Summary:

- Nvidia Corporation’s Q2 FY2023 results exceeded expectations – the operational side of the business is really growing by leaps and bounds.

- There are only questions about the future growth of it – more specifically, the projections Wall Street analysts are making for that future.

- Instead of spending more cash on more active development, the company plans to buy back its shares from the market, where they are already trading at too high a price.

- At the same time, the CEO started cashing in September, something he hasn’t done in a long time.

- As a result, I’m downgrading Nvidia stock from “Hold” to “Sell” today and expect that we’ll most likely see either a prolonged consolidation until the next quarterly results or a full-blown correction.

Justin Sullivan

Thesis: From Hold to Sell

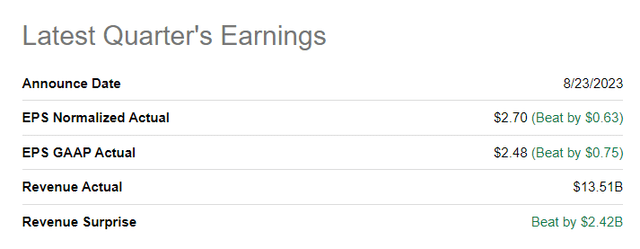

I wrote about Nvidia Corporation (NASDAQ:NVDA) last month, but that was before the company released its Q2 FY2024 results that stunned skeptics, including me: both EPS and revenue came in well above forecasts, forcing NVDA stock to continue its phenomenal rally.

But is everything really that good and what should investors expect next?

Although the company’s numbers for the last quarter looked strong, I want to bring to your attention some downsides that, against the backdrop of what I consider to be questionable capital allocation, lead me to downgrade the stock from Hold to Sell this time around.

Why Do I Downgrade NVDA?

Nvidia indeed reported exceptional fiscal Q2 2024 results, with revenue at $13.51 billion, up 101% YoY and 88% sequentially, exceeding expectations. Gross profit margin (and all other key margin levels) skyrocketed, leading the firm’s EPS to the strongest beat over the past years:

The data center business, driven by demand from cloud providers and internet companies, played a vital role, contributing $10.32 billion (76% of total revenue). Gaming revenue also grew positively to $2.49 billion.

We all know that Nvidia is a significant player in the AI industry, offering products like the H100 tensor core GPU, DGX supercomputers, and inference platforms. Their DGX Cloud, an AI Infrastructure-as-a-Service in the cloud, is poised to transform AI delivery, partnered with major cloud providers, Argus Equity Research analyst Jim Kelleher, CFA noted in his August report [proprietary source].

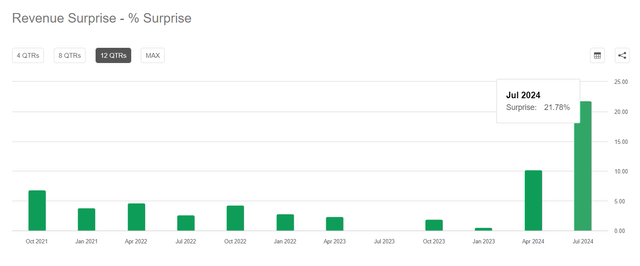

Nvidia’s guidance for fiscal Q2 2024 was also impressive, targeting $16 billion in revenue, and strong margins, resulting in EPS of ~$3.25 in Q3 2024. And the market likes to believe that, and expects even better results in the new reporting quarter, extrapolating the company’s recent success for many quarters to come:

Seeking Alpha, NVDA [author’s notes]![Seeking Alpha, NVDA [author's notes]](https://static.seekingalpha.com/uploads/2023/9/12/49513514-16945031871358492.png)

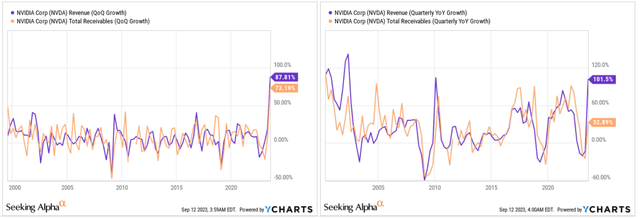

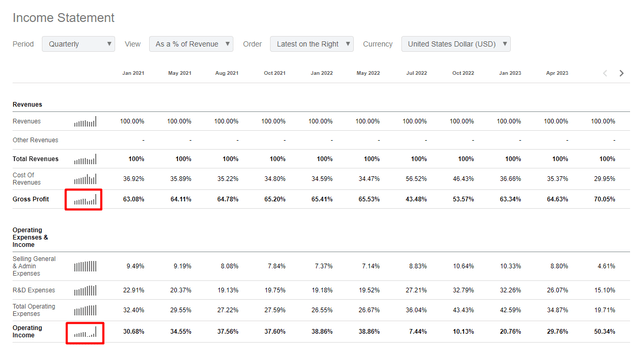

I hope I’m not the only one surprised that the company was able to grow its gross profit margin so quickly year-over-year, which looks absolutely amazing compared to the historical norm for Nvidia:

Seeking Alpha data, author’s notes

But can a company really increase its margins so easily and in such a short time? Yes, if it is the profit and loss statement, because NVDA recognizes revenue from product sales only after the product is shipped.

