Summary:

- Tesla, Rivian, and other EV companies may benefit from Detroit automakers’ labor issues.

- Rivian is undervalued and has strong management and growth potential.

- Rivian’s stock has bullish technical momentum and a potential target price of $40.

- I outline key price levels to watch as the EV name continues on its growth trajectory.

Mario Tama

Tesla, Rivian Automotive (NASDAQ:RIVN), and other electric vehicle (EV) companies are striving for a competitive advantage, while Detroit automakers grapple with the looming threat of a paralyzing strike. BofA sees the possible strike as “almost guaranteed” per a report last week. As the industry grapples with the renewed power of labor, non-legacy automakers may benefit – but only firms growing and executing well stand in prime position.

While the UAW negotiations may be a transitory hurdle for the incumbent OEMs, I assert that Rivian (RIVN) is undervalued today. Momentum is strong, and its management team is firing on many cylinders.

Is a UAW Strike Imminent?

BofA Global Research

According to Bank of America Global Research, Rivian is a new automotive company focused on the design, development, customer experience, sale, and service of electric vehicles across the consumer and commercial markets. Its initial consumer vehicles include the R1T pickup and R1S SUV, while its initial commercial vehicle is the EDV, co-developed with key anchor customer Amazon. Rivian’s vehicles are complemented by a suite of direct-to-consumer services, including finance, insurance, service, charging, resale, and membership/subscriptions.

The California-based $21.9 billion market cap Automobiles Manufacturers industry company within the Consumer Discretionary sector does not have positive trailing 12-month GAAP earnings and does not pay a dividend. Ahead of earnings in November, the stock features a high implied volatility percentage of 59% and carries a material short interest of 13%.

Back in August, Rivian beat Wall Street earnings estimates with EPS of -$1.08, $0.31 better than feared. Revenue growth was solid with Q2’s total being $1.12 billion, driven mainly by the delivery of 12,640 vehicles, up a robust 49% sequentially. What was particularly bullish was that the firm improved its gross margin and kept costs in check due to fixed cost leverage, lower material costs, and higher revenue per vehicle.

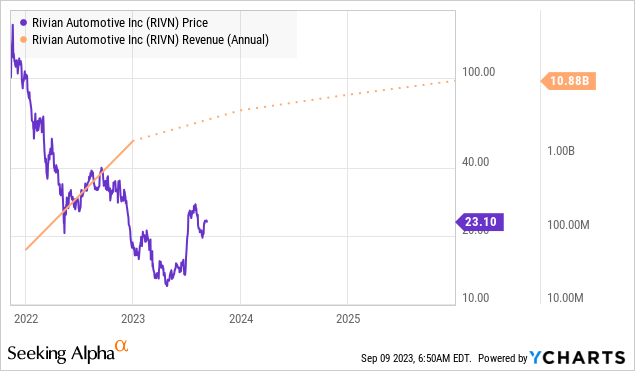

With more than $10 billion in cash, the company appears decently capitalized with improved liquidity. Also, sanguine to me was that the management team raised its production guidance and adjusted its EBITDA estimates. Couple volume growth with impressive execution, and the stock is well above the low of the year, though I still see it as undervalued with technical momentum.

Key risks include the reality that raising capital to fund high-growth initiatives is considerably more costly today, with a higher cost of equity and debt financing. The management team must also recognize the tall challenge that it may be unable to convert pre-orders to sales given expectations for climbing annual revenues – that includes agreements with key customers. Its direct-to-consumer model could be at risk if the consumer environment deteriorates or if preferences shift. Also, Tesla slashing prices for its models could portend poor ticket sales for the broader group.

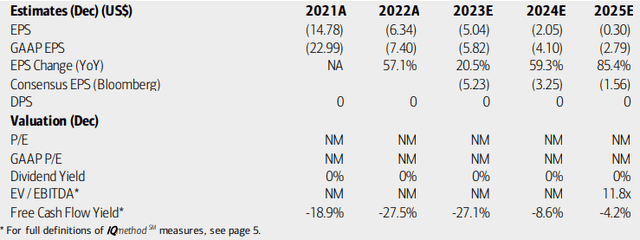

On valuation, analysts at BofA see earnings continuing in the red this year and through the out years. The Bloomberg consensus forecast is even more pessimistic, but there is a reasonable chance that the firm can turn profitable on a non-GAAP basis within a few years. With steeply negative free cash flow, no dividends are expected to be paid over the coming quarters. Still, Rivian stands out among many of its peers in the startup EV market and poses a threat to the embattled domestic auto OEM names given their ongoing labor issues.

