Summary:

- Bank of America’s stability and financial health in the current economic environment is reassuring, with solid credit quality and cautious client spending despite some economic uncertainties.

- The bank faces challenges like declining net interest income due to an inverted yield curve and potential risks related to rising interest rates and economic indicators pointing towards elevated unemployment.

- While Bank of America appears to be trading below its fair value, investing in non-bank alternatives with similar yields may come with a better risk/reward.

Scott Olson/Getty Images News

Introduction

Depending on when you’re reading this, it’s exactly 15 years after Lehman Brothers went bankrupt, triggering a recession that is still shaping the current investment landscape.

The Guardian

As Bloomberg’s John Authers wrote:

As for the global fallout, it’s also not been that surprising. In democracies, governments in power when Lehman fell were generally kicked out of office at the first opportunity. Growth has been sluggish. The eurozone sovereign debt crisis, and the trouble for China’s growth model after it resorted to extreme measures to re-stimulate its economy, are exactly what might have been expected. The same goes for the fracturing of globalization, growing inequality, and increasing disenchantment with elites that has led many countries to give populist alternatives a try.

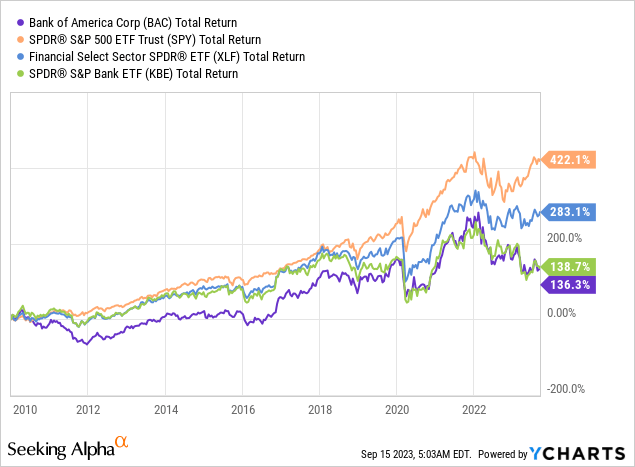

While major banks, in general, have been tricky investments with poor risk/rewards (especially in regions like Europe), one of the banks that stood out is Bank of America (NYSE:BAC).

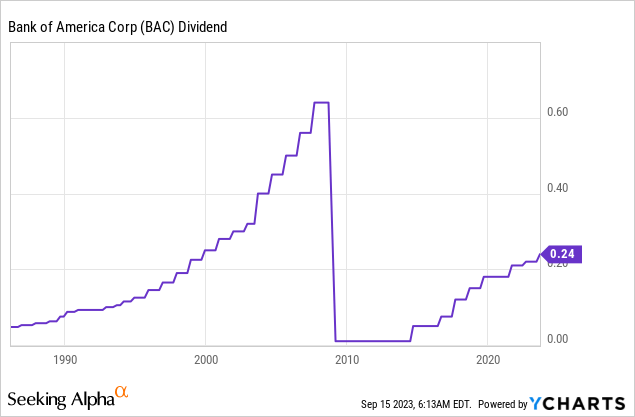

Since January 2010, the stock has returned 136%, including dividends. It yields 3.2%, has a subdued payout ratio of just 25%, and a 5-year dividend CAGR of 12%.

The bad news is that while 137% isn’t bad in the banking space, it’s not a great return when compared to the 422% return of the S&P 500.

As the chart below shows, investors would have been better off just buying the Vanguard High-Yield ETF (VYM), which has a similar 3.1% yield and much better diversification.

TradingView (BAC/VYM Ratio)

Having said that, this article isn’t dedicated to scaring you out of Bank of America.

No, 15 years after Lehman, we’re dealing with new challenges. Inflation is sticky, economic growth is slowing, and the Fed is unlikely to provide us with any relief.

In light of these developments, the bank just presented at the Barclays Global Financial Services Conference. The company gave us a detailed overview of its view of the market and explained why we shouldn’t worry about its stability.

In this article, we’ll discuss the risk/reward of buying BAC shares at these levels and assess the health of the economy using its comments and numbers.