Revenue from product sales is recognized upon transfer of control of products to customers in an amount that reflects the consideration we expect to receive in exchange for those products.

Source: NVDA’s 10-K for FY2022.

The “product sales” include the data center revenue part that generated the most of the revenue gain for the last reporting period. So in this particular case, we can forget about Nvidia’s licensing revenue recognition policy for a while.

In his quite interesting and informative thread, Kashyap Sriram mentioned the extreme growth in trade receivables: Out of 87.8% QoQ revenue growth, about 73.2% is due to growth in trade receivables, he states. In my opinion, this is quite normal – the growth of receivables is a completely healthy financial phenomenon for any company if profits grow at a relatively good pace and there is enough liquidity on the balance sheet. Additionally, NVDA’s receivables growth has historically matched revenue growth (usually), so I don’t think that’s a problem in itself.

What I find problematic, however, are the projections for the future. The growth in receivables suggests that the products already shipped will not affect future growth. The company will have to spend more money in the future to expand its production capacity. R&D costs and CaPEx will also have to increase significantly. I doubt that NVDA will be able to maintain the high profit margins that Mr. Market seems to expect from the company in the next few years.

Seeking Alpha, NVDA, author’s notes

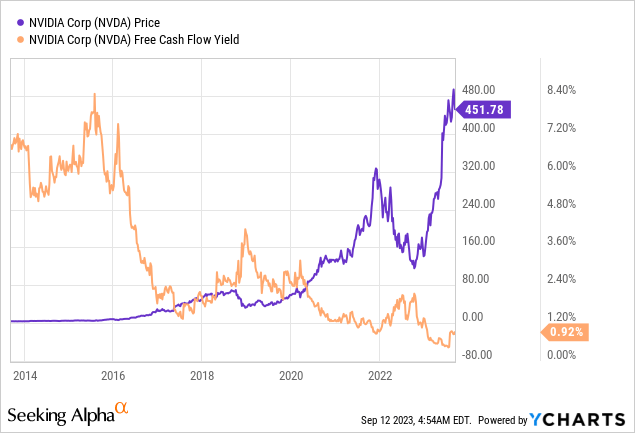

If we look at the cash flow statement, then yes, tripling cash flow from operating activities excites the mind. But at what price are investors actually getting this growth? Obviously at a price many times higher than at any time in the last 10 years.

As long-lasting as the current AI mania may seem, the semiconductor business is cyclical, and anyone buying NVDA stock today should be aware that the moment of purchase is likely behind them. The revenue growth forecast to date appears to be an extrapolation of the peak into future periods and is therefore vulnerable.

Investors need to understand one simple thing: Just as trees cannot grow without soil and water, revenues cannot grow without additional investments, expanding staff, etc. Instead of investing more actively in “soil and water,” to continue the metaphor, Nvidia spends its cash flow on “wind” – artificially boosting shares through buybacks.

I have nothing against buybacks – they are a very effective way to return value to investors. But financial theory says that buybacks are only effective if they are done: a) without negatively impacting the liquidity of the company; and b) at a favorable market price. How profitable it is to buy back shares from the market when the free cash flow, or FCF, yield is below 1% is the most important question shareholders must answer for themselves.

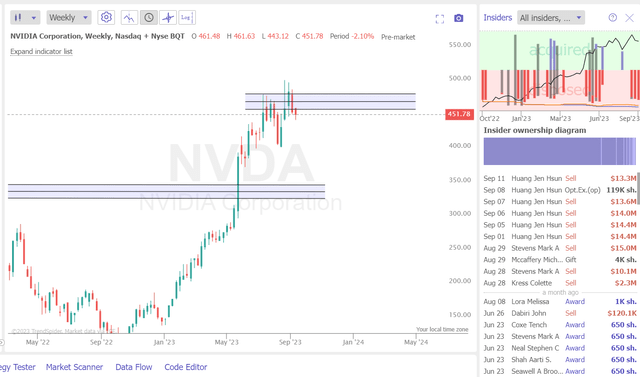

The question of valuation is a subjective matter. Perhaps the company’s management sees much more value in these buybacks. But then why does CEO Jensen Huang keep selling?

TrendSpider Software, author’s notes

The Bottom Line

The operational side of the business is really growing by leaps and bounds. There are only questions about the future growth of it – more specifically, the projections Wall Street analysts are making for that future. The company’s revenue in the most recent reporting quarter was greatly inflated by the growth in accounts receivables. Instead of spending more cash on more active development, the company plans to buy back its shares from the market, where they are already trading at too high a price.

At the same time, the CEO started cashing in September, something he hasn’t done in a long time, judging from TrendSpider Software data.

As a result, I’m downgrading NVDA stock from “Hold” to “Sell” today and expect that we’ll most likely see either a prolonged consolidation until the next quarterly results or a full-blown correction on the back of some negative sentiment as buyers decide to take their profits.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!