Rivian: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

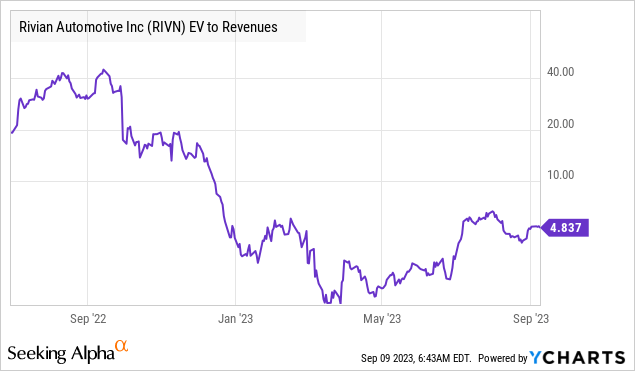

It is always tricky figuring out how to value a negative-earnings company. In this case, we can use the forward EV/sales ratio as a guide. Notice in the graph below that when RIVN debuted, it had an extreme multiple. The stock cratered as the firm grew sales and its enterprise value. So, with a current forward EV/sales multiple of 3.46 (per Seeking Alpha – slightly below what Ycharts shows), I assert there’s value here.

Why’s that? Consider that Tesla, its largest competitor, features an EV/sales ratio of 7.72. Now, I concede that Rivian should trade at a discount to TSLA, but if we give RIVN a 4.5 EV/sales ratio using out-year estimates, then the stock should be in the mid-$30s. A 4.5x multiple appears downright paltry compared with the 40+ levels seen shortly after its debut – of course, that was during the free-money period, so that’s like fantasy land these days.

RIVN: A Compelling EV/Sales Ratio Given The Growth Trajectory

YCharts

RIVN: Sales Growth Seen, Lower Stock Price From Year-Ago Levels

YCharts

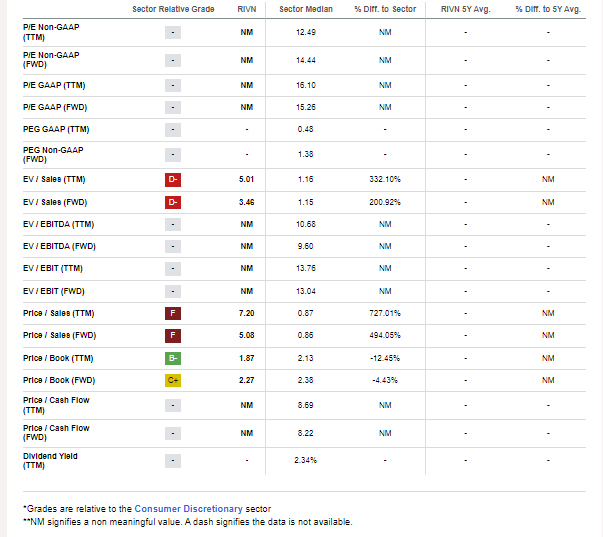

RIVN: Not Yet Profitable, Low EV/Sales Multiple Vs History

Seeking Alpha

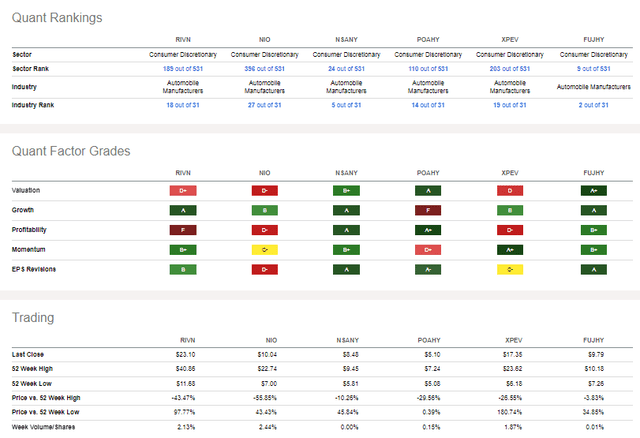

Compared to its peers, Rivian features a high valuation but also has arguably the best growth in the industry. And with just a ~$20 billion market cap, there’s room for upside. While the firm, like many EV-focused companies, is not yet profitable, I like the stock price momentum which I will detail later and recent earnings revisions have been positive.

