Summary:

- Visa is a must-have for investors, with strong profitability metrics and a wide moat in the digital payments industry.

- The company’s financial performance has been stellar, with double-digit revenue growth and high free cash flow margins.

- My valuation analysis suggests V stock is about 20% undervalued.

Justin Sullivan

Investment thesis

Visa (NYSE:V) is every investor’s must-have. Being an undisputed leader in the digital payments industry allows the company to enjoy by far best-in-class profitability metrics and a very wide moat. Having stellar profitability allows the company to sustain a healthy balance sheet and keep investors happy with massive stock buybacks and double-digit dividend CAGR over the long term. My valuation analysis that the stock is about 20% undervalued, which makes it a compelling investment opportunity. All in all, I assign the stock a “Strong buy” rating.

Company information

Visa is one of the world’s leading companies in digital payments, providing processing services and payment product platforms, including credit, debit, prepaid, and commercial payments. The company operates across more than 200 countries and territories.

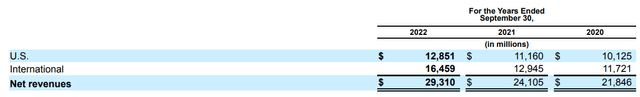

The company’s fiscal year ends on September 30 with a sole reportable segment. According to the latest 10-K report, Visa generates about 56% of its total revenue outside the U.S.

Financials

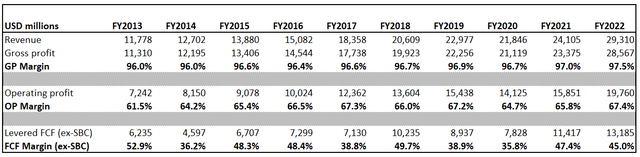

The company’s financial performance has been stellar over the past decade. Revenue compounded at 10.7% over the past ten years, which is impressive. As the business scaled up, the operating margin expanded from 61.5% to 67.4%.

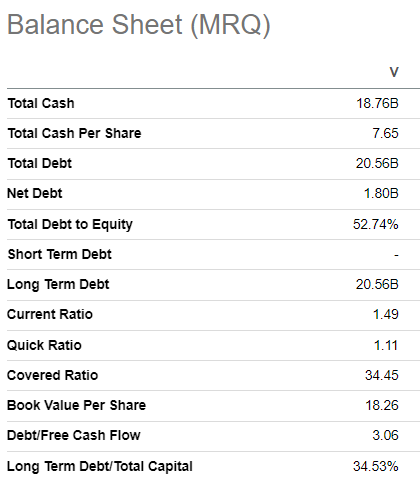

The business does not require much capital expenditure, considering the scale of the business. This allows the company to convert a significant part of its high operating profits into free cash flow [FCF]. The wide, consistently above 40% FCF margin allows the company to keep its balance sheet healthy and shareholders happy. As of the latest reporting date, the company had almost $19 billion in cash with a prudent level of leverage. Liquidity metrics are strong.

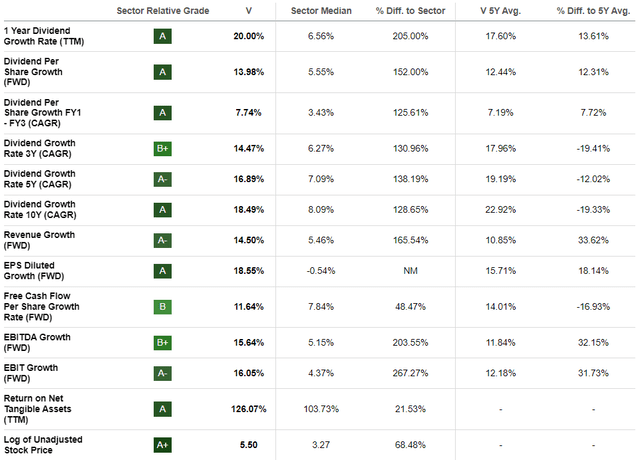

Seeking Alpha

Visa conducted aggressive repurchases, with almost $72 billion in stock buybacks over the past decade. To add context, share repurchases comprised about 38% of the total sales generated over the decade. The company keeps shareholders happy not only with stock buybacks but also with dividends. While the forward dividend yield might look very low at 0.7%, dividend growth has been stellar. First, there were 14 years of consecutive dividend hikes, and the payout ratio is still relatively low at 21.5%, which gives me the high conviction that dividend growth is safe. Second, over the past ten years, dividend CAGR was as high as 18.5%, which is massive.

