Summary:

- Apple is facing a string of international risks, from Europe to China.

- The main concern is that both these headwinds may only be the tip of the iceberg, and that they could become bigger problems for Apple going forward.

- Nexus Research does not believe Apple will be able to sustain its current forward P/E of around 30x, and the stock could indeed fall further.

Jerod Harris

Apple (NASDAQ:AAPL) is facing a perfect storm of legal woes. Europe’s Digital Markets Act is looking to curb Apple’s (as well as other tech giant’s) market power in the digital services space. At the same time, Apple is also caught up in the middle of US-China tensions, with the Chinese government looking to inhibit the use of iPhones across government agencies. The main concern is that these headwinds may only be the tip of the iceberg, and that they could become bigger problems for Apple down the line, posing significant threats to the tech giant’s key revenue segments. Nexus Research is downgrading the stock to a ‘hold’.

In the previous article, we discussed Apple’s AI opportunities through Siri and the Apple Vision Pro, and how the AI revolution should help drive Apple’s Services revenue growth. However, Apple’s Services segment has recently come under pressure from European regulators.

How Europe’s Digital Markets Act impacts Apple

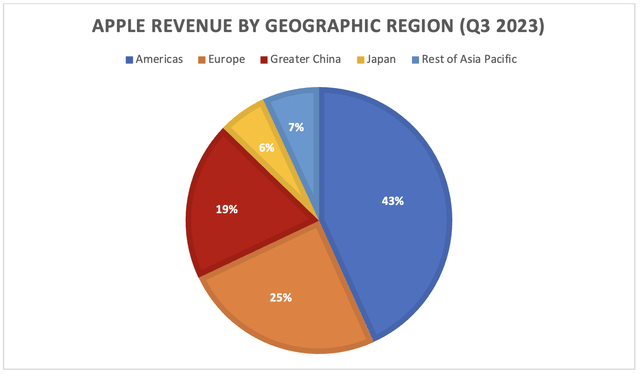

Europe is indeed a significant market for Apple, contributing 25% to total revenue last quarter. While the Digital Markets Act [DMA] only impacts Apple’s Services segment in Europe, there is certainly a risk that regulators from other geographic regions could follow suit, which could impact the entire Services segment going forward. Services made up 25.9% of total revenue last quarter, and is a major source of profit, with the segment boasting a gross margin of 70.5%.

The DMA is targeting the dominance of the iOS operating system, the iOS App Store and Safari web browser. The App Store is likely the most significant driver of Apple’s services revenue, through charging 15-30% commission rates on app sales and in- app sales.

Now the DMA requires Apple to allow other third-party app stores to run within the iOS operating system. Essentially, it will allow iPhone users to buy and install apps outside of the Apple App Store, and allow software developers to sell their apps through alternative, rival app stores.

With that being said, the Apple App Store and Google Play Store are the most prominent app stores, and most users aren’t even aware of the existence of alternative app stores. Therefore, it will be a steep uphill battle for third-party app stores to gain prominence against the Apple App Store.

However, it is well-known that software companies despise Apple’s commission rate, with companies like Epic Games and Spotify having legally challenged Apple on this issue. Hence, once third-party app stores become available on Apple’s iPhone (and other devices), software developers could indeed be encouraged to sell their apps through these alternative avenues to reduce their commission-related expenses.

Subsequently, software companies could also start emphasizing the availability of their apps on alternative app stores in their marketing and advertising strategies, to encourage users to explore these alternative marketplaces. If over time these third-party app stores successfully gain prominence, it would undermine Apple’s pricing power, whereby it may not be able to sustain its 15-30% commission rate on app sales and in- app sales, and consequently hurt Services revenue growth going forward.

And it doesn’t stop there, as the DMA is also challenging Apple’s ability to promote usage of its own apps:

“Key provisions the DMA applies to core platform services include a ban on self-preferencing or gatekeepers requiring business users to make use of their own services… Gatekeepers also cannot ban business users from offering and promoting competing services and they have an obligation to share with them information that their platform usage generates.

