Summary:

- McDonald’s is a remarkable company with multiple revenue streams and a dedication to customer experience, making it a strong investment opportunity.

- The company has a wide economic moat due to its strong brand image and operational synergies, allowing for significant pricing power.

- McDonald’s has a track record of outstanding financial results and is currently experiencing strong growth, making it a potentially lucrative long-term play.

- Current valuations imply a slight undervaluation in shares and thus, I believe an opportunity to pick-up a Buffett style company at a good price.

- I rate McDonald’s a Strong Buy.

thad/iStock Unreleased via Getty Images

Investment Thesis

McDonald’s (NYSE:MCD) is a truly remarkable company. Their robust set of revenue streams combined with an outstanding dedication to ensuring a high-quality customer experience has helped the company regain their pricing power and popularity among consumers.

When combined with a historically rare undervaluation in shares compared to a calculated intrinsic value figure, I believe that a real modern-day Munger inspired Buffett-style opportunity exists in the company.

While shares are roughly trading at what appears to be somewhere between fair value and a modest 20% undervaluation, I believe the firm’s continuous ability to generate sustained value for shareholders through market-beating results creates for a compelling “Strong Buy” opportunity.

Company Background

FY23 10-K

McDonald’s is the company that comes to mind when examining the consumer fast-food marketplace. Since their inception in 1940 through to today McDonalds has grown to become the largest fast food restaurant chain in the world serving over 69 million customers daily across over 100 countries. The firm employs over 1.7 million employees to operate their almost 45,000 outlets worldwide.

The firm’s classic menu items such as their iconic hamburgers, cheeseburgers, fries and chicken nuggets are complemented by a vast portfolio of products localized for each specific market they operate in.

McDonald’s extracts their revenues primarily from the rents paid by franchisees for operating their McDonald’s franchises on the land owned by the corporation. The firm also receives royalty and franchise fees which act as another important set of revenue streams. While the firm is known for their burgers and food, it is clear that McDonald’s as a business operates primarily as a real estate company.

Economic Moat -In Depth Analysis

McDonald’s has a wide economic moat which stems primarily from their reputable and globally renowned brand image combined. This brand image thus acts to further expand the breadth of their economic moat providing the firm the ability to have significant pricing power and multiple other positive operational synergies.

The powerful brand identity McDonald’s has managed to create for themselves as the go-to “American” fast-food establishment has been achieved through a combination of being innovators in the space and through multiple promotional eras the firm has experienced.

Quite simply, the invention of an ultra-fast, highly systematic and operationally efficient fast-food joint was pioneered by the McDonald brothers meaning that the establishment already stood-out thanks to being truly novel in the restaurant business.

Ray Croc can largely be credited with expanding the brand, the business and its influence across not only the US, but across the entire globe. The decision to operate using a franchise model allowed for rapid expansion of the brand while retaining the same high-quality food and operational model that worked at the original establishment. Furthermore, Croc was laser focused on reducing operational inefficiencies and further improving the core product offering McDonald’s provided eaters.

Ultimately, the food and experience provided to customers was the main driver in making McDonald’s the fast-food phenomenon they are today. Especially outside of the US in regions such as Europe or Southeast Asia, their product offerings were truly novel and unique compared to the local foods of these regions.

While it is undoubted that McDonald’s acts as a symbol of American influence both within the country and abroad, the firm has also understood the importance of catering both their menu and location style to the unique requirements of each geographic region independently of one another.

McDonald’s has many menu items which are only sold in certain locations across the globe with a huge variety and variance being present especially when compared to the traditional US menu. The firm combines these menu adjustments with changes to how their eating spaces are laid out to ensure customers in each and every country can experience the style of eating experience they desire within a McDonald’s establishment.

McDonald’s Strong Q2 Results – Press Release

This dedication to the eating experience is what I believe is the key driver in their current day reputation and image. The firm’s multiple special menu items, limited time offers and brand partnerships in Happy Meal (children’s menu which usually includes a toy) products also helps to create hype and novelty among consumers further enticing members of the public to eat at McDonalds.

The ensuing brand loyalty McDonald’s benefits from among its consumers helps drive multiple other operational synergies which further bolster the firm’s economic moat. Loyalty provides McDonald’s with the opportunity to enjoy significant pricing power in what is otherwise a hugely competitive and essentially undifferentiated market environment.

