Summary:

- Google has benefitted from a recovery in online advertising.

- The value in Google Cloud can no longer be ignored as the unit generated operating profitability once again at 28% top-line growth.

- The company maintains over $100 billion in net cash.

- The stock remains cheap here, and I am projecting considerable upside in the years to come.

Ramin Talaie/Getty Images News

Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) is one of my top picks as the mega-cap tech titan has not kept up with the explosive tech rally (at least not in full). The stock trades at undemanding multiples in spite of having an enviable business model and best-in-class tech team. Management is showing that they can execute against cost-cutting initiatives in the face of a tough macro environment. The stock appears to be weighed down by the narrative that Bing search will steal market share, but the market seems to be forgetting that GOOGL could have its own “Bing moment” in smartphones. The company maintains a net cash balance sheet and is aggressively repurchasing stock. GOOGL remains a top pick in spite of the ongoing recovery.

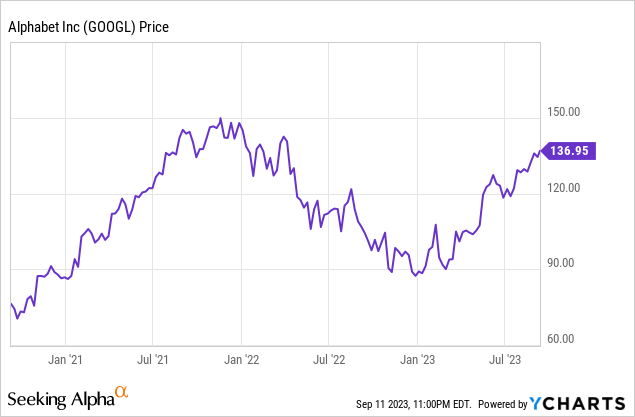

GOOGL Stock Price

GOOGL has finally recovered most of its losses – the stock did not trade bubbly at the peak and is looking compelling as always.

I last covered GOOGL in June, where I explained why Bing fears have made GOOGL a contrarian opportunity. That thesis appears on track given that GOOGL is showing superb fundamental results while still trading at below-market multiples.

GOOGL Stock Key Metrics

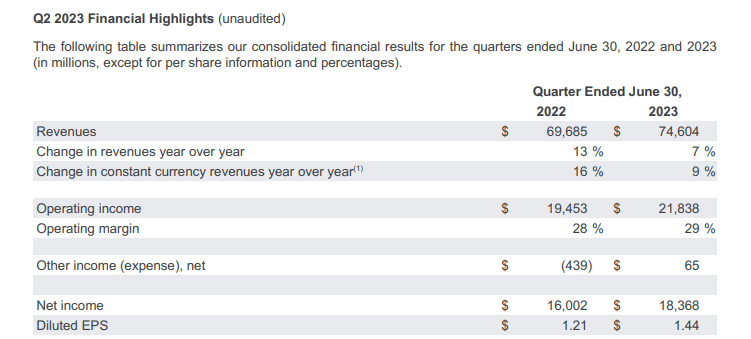

In its most recent quarter, GOOGL delivered 7% YOY growth in revenue (9% constant currency), marking strong sequential acceleration from the 3% growth shown in the first quarter. If Bing was supposed to kill Google, that hasn’t happened yet. Microsoft (MSFT) for its own part appeared to temper expectations, stating that they expect growth from AI to be “gradual.”

2023 Q2 Earnings Release

GAAP EPS grew 19% YOY, but that included non-cash investment changes. Excluding unrealized gains and losses from the investment portfolio, earnings came in at $1.48 per share, representing 14.9% YOY growth. This number reflects the impact of operating leverage and share repurchases.

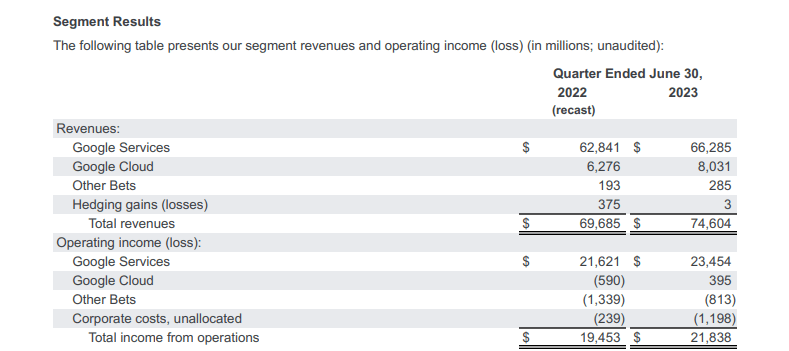

GOOGL saw a recovery in advertising growth with Google Services revenues growing 5.6% YOY (the first quarter saw minimal growth) and Google Cloud revenues grew by 28% YOY, in-line sequentially.

2023 Q2 Earnings Release

Management noted that their Google Cloud Platform (‘GCP’) growth was above the growth rate for cloud overall.

