Summary:

- Adobe Inc. is set to report Q3 results amid an amazing year for software companies, especially ones that are expected to significantly benefit from AI-related products.

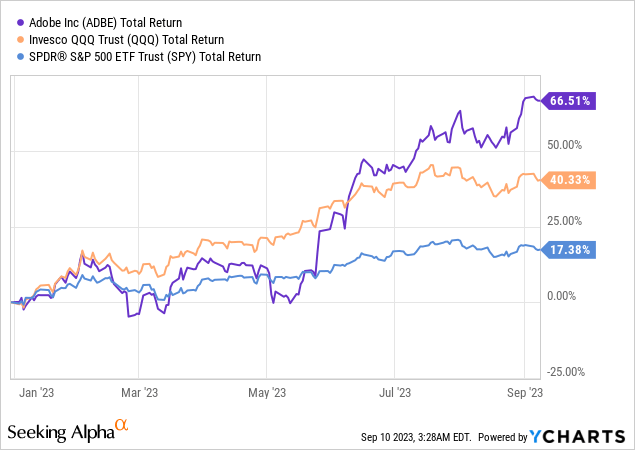

- Fueled by optimism regarding its Firefly offering, Adobe’s stock has significantly outperformed the market year-to-date, recovering all the way back to its historical valuation.

- Key factors to watch in the report include the progress of the company’s AI ambitions and Figma deal, as well as the resiliency of its core businesses.

- I expect ADBE to beat and raise, but coming at an elevated price, Adobe’s shareholders should acknowledge the possibility of a selloff even in case of a report that exceeds estimates.

hapabapa

Adobe Inc. (NASDAQ:ADBE) is set to report its third-quarter results on Thursday September 14th, after market close. Somewhat quietly compared to other AI winners like Nvidia (NVDA), the leader of creative and design software has had a marvelous 2023, seeing its stock rise by 66% year-to-date and up more than double from its 2022 lows.

All eyes are on Adobe’s AI progress, and with the stock coming in at a relatively high valuation, pressure is high to deliver on key focus areas for investors.

Understanding ADBE Stock’s Year-To-Date Outperformance

So far, Adobe’s rise was primarily driven by higher expectations, specifically regarding the success of its proprietary AI model in Adobe Firefly. And now, it’s materialization time.

Aside from continued resiliency in Adobe’s core services and Figma-related updates, investors are mostly eager to get more insight into Firefly’s progress as a standalone product, as well as a feature and growth accelerator in other Adobe services, including Photoshop, and Adobe Express. Questions about Firefly’s contribution to revenue and ARR, Adobe’s margins, and the deal-making environment, are all going to become much clearer after the report.

Let’s discuss the key factors to focus on.

Adobe Firefly

Firefly is a proprietary AI model developed within Adobe, which enhances digital creativity with three very important differentiating factors – it’s fast, it’s approachable, and it’s commercially safe. By fast and approachable, I mean that by typing a short query, creators can transform their work, making it much easier even for amateurs to engage with Adobe’s platforms. And by commercially safe, I mean that companies can use Firefly-based creations on their websites, social media, advertising, and any form of media you can think of. I can go on and on explaining, but Adobe’s demo does a better job in that than me, so see for yourselves.

According to industry estimates, Firefly standalone should be priced at $5-$10 per user initially and is expected to provide an incremental $150-$300 million to Photoshop with its beta version alone. In my view, those estimates are nice but they are, in fact, estimates, and are far from being certain.

Firefly is still in its early days, and my best guess is we won’t get any specific financial results in the third-quarter report. It’s more likely that we’ll get information around the number of generations, similar to what we got in the second quarter, where management cited Firefly surpassed the 500 million generations threshold.

To put it simply, I don’t expect a significant headline or major drama here. The success of Firefly will be determined over a longer period of time and will be measured by its ability to sustain and accelerate growth in the Digital Media and Digital Experience segments, as Firefly is a significant connective tissue between Adobe’s different lines of business.