The latest quarterly earnings were released on July 25, when the company topped consensus estimates. Revenue demonstrated double-digit YoY growth again, with an 11.7% increase. The operating margin expanded 50 basis points, which is a good sign amid the current uncertain environment.

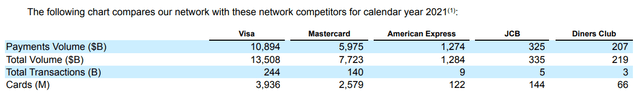

The reason why Visa delivers such a stellar financial performance is because the company dominates the global digital payments market. The company is by far leading across all the key metrics: total payment volume, total transactions, and number of cards issued. Visa’s closest rivals are Mastercard (MA) and American Express (AXP).

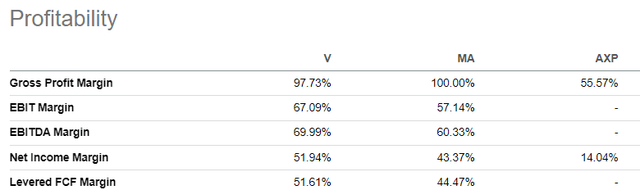

Being the undisputed leader gives the company several massive advantages over competitors. First, the larger the network the company operates the more attractive it becomes to potential partners. The more customers use Visa, the more attractive it looks to merchants because of the potential big market. The more merchants accept Visa cards, the more customers tend to use these cards. Second, the biggest scale gives an advantage to Visa which allows the company to generate unmatched profits. Regarding key profitability metrics, Visa is far beyond its major rivals. Third, Visa’s massive scale gives it a very wide long-term moat because it is impossible to build such a scale from zero. A merger between Mastercard and American Express is almost impossible, but even if we assume it could have been possible, the combination of these businesses will still lag behind Visa in terms of key metrics.

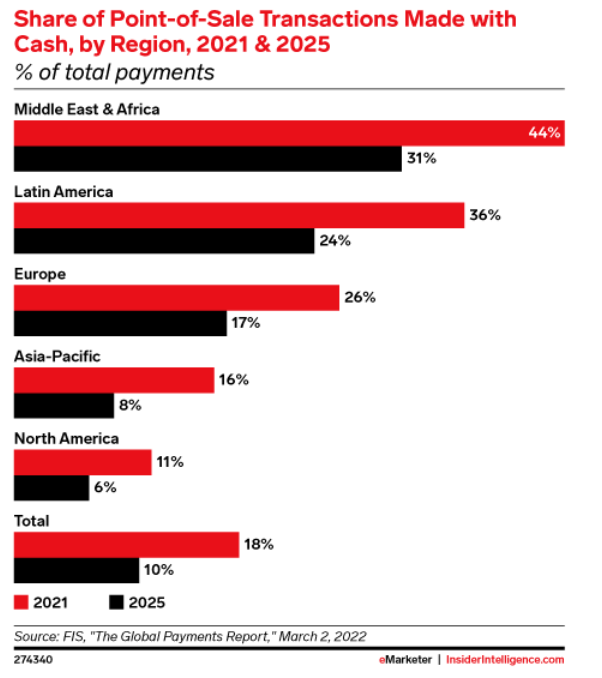

It is crucial to understand that Visa dominates the market, which is still expected to compound double-digits in the foreseeable future. According to statista.com, the total transaction value of global payments is expected to demonstrate an 11.8% CAGR up to 2027. E-commerce is a big secular shift for the digital payments industry. The e-commerce industry is expected to compound at 16.9% up to 2030, which is a massive tailwind for the digital payments industry. The decreasing usage of cash due to its inconvenience compared to using cards is also a notable favorable trend. While people in North America might consider this to be a weak factor due to the high level of payment digitalization there, in many other parts of the world cash is still frequently used at points of sale [POS]. According to insiderintelligence.com, even in Europe in 2021 26% of all POS transactions were made with cash.