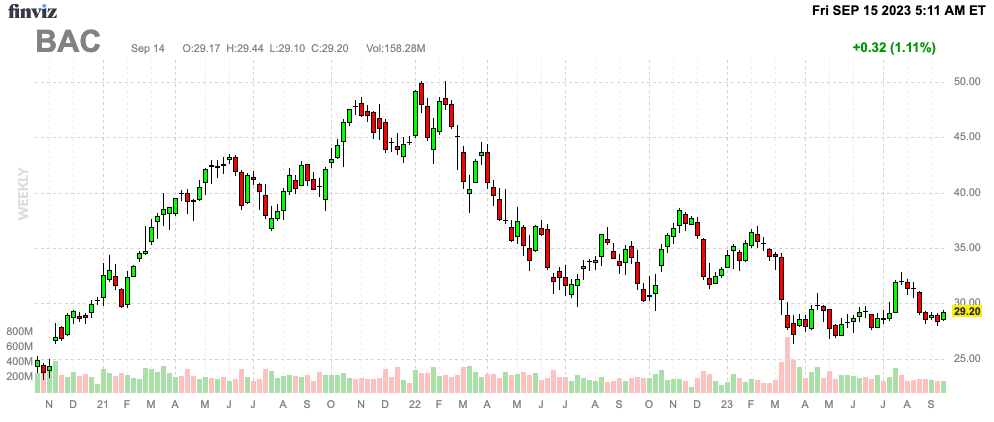

FINVIZ

So, let’s get to it!

What To Make Of Bank Of America

Even if you don’t care about Bank of America, hearing/reading what it has to say is always great for financial intel. After all, the bank has a $230 billion market cap and more than $3.1 trillion (with a T) in assets.

One of the first things the company said during the conference is that the current economic backdrop suggests a slow decline in consumer spending, eventually reverting to pre-COVID growth levels by the first quarter of 2024.

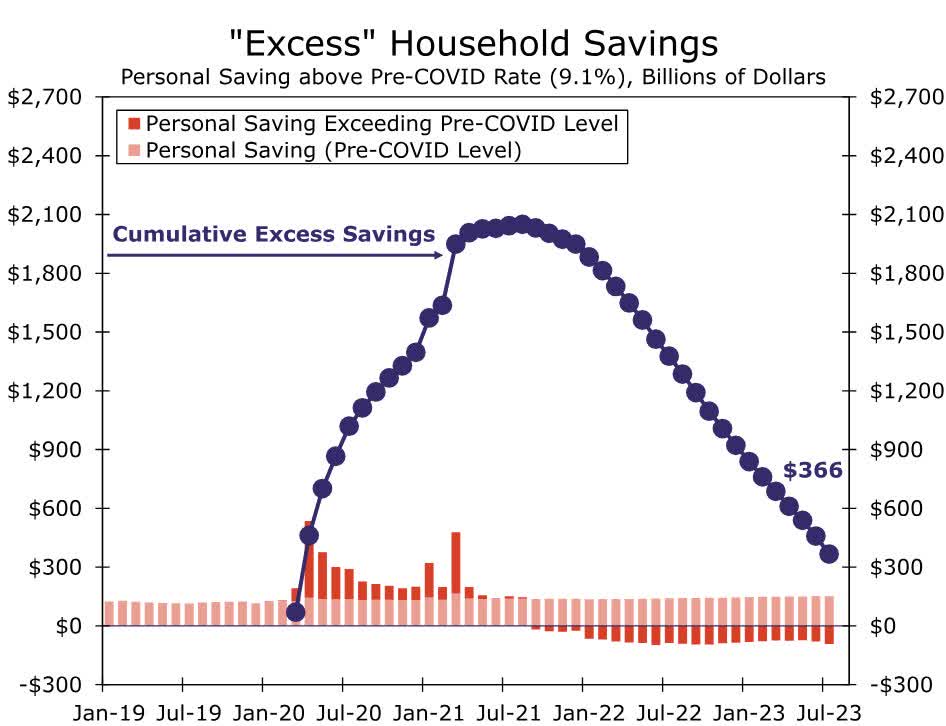

The chart below shows what excess savings after the pandemic look like. We’re seeing a steep decline that could result in a full normalization by the end of this year. Please bear in mind that these numbers are skewed. Although I do not have the data to back it up, we can make the assumption that lower-income spenders ran out of excess spending many quarters ago. This also explains why companies like Dollar General (DG) and Dollar Tree (DLTR) see tremendous pressure on discretionary goods spending.

Wells Fargo

However, the bank’s clients are financially sound, with heightened credit card repayment rates and cautious spending.

Bank of America observed clients holding an average of 27% more cash compared to pre-pandemic levels.