So what should investors monitor when it comes to Adobe Firefly? First, we’d want to hear how far are we from an official launch, as we’re still currently under the beta version. Second, adoption numbers, in terms of percentage or amount of generations will be key. Third, information about incremental expenses associated with the leading creativity AI model, or some kind of outlook about the margin of the future business, could be critical as well.

Digital Media & Digital Experience Growth

Artificial intelligence has been the main theme of 2023, and while Adobe isn’t the main character in the story, it is certainly playing a major part, as one of the bigger beneficiaries of AI.

That being said, Firefly and generative AI, in general, are still a very small portion of the actual Adobe business, and as we said, the company’s success in this area will be measured by its contribution to the success of its core businesses. Thus, Adobe’s core businesses are still the main factors to look at.

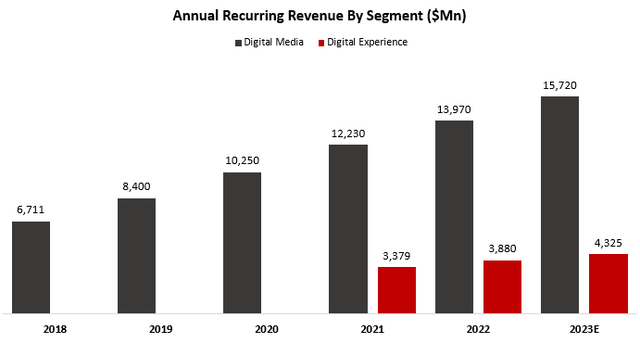

Created by the author using data from Adobe’s financial reports. Digital Experience ARR was first disclosed in 2021; Numbers are based on constant currency rates.

As we can see, ARRs are on a steady incline. The resiliency of those businesses has been industry-leading, with continued double-digit growth on a constant currency basis even during the trough quarters in the tech industry, which are seemingly behind us.

Content creation and content usability are growing “up and to the right” in the words of Shantanu Narayen, Adobe’s CEO, and as such, investors should expect continued strength. As we can all sense as internet users, content is becoming more and more personal and targeted. Paperwork is becoming increasingly digital, and Adobe is there to capitalize on all those megatrends.

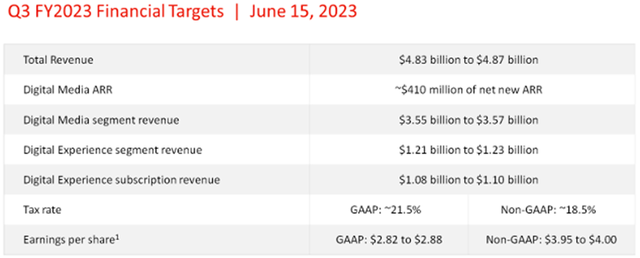

For the third quarter, Adobe expects $410 million net new Digital Media ARR, and $1.09 billion from Digital Experience subscription revenue, reflecting a $4.4 billion ARR at current rates.

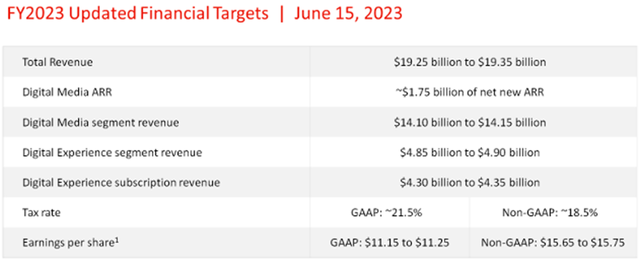

For the full year, Adobe expects to add $1.75 billion in net new Digital Media ARR, up from its Q1 targets of $1.65 billion. Digital Experience subscription revenue is expected to reach $4.325 at the mid-point, which is a $0.75 downgrade from the first-quarter targets, reflecting higher resiliency in the more significant Digital Media segment.

