Summary:

- JPMorgan Chase was classified as a Dog of the Dow at the start of 2023 due to falling stock price and high dividend yield.

- JPMorgan’s strong cash flow will likely result in strong dividend increases.

- Valuation suggests a fair value of $205 per share for 2024, indicating significant upside potential.

winhorse

Thesis

JPMorgan Chase (NYSE:JPM) offers the reassurance of a strong balance sheet during a time where the financial sector has been shaken. Once classified as a “Dog of the Dow”, I believe buying shares would return tremendous value as there is still upside to be captured. I believe that JPM was classified as a Dog of the Dow partly because of the circumstances of the financial sector being reactive to a post-pandemic world. The fundamentals of JPM were always strong but it got lumped into the mess of the sector by association. JPM reinforces their position as a top tier holding after their latest earnings report where they reported strong cash flow growth in almost all areas of their business. Their increased revenue is likely to result in consistent dividend raises into the future and this combined with the recovery of the financial markets should deliver above average returns to investors.

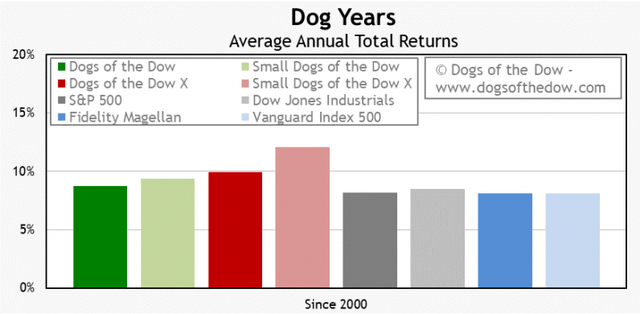

Dog Of The Dow

JPMorgan Chase was classified as a Dog Of The Dow at the start of 2023. In short, Dogs Of The Dow are companies that are listed in the Dow Jones Industrial Average that fell substantially in price resulting in the dividend yield being in the top ten highest of the DJIA. This investment strategy involves investing these ten high yielding stocks and it has averaged an annual return of approximately 10% since 2000.

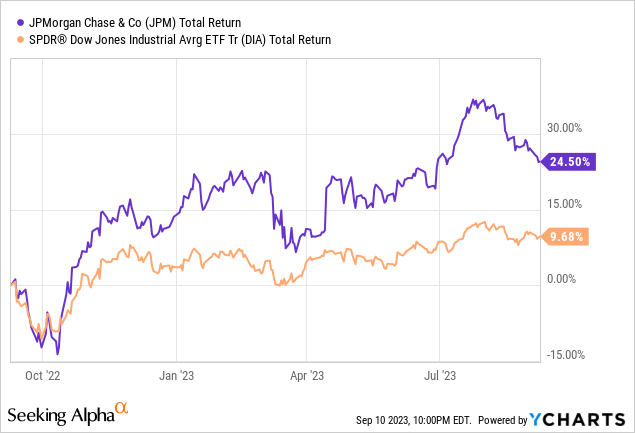

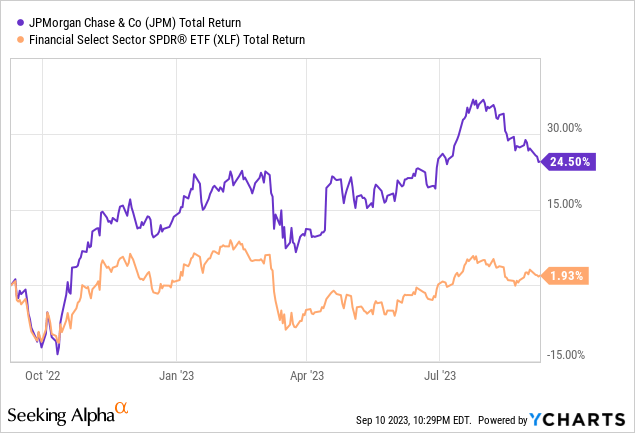

While it’s a cool investment strategy, I wouldn’t advise blindly following it without further research. However, in the case of JPM, this strategy would have worked out beautifully and resulted in superior total returns. Dogs of the Dow are usually high quality companies that are going through some kind of temporarily trouble, or in the case of JPM, are victims of weird market conditions. We’ve all seen financials get beat up over the last year and a half and I think the price movement of JPM shows that they were no exception. Reasons for such a price suppression includes:

- The SVB collapse

- Continued interest rate hikes

- Extremely high inflation

- Lowered credit ratings of banks

Despite this, we see JPM outperforming the Dow Jones over the last year. Market conditions sometimes skew how we perceive some of these companies but it’s important to remember to look at the fundamentals.

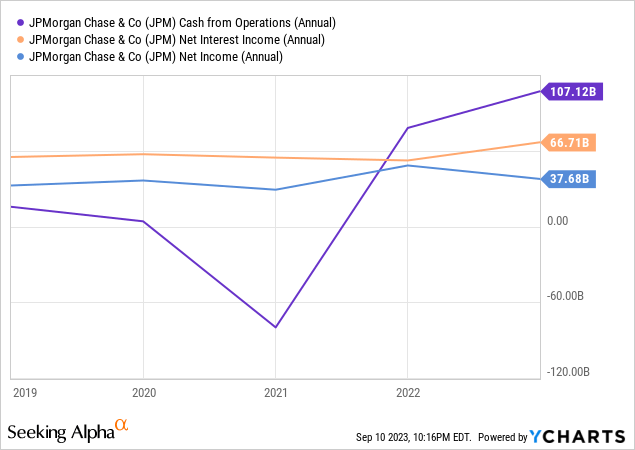

The Fundamentals – Strong Cash Flow

JPM is a global financial services giant operating in various sectors, including Consumer & Community Banking, Corporate & Investment Banking, and Asset Wealth Management. As mentioned previously, JPM was classified as a Dog of the Dow simply due to macro conditions that made all of the financial sector face some headwinds. However, JPM has been crushing it by reporting increased cash flows in almost all categories of their business.

JPMorgan had a really good second quarter in 2023. They earned $42.4 billion which is 34% more than the $31.6 billion they made during the same time last year. Cash from operations, net interest income, and net income have all increased above pre-pandemic levels now. I believe this will continue to trend upwards as JPM is also positioned to benefit from higher interest rates.

One of the reasons for their strong earnings was that they made more money from the interest they earned on loans. They earned $21.8 billion from this in the second quarter of 2023, compared to $15.2 billion in the same period last year. This represents a 43% increase in interest income!

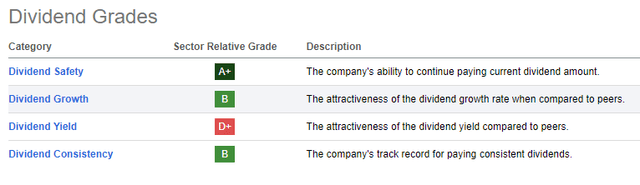

This strong cash flow is also represented in the dividend stability of JPM. JPM has increased their dividend payouts for 8 consecutive years in a row. The starting yield conservative starting at 2.8% but the 5 year dividend growth rate is at an impressive 12.3% average increase per year. Fundamentally, the dividend has plenty of room to grow because of their very safe dividend payout ratio of only 25.7% compared to the sector median of 35%. As previously mentioned, JPM’s interest income has increased substantially and this is reinforced as their net income margin sits at 35% compared to the sector median net interest margin of only 25%. This is why I strongly believe that we are very likely to see some aggressive dividend raises as their income continues the upward trend.

Valuation

Over the last decade, JPM’s PE (Price-Earning Ratio) sits above some of their peers because of the quality they offer. Once again though, this is completely understandable. Quality will rarely be on sale. Using EPS (earning per share) estimates and using conservative growth estimates, we can calculate a fair value using a discounted cash flow model.