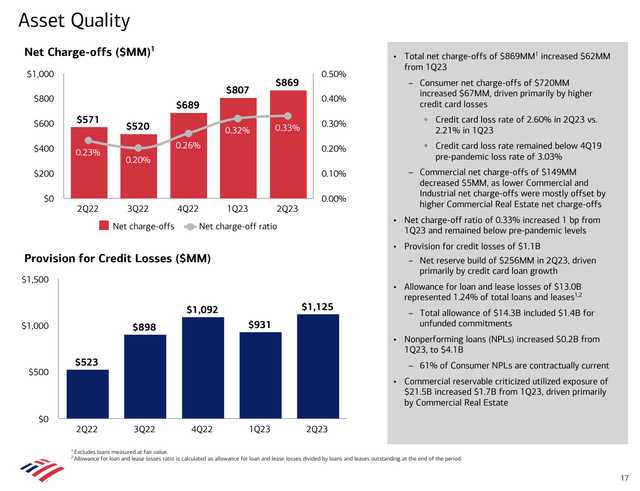

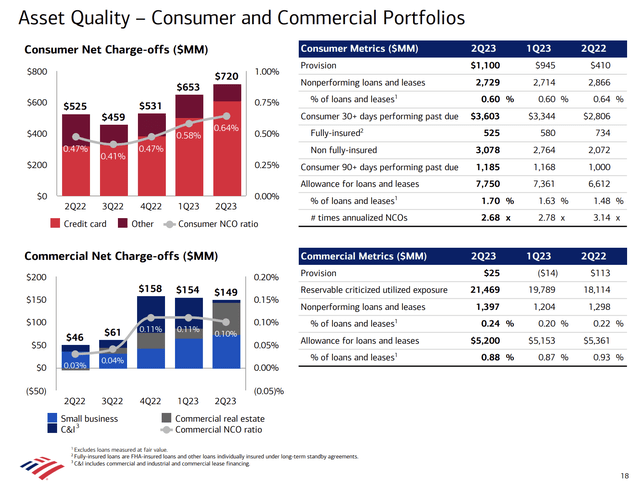

Looking at the bigger picture, we see that although net charge-offs are rising, there’s no data that shows distress among Bank of America clients. The same goes for credit loss provisions.

Bank of America

In the consumer portfolio, the percentage of nonperforming loans and leases is 0.60% as of the second quarter. That’s unchanged compared to the first quarter and slightly below the prior-year quarter.

Bank of America

The bank also made the case that the economic environment presents a positive outlook, driven by factors like ample job opportunities and increased wages, contributing to the robust financial health of consumers.

In other words, the soft landing scenario is expected.

The company also highlighted shifts in consumer lending behaviors, particularly a decline in mortgage applications due to stable housing conditions.

The chart below shows the implosion in mortgage applications, as rates over 7% are too much to handle for most.

Bloomberg

On the other hand, credit card usage remains strong as consumers prioritize experiences and discretionary spending.

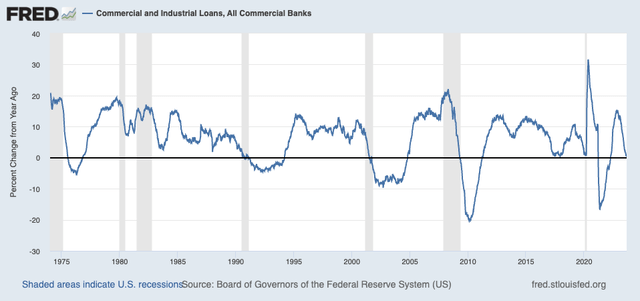

Commercial lending, however, has experienced a slowdown due to client-driven factors, with businesses showing caution in borrowing and focusing on debt reduction.

This is confirmed by St. Louis Fed data, which shows zero growth in commercial and industrial loans.

Federal Reserve Bank of St. Louis

As a result, the bank maintains a disciplined approach to pricing, remaining centered on core operating accounts and ensuring strategic allocation of deposits.

After all, risks are rising.

For example, the company noted that potential job losses or rising unemployment rates could impact credit quality negatively.

However, overall, credit quality is viewed as positive, resembling rates from 2017 to 2019, with the ongoing availability of jobs and cash inflow providing a cushion against deterioration.

