Summary:

- Rumors of Disney being acquired by Amazon or Apple have been strongly denied by CEO Bob Iger.

- I argue that Disney’s stock is overvalued and predict it will drop into the $60s.

- I suggest that Disney needs to overhaul its business model and focus on generating new IP internally.

Bastiaan Slabbers

“Every organization should tolerate rebels who tell the emperor he has no clothes”…Colin Powell

We’ve had heard that Disney (NYSE:DIS) was rumored to be in contact with Amazon (AMZN) about them writing the big check for the whole mouse house. Also buzzing was that Apple (AAPL) actually might be the candidate to take a Disney bite. All’s been strongly denied by CEO Iger during the last earnings call. We agree, in so many words, Iger’s subtext suggests: Who would want the Disney’s mess of the moment at any price?

Yet, if AMZN can get the company cheap it makes sense. But a price tag anything well above $62 in our view is makes you a full time, matriculated student in the Greater Fools Investment Academy. One can indeed scramble enough metrics into a coherent bull case for those inclined to cling to the possibilities of past glories recreated once somebody figures all this out.

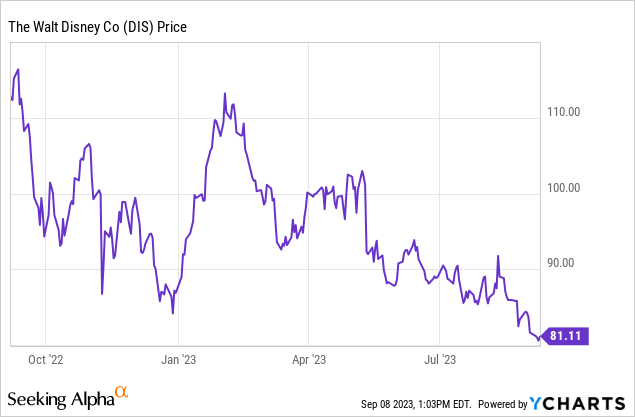

We can’t see it. We read the numbers and our bear growl – sorry to say – gets louder. At writing, DIS has temporarily broken the $80 support level and dipped to $79.97 and later recovered over $80. It may rebound a bit more, but more likely we believe it is headed into the $60s because its core problems – like those of its peers – won’t be band aided away.

It’s either a sell or a short candidate with a long breather taken until some kind of real news breaks out of Culver City that feels like recovery. And then could signal a buy.

The free forum that SA offers to investors does indeed have its wisdom sunk in the idea that a diversity of opinion melded together in one place can usually produce a refined, educated guess on the trajectory of a given stock. This has been clearly demonstrated by the constant flow of SA articles on the prospects ahead of the Walt Disney Company.

There is no shortage of bull cases made, to be made, even begged out, that DIS has absorbed all the blows of a chaotic post-Covid, media/entertainment tsunami. And that only the sunny uplands of a return to fat valuations lie ahead. We are seeing analysis that tells us $80 a share is a screaming buy. Supporting that case are piles of neatly arrayed metrics that lean on legacy tent poles of the company. And faith in its immense IP treasure trove that can be endlessly repurposed, turning animated winners into live action winners among other strategies yet to be articulated.

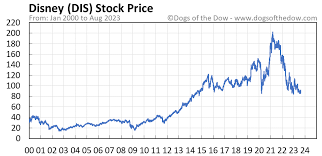

In 2005, Robert Iger ascended to the CEO post replacing Michael Eisner. At that point, DIS stock was hovering around $22 a share. So even factoring in an inflator for that would bring you to $34 a share in today’s money. Good for him? Partially to be frank. Yet in 18 years the stock has moved to its current $80 price. In reverse inflationary value, that would be equivalent today to $51 according to the inflation calculator reversed. As to its $189 February 2021 high, fuggetaboutit- – – for the foreseeable future. Consensus PT at the moment falls in a $100 range or higher among some bulge analysts.

The foundational bull scenarios all lean on the conviction that DIS IP, repackaged, repurposed and woke loaded can resume producing outsized grosses in the years ahead. And the disparity of prices among media stocks seem to suggest that conviction still lives to support its premium price. The perception of value in times like these for the sector is distorted by events.

Sector valuations at writing for perspective only:

Netflix: $443

Investor rationale – A pure play, a sector leadership play. Easier to understand, a sales and earnings growth scenario. If you buy into it as the probable biggest and best survivor of the streaming wars, you can make the case for $443.

Warner Bros/Discovery: $11

Investor rationale – Waiting for Malone and Zaslav to figure it out. Be patient.