While foods may taste slightly different, anyone can sell a burger. McDonald’s, however, is not just selling its consumers food but a reliable, trusted and enjoyable experience. Going to eat at a McDonald’s is a safe-bet for most consumers, the food is a known quantity and the service will be fast. This sale of an experience allows the firm to charge a premium on many of their menu items.

McDonalds.com | 1,2,3 Dollar Menu Items

Many McDonald’s restaurants still offer “$1” or “Euro-saver” menu items aimed at budget conscious customers, but a large portion of the firm’s offerings cost between $3-$10 depending on the style of product or menu selected. In Europe McDonald’s has many “premium” product offerings such as the Maestro Generous Jack Burger in Belgium which as part of a standard medium fries and drink menu can cost up to €13.50 ($14.49).

mcdonalds.be | Menu | Generous Jack

This illustrates how McDonald’s has been able to consistently move up-market in the fast-food business particularly in European and Asian markets.

McDonald’s also enjoys multiple operational synergies arising from the sheer scale of their business. With over 42,000 restaurants the firm is able to negotiate lucrative local food supply deals which minimize the amount of shipping and transporting required.

The large scale of most orders for raw ingredients also helps decrease the COGS associated with running the franchises. These economies of scale benefits combined with their strong pricing power allows the firm to charge huge markups on their products.

The chain’s soda is sold at a 1150% markup while many breakfast items cost less than $1 to make in US markets. McDonald’s has also become one of the world’s largest coffee chains known particularly for their great tasting and affordable coffee. Even in this incredibly competitive market, McDonald’s is able to charge customers a 2,900% markup.

McDonald’s has managed to carve-out a hugely deep and broad economic moat in a market environment which usually results in no-moat situations and businesses and restaurants. Their unique operational model combined with a strong brand identity affords the company the opportunity to control prices to quite a large degree.

When combined with their unmistakable brand image, McDonald’s is a perfect example of how to differentiate a business in an extremely competitive market environment. I believe this wide-moat secures McDonald’s position as the leading fast-food eatery for at least the next 25 years.

Financial Situation

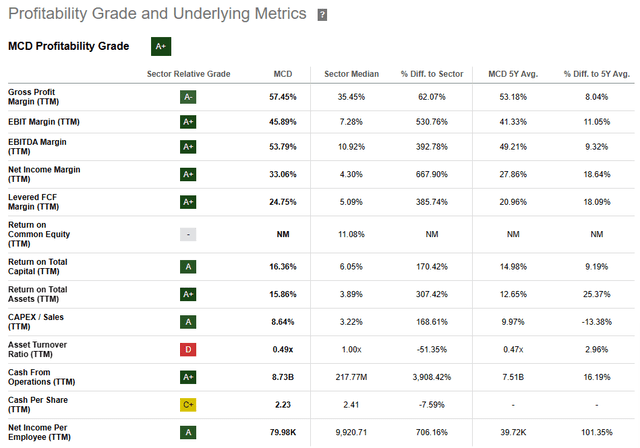

McDonald’s has a track record for producing outstanding financial results and turning huge amounts of profit. Their 5Y average ROA, ROE and ROIC are 13.26%, 77.60% and 19.5% respectively. These returns are very healthy not only for a restaurant business, but truly gold-standard for any type of business.

The firm’s 5Y average margins are equally impressive with gross, operating and net margins totaling 53.35%, 41.73% and 28.12% respectively. Once again, these basic operational performance metrics highlight the profitability powerhouse that is McDonald’s.

Accelerating The Arches | McDonald’s.com

Considering McDonald’s progress in recent times and FY23 in particular, it is clear that their current “Accelerating the Arches” operational strategy is working effectively.

This strategy encompasses five operational objectives all aimed at ensuring strong and reliable growth is achieved at the firm. The strategy aims to invigorate the core product offerings and familiar fan favorites through creative and relevant marketing material, increased digital, delivery and drive thru offerings and overall organizational improvements.

When first reading the promotional materials for this updated strategy in January 2023, I was pleasantly surprised by the level of awareness and acute understanding CEO Chris Kempczinski seems to possess regarding the main hurdles McDonald’s faces in guaranteeing future popularity and growth. Nonetheless, I remained hesitant to lean to heavily on this press-release and wanted to see fiscal data to backup these bold objectives.

When analyzing the Q1 and Q2 data, it is clear to me that the strategy appears to be working excellently.

