Summary:

- Oil prices expected to remain high in 2023 due to voluntary production cuts in Saudi Arabia and Russia, leading to an oil deficit.

- Demand for oil set to rise in countries excluding China, US, and EU, with China’s demand expected to grow steadily throughout 2023.

- Gas demand expected to decline due to lower gas consumption in the manufacturing industry and lower demand for pumping gas into storage.

Bruce Bennett

Investment thesis

We expect oil prices to remain high in 2023 in part due to voluntary production cuts in Saudi Arabia and Russia, which we expect to lead to an oil deficit in the second half of 2023. Gains from higher oil prices are partially offset by lower gas demand in 2023. We expect Exxon Mobil (NYSE:XOM) to face lower combined oil and gas sales in 2023 but recover in 2024, therefore we maintain HOLD status.

Macro outlook for the oil market

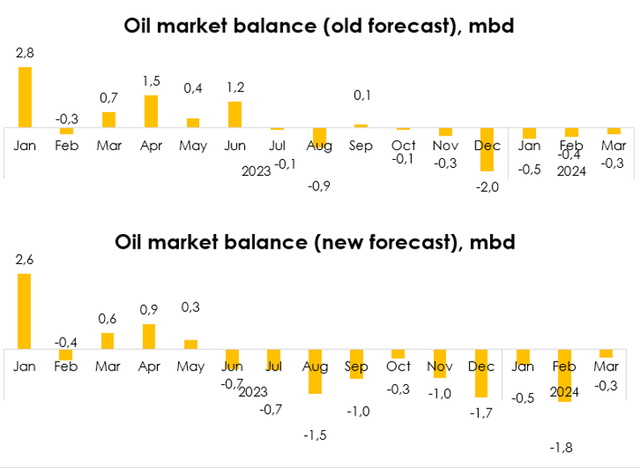

We have taken into account that in 2023 demand for oil in countries excluding China, the US and the EU is set to rise by 1.2 mbd y/y (the average between the estimates by the US Department of Energy and OPEC). We also expect demand in China to grow by an average of 1 mbd y/y amid the lifting of its COVID restrictions, with demand climbing steadily throughout 2023. We have taken into account the reduction of the combined US and EU demand by 1.1 mbd y/y due to an expected recession. We expect that countries excluding OPEC members and Russia will boost production by 2.2 mbd y/y in 2023 (according to US DoE and OPEC estimates).

In our forecast for oil market balance, we have factored in weaker demand in China in June 2023 and higher-than-expected oil demand in the US, EU and other countries. At the same time, the outlook for oil prices remained unchanged. We expect oil to remain in short supply globally from now until the end of the year, even with a recession in the EU and the US (thanks to the OPEC+ deal and voluntary cuts).

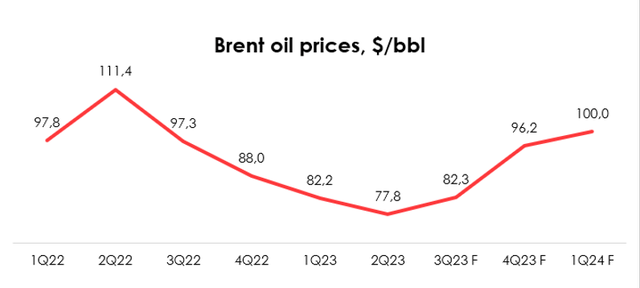

We anticipate that Brent oil prices will average $84.6/bbl in 2023, with the price tentatively going up from $82.3/bbl in 3Q 2023 to $96.2/bbl in 4Q 2023 and $100/bbl in 1Q 2024.

We believe that oil prices have bottomed out and will continue to rise through the end of the year. We do not expect them to fall below $70 in the medium term, despite the recession (which we expect in the coming months), due to voluntary production cuts in Saudi Arabia and Russia (in July-August). We expect the Brent price to rise to $100.0/bbl by 4Q 2023 as the recession winds down and growth in demand exceeds growth in global oil production.