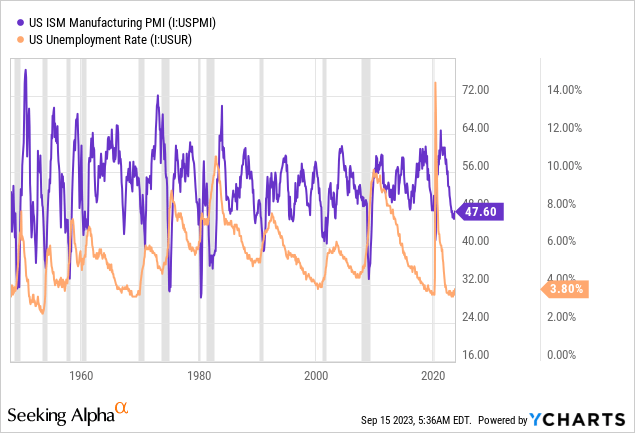

I do not disagree with that. However, I want to note that economic growth indicators are not painting a pretty picture.

For example, comparing the ISM index (a leading economic index) to the unemployment rate, we’re in a situation with an increased likelihood of elevated employment. This could do some damage to the housing market, as it could unlock supply because people aren’t willing to sell yet. Higher unemployment could cause forced selling, pressuring prices across the board.

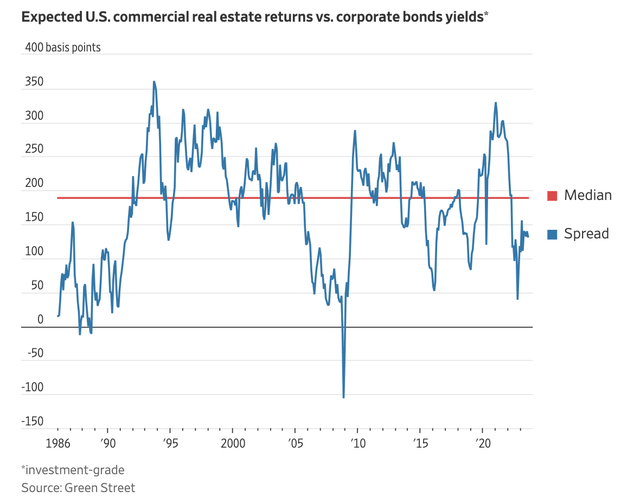

The Wall Street Journal expects that real estate prices need to fall at least 10% for a better balance between prices and corporate bond yields.

Right now, real estate only offers a 1.3 percentage point premium. For the relationship to return to normal and make property attractive again, U.S. real-estate prices need to fall a further 10% to 15%.

Wall Street Journal

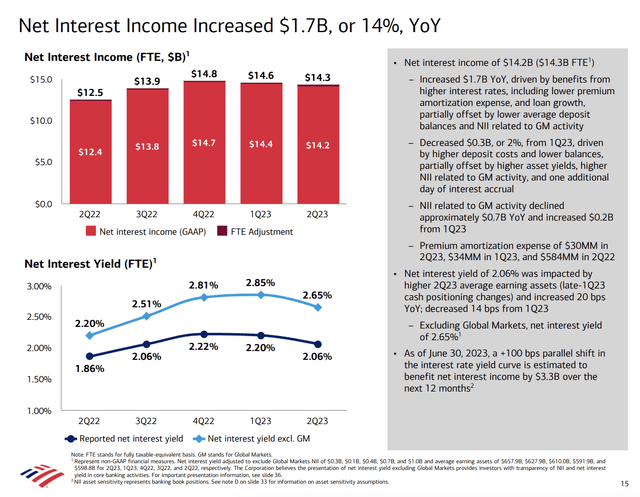

Having said that, one of the issues the bank is dealing with is a decline in net interest income. After all, we’re dealing with a deeply inverted yield curve.

Bank of America

This is what the company said in its second-quarter earnings call (emphasis added):

[…] NII of $14.3 billion is down $289 million or 2% from the first quarter, and that’s driven primarily by the continued impact of lower deposit balances and mix shift into interest bearing, partially offset by one additional day of interest in the period. Global markets NII increased during the quarter.

[…] We still believe NII for the full year will be a little above $57 billion, which would be up more than 8% from full year 2022, and this could include third quarter at approximately the same level as second quarter, so think $14.2 billion, $14.3 billion.