Paramount Global: $13

Investor rationale – Shari has to keep selling stuff, anything. Don’t stop at Simon & Shuster Shari.

Comcast: $44

Investor rationale – Somewhat of a less delusional vision about valuation of its asset base.

Lions Gate: $8

Investor rationale – High-risk tolerance players in the space think its asset IP base is way undervalued. Could be. At $8 a share it seems like a decent dice roll.

We don’t imply here that we have equal asset playing fields as the determinant of the share prices. DIS has by far the biggest, most diverse asset base, of course, bringing the dollar for dollar value into entirely different territory to most peers. The others do not have theme parks, cruise lines, vast merchandise businesses. But they do have either linear networks, cable IP as well as streamers. And therein lies our thesis here:

We believe that the DIS asset base, diverse, spread over many businesses, is vastly overvalued. Add its huge debt profile, the morass of the current media/entertainment business in general and for the rotten cherry on top of this sundae, the current writers/actors strike and Huston we have a problem.

So you have what in our view is a very tough case to make for a bull outlook based on the assumption that DIS businesses as they are now run can continue laying golden eggs.

With all peers (except Netflix) priced so dramatically lower than DIS, you have to find your logic base in the case for price recovery in all, or most of its verticals. We think for now, there is no answer for DIS other than a full-scale attack on the extinct business model that has guided it since the departure of Eisner in 2005. The objective: A slimmed down DIS with only its most viable elements remaining, a healthier debt profile and a clear policy to generate new IP out of internal creative juices rather than overpaying for IP created by others could be a start.

We call attention to the old rancher’s adage as the difference between analysts of a sector and operators: Anyone can weigh cattle, not everyone can raise cattle.

DIS used to be one of the better raisers of cattle in the business. That is no longer the case. Building a bull scenario on that assumption goes way beyond the piling up of metrics.

The ongoing delusions that support $80 today and PTs of over $100 going forward

google

Line up the usual gaggle of IP golden geese: Original Disney legacy animated features, Marvel superheroes, Star Wars, Indiana Jones, Pixar oldies, you name it. These are wells we are told that will never run dry, but keep pumping out so many barrels of money a day deep into Disney’s future. In truth, they can still trickle out a few barrels here and there, but they are aging fast and are already going dry.

The performance of DIS films released over the past year appear to confirm the view that they have been aging out. Guardians of the Galaxy broke the mold of failure because it was a really good film at the endgame of the superhero genre.

Then you are told that Disney theme parks are so much a part of the childhood of American children that no matter how high prices are raised, parents will cough it up – even at the expense sometimes of more pressing family needs. There is a core truth in this if you assume that the economic laws of price elasticity or inelasticity no longer apply to Disney.

But the price hikes at the parks have broken through even the powerful parental need to produce memories for their kids. Families paying the out of control king’s ransoms just to keep everyone fed in this inflationary insanity of a world is being felt. Diminishing numbers at the DIS parks are the true tale of the tape. Whether attendance rebounds or not nobody knows, inflation numbers have reignited all over again.

You are told that the rescue of DIS streaming verticals lies in a steady tweaking of pricing between ad free and ad supported. That’s too facile an answer. The hard truth is the persistence of glut throughout the sector and the habit pattern that the streamers have created. It’s their own Frankenstein monster. In brief it has produced a subscriber mentality that picks a handful of shows per company, gets either a cheap trial or a low price to entice. And then when the shows are viewed, off the new subscribers go, looking for the next sucker deal on a platform with another show they want to see.

As a result, sustaining a viewership over time leans on the occasional dice throw of a big winner. No streamer has an exclusive franchise on the lightning strike of a blockbuster series. Viewership is fungible. In brief, streaming thus far has proven itself a lousy business model. It can be viable at some point, but how and when remains the biggest unanswered question in the sector.

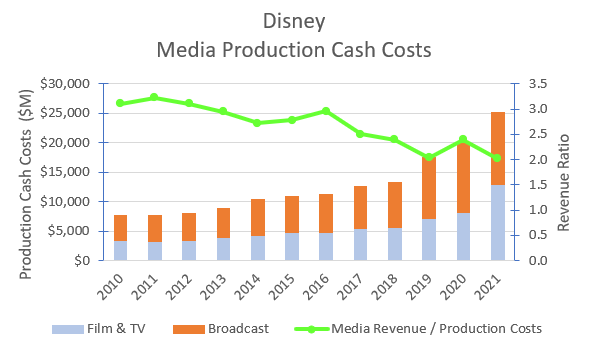

You are told that DIS is bringing down the hammer on runaway production costs on its movies so that the endgame as the flicks sink into final oblivion of streaming its profitable. It’s a start, but someone needs to look around at cascading number of movie theaters closing down and the shrinking aperture of time in which audience interest flags. Count the Barbie’s to come on one hand. The Lion King is long fast asleep.