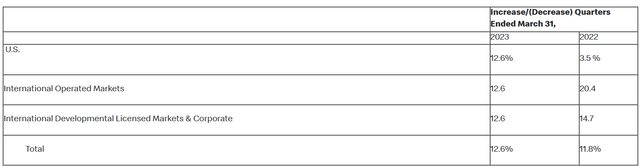

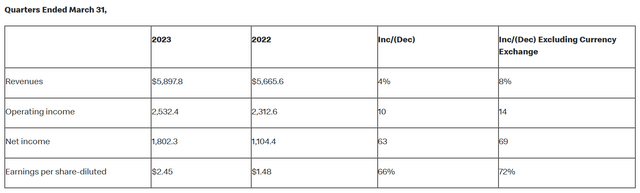

mcdonalds.com | Q1 Press Release

FY23 Q1 saw comparable sales grow 13% for the quarter alone with growth being experienced across each and every geographic segment in which the firm operates. This represented a 1% improvement over the previous fiscal year.

These impressive growth figures come on the heels of McDonald’s new operational strategy successfully driving increased customers satisfaction thus resulting in increased demand for their products.

Not only is 13% growth in comparable sales impressive as a metric alone, but to have increased this by 1% over a year where inflation has run rampant with real pricing levels rising steeply for consumers illustrates the powerful grasp McDonald’s has on consumers eating habits.

mcdonald.com | Q1 Press Release

These strong comparable sales figures are backed up by revenues increasing 4% (8% on a constant currency basis) with consolidated operating income increased 10% YoY to over $2.53B. This significant improvement in operating income was a result of the firm’s continued drive to decrease COGS and organizational inefficiencies in order to expand their operating margin.

Net income for Q1 grew by 66% YoY.

Similarly strong sales growth and margin expansion was achieved by the firm in Q2. Comparable sales increased another 2% YoY thanks to a strong recovery in YoY Q2 sales growth in their US market segment.

Revenues for Q2 also increased 14% with operating income increasing 20% compared to the same quarter in Q2. Net income increased 79% YoY with EPS being 82% larger than in Q2 FY22.

This continued and strong quarterly growth illustrates how the brand’s successful execution of their operational strategy is driving results and profitability further. Considering the incredibly tough macroeconomic backdrop upon which McDonald’s has achieved these results, I am nothing short of highly impressed.

The majority of McDonald’s revenues arise from the rent it collects from its franchisees for operating their restaurants on the land owned by the firm.

This model allows McDonald’s to have a significant degree of stability in their primary revenue stream compared to a traditional restaurant as their ultimate profitability (at least in the short- to mid-term) is not defined by the revenues generated by their individual restaurants.

Furthermore, the lease agreements established by the company with their franchisees guarantee rents for many years to come, further helping to ensure that the company’s key revenue stream remains unharmed by short-term headwinds.

McDonald’s also continues to harness a huge stream of franchise fees from their franchisees. While these fees vary by site type, amount of company investment in the establishment and the local business conditions, these agreements also have long 20-years terms.

Once again, the careful planning regarding the manner in which McDonald’s benefits from the operation of their Franchises helps increase the robustness of their revenue streams. Furthermore, by ensuring franchisees remain in possession of a significant portion of their operating profits, McDonald’s ensures the opportunity to run a restaurant remains attractive and lucrative for their franchisees.

The main way in which McDonald’s could begin to see declining revenues is through wide-spread poor restaurant performance leading to closures of eateries and thus, a loss in rental income and franchise fees for the firm.

Seeking Alpha | MCD | Profitability

Seeking Alpha’s Quant assigns McDonald’s with an “A+” profitability rating. I believe this is the perfect snapshot and summary of McDonald’s undeniable profit generating prowess.

From a balance sheet perspective McDonald’s is in excellent shape. The firm currently has $5.42B in total current assets with just $3.63B in total current liabilities. This leaves the firm with a quick ratio of just 1.04 and a current ratio of 1.35.