[…] First, it assumes that interest rates in the forward curve materialized, and an expectation of modest loan growth driven by credit card. On deposits, we are expecting modestly lower balances led by consumer, and we expect continued modest deposit mix shifts from global banking deposits into interest bearing. The past few months have provided us a little more positive outlook around NII, given the apparent stabilization of some elements of deposits as well as better pricing, and now we’ll see how the rest of the year plays out.

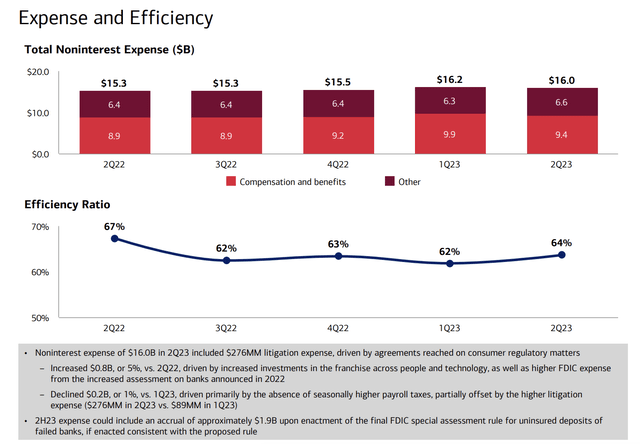

The efficiency ratio remains strong, which shows the company’s ability when it comes to dealing with higher expenses and a more uncertain environment.

Bank of America

Furthermore, the company addressed ongoing problems in the industry with held-to-maturity assets. After all, earlier this year, some banks went bust due to insufficient liquidity and being forced to sell assets they intended to hold until maturity.

According to Bank of America, held-to-maturity losses are not a capital, liquidity, or earnings issue for the bank. The strategy of investing in long-term fixed and short-term floating assets has proven beneficial, contributing significantly to NII.

The company also emphasized the ongoing benefits of this strategy, which is already yielding positive results and is expected to continue being a tailwind for the bank. For example, during the conference, the company detailed the process of converting these assets into cash and reinvesting them for maximum yield.

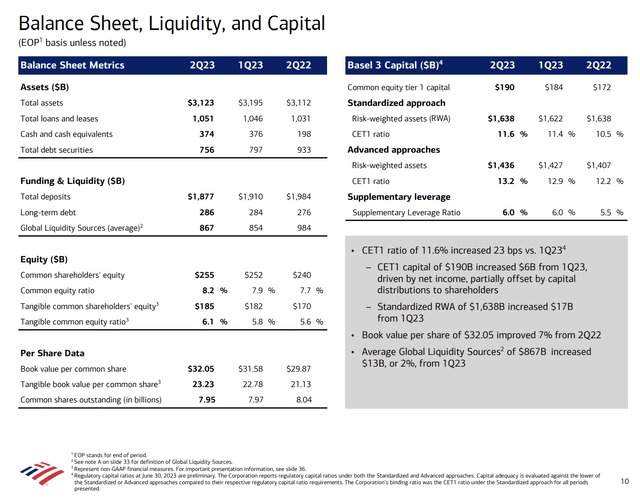

Currently, the company maintains a CET1 ratio of 13.2%. It aims to further increase its buffer (while supporting its dividend). Please note that RWA stands for risk-weighted assets.

If you took our Q2 RWAs and just close to up by 20%, you’re going to get to a number like $1.95 trillion. I would imply we’re going to need $195 billion of CET1. And we ended Q2 at $190 billion. So it gives you an idea of our gap. And we’ve been — we’ve been adding pretty significant clip of CET1 each quarter. So we should be able to get there in a quarter or two. At that point, then the rest of the challenge is just growing to build the buffer. Everyone overtime and just support the growth over-time and just support the growth and dividend buy-back the shares. We got five years to do that. So, I think we’ll have plenty of flexibility once we get through the course of the next quarter or two just build the capital we want, then we get to the point where we’ve got a lot of flexibility and we didn’t just go through our usual priorities for how we think about setting up the balance sheet.

Bank of America

According to the bank, higher RWA products like mortgages require tailored pricing actions. The bank aims to align its balance sheet with the evolving capital requirements, strategically reallocating capital to more advantageous areas while addressing the increased capital charges. The focus is on adapting and mitigating the impact by constantly reassessing and adjusting the product portfolio to optimize results.

Earlier this year, the dividend was hiked by 9% to reflect the company’s stability and commitment to shareholders.

