Summary:

- American Airlines’ stock is near yearly lows despite the airline returning to producing massive profits.

- Higher fuel prices are a concern for the market, but they don’t significantly impact the airline’s ability to generate substantial profits.

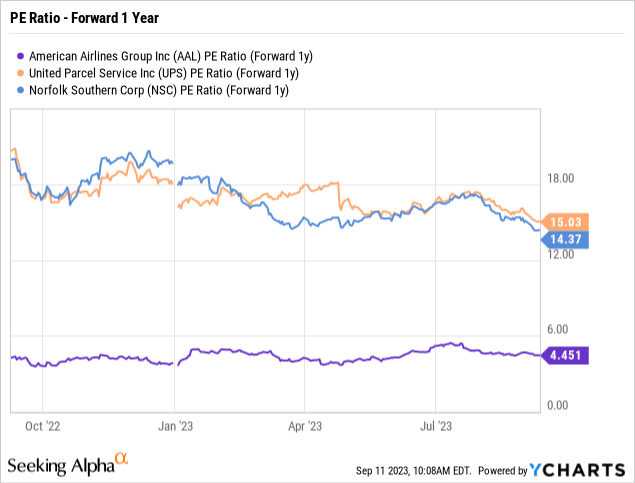

- The stock is far too cheap trading at only 4.5x EPS targets while industrial transport peers trade at 3x the PE multiple.

Wirestock

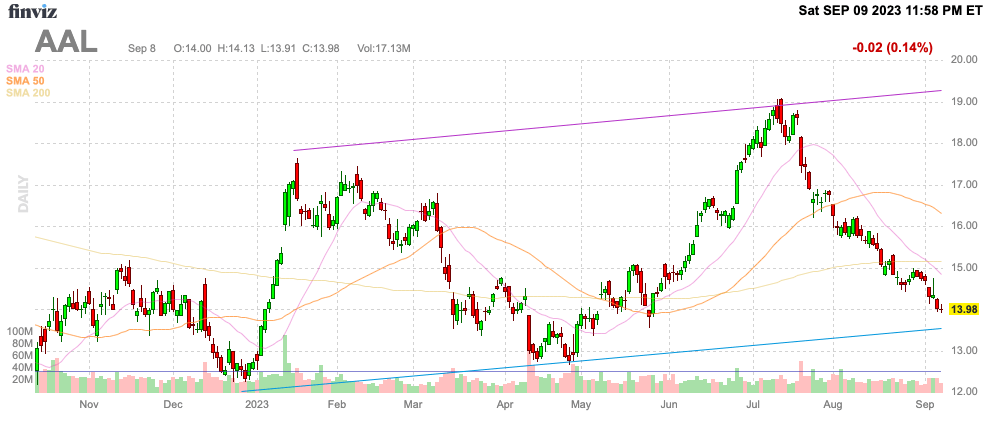

Despite the airlines returning to massive profits over the last year, American Airlines Group (NASDAQ:AAL) is back to near yearly lows. One prime reason for the weakness is higher fuel prices constantly feared by the market for no rational reason pushing the valuation far below industrial transport peers. My investment thesis remains ultra Bullish on the airline due to the cheap valuation from the irrational dip in the stock back below $14.

Source: Finviz

Fuel Hiccup

Over the last decade, the airlines have made fuel costs only a small-term issue for profits. Airlines alter ticket prices to address rising and falling fuel prices to eliminate any impact to profits over the long term.

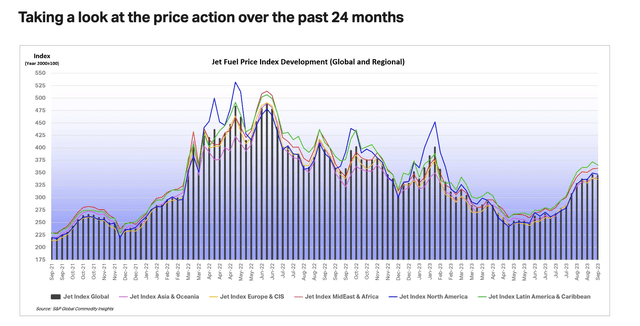

So despite fuel being a large cost for American Airlines, higher fuel costs don’t alter the ability of the airline to generate substantial profits. After all, the airline produced substantial profits in late 2022 when jet fuel prices were much higher than now.

Last week, legacy airline peer United Airlines Holdings (UAL) warned about the 20% rise in jet fuel prices. The average price per gallon was hiked to $2.95 to $3.05.

