Summary:

- Transocean finally announced the eagerly-awaited maiden contract for the newbuild 7th generation drillship Deepwater Aquila.

- The three-year contract is valued at $486 million, with a $40 million mobilization fee on top. Work is expected to commence in Q3/2024.

- The decision to acquire the drillship from its joint venture partners is likely to result in some near-term cash flow pressures and higher debt levels.

- Considering the strong market environment, raising additional debt at acceptable terms shouldn’t be an issue.

- Contract margin should be more than sufficient to recoup the company’s entire activation investment. Consequently, I am reiterating my “Buy” rating and would advise investors to use any major weakness in the shares to initiate or add to existing positions.

pabst_ell

Note:

I have covered Transocean Ltd. (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

On Thursday, leading offshore driller Transocean Ltd. or “Transocean” finally announced the eagerly-awaited maiden contract for the newbuild 7th generation drillship Deepwater Aquila (emphasis added by author):

Transocean Ltd. (…) today announced a three-year award for the newbuild ultra-deepwater drillship Deepwater Aquila with a national oil company for work offshore Brazil.

The contract is expected to commence in the third quarter of 2024 and represents approximately $486 million in firm backlog, excluding a mobilization fee of approximately 90 times the contract dayrate.

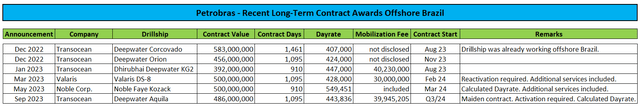

While the contract award has been reported in the media for quite some time already and was also mentioned by management on the company’s Q2 conference call, the information provided in the press release allows for some comparison to other drillship contracts recently awarded by Petrobras (PBR) offshore Brazil:

Press Releases / Fleet Status Reports

Please note that the contract award for the drillship Noble Faye Kozack includes both mobilization fees and additional services with a “clean” dayrate likely being closer to $460,000.

While the calculated dayrate for the Deepwater Aquila looks very much in line with other recent contract awards, the newbuild drillship will have to be mobilized from the Korean shipyard and extensively prepared for its maiden contract.

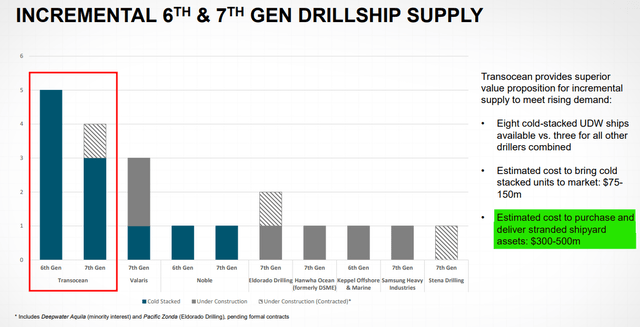

As outlined in a recent Transocean presentation, acquiring and activating a stranded shipyard asset could result in a required investment of up to $500 million.

Company Presentation

But with the drillship currently being owned by a joint venture in which Transocean only holds a minority stake, one would assume the required investment for the company to be limited. Wrong (emphasis added by author):

Transocean has also agreed to acquire the outstanding interests in Liquila Ventures Ltd., a company formed to acquire the Deepwater Aquila, from its joint venture partners, Perestroika and Lime Rock Partners. Following this acquisition, Transocean will own and operate eight of the twelve ultra-deepwater, 1,400 short-ton hookload drillships in the world. The Deepwater Aquila is expected to be delivered from the shipyard in October 2023.

In connection with the execution of the drilling contract for the Deepwater Aquila and the acquisition of the outstanding interests in Liquila Ventures Ltd., Transocean is exploring various debt financing alternatives to partially fund the costs associated with acquiring the rig from the shipyard and preparing it for its contract in Brazil.

Make no mistake, I actually applaud the decision to acquire the rig from the company’s joint venture partners but the purchase will put some sizeable near-term pressure on cash flows.

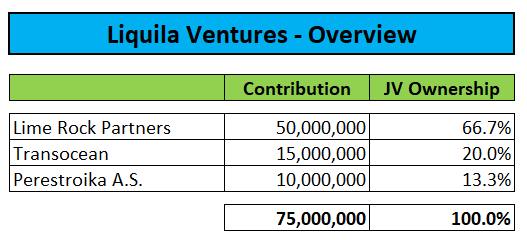

Remember, last year, Liquila Ventures agreed to acquire the drillship for approximately $200 million from Daewoo Shipbuilding & Marine Engineering Co., Ltd. (“DSME”) and made a $75 million initial payment to the shipyard.

Regulatory Filings

Consequently, Transocean will be on the hook for the remaining $125 million shipyard payment.

Mobilizing the drillship from South Korea and preparing the rig in accordance with Petrobras’ specifications could easily require an additional $150 million investment but at least some of this amount will be covered by the sizeable mobilization fee.

Based on the 8-K filed with the SEC after the close of Thursday’s regular session, Transocean won’t have to use valuable cash to buy out its joint venture partners (emphasis added by author):

On September 12, 2023, the Articles of Association of Transocean Ltd. were amended (…) to reflect changes in the Company’s total issued share capital resulting from the issuance of 11,870,376 shares (…) to one of the Company’s wholly-owned subsidiaries at par value for a total consideration of CHF 1,187,037.60 (the “Capital Increase”). The Company’s Articles of Association now reflect a share capital of CHF 84,371,527.60 divided into 843,715,276 fully paid registered shares.

The Capital Increase was made pursuant to agreements (the “Purchase Agreements”) entered into by the Company on September 9, 2023, with holders of the outstanding equity interests of Liquila Ventures Ltd. (“Liquila”), a company formed to acquire the newbuild ultra-deepwater drillship Deepwater Aquila. Pursuant to the Purchase Agreements, the Company agreed to issue the New Shares to the outstanding equity holders of Liquila in exchange for all of their respective equity interests in Liquila. Upon consummation of the transactions contemplated by the Purchase Agreements, the Company will own all of the issued and outstanding equity interest in Liquila indirectly through its subsidiaries.

Based on Thursday’s closing price, Lime Rock Partners and Perestroika A.S. would realize a staggering 70% return on their investment in Liquila Ventures.

With liquidity still tight, I wouldn’t be surprised to see Transocean issuing up to $250 million in new debt to finance this latest endeavor.

However, with floater dayrates being the highest in almost a decade and oil prices approaching $100 again, I really do not expect this to be an issue as also evidenced by the strong demand for Valaris’ (VAL) recent offering of additional 8.375% Senior Secured Second Lien Notes due 2030 to finance the exercise of its purchase options for the newbuild drillships Valaris DS-13 and Valaris DS-14.

Bottom Line

Transocean formally announces the maiden contract for its newbuild drillship Deepwater Aquila with the rig having been awarded a three-year contract offshore Brazil by Petrobras valued at $486 million excluding a $40 million mobilization fee.

While the company’s decision to acquire the rig from its joint venture partners will result in some near-term cash flow pressures and higher debt levels, investors should applaud the purchase as the contract margin should be more than sufficient to recoup the company’s entire activation investment.

As discussed above, I do not expect raising additional debt to be an issue in the current environment.

Consequently, I am reiterating my “Buy” rating and would advise investors to use any major weakness in the shares to initiate or add to existing positions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.