Based on current targets, Adobe is guiding for nearly 10% reported revenue growth and a similar rate for GAAP EPS. However, it’s quite clear that just like the first and second quarters, investors are expecting at least a moderate beat and raise from Adobe.

As for me, I expect Adobe’s revenues for the third quarter to amount to $4.95 billion, slightly higher than the $4.87 billion consensus. For the full year, I expect total revenues of $19.7 billion, also higher than the consensus of $19.3 billion.

I won’t pursue a doomed-to-fail attempt to foresee how the markets will react to Adobe’s results. However, we can say that coming into the report with obviously high expectations could turn out in a near-term downfall. On the contrary, Wall Street estimates have been quite steady for a few months now, so expecting a decent beat would be reasonable.

I encourage investors to focus on the actual fundamentals here and exploit an overexaggerated response to Adobe’s highly anticipated numbers if one were to occur. With nearly 95% of Adobe’s revenues generated from subscription-based arrangements, it’s quite easy to grasp how Adobe’s future will look like based on its results, and thus, a major miss is presumably unlikely.

Operating Margins (GAAP)

Up until now, we focused on the revenue side of things. While AI-fueled growth is clearly a good thing, there are still unknowns surrounding its effect on Adobe’s margin.

At least for now, AI is considered an expensive form of software service, at least relative to traditional cloud-based usage. For example, Alphabet’s John Hennessy told Reuters that an AI query likely costs 10 times more than a standard keyword search. There’s no reason to suggest that Adobe’s costs to operate its own Firefly model won’t be higher than its traditional offerings as well.

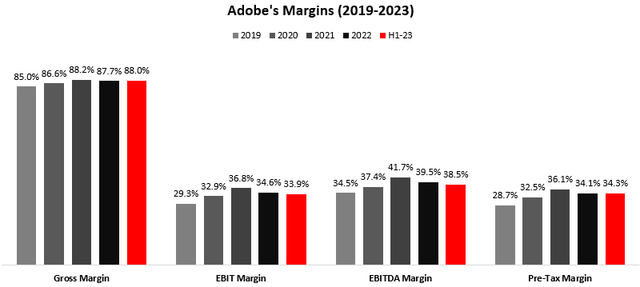

Created and calculated by the author using data from Adobe’s financial reports.

Since its migration to the cloud, Adobe’s been one of the most profitable companies in the market, with gross margins steady above 85%, and over the last three and a half years, the company’s GAAP operating margins topped 33%. After the announcement of Firefly, we realized that whilst Adobe achieved those industry-leading numbers, it was still able to spend a significant part of its expenses on R&D, to develop its proprietary AI model.

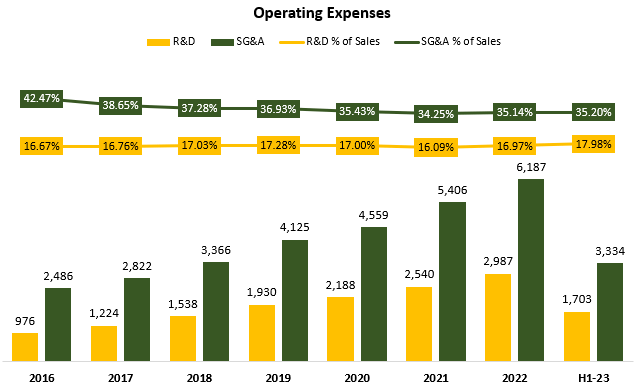

Created and calculated by the author using data from Adobe’s financial reports.

As we can see, Adobe was able to more than offset its R&D expenses increase with operational leverage in its SG&A. However, we can see that as a % of sales, SG&A is now slightly trending up. Thus, maintaining an operating margin in the 33%-34% range will be a tough task as the company continues to invest in its AI efforts.

I think it would be reasonable to expect Adobe will remain above the 33% level for the near term, as Firefly remains a relatively small portion of the business and the company manages its development budgets prudently. However, investors should closely monitor any additional insight management provides regarding the economics of its AI ambitions.