Insider Intelligence

Valuation

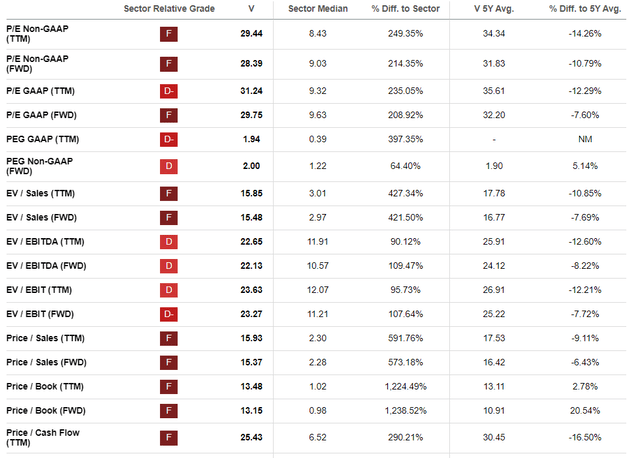

The stock rallied 19% year-to-date, outperforming the broader U.S. market. Seeking Alpha Quant unsurprisingly assigns the stock the lowest possible “F” valuation grade due to multiples mostly multiple times higher than the sector median. However, Visa is a unique company dominating the market with MasterCard, and the substantial premium compared to the sector median is fair. It is better to compare current multiples with historical averages, and here we see that the stock is slightly undervalued from this perspective.

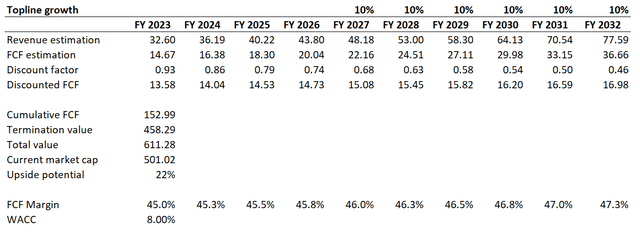

To continue my analysis, I want to simulate the discounted cash flow [DCF] model. Due to the wide FCF margin and vast market share, I use a low 8% WACC for discounting. Revenue consensus estimates are available up to FY 2026, and I incorporate a 10% CAGR for the years beyond. I use a 45% FCF margin for my base year and expect a 25 basis points yearly expansion.

According to my calculations, the stock has about 22% upside potential. That said, the fair stock price is close to $300.

Risks to consider

Visa’s earnings significantly depend on the overall spending since purchases volumes and amounts drive the company’s revenue. That said, the company is vulnerable to adverse trends in the broader economy. Weakening spending is a risk to the company’s financial performance. While consumer spending has demonstrated strength recently, the macro environment is still uncertain and tight. Interest rates are at their highest since the beginning of the 2000s, and if they remain there over multiple quarters, it will ultimately undermine consumer spending. But these challenges will be temporary and not secular, as the economy is cyclical and recovery is inevitable after a downturn.

Since three major players hold about 95% of the credit card market in the U.S., Visa is subject to antitrust scrutiny. Antitrust fines and penalties are not rare for the company. However, these fines never disrupted the company’s operations and were relatively insignificant compared to the company’s scale; investors should be aware of significant regulatory risks.

Bottom line

To conclude, Visa is a “Strong buy”. The company undisputedly dominates the industry which still has vast room to grow thanks to multiple tailwinds. Being the leader with the largest network allows the company to enjoy substantial cost advantages due to its hyperscale. This results in wide profitability metrics which allows the company to conduct massive stock buybacks and deliver stellar dividend growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in V over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.