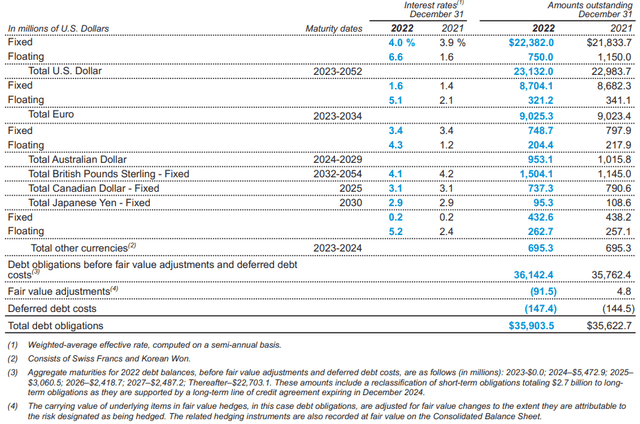

Their total debt/equity ratio is 1.12 due to the relatively large number of long-term debentures held by the company. While having more liabilities than assets is not ideal, McDonald’s has managed this debt excellently.

Their debt is staggered with a primary portion of these debentures experiencing maturity between 2023-2052. This hugely planned-out debt repayment profile is combined with a majority of these debentures being fixed at interest rates between 1.6% and 4.0%. The firm has very little obligations on floating interest rates.

Such proactive and responsible fiscal planning allows McDonald’s to benefit from having huge amounts of capital with which to finance their continuous expansion while also maintaining a manageable and responsible debt profile.

McDonald’s has obtained a Baa1 credit rating from Moody’s on their Senior Unsecured debts. The agency believes the outlook is stable. Baa1 is classified as credit obligations which are “judged to be lower medium grade” by Moody’s.

Overall, I believe McDonald’s is a business powerhouse capable of generating huge and consistent fiscal results and thus, investor returns. Their robust revenue streams and continuous drive to achieve greater levels of operational excellence paint a positive and profitable future for the firm.

Valuation

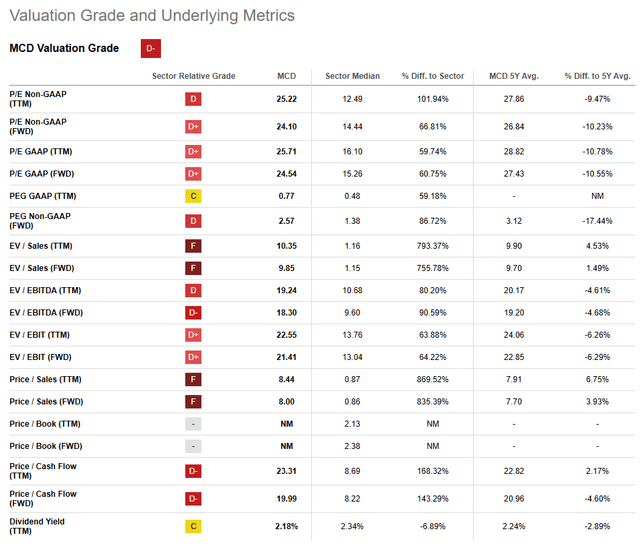

Seeking Alpha | MCD | Valuation

Seeking Alpha’s Quant assigns McDonald’s with a “D-” Valuation rating. I believe this is an excessively pessimistic evaluation of the value present in McDonald’s stock.

The firm currently trades at a P/E GAAP FWD ratio of 24.54x along with a P/CF FWD of just 19.99x. Their FWD EV/EBITDA of 18.30x is combined with EV/Sales TTM and FWD of 10.35x and 9.85x respectively.

These basic valuation metrics suggest McDonald’s is trading in a region I believe to be approximately fair value.

Seeking Alpha | MCD | Summary Chart

From an absolute perspective, shares are trading pretty close to their historical highs. However, given the continuous value generation by the firm, this fact does little to inform of McDonald’s relative price on its own. To understand the bigger picture, these fiscal metrics and absolute comparisons must be combined with an intrinsic value calculation.

The Value Corner

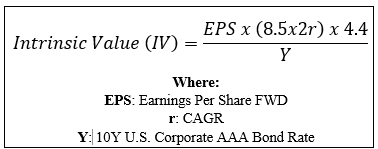

By utilizing The Value Corner’s Intrinsic Valuation Calculation, one can better understand what value exists in the company from an objective perspective.

Using McDonald’s current share price of $279.22, an estimated 2023 EPS of $11.59, a conservative “r” value of 0.10 (10%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.95x, I derive a base-case IV of $293.6. This represents just a 4.9% undervaluation in the firm which can roughly be interpreted as fair value.

When using a more optimistic best case CAGR value for r of 0.13 (13%), McDonald’s appears to be undervalued by around 21% with an intrinsic value of $355.4 per share.