Plus there’s a ban on … stopping users from un-installing gatekeeper preloads; and a requirement to apply FRAND terms for general access (and avoid discriminatory T&Cs) for fair dealing with business users.”

Note that “gatekeepers” are the tech giants whose digital market dominance the European Union is looking to restrict.

The rules relating to “self-preferencing” and “preloads” essentially disallows Apple from displaying its own apps, such as Apple Wallet/ Pay and Apple Maps more prominently over rival apps. This undermines a powerful competitive advantage that Apple enjoys, as “self-preferencing” is conducive to greater usage of its own apps and importantly enables Apple to continue delivering strong Services revenue growth. The ban on such “self-preferencing” practices will put to test just how loyal users are to Apple’s pre-installed apps, and essentially requires Apple to become more innovative with the kind of app-based services they provide, as opposed to relying on ‘lock-in’ strategies whereby the tech giant enforces the use of its apps by default.

It seems like the EU is still allowing Apple to pre-install its own apps, but requiring the company to support alternative options for users to negate “self-preferencing” practices. It opens the door for competitors that offer similar apps to gain market share, at the expense of Apple Services revenue.

On top of this, Apple is also required to share “platform usage” data with its competitors, undermining Apple’s competitive advantage through first-party data insights to drive Services revenue growth.

Furthermore, as part of the DMA:

“There are also data portability and service interoperability requirements, including specific interoperability obligations for messaging giants and choice screens-style obligations for OSes, browsers, search engines and virtual assistants. Plus there’s a ban on gatekeepers tracking and profiling users for ad targeting unless they obtain their consent”

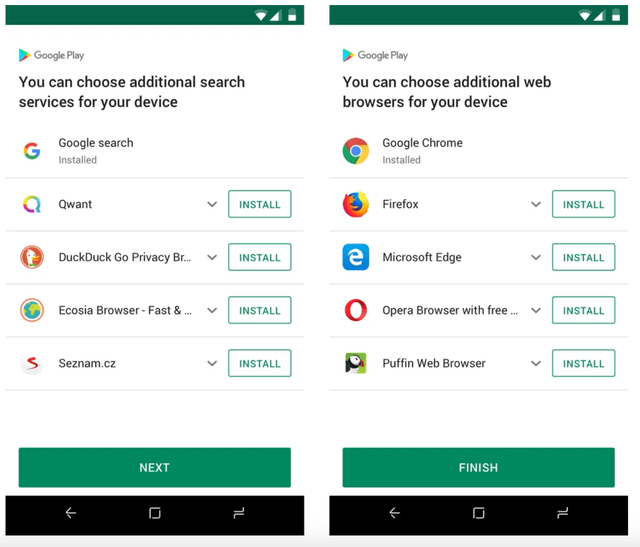

For context, “choice screens” consist of a set of app options including competitive alternatives that tech giants are required to offer users, instead of locking in users to use their own apps by default. Here is an example of a choice screen from Google:

The requirement to offer “choice screens” will ultimately test Apple’s brand power. For instance, the chances of users opting for alternative web browsers remains unclear, and ultimately depends on how much brand power Apple’s Safari has over rival browsers like Google’s Chrome and Microsoft Edge.

Given that the DMA only applies to operations in the European Union, the impact to Services revenue is limited to a certain extent, for now. There is indeed the risk that global regulators introduce similar laws over time to level the playing field, or even in the interest of supporting the growth of domestic software start-ups.

Though on a positive note regarding Apple’s own suite of apps, Apple indeed enjoys strong brand power and trust. Therefore, the availability of alternative apps is unlikely to have immediate impact on Apple’s Services revenue. Though these regulatory pressures could undermine the longer-term growth rates of the Services segment.

Apple’s China risk

As if the DMA was not enough for Apple to be dealing with, the tech giant is now also caught up in the middle of US-China tensions. Over the years, the US has taken various steps to hinder the progress and growth of Chinese tech giant, Huawei, and China is now striking back.

