Summary:

- Accenture is a digital consultant specializing in helping businesses achieve their strategic objectives through digital transformation.

- Digital transformation is important for businesses to optimize operations, improve productivity, and reduce costs. This makes the company’s services a necessity for the customer.

- Despite the good that there is in the company, the current valuation is not attractive enough, especially considering other options within the same sector.

JHVEPhoto

Investment Thesis

Accenture (NYSE:ACN) stands as one of the leading companies in the digital consulting sector, which has played a pivotal role in driving the digitalization of the economy – a trend that’s expected to persist in the coming years. As illustrated in the chart, the company’s stock price has aptly reflected this, consistently outperforming the S&P 500 in recent times.

However, recent headwinds within the sector, stemming from a cooling economy, have led to a 22% decline from the all-time highs achieved in 2022. The question that begs consideration is whether this decline presents a compelling opportunity for investment. This article delves into this very question.

Stock Price vs S&P500 (Seeking Alpha)

Business Overview

Accenture is a digital consultant, often referred to as a digital transformation consultant, which is a professional who specializes in helping businesses and organizations leverage digital technologies to achieve their strategic objectives and stay competitive in the digital age. The specific job of a digital consultant can vary depending on the client’s needs, but I will mention some of the main tasks that Accenture performs, in order to better understand the business model and its importance for the client:

- Strategic Planning: They work with clients to develop digital strategies that align with the organization’s overall goals and objectives. This includes identifying opportunities for digital transformation, setting priorities, and defining a roadmap for implementation.

- Technology Recommendations: Digital consultants provide recommendations on which digital technologies and tools are most suitable for the client’s needs. They help clients select software, platforms or systems that align with their digital strategy and sometimes they are the ones that refer clients to digital engineering companies, such as EPAM or Nagarro.

- Data and Analytics: Digital consultants assist organizations in leveraging data and analytics to make informed decisions. They help clients collect, analyze, and interpret data to gain insights into customer behavior, market trends, and operational efficiency.

- Monitoring and Optimization: After the initial implementation, consultants continue to monitor the digital initiatives, track key performance indicators (KPIs), and make recommendations for optimization and continuous improvement.

As can be noticed, these services focus on guiding their client through all the complex work involved in making a digital transformation, which is why the company’s services are so valuable.

Why do customers want to digitally transform?

Digital transformation is a critical process for businesses and organizations since it involves integrating digital technologies into various aspects of a business’s operations to optimize its operation, improve productivity and, as a consequence, reduce costs.

The Power MBA

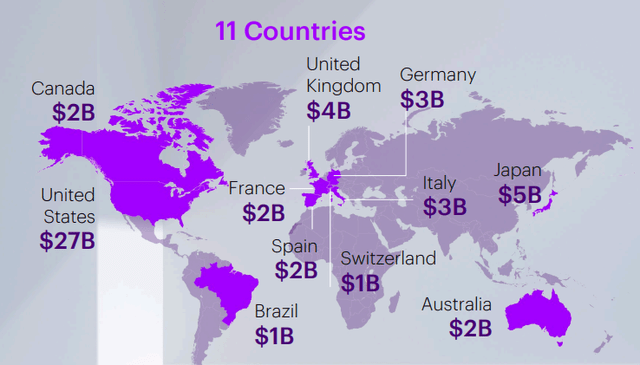

As can be seen, the geographic regions with the greatest presence of Accenture are Europe and the United States. These countries are quite solid economies but they also have old IT technologies because they are developed economies, contrary to cases like Asia where the technology they are implementing in their cities is much more recent because they are economies that are just emerging.

These countries are attractive places to carry out digital transformation, because they have a great need to update their technological systems, but they also have the economic capacity to do so.

Key Ratios

Sales per share have shown robust growth, increasing by 11% over the last 5 years, accompanied by a compound annual growth rate of 13% in EBITDA and Free Cash Flow. This growth is attributed to slight margin expansion, which I believe is entirely sustainable. For instance, the EBITDA margin has risen from 15.8% to the current 16.9% and has remained above 16% for 4 years.

Looking ahead, I anticipate a top-line growth rate of 8% to 10%, but I don’t expect significant further margin expansion. The company is already trading at sector-average margins, as we’ll explore in the final section of my analysis.

