Summary:

- Google’s Q2 2023 earnings highlight its dominance in the tech industry, particularly in search and digital advertising.

- The company’s stock price shows a strong foundation and suggests potential for upward movement.

- Google’s investments in AI, such as the launch of its generative chatbot “Bard” and Google Lens, position it to lead the future of search.

- The appearance of the inverted head and shoulders and the triple bottom suggests a price rise soon.

Ole_CNX

Alphabet Inc. (NASDAQ:GOOG), (NASDAQ:GOOGL), aka Google, has reported earnings for the second quarter of 2023, that have drawn significant attention from industry experts and financial communities globally. The upward trajectory in its financial performance underscored the company’s undisputed dominance in the tech landscape, especially with its monumental presence in search and the digital advertising realm. As the tech landscape evolves, the emergence of artificial intelligence (AI) hints at a transformative future for search. This article offers a technical analysis of Google’s stock price to forecast its future trajectory and pinpoint potential investment opportunities. There’s a noticeable formation of a robust foundation in the stock price, suggesting an upward movement due to solid price action.

Google’s Meteoric Rise and the Future of AI

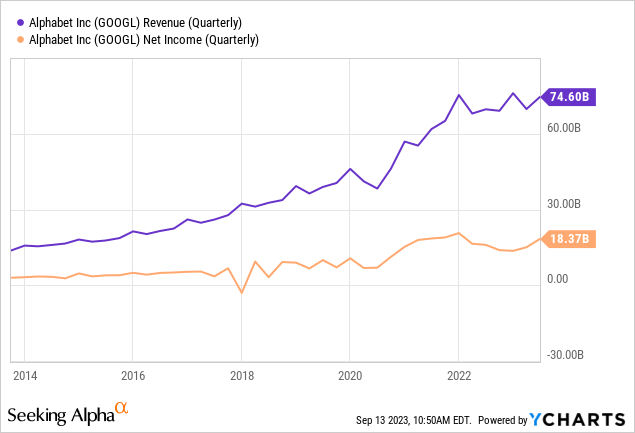

In 2023, Google’s stock showcased a remarkable ascent, driven by two strong earnings announcements. Surpassing Wall Street’s expectations, the company recorded an impressive revenue of $74.6 billion for the June 30, 2023 quarter. The following chart showcases Google’s quarterly revenue and net income over the last decade. For Q2 2023, the net income stood at $18.37 billion, rising alongside its revenue. This consistent revenue and net income increase emphasizes Google’s potential for sustained profitability and its capability to tackle upcoming challenges.

Google’s unparalleled dominance in its industry provides the first compelling reason to consider its stock as a viable investment. Owning a significant portion of the domestic digital advertising market, most of its income is still anchored on advertising revenues. Moreover, Google Search boasting an impressive 92% market share underscores the dominant position of Google’s offerings. However, such dominance inevitably leads to regulatory challenges. Yet, it’s crucial to emphasize that consumers and businesses choose Google’s services due to preference, not obligation. Their offerings consistently outshine competitors, making the choice evident for users.

Google announced a reduction in its workforce during the start of the year 2023. This strategic decision led to employee severance and related charges amounting to $2.0 billion for the first half of the year ending June 30, 2023. Additionally, Google has proactively re-evaluated its global office space, resulting in charges of $633 million recorded within the same period. Of these charges, $564 million was accounted for in the first quarter, ending March 31, 2023, and the remaining $69 million in the second quarter. As the tech giant reassesses its real estate requirements, there’s potential for incurring additional charges in the foreseeable future. For the purpose of segment reporting, the majority of these charges are categorized under unallocated corporate costs in their segment results. Such strategic changes and associated costs could influence investor sentiment and create short-term uncertainty.

For many years, Google Search held its position as the world’s primary search tool. However, introducing Microsoft’s ChatGPT, a chatbot powered by AI, sparked a fresh conversation that veered away from standard financial topics to the immense possibilities within AI. Although ChatGPT enjoyed initial acclaim, its momentum eventually tapered, hinting at its inherent constraints. In response, Google unveiled a generative chatbot, “Bard,” and integrated Google Lens, ushering in a revolutionary image-based search capability.

