Summary:

- Adobe’s revenue growth has slowed due to weak enterprise digital marketing spending, but the slowdown is expected to be temporary.

- Adobe has invested in new AI capabilities with fresh, new Adobe Express and Firefly, which can expand their user base and generate additional revenue streams.

- Adobe’s transition to a subscription-based model has been successful, with subscriptions representing 93% of total revenue, leading to improved financials and value for shareholders.

gorodenkoff/iStock via Getty Images

Adobe (NASDAQ:ADBE) owns a broad range of industry-leading software platforms, including Photoshop, Lightroom, Illustrator, and Premiere Pro, among others. Adobe is one of the pioneer companies that have successfully transitioned from a traditional on-premises license model to a pure subscription business model. The company’s revenue growth has been decelerating in recent quarters as enterprises are constraining their digital marketing spending. However, Adobe is investing in new AI capabilities with fresh, new Adobe Express and Firefly. I believe these investments lay a solid foundation for their future growth acceleration.

Decelerated Revenue Growth Amid Weak Enterprise Market Spending

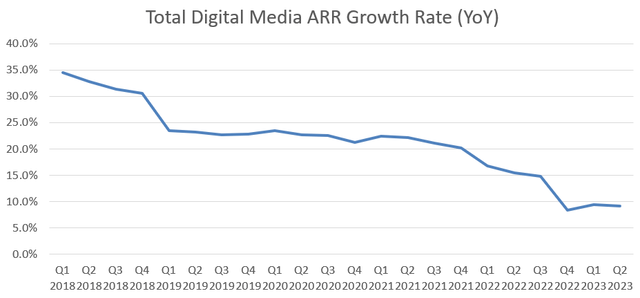

A good metric for measuring Adobe’s Digital Media business is the Net New Digital Media Annualized Recurring Revenue (ARR) growth. The Digital Media business represents approximately 73% of Adobe’s total revenue and was growing at an above 20% rate in the pre-COVID period.

When enterprises began cutting their digital marketing spending, the total digital media ARR started to decelerate, and it only grew by 9.2% in Q2 FY23. The key question here is whether the reduced digital marketing spending is temporary or structural. I believe it is temporary in nature as enterprises need to reduce marketing spending to control their budgets in a weak macroeconomic environment. Firstly, traditional media like newspapers and TV cannot deliver the same level of personalized marketing experience to potential customers as digital media can. Digital media can better target potential customers and generate a higher return for marketers. Secondly, the global smartphone and internet user base continues to grow over the next few years. With more smartphone and internet access, digital media can better reach the mass population. According to Fortune Business Insights, the global smartphone market is expected to grow at a 7.3% compound annual growth rate from 2022 to 2029. In addition, Statista estimates that the number of internet users worldwide stood at 5.18 billion in 2023, and there are still 1/3 of the global population that doesn’t have access to the internet. Lastly, digital marketing enables marketers to better measure their return on the marketing spending dollar. With digital marketing, marketers can track the conversion ratio and measure the total return of a specific marketing campaign. Overall, I believe Adobe’s Digital Media business slowdown is temporary and will recover in the future.

Adobe Express and Firefly AI Capabilities

Adobe possesses tremendous data, platforms, and a vast customer base, positioning them well for AI innovation. Adobe recently launched the fresh new Adobe Express platform, powered by generative AI through Adobe Firefly. Adobe Firefly can generate images from text, perform generative fills, apply text effects, and recolor, among other capabilities. These AI-powered functions empower an average person to become a media creator. According to their management, since the launch of Firefly, there have already been 1 billion images generated on the platform. Adobe plans to offer Firefly as both a standalone product and an integrated feature within the Adobe family. They are leveraging their extensive image data and user base for machine learning and developing their own models for these platforms. Their management also indicates that the current Firefly functionality is just the beginning, with plans to expand these AI capabilities to all digital media, including videos. I believe Adobe’s early investment in these AI platforms is a strategic move, and Adobe can benefit in several ways:

Expand User Base: Becoming a master of photo editing software like Photoshop takes a significant amount of time. However, these AI-powered platforms are incredibly user-friendly, requiring only a few mouse clicks. Adobe can use these platforms to expand their user base, enabling more people to become content creators.

Additional Revenue Streams: All these platforms operate on a subscription-based model. Adobe’s management has indicated that Firefly is expected to contribute to their Annualized Recurring Revenue starting next year. This argument makes sense, as these AI functionalities will make image and video editing more convenient than ever, saving users a considerable amount of time. The convenience and time-saving aspects justify the subscription spending, in my opinion.

Adobe’s Subscription-Based Model

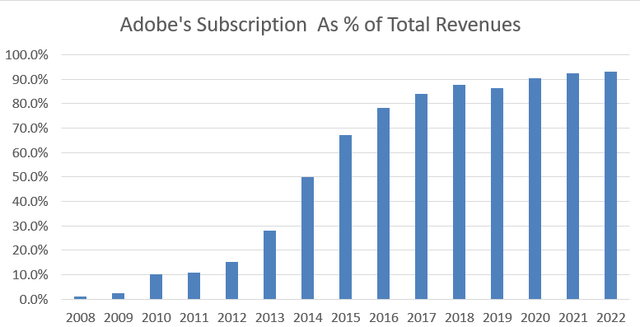

Adobe initiated the transition from a one-time purchase product model to a subscription-based model in 2012, making them pioneers in the software subscription transition. In hindsight, their transition has been quite successful, with subscriptions representing 93% of total revenue in FY22. The subscription-based model provides a more recurring revenue stream and helps prevent users from pirating Adobe’s platforms.

