Delta Air Lines (DAL) and Alaska Air Group (ALK) and only slightly higher than United Airlines (UAL).

To determine a fair value for the shares, I compared American Airlines EV-to-EBITDA and EV-EBIT ratio with its peers. I then calculated a fair enterprise value for the company using the average ratios of the company’s peers and the last 12 months EBITDA and EBIT. From this enterprise value by deducting the company’s debt and adding its cash, the fair value market cap could be calculated and hence fair value per share.

Calculated by the author using data from Seeking Alpha

This suggests a fair value per share of $20.37, which implies an upside of 45.81% from the current share price of $13.97.

Future Earnings Estimates for American Airlines taken from Seeking Alpha

With revenue and earnings set to continue growing over the next few years and American Airlines’ balance sheet continuing to strengthen as debt is reduced, further upside can be expected. Despite the airline industry being well known to be a cyclical and capital-intensive business, the earnings ratios American Airlines trades on, are just too low and should be higher. As such, I see further upside for American Airlines with an initial price target of $20.37 a share.

Risks

Although American Airlines offers a compelling case to invest in, it is worth noting that it is not without its challenges. As such, there are three main risks I have when investing in American Airlines and in all airlines.

Firstly, cyclicality. The airline industry is a highly cyclical industry and sensitive to economic downturns. During recessions, demand for both business and leisure travel declines significantly, which leads to significant reductions in revenue. As such, American Airlines’ financial performance is closely tied to overall economic health. With rising interest rates, and some economic indicators showing a slowdown in activity, American Airlines may see earnings contract in the short term.

Secondly, fuel costs. With fuel making up almost 23% of operating expenses in Q2, American Airlines is sensitive to fluctuations in oil prices. Given the recent rise in oil prices to over $90 a barrel, this risks damaging margins. Although this risk can be partly mitigated by hedging fuel costs, a long-term higher oil price would have a potential impact on the company’s profit.

Finally, labor relations. Labor disputes and strikes have always been a challenge in the airline industry, given the highly unionized workforce. Although American Airlines pilots approved a deal earlier this year, this is a constant challenge facing the company, with industrial action imposing not just a financial risk but also a reputational risk for the company. This risk is worth watching as protracted disputes can impact the share price.

Conclusion

In conclusion, based on its strong financial performance in recent quarters, and improving balance sheet as debt is reduced, there seems no reasonable explanation for American Airlines to trade for a value below its peers. As such, I believe American Airlines has an upside of 45.81% to reach a fair value per share of $20.37.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.