Revenue and Profitability (Author’s Representation)

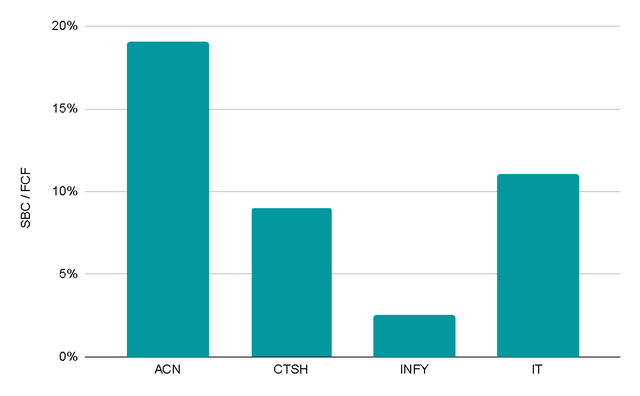

It’s crucial to consider the significance of stock-based compensation (SBC). This method of compensating employees with stock instead of cash is particularly attractive in industries like technology, where competition for top talent is fierce.

During periods of rapid growth, SBCs serve as an effective tool to attract and retain skilled employees by offering competitive compensation packages. However, when a company’s growth slows down, these SBCs can become dilutive for shareholders. They cause the number of shares outstanding to increase at a faster rate than earnings, potentially resulting in a decrease in earnings per share or slower growth.

In the case of ACN, SBCs account for a substantial 19% of total Free Cash Flow (FCF). This is notably high when compared to other similar companies, which typically maintain levels closer to an average of 8%.

SBC / FCF (Author’s Representation)

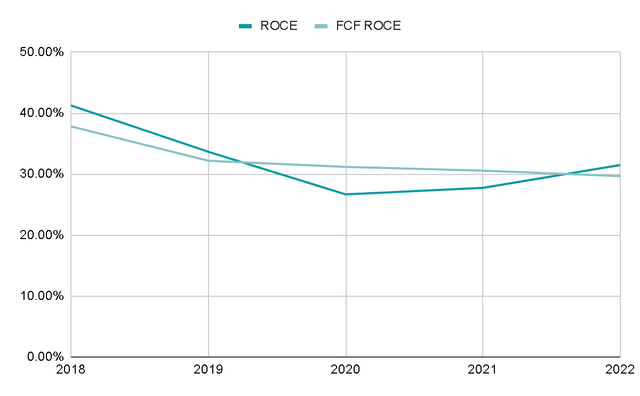

If we exclude the year 2018, which had higher returns, the average return on capital employed (ROCE) has consistently stood at 30%. This also holds true for the return on invested Free Cash Flow (FCF). This is a highly positive indicator for the company, as it signifies how effectively it generates returns from its invested capital, encompassing both debt and equity.

A ROCE consistently above the market average (typically around 12%) demonstrates the presence of competitive advantages and efficient capital utilization. It indicates that the company possesses a higher level of quality compared to the market average. This metric closely resembles that of other digital consulting firms such as Gartner, maintaining levels around 32%, and Infosys, which boasts an ROCE of 34%.

ROCE and FCF ROCE (Author’s Representation)

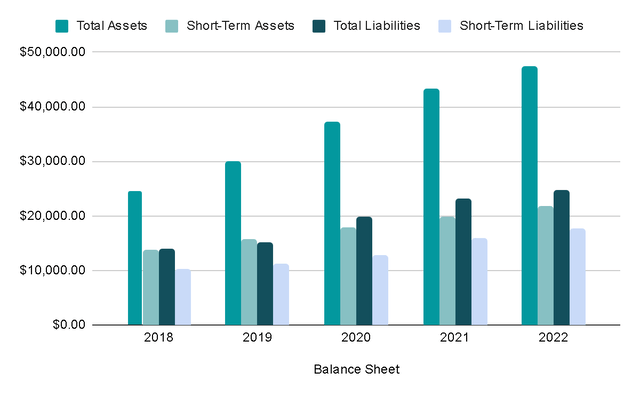

In terms of debt, Accenture holds more than it owes. The value of its assets is nearly twice that of its liabilities, and its short-term assets exceed short-term liabilities by a factor of 1.25x.