On the financial side, as a result of the transition to the subscription model, Adobe’s free cash flow margin has shown significant improvement, rising from 28% in FY12 to 42% in FY22. Additionally, their Return on Invested Capital has increased from 15% in FY12 to 26% in FY22. This business model transition is indeed noteworthy and adds substantial value for shareholders.

Financials and Outlook

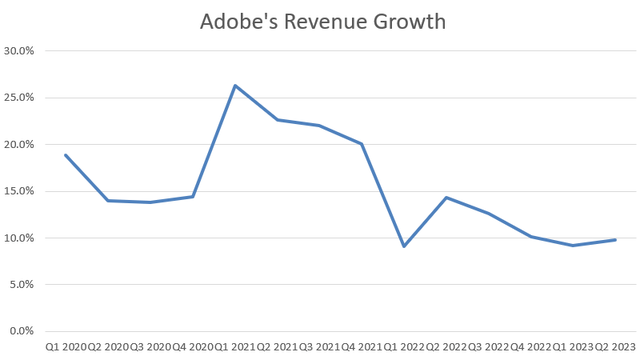

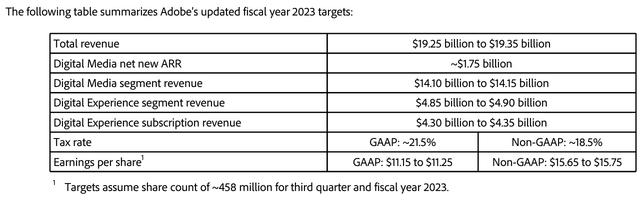

Despite Adobe’s revenue growth decelerating to 9.8% in Q2 FY23, their management anticipates better performance from Creative Cloud and Document Cloud compared to their previous guidance. Consequently, they have increased their full-year revenue and EPS targets.

For the full year of FY23, the midpoint of the revenue guidance implies only 9.3% of growth year over year, and this deceleration in growth is already factored into the guidance.

They generated $2.14 billion in operating cash flow and repurchased 2.7 million shares during the quarter. In my opinion, their cash flow generation and capital allocation appear robust and stable. Furthermore, they currently hold $6.6 billion in cash and cash equivalents as of Q2 FY23. Additionally, they still have $4.15 billion remaining on their $15 billion share repurchase authorization granted in December 2020. I believe they will continue to repurchase their shares over the next few years. Over the past five years combined, they repurchased $18 billion worth of their own shares, utilizing a portion of the $29 billion generated from operations. Their financial strength is quite evident.

Risks to Consider

Apart from the slowdown in enterprise digital marketing spending, I believe the most significant near-term risk is associated with Adobe’s acquisition of Figma.

Figma Acquisition: Adobe announced its acquisition of Figma in September 2022 for approximately $20 billion in cash and stock. Figma’s products enable customers to create mobile apps and web applications more efficiently. While the acquisition makes strategic sense by expanding Adobe’s creative platforms and offering potential sales synergies, it’s worth noting that the deal comes at a substantial cost for Adobe. Additionally, if Figma continues to grow, it could pose competitive challenges to Adobe in the future.

As reported by Reuters in June 2023, European antitrust regulators have initiated an investigation into potential anti-competitive concerns related to this acquisition. During Adobe’s Q2 FY23 earnings call, the company’s management mentioned that they were in discussions with the UK regulator and the U.S. Department of Justice. They still anticipate closing the deal by the end of FY23. However, the final decisions from European and U.S. regulators remain uncertain, which introduces some unpredictability regarding Adobe’s future stock price.

Valuation

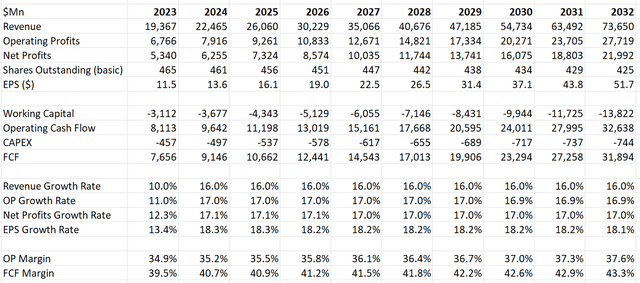

In the DCF model, I consider the potential deceleration of revenue growth in FY23 due to the weak macroeconomic environment. I assume a 10% revenue growth rate for FY23, with a recovery back to 16% in the future.

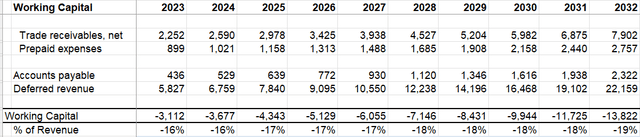

The operating margin is estimated to expand to 37.6% by FY32 and the free cash flow margin to reach 43.3%. Due to Adobe’s subscription model, they are operating with negative working capital, and the working capital is projected to reach -19% by FY32 in the model.

The model applies a 10% discount rate, a 4% terminal growth rate, and a 20% tax rate. By discounting all the free cash flows from the firm and adjusting the cash and debt balances, the fair value is estimated to be $590 per share, based on my calculation.

End Notes

I believe Adobe is well-prepared for the new AI era, and their AI platform enables them to expand their user base and generate additional revenue streams. I have confidence that the digital marketing slowdown is temporary, and Adobe’s revenue growth will re-accelerate in the future. Considering the valuation, I would give Adobe a ‘Buy’ rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.