Morningstar’s price versus fair-value graphic illustrates that McDonald’s has only traded below its fair value in the last 10 years for approximately 15% of the time and never at more than a 20% discount. The current undervaluation suggests a good buying opportunity may exist which doesn’t come around that often for such a high-quality company.

Considering these two possibilities and the firm’s historic share price relative to its intrinsic value, I believe McDonald’s is trading at approximately its fair value if not slightly below. While this does not immediately set-off the Buffett bells for a deep value steal, I actually believe McDonald’s presents investors one of the most compelling Buffett-style picks today.

Charlie Munger helped evolve Buffett’s “cigar butt” style of investing into the “great company at a good price” mantra many use to describe their investment strategy today. I believe McDonald’s is truly a great company and what can only be considered a good price.

In the short term (3-7 months), I find it very difficult to say exactly what may happen to valuations and share prices. While a 10Y historic average implies that a roughly consistent and generous 18.6% increase in value per annum is to be expected, this is impossible to assume on a short timeframe.

The firm’s short-term performance is also exposed to the general sentiment surrounding U.S. and global economic performance as a whole with a recession potentially leading to dropping share prices.

In the long-term (3-10 years), I see a very positive outlook for McDonald’s. I believe their position as the leading fast-food restaurant chain will continue to strengthen and that their drive for operational efficiency will lead to even greater margin expansions. While it would be foolish to assume a linear value generation outlook, I believe McDonald’s will continue to significant outperform market indexes such as the S&P 500 or NASDAQ for at least the next 10 years.

Risks Facing McDonald’s

McDonald’s faces a few risks that present some uncertainty to the sustainability of their operations. The primary material risk arises from the potential for significant inflation and a changing labor market to present a double whammy to their growth and margin expansion

High rates of inflation act to immediately reduce the real disposable income held by consumers as the time-lag between salaries catching-up to increasing pricing levels is between 1-3 years. Therefore, McDonald’s could find themselves in a situation where customer demand (especially for their pricier menu items) drops as consumers become more conscious of their spending habits.

This could reduce the margins McDonald’s is able to extract from their business as falling revenue per item sold increases the relative size of the COGS. While McDonald’s still enjoys significant markups and profit margins even on their most inexpensive menu items, the possibility for revenues to experience in a slowdown in growth is real.

When combined with the growing expectation for an increase in the minimum wage particularly in the US along with potential changes to key overtime pay rules, McDonald’s could find themselves in a situation whereby revenues are dropping and COGS are increasing.

This could lead to an overall slowdown in the ambitious margin expansion objectives set out by the firm which could cause a drop in investor confidence. This creates the real threat for a drop in share prices as a more negative sentiment is held against the company by investors.

From an ESG perspective, McDonald’s has a history of accusations against them relating to poor employee treatment and excessive environmental degradation as a result of their business model. Many critics also argue that McDonald’s restaurants contribute to unhealthy eating habits and increase litter in the areas in which they operate.

While many of these claims are anecdotal or specific to localized events, it is important for McDonald’s to consider the image they are portraying with their restaurants.

The current wave of pro-environmental behavior and a change in customer tastes and preferences towards more healthy food alternatives has resulted in McDonald’s dropping the once iconic red and yellow colors in European markets for a more eco-conscious green and yellow color scheme.

I believe this illustrates McDonald’s awareness of the demands consumers and investors have for the company and suggests the firm is well equipped from an information perspective to deal with any potential ESG issues.

While McDonald’s does face some ESG concerns, I believe it would still be a relatively suitable choice for any ESG conscious investor. Of course, opinions may vary and I implore you to conduct your own ESG suitability research should this be of concern to you.

Summary

In my opinion, McDonald’s is the perfect example of a Charlie Munger-era Buffett style pick. The company’s strong balance sheet is accompanied by huge profitability obtained primarily through a set of reliable and consistent revenue streams.

The firm’s understanding that a great customer experience is the only way to drive future growth illustrates that the current management team is acutely tuned in to the requirements and desires of their customers.

When combined with a drive to increase operational efficiency, the potential for McDonald’s to continue their historic market-outperformance through consistent value generation looks real.

Therefore, I rate McDonald’s a “Strong Buy”. While a significant undervaluation may be present, the opportunity to obtain a great company at even a slight discount makes for a real modern-day Buffett style pick.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.