Competitor Analysis

Seeking Alpha

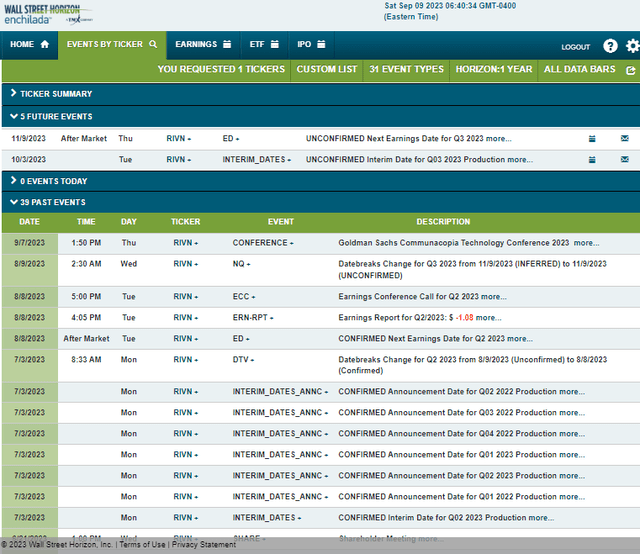

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3, 2023 earnings date of Thursday, November 9 AMC. Before that, we will get interim production data on Tuesday, October 3 that could drive share price volatility.

Corporate Event Risk Calendar

Wall Street Horizon

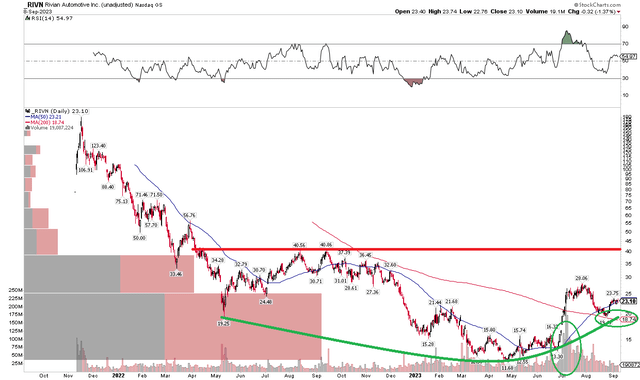

The Technical Take

This is where I am particularly bullish on Rivian. Notice in the chart below that shares are putting in a bearish to bullish rounded bottom reversal pattern. While the long-term 200-day moving average remains downward sloping, the shorter-term 50dma crossed above the 200dma in a bullish golden cross pattern for the first time in the stock’s history back in August. Before that, shares surged from near $13 to $26 over a handful of trading days on extremely high volume.

RIVN naturally pulled back in August, but the bears were unable to fill a gap that lies near $16.50, all while the bulls defended the 200dma as support (it had been resistance in late 2022). What’s more, the retreat from $28 to $19.48 occurred on declining volume, which tells me that it was merely a correction in the trend of larger degree – higher. With ample volume by price underneath the current price (support in the $19 to $22 zone), I see upside potential to $40 – the range highs from the back half of 2022, though it could be tough slogging for the bulls given a congestion zone from $29 to $40.

Overall, the chart appears bullish to me, despite this stock being a shadow of its valuation shortly after the November 2021 IPO.

Rivian: Bearish to Bullish Reversal, Technical Target $40

Stockcharts.com

The Bottom Line

I have a buy rating on Rivian. This highly volatile stock continues to grow into its valuation, while the technical situation appears compelling. I see fair value closer to $30 while the chart suggests a move toward $40 could be in play.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.