Summary:

- Telecommunication stocks have sold off due to industry challenges and rising interest rates.

- AT&T is popular among passive income investors, but Telefonica may be a better investment.

- We share two reasons why we own TEF instead of T.

olaser

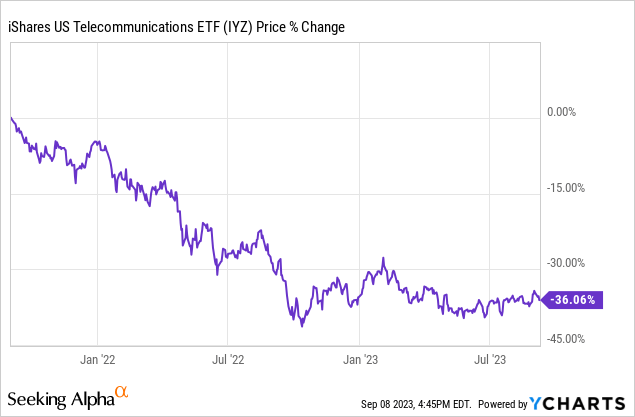

Telecommunications stocks have sold off quite aggressively over the past two years due to heavy cap-ex needs in the industry, overleveraged balance sheets, an increasingly competitive landscape, and rapidly rising interest rates:

In the sector, AT&T (NYSE:T) stock is particularly popular among retirees and other passive income investors because it offers:

- A very attractive dividend yield that appears well-covered by cash flows

- A stable business model that should be able to support the dividend for years to come

- An investment grade balance sheet that helps to mitigate risk

While all of these things are true, we believe that investors would be better served by investing in a different telecommunications giant: Telefonica (NYSE:TEF) stock. In this article we discuss three big reasons why.

Company Overviews

Both T and TEF operate in the telecommunications sector. T is a U.S. based company that sells wireless voice and data services, devices, and various data and communication solutions to businesses and residential customers through brand names such as AT&T, Cricket, and AT&T Fiber via its Communications segment. Meanwhile, it also has a substantial business presence in Latin America where it also sells wireless services and smartphones.

TEF, meanwhile, is based in Spain and operates in several European markets as well as Latin America. It offers mobile services (such as mobile voice, value added, mobile data, Internet, wholesale, corporate, roaming, fixed wireless, trunking, and paging services) and fixed communication services (i.e., PSTN lines, ISDN accesses, public telephone services, local, domestic, and international long-distance and fixed-to-mobile communications, corporate communications, supplementary value-added services, video telephony, intelligent network, and telephony information services). TEF also provides internet, broadband, and multimedia services, along with leased lines and network solutions, serving both retail and wholesale customers as well as telecommunication operators. Additionally, TEF offers video/TV services, IoT products, cloud computing, advertising, and various digital services.

#1. Telefonica Has Better Growth Potential Than AT&T

In our view, TEF is better positioned to deliver growth than T is. T has had to spin off its growthiest business (media assets) in a desperate attempt to disguise a dividend cut and get rid of some of its debt, leaving a very low growth business remaining behind. As a result, T is caught in a cycle of having to invest aggressively in its capital intensive core business just to tread water.

Moreover, it is having to dedicate every last free dollar towards paying down debt as it seeks to strengthen its balance sheet in a “higher for longer” interest rate environment.

Despite all this, its competitive positioning appears to be quite tenuous as not is competition from the likes of T-Mobile (TMUS) and Verizon (VZ) heating up, but even rumors about a potential future entry of Amazon (AMZN) into the space sent the stock tumbling. This reveals just how little confidence the market has in T’s competitive strength in an industry that is only growing more competitive.

Moreover, in the near term, T is facing a potential major headache (and substantial liability risk) from an ongoing investigation into potential damages caused by led cables that the company was at least partly involved with in the past. All of these issues weigh heavily on T and give it a very weak – if not non-existent – growth profile for the foreseeable future.

Meanwhile, TEF is no strong growth stock either and it certainly faces similar capital expenditure, competitive, and balance sheet demands. However, it does not face the risk of Amazon entering its main market like T does, nor does it face the same led cable risk.

In addition, TEF is generating substantial organic growth this year. It recently upgraded its guidance for the year after generating 4.1% year-over-year organic revenue growth and expects a similar growth rate for the full year along with ~3% full year organic OIBDA (similar to EBITDA) growth.

Management believes that their peak capex requirements are behind them and expects to continue driving sustainable organic profitability growth in the business moving forward, with a particular focus on free cash flow generation in its core markets of Spain, Brazil, Germany, and the U.K.

TEF also has some strong growth engines in its Telefonica Tech and Telefonica Infra businesses as well as its Telefonica Hispam business segment, which it has derisked considerably in recent years as it tries to reduce capital in that segment.