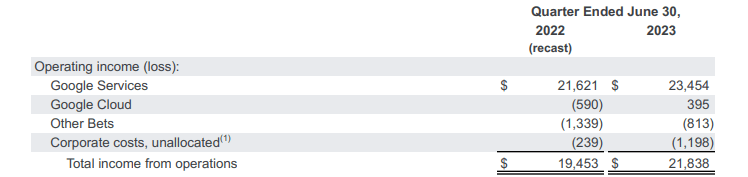

GOOGL was able to drive stronger profit growth due to their headcount reduction as well as overall greater cost discipline. I note that the company has reallocated costs from Google DeepMind from Google Services to unallocated corporate costs, as seen below.

2023 Q2 Earnings Release

The company noted that current CFO Ruth Porat would be transitioning to the newly created role of Chief Investment Officer. It is not entirely clear if this also marks a change in capital allocation moving forward, though the company has already seen a great shift over the past couple of years, notably changes including the apparent increased focus on profitability and more aggressive share repurchase program. Regarding that last point, GOOGL repurchased $15 billion of stock while generating $21.8 billion of free cash flow. The company ended the quarter with $118.3 billion of cash and $31.2 billion of non-marketable securities versus $13.7 billion of debt.

On the conference call, management reiterated expectations for expenses to grow slower than revenue in 2024. After many years of overly-aggressive investment, GOOGL appears finally set to start showing some operating leverage (the tech crash has undoubtedly helped in inspiring this change).

It is easy to forget that GOOGL is a legitimate generative AI play, being a long-time investor in artificial intelligence. Management noted that “nearly 80% of advertisers already use at least one AI-powered search ads product.” Prior to all the focus on AI, GOOGL had been seeing near-term headwinds from lower monetization of Shorts (the company’s answer to TikTok). Management noted that they have opened testing of Shorts ads and awareness campaigns. Management noted that due to the attractive growth opportunity of generative AI, they expect CapEx to grow in the back half of 2023 and continue to grow into 2024. While some investors may view this negatively as potentially being a step backwards, such thoughts would imply some cognitive dissonance as generative AI in general has been viewed as a strong growth story to say the least.

Is GOOGL Stock A Buy, Sell, or Hold?

Like many tech companies, GOOGL has emerged from the tech crash with a different mindset. This is a company which previously may have been content with investing heavily in secret projects and expecting investors to just be OK with it. But based on the quick pace of execution ever since the emergence of ChatGPT, it is clear that those days are gone. ChatGPT raised fears of secular risk for the first time for the company – but ironically also lit a fire under management to the benefit of shareholders.

While GOOGL stock continues to trade at a discount to mega-cap tech peers due to Bing fears, it is curious that Wall Street seems to be overlooking the potential for GOOGL to have a “Bing moment” of its own. Android has long been losing market share to Apple (AAPL) in the United States and GOOGL has been a minor competitor even within the Android market. But that may eventually change, with GOOGL announcing that the Android 14 OS release will include generative AI and its own Google Pixel Fold seeing notable success.

As of recent prices, GOOGL was trading at just around 24x this year’s earnings estimates.

As typical, these estimates understate the value here. Substantially, all of the profits are generated from the core advertising business, with the Other Bets segment having an implied negative value. With cloud now generating positive operating profits, I see little reason to continue ignoring the value there. Based on 25% growth (as stated earlier, the segment generated 28% growth this past quarter), 40% long term net margins, and a 1.5x price to earnings growth ratio, I see cloud being worth 15x sales, or roughly $480 billion ($37.65 per share). I note that this is an upgrade from my prior estimate of $26 per share. Even excluding the non-marketable securities, net cash made up $8.17 per share in value – I expect the company to eventually take on net leverage at some point. Applying a 23x multiple to the advertising business leads to around $130 per share in value for that segment. Again assuming no value for Other Bets, we arrive at a total value of around $175 per share. An argument can be made that the advertising business is worth at least 25x to 30x earnings, adding additional upside to that target.

What are the key risks? The main risk here is if Search is the “new tobacco.” I am not too concerned if Google Bard becomes more dominant than Google Search over the long term because GOOGL has a long history of successfully monetizing various platforms. The main risk is if ChatGPT takes off as an alternative to Google, especially among the younger demographic. GOOGL has historically benefited from long-running tailwinds from increased adoption of the internet, but those tailwinds would turn to headwinds if ChatGPT (and Bing Chat) usurp Google search over time. In such a case, GOOGL may see its valuation drop to as low as 10x earnings, which would invariably offset any ongoing growth in the near term. Management undoubtedly is well aware of this risk, and I expect them to make every effort to show that their other business lines are strong in their own right. For now, though, it is not immediately clear if adding chat capabilities to Bing have made it more competitive relative to Google (from personal experience I can say that there is some learning curve to working with generative AI). GOOGL stock might not deliver strong returns relative to mega-cap tech peers if the valuation overhang persists – but at the same time, management is making all the right moves in prioritizing operating leverage and aggressively repurchasing stock. I am of the view that GOOGL is more than just search and should be able to fend over the long term. More importantly, I expect the company to benefit from strong narratives over the near term as the company works to drive margin expansion like never before.

I reiterate my strong buy rating for the stock as the name is offering considerable value even before accounting for the potential for growth to accelerate for its cloud division. The net cash balance sheet helps to add a further margin of safety as well as additional potential upside over the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset (and recovery), the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!