Additionally, as the economic environment remains stretched, Adobe’s sales and marketing spend will be under scrutiny. Historically, the third and fourth quarters are slightly lower in terms of margins, and with the company’s margins decreasing Q/Q and Y/Y in the second quarter, there are some question marks surrounding profitability.

Figma Updates

The excitement around Figma was in three areas. The first was product design. They had a leading product and product design. The second was collaboration and using the web as a platform to have more people collaborate. And I think they had some really innovative work in that space.

And the third was this sort of we think emerging area of creativity and productivity, where in the past, there were creative tools and productivity tools. And so that was strategically where we looked at it and said, we think that Figma has done some incredible technology work, and that’s why we announced the intent. As we have said publicly, it’s still under the regulatory process.

— Shantanu Narayen, Chairman and CEO, Goldman Sachs 2023 Communacopia + Technology Conference.

If you’ve been following Adobe since the acquisition was announced, I think this is the least enthusiastic I’ve seen the company’s management when asked about the acquisition. Maybe it’s just me, but it sounds like they are much more focused on Firefly and growing their core businesses for now, as the regulatory obstacles are still many.

That being said, we are still talking about a $20 billion commitment made by Adobe, which is roughly 8% of its current market cap, and nearly three times its annual EBITDA. Investors should not overlook comments regarding Figma and the progress of the regulatory investigation.

Non-GAAP Adjustments

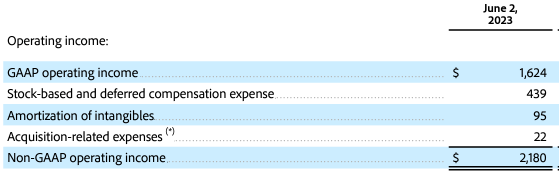

An important issue to keep in mind when it comes to Adobe is its non-GAAP adjustments. For some reason, and I have to say I have no explanation for it, the company provides investors with start-up-like adjusted figures, despite its GAAP numbers being nearly impeccable. Let me show you what I’m talking about.

Adobe Q2-2023 Earnings Release

As we can see, Adobe’s non-GAAP operating income is nearly 35% higher than its GAAP operating income, primarily due to the miracle of excluding stock-based compensation expenses. The theoretical argument behind it belongs to a different article, but I believe it’s important to point that out. In my previous article about the company, I dived deeper into this topic, in case you’re interested in further reading.

When evaluating Adobe’s valuation, I strongly encourage investors to disregard its non-GAAP metrics, as well as deduct its SBC expenses from their free cash flow analysis. The majority of Adobe’s employees are knowledge workers who receive stock-based compensation in one way or another, and I see no reason whatsoever not to include it in the core profitability analysis of the company.

Risks

Before we head into valuation, let’s discuss risks, or in this case, just a risk.

Looking at Adobe, I believe it is unquestionably one of the highest-quality companies in the market. It operates in somewhat of a niche, where big tech is somewhat reluctant to enter as Adobe is a major leader, and the size of the market isn’t big enough.

Aside from the Figma deal, Adobe hasn’t really been the subject of significant regulatory scrutiny, as it’s quite focused on its own industries without constantly expanding horizontally (i.e. Amazon).

Furthermore, it’s greatly positioned to capitalize on the increasing need for personalized content through its creativity tools and digital experience platforms.

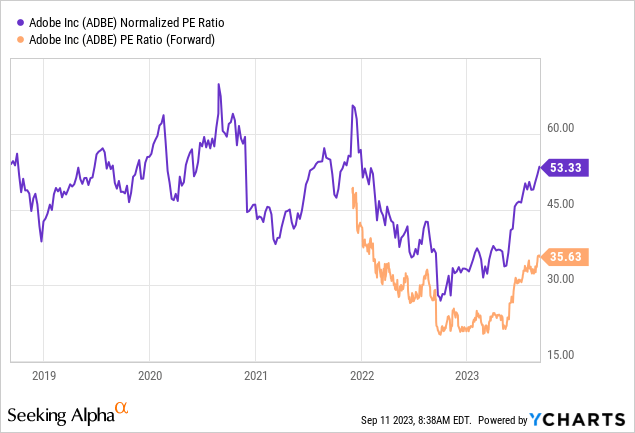

So, what is this risk? Let’s take a look at the following graph.