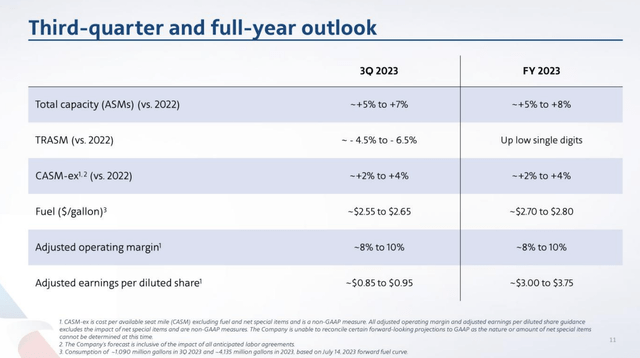

When American Airlines forecast Q3 earnings, the airline was only forecasting a fuel price of $2.55 to $2.65 per gallon for the quarter. The sharp fuel price rise will no doubt impact some short-term profits and could impact the guidance for a $3.00 to $3.75 EPS for 2023.

Source: American Airlines Q3’23 presentation

American Airlines guided to Q3 fuel consumption at ~1,090 million gallons. A $0.10 shift in fuel prices would impact costs by $109 million in the quarter for a total fuel cost originally targeted at $2.8 billion.

The airline has a revenue target of $13.6 billion. The market is correct to have concerns regarding fuel prices considering costs run at about 20% of revenues despite more fuel efficient airplanes now.

Huge Valuation Discount

The part constantly missed by the stock market is that the airlines quickly shift fares higher to accommodate the higher fuel costs. The old legacy airlines use to absorb the fuel costs leading to massive losses during periods of high energy costs.

Last Q4, American Airlines reported a booming quarter with an EPS of $1.17 topping the Q4’19 level of $1.15. This booming EPS was generated with a fuel cost of over $3 per gallon.

American Airlines even guided to a 2023 fuel price of $3.00 to $3.10 per gallon. The airline guided to a 2023 EPS of $2.50 to $3.50 for the year when the consensus was only $1.79.

The stock traded up at $16+ when American Airlines reported Q4’22 results in last January. So the odd part here is the continual hike to profits hasn’t led anywhere close to a higher stock price.

United suggests fuel prices are now slightly below the original guidance for the year by American Airlines when the EPS target was $3. Now, the stock trades at a lower price with the expectations for booming profits still inherent in the long-term business model.

As demonstrated, American Airlines was highly profitable at higher fuel costs in late 2022. The stock shouldn’t trade at a minimal PE multiple of only 4.5x forward EPS targets.

The strange part about the valuation story is how United Parcel Service (UPS) and Norfolk Southern Corp. (NSC) in the industrial transport sector continue to trade at far higher multiples. As an example, Norfolk Southern just reported a quarter where revenues slipped 8% and missed analyst targets by $80 million, yet the stock market values the earnings at over 3x the earnings from American Airlines.

As with fuel costs, the market constantly makes excuses for paying a low PE multiple for airlines like American Airlines, yet other industrial transport stocks face similar, if not bigger challenges. The airline even has the debt issue under control now eliminating the excuse for the stock still trading at the low PE multiple.

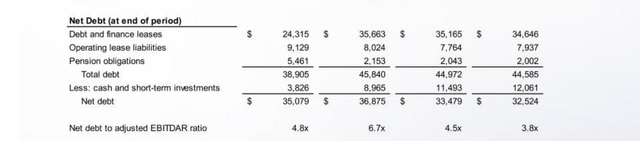

The company ended the last quarter with net debt of $22.6 billion. The airline has already produced $4.3 billion in free cash flow this year due to higher advanced ticket sales and profits leading to the debt position falling towards the 2019 levels.

The even more bizarre part of the low PE multiple is that American Airlines has a far lower leverage ratio now than back in 2019. The debt portion is under control and the airlines will slowly cut total debt levels by reducing the cash position now sitting at $12.1 billion to eventually lower interest expenses.

Source: American Airlines Q2’23 presentation

Takeaway

The key investor takeaway is that American Airlines is absurdly cheap here. The airline continues to take major steps forward, but every perceived negative holds the stock down while industrial transport peers trade at far higher valuation multiples while facing their own problems.

An airline stock producing this level of profits and cash flows only years after facing major debt fears shouldn’t trade below 5x forward EPS targets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.