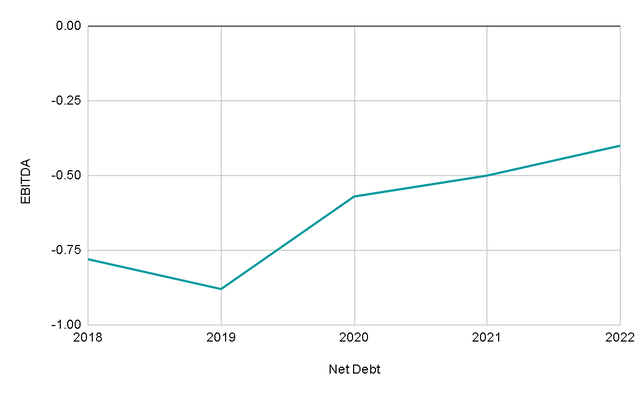

In terms of net debt/EBITDA we also have a healthy negative ratio, which means that with the current EBITDA the company could pay off all of its net debt. Although in the graph it can be seen that the company has increased its leverage level these years, it continues to remain at a level of -0.4, which is positive overall.

Management Team

Serving as CEO is Julie Sweet, who assumed the role in September 2019 and took on the additional position of chair in September 2021. Prior to this, she served as the chief executive officer of Accenture’s business in North America, the company’s largest geographic market (Source: Accenture).

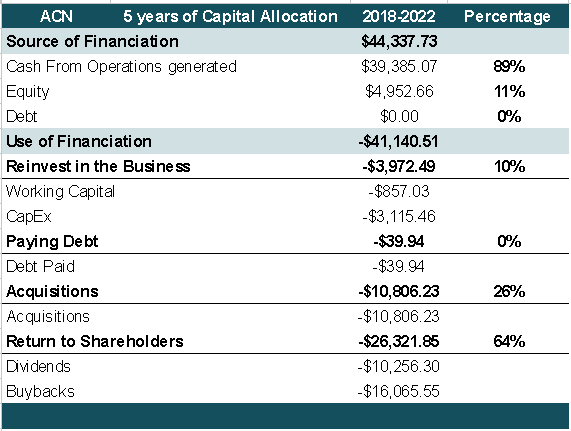

The company primarily finances the majority of its operations through the cash flow it generates, with only a small portion (approximately 11%) being funded through the issuance of shares.

This cash is predominantly allocated to reward shareholders through buybacks and dividends, while another portion is earmarked for acquisitions. Additionally, around 10% of the capital is reinvested in the business.

The opportunity for growth through acquisitions is particularly intriguing, given that the company is one of the largest competitors in a fragmented sector. This fragmentation means there are numerous small players that can potentially become acquisition targets.

Capital Allocation (Author’s Representation)

While the dividend yield is relatively small at 1.4%, it’s worth noting that it’s a growing, stable, and, most importantly, sustainable dividend. It accounts for only 30% of Free Cash Flow, meaning the company has allocated approximately 30% of its profits to the dividend, leaving ample room for further increases.

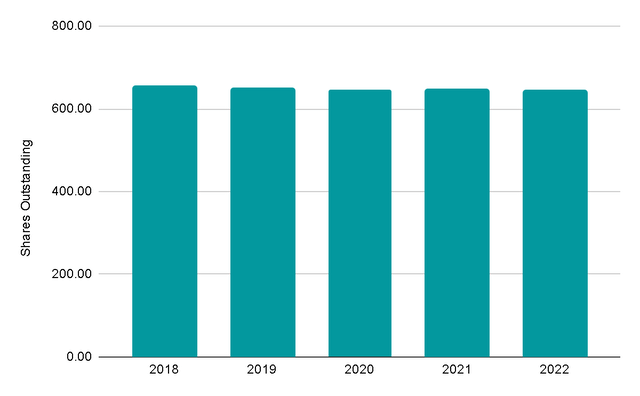

On the other hand, buybacks appear somewhat less attractive to me. Over the last 5 years, the company has allocated nearly $16 billion for buybacks. A quick calculation reveals that the average stock price during this period has been approximately $280 to $300 USD. With this budget, the company has been able to repurchase nearly 57 million shares ($16 billion / $280 per share).

However, the actual reduction in shares outstanding has been only 12 million, largely due to the shares issued through stock-based compensation (SBC). In essence, the apparent share buybacks have primarily served to prevent excessive shareholder dilution rather than delivering positive cash flow returns.

Overall, shares outstanding have decreased at a Compound Annual Growth Rate (CAGR) of 0.5%. Without the high level of SBC, this reduction could have been closer to 2% when considering the total cash spent.