As we can see, the best time to buy Adobe, was clearly when the company was around late 2022, beginning 2023. Today, the company is trading at a 53x multiple based on its LTM GAAP earnings, and a 36x multiple based on its projected adjusted earnings, which we established are inflated due to SBC adjustments. Based on its guidance, Adobe is currently trading at a 50x P/E based on its 2023 earnings.

This is, undeniably, high. Even if we assume Adobe’s EPS grows by 20% in 2024, we are still talking about an above 40x P/E. However, looking at the above graph, we can understand that Adobe can trade at these levels, and even higher. Actually, its 5-year average is somewhere around 46x.

So, I don’t think investors should run away from this relatively high valuation for the qualitative reasons I discussed above. However, I think it’s important to understand the limited upside as well as the probable volatility that is expected at these levels.

Adobe Stock Valuation

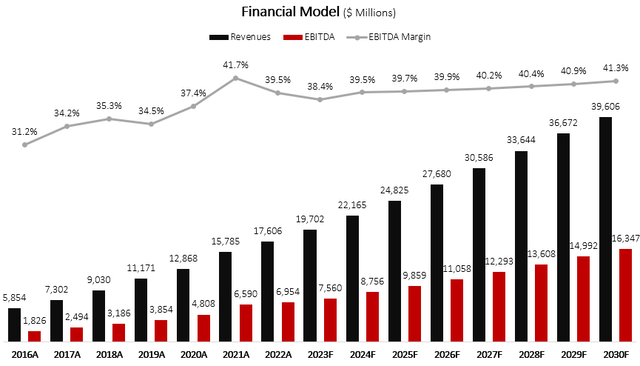

I used a discounted cash flow methodology to evaluate Adobe’s fair value. I forecast Adobe will grow revenues at a 10.7% CAGR between 2022-2030, which is close to the consensus but significantly below Adobe’s past 7-year CAGR of 20.1%. I estimate revenues will grow at this pace due to a growing customer base, as Adobe continues to grow ARR and subscription revenues at a double-digit pace. In addition, the introduction of market-ready AI solutions will increase the company’s total addressable market, and I believe Adobe is ready to capitalize on that trend.

I project EBITDA margins will increase incrementally up to 41.3% in 2030. In my view, this is a conservative projection as the company already surpassed this number in 2021 and would have surpassed it in 2022 if it hadn’t experienced FX headwinds. Overall, my assumptions result in EBITDA growth slightly higher than revenue.

Created and calculated by the author based on data from Adobe’s financial reports and the author’s projections.

Taking a WACC of 7.2%, I estimate Adobe’s fair value at $576 per share, which represents a 3% upside compared to the market price at the time of writing.

Conclusion

Adobe is scheduled to announce its third-quarter results on Thursday, after the market close. With the stock coming highly elevated after a 66% surge year-to-date, I believe investors should acknowledge the possibility of a selloff even in case of a report that exceeds consensus estimates.

Investors should watch for additional insight into the company’s Firefly development and Figma deal, as well as monitor the resiliency and profitability of the core businesses which are expected to deliver a beat and raise.

While Firefly does increase the company’s TAM, it’s not a near-term catalyst for additional upside. On the flip side, I believe Adobe will continue to demonstrate industry-leading resiliency, and expect it will continue to trade around its historical average valuation.

With high optimism baked into Adobe’s price, I rate Adobe a Hold ahead of earnings, as I believe most of its future success is already priced in.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.