Macro outlook for the gas market

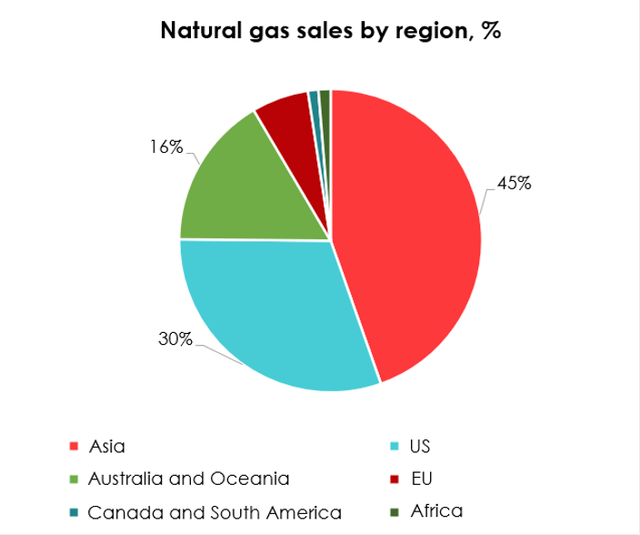

Every quarter, Exxon Mobil sells about 70% of its natural gas output outside the US. In 2Q 2023, most purchases of natural gas were made by Asia (45%), the US (30%) and Australia & Oceania (16%). The EU made up about 6%.

According to the latest data from Trading Economics, the Manufacturing PMI in all of the abovementioned top regions (China; US; Australia Judo Bank Manufacturing PMI – August 2023 Data – 2016-2022 Historical; Europe) fell below 50 by July, indicating a decline in new orders in the manufacturing industry and therefore lower gas demand.

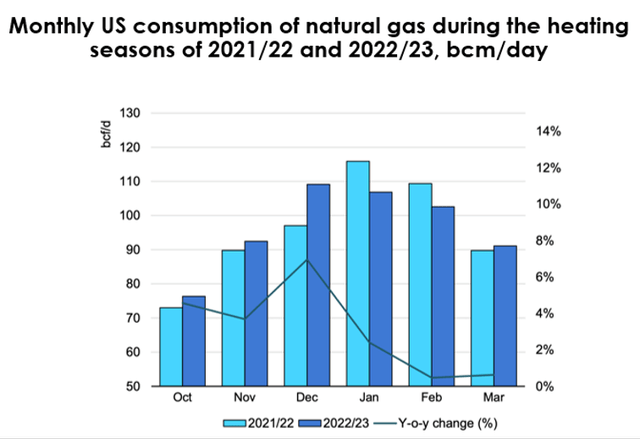

The 2022/23 heating season for Asia, North America, and the EU ended with the remaining reserves exceeding the five-year average for this metric by 20% to 67%. These higher levels were made possible by the following reasons:

- mild weather conditions, which reduced gas consumption in the residential and commercial sectors;

- gas saving measures that were adopted in public buildings in Europe (for example, mandatory temperature control), installation of heat pumps, fuel switching in rural households.

Lower demand for pumping gas into storage during the summer of 2023 could lead to weaker market fundamentals, primarily related to gas demand.

According to the latest data from the International Energy Agency, North American gas consumption will decline by about 2.9% in 2023. In the US, slowing economic growth is reducing industrial gas demand, and unseasonably mild weather in 1Q 2023 meant lower gas consumption in the residential and commercial sectors, adversely impacting the full year outlook. Slower economic growth along with the rapid development of the renewable energy sector will tamp down gas demand from power plants, although the ongoing transition from coal to gas may mitigate this trend.

Gas demand in the 22 EU countries that are members of the Organization for Economic Cooperation and Development (OECD), is forecast to decrease by 5%. That’s largely because of lower gas consumption in the power sector, which is set to decline by almost 15% amid rapid development of the renewable energy industry. Industrial gas consumption is expected to recover by almost 5% as lower gas prices allow demand to bounce back in the second half of the year. Given the decline seen in the first quarter, residential and commercial gas demand is expected to fall by 4% in 2023.

Gas consumption in Asia slowed by an unprecedented 2% in 2022 due to high LNG prices, downtime related to Covid-19 in China and mild weather for most of the year in Northeast Asia. This trend continued in January 2023, with a 2% decline from a year earlier. In 2023, growth of gas demand in Asia is forecast to resume at a moderate pace of 3% due to the repeal of the zero-Covid policy in China, the expected normalization of weather conditions and a moderate recovery in gas consumption in India and developing countries of Asia after a sharp decline in 2022.