Shares Outstanding (Author’s Representation)

Valuation

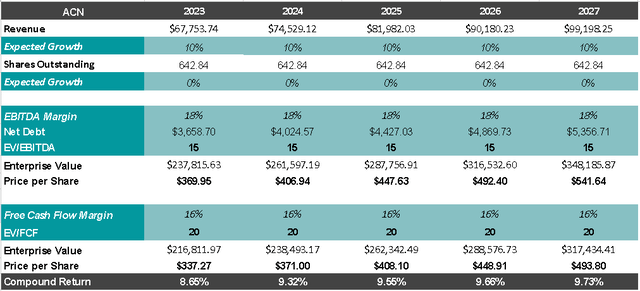

In my valuation analysis, I will factor in a growth rate of 10%, which combines the organic growth driven by sector tailwinds with potential acquisitions.

Additionally, I think that Accenture can slightly increase its profit margins by optimizing processes thanks to AI or maintaining its current scale.

If we factor in the debt, subtract the cash, and apply valuation multiples of 15x EBITDA and 20x FCF, we would arrive at an Enterprise Value ranging from $320 to $350 billion by FY2027. This translates to a return of approximately 10%, which, while not exceptionally high, is a respectable return considering the company’s quality. This may particularly appeal to more conservative investors, but in my case I would like to obtain returns closer to 15%.

To reach these returns the company would have to trade at around $250 USD per share. This would imply a PER of 22x, which doesn’t seem crazy to me either.

Valuation (Author’s Representation)

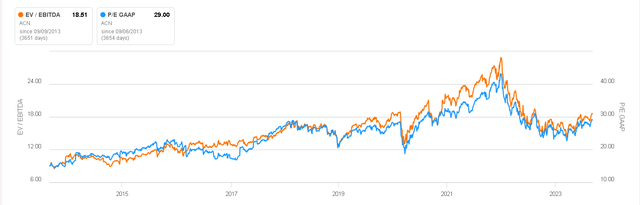

I chose the valuation multiples based on the history of the last 10 years. In this image, you can see how the stock was trading at very rich multiples, which justifies the drop in the price. Despite the drop, the current P/E of almost 30x is still far from the levels the company had in previous years before the risk-free rate was almost 0%.

As I mentioned, I would be willing to pay a multiple between 20 and 25 at most, although due to the low double-digit growth and the cyclicality of the sector, perhaps less than 20 could also be justified.

Valuation Multiples (Seeking Alpha)

Risks

Economic Downturns: Economic recessions or downturns can lead to reduced client spending on consulting and technology services, affecting Accenture’s revenue and profitability.

This has already been noticeable in the sector, since companies such as EPAM (EPAM), Accenture itself or Cognizant (CTSH) have lowered their guidance and it is clear that their clients are pausing spending on digitalization.

Competition: Accenture competes with other global consulting and technology firms, as well as smaller niche players. Intense competition can lead to pricing pressures and the need to continuously innovate to maintain a competitive edge.

While Accenture has some dominance in the market, it also means that smaller competitors will target it to steal market share, especially in such a competitive sector with little differentiation.

Talent Retention and Recruitment: Attracting and retaining top talent is crucial in the consulting and technology industry. High turnover or difficulty in recruiting skilled professionals can impact project delivery and client satisfaction.

This has already had a negative effect on earnings per share, which could have been about 2% higher if the company did not dilute through SBC to attract talent.

Final Thoughts

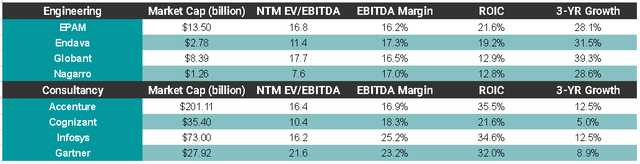

The sector in which the company operates is good and its competitive position is perhaps the strongest within the industry, but the valuation doesn’t appear to be particularly compelling. Within the same sector, there are other players specializing in digital engineering that offer more significant value to their clients and are experiencing faster growth. Surprisingly, these competitors are also listed at valuations similar to that of ACN, as can be seen in this comparison table:

Accenture Comparables (Author’s Representation)

Considering all these factors, in conjunction with the macroeconomic uncertainties, I have opted to issue a ‘sell‘ rating for now. However, I remain open to revising this assessment if the valuation aligns with the considerations mentioned earlier

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.