You are told that DIS linear networks are under scrutiny for possible sale or spinoff, or are candidates for cost discipline. Does this mean an end to the catering of the massive egos of name performers, producers and of course, dedicated wokeists could be gone? Perhaps, perhaps not. We do know that far too many famous names behind old hits have long underperformed their bloated price tags. DIS appears to continue to be overpaying people for what they were, not what they could be.

ESPN: Thus far DIS has failed to solve the ESPN dilemma even with its PENN Entertainment (PENN) deal, its plan to go full bore streaming. These tweaks to us are clear evidence that management has yet to confront the only sensible course for the unit: Sell it, sell it now, take the proceeds and divide it up between taking multi-billions of debt off the balance sheet and add to your production schedule of reasonably budgeted movies that do not need mega-grosses to bring shekels down to the bottom line.

google

Above: ESPN’s subscriber base has been in a death spiral for years a little at a time. Meanwhile the cost of sports rights has skyrocketed.

google

Above: Who’s minding the store? Costs of production going up, revenue going down with no end yet in sight.

Live action remakes of animated classics have a mixed history. What should raise hackles among investors is that DIS management appears oblivious to risk. The unique charm and usual brilliance over decades of DIS animators is not easily transmitted to live action no matter how wonderful the human cast members perform.

Aladdin for example, made $1b and was adapted from an old pot boiler from another studio decades ago. Broadway versions of it as well as the wonderful Lion King) ($1.66b grosses) did great. But that was pre-Covid 1994, when repurposed content still found new audiences in a different world than today. And the wokeist insanity had yet to run rampant in moves as well as television programming.

Movies budgeted for profit not brownie points

The Little Mermaid had made an estimated $569m gross globally against a cost of near $400m for production and marketing. Colleagues who are veterans of the movie business have told us that it is reasonable to expect the movie to produce one of three endgames: It will either a) make a few dollars, not many b) break even – most likely or c) lose money – possible, but not probable.

Given the lackluster grosses globally of TLM film we can reasonably assume it had a woke obstacle to overcome as some expect to reoccur when and if the woke version of Snow White ever appears in theaters. Not to accept that it is a factor – big, small or tiny is a head in the sand response.

The point is that investors expect the managements of the companies in which they hold stock to be smarter than they are when it comes to making sector decisions. That has not been the case with DIS when you objectively look at its operating results under the pressures of chaos and uncertainty. Easier said than done of course. But the corrective actions we’ve seen to date do not as yet to boost Mr. Market’s overall conviction that DIS has no answers yet.

More important than that, what really reveals the hard truth of today’s movie business, is that the days of loading $400m into one movie, albeit its animated precursor was a hit are over.

Conclusion: Content is not king – it’s king at times, otherwise a pawn in a game where the rules have changed

Examining both the bull and bear takes on DIS on SA as well as other sources in financial reporting and analysis, we come up with this: Thus far DIS management and board have yet to confront the reality that the long, glorious business model and performance of the company is not just a broken business model due to macro factors. Broken implies repairs are possible to make the engine purr again. In our view, extinct is closer to the truth. When an animal or plant goes extinct, it means that it has failed the test of survival when buried by catastrophic change, thank you Mr. Darwin.

It is fair to state that the media/entertainment sector has entered something of an ice age. The compounded after effects of Covid on dramatic changes in life style, the untamed burst of runaway inflation, and the sheer build-up of content glut has squeezed the life out of attention spans already shrunk after being assaulted by social media obsessions for so long.

Audiences such as they are, are more fickle than ever, more harder to please, more just as happy snapping moronic selfies for their kicks than sitting out a long movie.

The RXs that have come out of DIS since the destruction of the old world of media and entertainment began in 2020 IMHO fail to meet the Darwin test. Somewhere in the ranks of DIS management at all levels we are told by some former employees, there are indeed rebels. There are people who have a grasp on reality that is valuable. There are people who can conjure up new IP so that the corporation does not have to pay punitive premiums for the creativity of others.

Until then investors can expect to be offered more old wine in new bottles from this management.

Until real change happens, DIS is a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" – free to existing members and new subscribers.