China represented 19% of total revenue last quarter, hence growing efforts by the Chinese government to hurt Apple will inevitably have big ramifications for the stock.

China is banning the use of iPhones by government agencies, and this ban could extend to state-owned enterprises. Wall street believes that this issue is being overblown, given that the ban currently impacts “~500k iPhones of roughly 45 million” that are expected to be sold over the next year in China, according to Wedbush Securities.

But the concern is less over the measures the Chinese government has already taken, and more about what could come next. This could indeed just be the tip of the iceberg.

The Chinese government is notorious for giving preferential treatment to domestic companies, inducing competitive advantages over foreign players. Hence, the Chinese government could indeed take further measures to suppress Apple in favor of domestic tech companies.

Now some investors suggest that one saving grace for Apple here could be the fact that Apple is one the largest employers in China, given Apple’s extensive manufacturing supply chain there. However, amid the Covid-related issues last year, Apple has started pulling out of China and moving manufacturing facilities to countries like India. The Chinese government knows that Apple will continue to reduce its reliance on China over time through greater diversification, at the expense of Chinese manufacturing jobs. This will only further encourage the Chinese government to aid the growth of domestic tech companies in the interest of replacing lost manufacturing jobs.

Therefore, given that Apple is already pulling out, the Chinese government is unlikely to hesitate in introducing new measures against Apple. So, while the iPhone bans currently apply to government agencies, there is indeed the possibility of the Chinese government taking measures to impede sales of iPhones to consumers at some in the future. It could also extend its restrictive measures to other hardware devices, as well as laws targeting Apple’s Services revenue, in favor of domestic software companies.

This would pose a significant threat to Apple’s China revenue, which currently accounts for around one-fifth of total revenue.

Financials & Valuation

Both Europe and China contribute significantly to Apple’s total revenue, together making up 44% of company-wide revenue in fiscal Q3 2023.

While in both cases the current plight doesn’t seem too egregious at the moment, the risk is that this could only be the beginning.

In the case of Europe’s DMA, global regulators will be watching closely how successfully Europe is able to rein in the power of tech giants like Apple, and may indeed follow suit in the interest of supporting the growth of domestic software start-ups. This could threaten the growth rate of Apple’s Services segment, a key source of growth and profitability.

In the case of China, investors should certainly not underestimate how far the Chinese government is willing to go in curbing Apple’s market presence as the tech race between the US and China continues to intensify. Around one-fifth of Apple’s revenue is at risk here. While Apple is proclaiming its growth potential in India, the tech giant will have to prove that revenue growth from this region can offset any lost revenue from China.

Given the rise in international risks facing Apple, investors could indeed avoid buying Apple stock for the time being. Amid the ongoing generative AI revolution, Apple is the only Magnificent 7 stock that has yet to prove how it will win in this new era. Make no mistake, Apple’s opportunities here are indeed massive. But given that other Magnificent 7 companies are already proving (or at least showing strong prospects of) how they can win at AI, investors could indeed be encouraged to allocate more capital in those stocks over Apple.

Therefore, Nexus Research does not believe Apple will be able to sustain its current forward PE of around 30x, and the stock could indeed fall further. Note that the 5-year average forward PE for the stock is under 25x, and it would be unsurprising for the stock to pull back further to trade more in line with its 5-year average. The loss of revenue from China over time should not be underestimated. Additionally, Europe may certainly not be the only geographic region looking to crack down on the tech giant’s digital market power, threatening one of Apple’s main growth engines, Services.

Nexus Research does not advise on short-term trades, but rather focuses on the long-term opportunities. Therefore, despite the strong likelihood of Apple stock falling further, Nexus Research does not recommend long-term investors to sell the stock. It ultimately depends on your average buying price, but Apple remains a solid investment security to hold. However, neither does Nexus Research recommend buying the stock here, given the seriousness of the international risks the stock faces. Nexus Research is downgrading Apple stock to a ‘hold’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.