TEF is also canceling its treasury stock alongside its attractive all-cash dividend, which should serve as a per-share intrinsic value growth catalyst moving forward.

#2. Telefonica Stock Is Cheaper Than AT&T Stock

Last, but not least, as the table below makes clear, TEF is clearly cheaper than T, particularly in the most important valuation category that takes leverage into account (EV/EBITDA):

| Security | EV/EBITDA | P/FCF | Div. Yield |

| TEF | 5.16x | 5.87x | 7.82% |

| T | 6.39x | 5.91x | 7.69% |

While T looks attractive at the moment given that it is finally trading at a discount to its long-term average EV/EBITDA multiple, TEF is trading at an even larger discount to its long-term average EV/EBITDA multiple and is also trading at a very large discount to T’s EV/EBITDA. While its P/FCF and dividend yield are only slightly more attractive than T’s at the moment, they are still more attractive and its superior EV/EBITDA reflects the fact that its business model is better positioned to deliver long-term growth for shareholders as it is generating more EBITDA per dollar of enterprise value than T is.

Moving forward, we expect neither business to generate much in the way of dividend growth as both remained focused on continuing to deleverage their balance sheets and invest aggressively in their capital intensive businesses. However, TEF’s deeper discount and slightly higher current dividend yield give it the clear edge when it comes to total return potential.

#3. TEF’s Dividend Is In Better Shape Than T’s

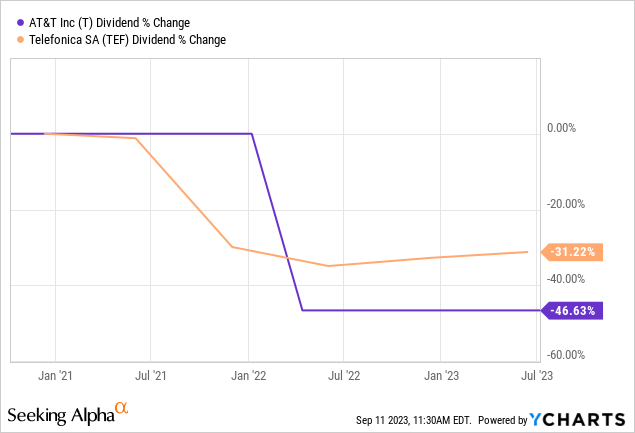

Both TEF and T have cut their dividends fairly steeply in recent years:

While analysts don’t expect either business to grow their dividend payouts much – if at all – over the next several years, we believe that TEF’s dividend is on firmer footing than T’s is.

First of all, in 2024 TEF has 5.7% (2.01 billion Euros) of its total debt maturing whereas T has 6.4% (8.95 billion USD) of its total debt maturing. While both companies have sufficient cash on hand plus free cash flow net of dividends to pay off this debt in its entirety as it matures, this comparison shows that T has a slightly greater incentive to pay down debt next year, leaving less funds available for its growth investments and potential buybacks.

Moreover, TEF’s leverage ratio as of June 2023 was 2.62x in contrast to T’s reported leverage ratio of 3.25x. As a result, TEF has a much lower debt burden weighing on it, which is particularly important given that we are in an elevated interest rate environment. This means that TEF’s free cash flow and earnings per share will be more resilient than T’s in the face of volatility in interest rates as well as broader economic conditions, thereby making its dividend safer.

Another sign that TEF’s dividend is on firmer footing than T’s is that – despite having a lower leverage ratio – TEF’s 2022 free cash flow yield is a whopping 20.7% of its current market cap compared to T’s 2022 free cash flow yield of 15.7%. This once again implies that its dividend is much better covered by free cash flow than T’s is.

These safety metrics look even better when taking into account that T is facing the led cable risk whereas TEF is not. Moreover, T could face a mortal wound should AMZN enter the space whereas TEF is pretty well diversified by geographic market such that should AMZN do this, it would not impact them nearly as much.

Investor Takeaway

The telecommunications sector has taken a beating recently and we believe that much of these headwinds have been justified. As a result, we have very minimal exposure to the space and prefer to allocate our capital into more profitable and better-moated infrastructure businesses.

That being said, the selloff has been aggressive enough that, at a time when macroeconomic fundamentals seem to be increasingly pointing to an economic downturn and interest rates being near or at their peak in the cycle, some telecommunications stocks are beginning to look more attractive relative to some other opportunities out there right now.

Overall, we believe that TEF is a much better pick than income investor favorite T because its dividend yield is slightly better and convincingly safer in our view, the stock itself is much cheaper, and the growth momentum and potential is stronger while the headwinds and risks are fewer. As a result, we rate TEF a Strong Buy and T a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TEF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!