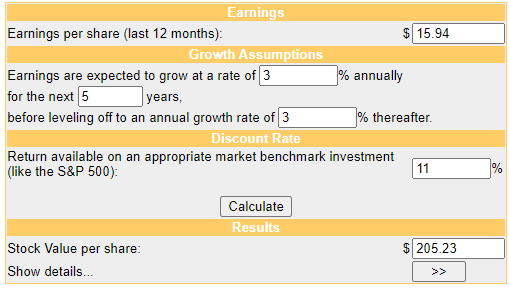

According to Seeking Alpha’s earnings tab for JPM, the expected EPS for 2023 comes out to $15.94. If we pull the earnings data history from Seeking Alpha then take the average YoY eps growth over the last 5 year period, we determine an average EPS growth of approximately 6.4%. Given the uncertain nature of the financial sector, we will take a conservative estimate and lower this estimate to a very modest 3% growth rate to calculate the estimated fair value per share.

Money Chimp

Using these metrics, we believe in a fair value of $205 per share going into 2024 based on the current earnings outlook and estimates. This would represent a large upside potential of 42% if JPM can maintain their revenue growth. Keep in mind, this is only an estimate on the current outlook for JPM. The outlook estimates can change in any given quarter but as it stands now, JPM is in a strong financial position to thrive.

JPM is a top tier company to hold and they’ve seen double digit growth in almost all avenues of their business which I don’t believe has been fully priced in yet.

- Consumer and community: 61% Net Income YoY (Year over year)

- Corporate & Investment banking: 10% Net Income Growth YoY

- Commercial Banking: 54% Net Income Growth YoY

- Asset & Wealth Management: 10% Net Income Growth YoY

With these factors at play, I feel fully confident and comfortable buying at these levels and I plan to continue increasing my position size as we move into 2024.

Risk

Credit downgrades from rating agencies have shaken the markets and we may see some price suppression for an extended period of time. These rating downgrades have potential to make borrowing more costly for banks, therefore reducing their net margin on lending and interest. None of the credit downgrades even mentioned JPM by name but nonetheless effected the stock price when first announced. Being in the financial sector, JPM’s price can have knee-jerk reactions to news like this.

In the case that the credit rating agencies do mention JPM in the future, I see a price risk because it’s very likely we’ll see a decline. Still, a credit downgrade would only mean that JPM was downgraded to a A+, which in my book, is still great. Once again though, from a fundamental perspective JPM is well suited to ride out the short term price movements as their balance sheets are rock solid at the moment. It’s only worth mentioning because this combined with the already high interest rates are likely to have big short term effects on the price.

Another risk to be considered is the on-going interest rate hikes. The Fed has indicated that there is likely to be one more interest rate hike before the end of 2023. I do think that the financial sector as a whole will react to another interest rate hike. Higher rates can be a double end sword because on one end, banks can earn more money through higher interest rates. At the same time though, there are less borrowers taking on a lesser amount of loans which can also effect revenue negatively. Although JPM seems to have done just fine through previous interest rate hikes, I still think it’s worth mentioning to be recognized as a possibility.

Conclusion

JPMorgan Chase & Co., initially labeled a “Dog of the Dow” for 2023, has exceeded expectations with its resilient performance. Despite facing challenges like rising interest rates and inflation, JPMorgan has outperformed the Dow Jones over the past year, fueled by robust cash flow and growing profits across its sectors.

Their commitment to dividend growth, supported by a conservative payout ratio and healthy net income margins, positions them well for future dividend increases. While their PE ratio may be higher than peers, their quality justifies it, and a fair value estimate of $205 per share for 2024 suggests significant upside potential.

Despite potential risks like credit downgrades, JPMorgan’s strong balance sheet and impressive business segment growth inspire confidence, making it an attractive investment as we enter 2024. I plan to continue increasing my position in JPM.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.