The potential of AI platforms to surpass traditional search methods is a growing concern. With significant investments in AI and breakthroughs like Google Lens, Google demonstrates its dedication to staying ahead in the sector. As AI sets the stage to transform the world of search, Google seems well-prepared to steer and champion this change. Given that technologies like ChatGPT and similar AI advances are still emerging, coupled with Google’s established market dominance, it appears Google will maintain its current leadership.

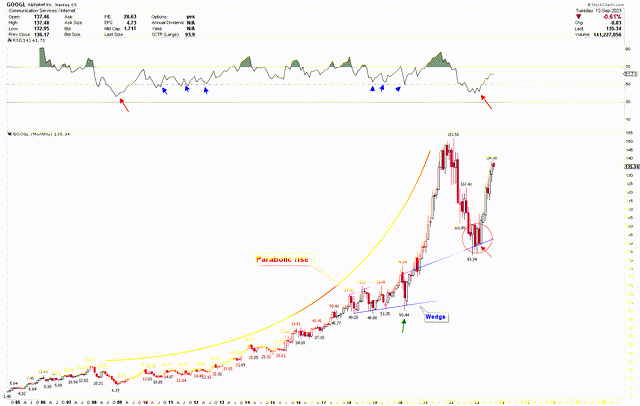

Navigating the Factors of Parabolic Increase

The monthly chart below shows that the technical price action for Google remains strongly bullish. The stock price has ascended in a parabolic manner since its Great Recession low at $6.19, achieving an all-time high of $151.55 in 2022. Although Google has exhibited a consistent parabolic climb, the most substantial rally commenced in 2020 after the Covid-19 pandemic.

This dramatic ascent was attributed to multiple interrelated factors. As the pandemic triggered global lockdowns and necessitated social distancing, there was a marked uptick in online engagements, from remote work and e-learning to digital entertainment and shopping. This scenario bolstered the dependence on Google’s comprehensive digital services like Google Workspace, Google Cloud, and YouTube. Furthermore, with firms transitioning to online modalities and leveraging digital marketing to engage homebound consumers, Google witnessed a resurgence in advertising revenue after initial pandemic-induced downturns. The expedited shift towards digitalization across diverse industries accentuated the pivotal role of tech behemoths like Google in the post-Covid era, fueling investor optimism and driving the stock price upward.

Google Monthly Chart (stockcharts.com)

After achieving its record high, the stock experienced a notable correction in 2022, marking the most significant dip in the market. This adjustment can be attributed to the massive price hike post-COVID-19, as expansive rallies typically culminate in sizeable market corrections, interpreted as a robust market hallmark. This pronounced correction carved out a potent support line at $83.34 from the blue wedge established just before the COVID-19 rally.

A notable observation point is that in 2022, the RSI dipped below the 50 mid-level, a situation not seen since the depths of the Great Recession in 2008. This profound dip in Google’s market suggests the correction phase has been completed, setting the stage for a promising upward trend.

