Summary:

- Rivian stock remains well above its April 2023 lows, as the market priced in significant pessimism. However, sellers digested its July gains, as it fell nearly 30% through recent lows.

- Rivian’s Q2 results show improved scale and operating performance, but negative free cash flow is a significant concern. Investors must be prepared for additional fundraising.

- The competitive challenges from legacy automakers and Tesla remain formidable headwinds even as Rivian continues to ramp production. RIVN’s growth valuation isn’t justified.

- I argue why RIVN is at a critical juncture as much of its near-term upside seems reflected. Investors who don’t have positions should continue staying on the sidelines.

Mario Tama

Rivian Automotive, Inc. (NASDAQ:RIVN) stock has benefited from the recent UAW negotiations involving legacy US automakers such as General Motors (GM), Ford (F), and Stellantis (STLA). As such, while RIVN has significantly pulled back from its July 2023 surge, buyers still hold the $19.5 level. My last update in July urged investors to remain cautious and not buy into the price surge motivated by its solid deliveries performance.

As such, I assessed that it’s apt for investors to determine whether the approximately 30% decline in RIVN from its July highs justifies an upward re-rating. Rivian’s early August second-quarter or FQ2 earnings release corroborates the market’s conviction of improved scale and operating performance.

Accordingly, Rivian upgraded its full-year guidance to 52K deliveries while telegraphing a lower-than-expected adjusted EBITDA loss. Despite that, investors must account for negative free cash flow or FCF through FY27. As such, based on the company’s cash and equivalent balance of about $10.2B, additional requirements for capital raising must be considered.

However, I gleaned that management is keenly aware of it, as it informed investors that it anticipates a cash runway to “fund operations through 2025.” In addition, Rivian demonstrated its ability to bolster its balance sheet through the $1.5B green convertible notes and the “extension of a $1.5 billion asset-based lending agreement.”

As such, the fluidity of the capital markets to fund Rivian’s ongoing operations as it scales further is critical. Despite the recent regional banking crisis, I assessed that the lending environment is not expected to deteriorate much further. While regional banks are expected to maintain tight credit and lending standards, it has not led to a liquidity crisis, suggesting that overall market conditions remain healthy. As such, while high-interest rates are still expected to hit Rivian’s profitability trajectory, Rivian Bulls would likely argue that such headwinds and pessimism have been reflected in RIVN’s lows in April 2023 (amid the throes of the regional banking fallout).

Notwithstanding the recent optimism, investors must still consider the competitive and scaling challenges that Rivian could face as the legacy automakers and Tesla (TSLA) step up their game. While the recent UAW impasse affected the stock performance of the legacy OEMs, they have not gotten much worse over the past three to four weeks. As such, I believe the message from market operators suggests that they have likely priced in significant pessimism, and thus, the “implied tailwinds” to RIVN might have been accounted for.

Moreover, leading lithium miners Albemarle (ALB) and Sociedad Química y Minera de Chile (SQM) remain confident in their long-term game plan. Both companies have inked long-term strategic supply agreements with Ford as they look to partake in Ford’s EV transformation. As such, it doesn’t make sense that the market is betting on a total collapse between the legacy OEMs and UAW, supported by constructive price action. Investors must account for the substantial competitive headwinds from the legacy OEMs once they get through the recent labor negotiations and continue scaling their EV production.

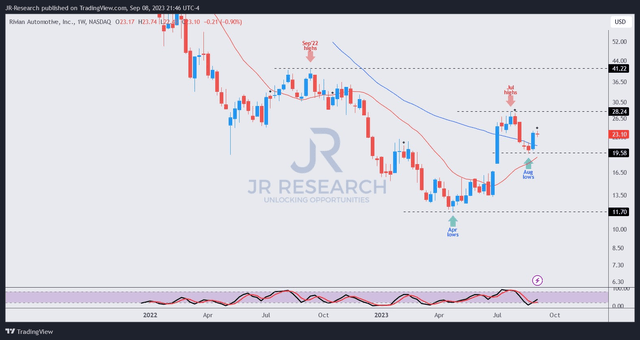

RIVN price chart (weekly) (TradingView)

RIVN sellers astutely digested the surge that lifted it to its July highs ($28 level), although buyers returned at the end of August, forming RIVN’s recent lows at the $19.5 level.

The UAW tailwinds likely lifted buying momentum last week, although I don’t expect it to be sufficient in raising it toward RIVN’s July highs. A rotation back into the legacy OEMs could be in store if the market doesn’t expect the impasse to lead to a debilitating strike, corroborating the current consolidation zone in their stock. In other words, RIVN could top out at the current levels before falling further to re-test its August lows.

My assessment suggests RIVN’s April 2023 lows indicate that the worst is likely over as it ramps up and demonstrates resolve toward its profitability targets. However, I’m not convinced with its price action and growth premium (rated “D+” in valuation by Seeking Alpha Quant) as it navigates its unprofitability.

Unless you are a high-conviction RIVN investor, I suggest new investors stay on the sidelines on this no-moat EV operator.

Rating: Maintain Hold. Please note that a Hold rating is equivalent to a Neutral or Market Perform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!