Outlook for oil, gas sales volumes

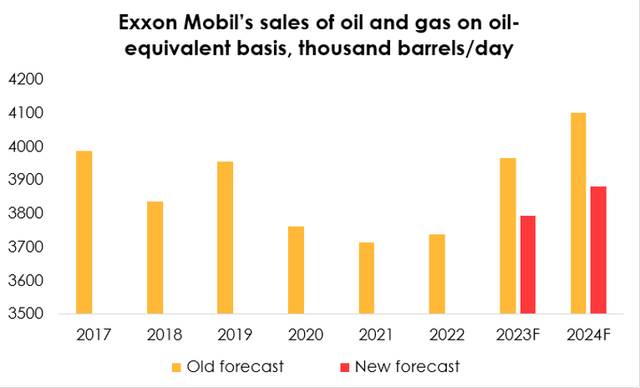

Given the falling demand for gas, we are lowering the forecast for Exxon Mobil’s gas sales from 1506 thousand barrels per day (on oil-equivalent basis) to 1358 thousand barrels per day for 2023 and from 1599 thousand barrels per day to 1383 thousand barrels per day for 2024. The forecast for Exxon Mobil’s oil sales has remained unchanged. As a result, the forecast for the combined average volume of oil and gas sales fell from 3964 thousand barrels per day to 3791 thousand barrels per day for 2023, and from 4098 thousand barrels per day to 3880 thousand barrels per day for 2024.

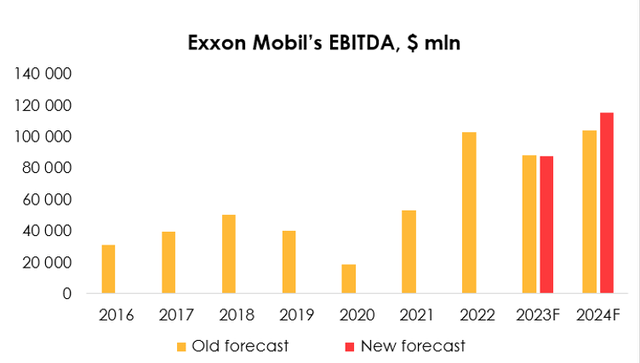

As a result of the changes in gas sales volumes, the decreasing projected gas prices and rising projected oil prices, we are slightly lowering the EBITDA forecast from $88.1 bln (-14% y/y) to $87.5 bln (-15% y/y) for 2023, but raising it from $103.9 bln (+18% y/y) to $115 bln (+31% y/y) for 2024.

Valuation

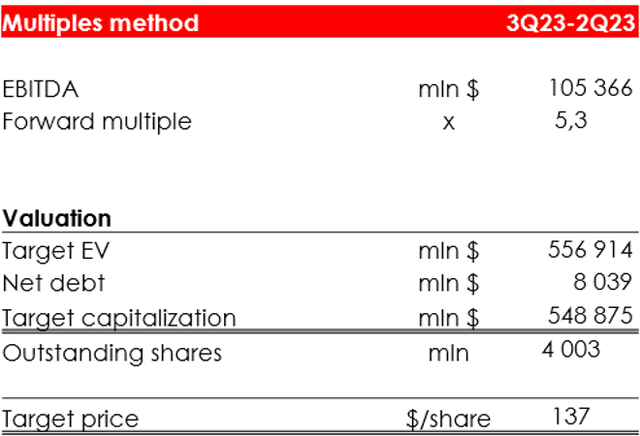

We are raising the target price of the shares from $113 to $137 due to:

- the increased EBITDA forecast for 2024;

- the shift of the FTM valuation period forward by one quarter.

Conclusion

Exxon Mobil is one of the beneficiaries of the increased oil shortage that’s expected in the second half of 2023. Despite the current decline in gas demand due to high gas storage capacity, we have to wait for the winter and go through the 2023/2024 heating season, the weather conditions of which will determine how strong the gas demand will be. At this point, the company’s shares are fairly valued by the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.