Decoding Price Targets and Strategic Investor Actions

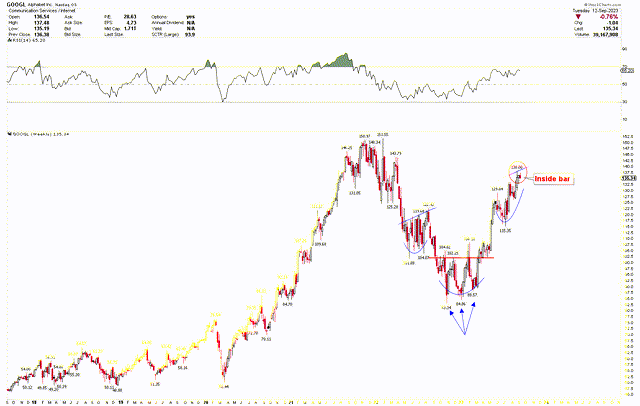

The weekly chart below illustrates an inverted head and shoulder pattern, offering a clearer insight into Google’s stock price’s notable upward trajectory. This pattern showcases the head at $83.34 and the shoulders at $101.88 and $115.35, respectively. Notably, the right shoulder is elevated compared to the left, suggesting significant market volatility. The head of this pattern boasts triple bottom support, evident at the price points of $83.34, $84.86, and $88.57. This triple-bottom formation accentuates the bullish trajectory in Google’s stock value. Furthermore, the previous week’s candlestick represents an inside bar, indicating price consolidation within a narrow range and impending bullish momentum. A vigorous bullish rally might be observed if the price exceeds the previous week’s highs. The crucial neckline for the inverted head and shoulder stands at $138. Breaching this point may very well set the stage for record-breaking highs.

Google Weekly Chart (stockcharts.com)

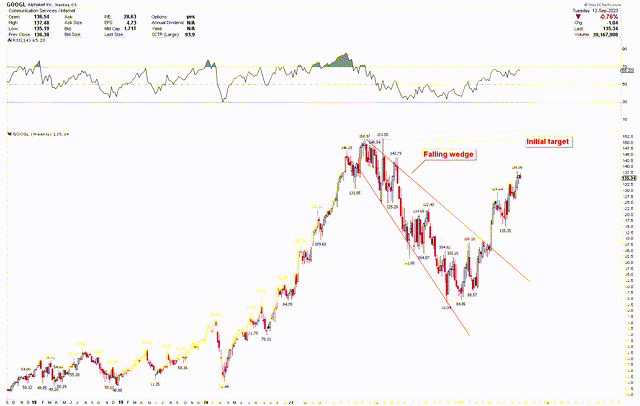

The weekly chart also unveils a falling wedge pattern to project the potential rally for Google’s stock price. This pattern originates from the record highs and encompasses the significant downturn witnessed in 2022. Upon breaching this wedge, the stock made substantial gains. The price target for this wedge rests at around $150. Surpassing the $150 mark could stimulate additional buying interest in the market. Investors may consider buying Google at current levels targeting $150, and accumulate more positions if the stock price corrects lower.

Google Weekly Chart (stockcharts.com)

Market Risk

Google’s formidable earnings from advertising illustrate its market dominance and expose a potential weak spot. The heavy reliance on advertising revenues suggests that any disruptions in the advertising landscape, whether from regulatory changes, evolving consumer behaviors, or rival innovations, could profoundly impact Google’s financials. Google’s widespread influence in multiple sectors puts it under regulatory authorities’ scrutiny. In major markets, if deemed monopolistic, there’s the possibility of facing fines, restrictions, or even enforced structural modifications, posing threats to its operational efficiency and profitability.

Google has demonstrated adaptability in AI by introducing “Bard” and Google Lens. However, the rapid evolution of AI means that Google must consistently stay a step ahead. The risk stems from potential technological breakthroughs by competitors, which might erode Google’s market position.

From a technical standpoint, while current indicators highlight a bullish trend for Google’s stock, these inherently retrospective metrics don’t guarantee future outcomes. Should the stock price plunge below $83, it would disrupt the inverted head and shoulders pattern, hinting at a potential downward spiral in momentum.

Bottom Line

Google has experienced a remarkable journey, showcasing a striking financial performance and solidifying its foothold in the tech domain. Its dominance in digital advertising, highlighted by its unparalleled market share in search and mobile OS, attests to its industry leadership. Yet, this dominance brings challenges, from regulatory scrutiny to the ever-present need for innovation in an evolving tech landscape. As AI emerges as the next frontier, Google has proactively embraced its potential, steering innovations to ensure its leadership in the future of search. While the company faces potential threats from regulatory angles and competitors’ advancements, its strategic moves and market position suggest resilience and adaptability. The persistent bullish trend over the long term is evident. The market’s dip in 2022, followed by a robust rebound from the long-term support, signals that a turning point has been reached, and prices are primed to soar. The appearance of an inverted head and shoulders pattern and an inside bar at the neckline suggests that Google’s stock is poised for significant growth. Investors may consider purchasing Google shares at present value and anticipate increased returns. If there are any pullbacks from this resistance level, it could present more favorable buying chances at lower prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.