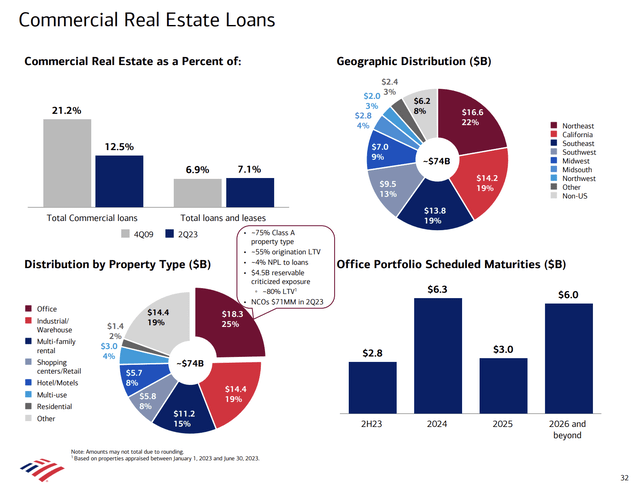

It is important to note that the company is well-insulated against any potential weakness in the commercial real estate market. While it may suffer in the case of an extensive economic recession, it has only 2% exposure to the struggling office sector, which is just a quarter of its CRE portfolio and a small part of its total investments on the balance sheet.

Bank of America

Having said that, next year, more than $6 billion CRE office debt is due at Bank of America. I’m eager to see what happens to credit quality once CRE investors need to refinance.

So far, the company sees no red flags in its CRE portfolio. I hope it remains that way, although I wouldn’t bet against a bit more CRE weakness down the road.

Valuation

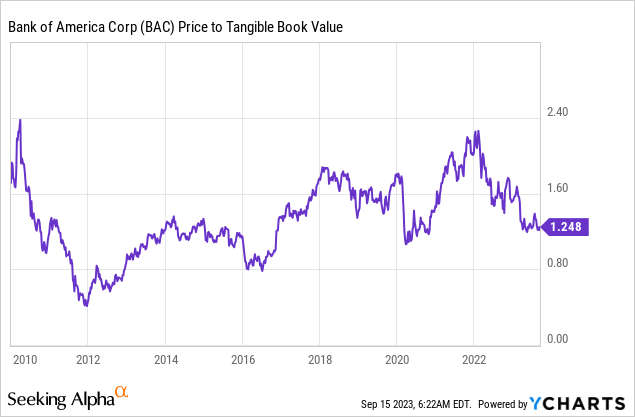

BAC is trading at 1.25x its tangible book value. This is close to the longer-term median.

The current consensus price target is $35.50, 22% above the current price.

I do agree that BAC is trading below its fair value. However, assumptions seem to be based on a soft landing. That’s what BAC is expecting as well.

If the Fed is able to lower inflation to its 2% target over the next few months and starts cutting rates gradually next year, we could see a stock price upswing to at least $35.

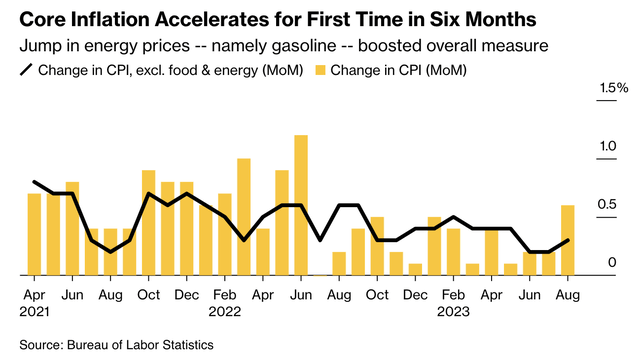

However, the problem is that developments are not favoring a soft landing. Inflation is rising again, boosted by energy.

Bloomberg

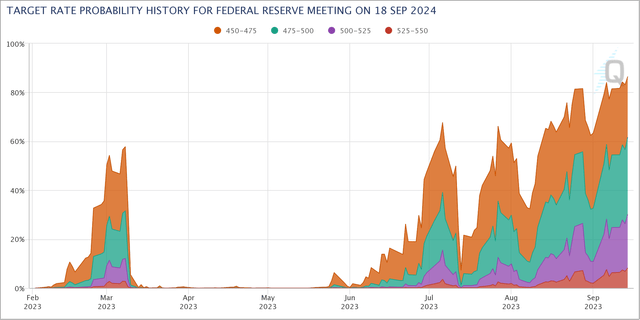

For example, the market is now pricing in a probability of more than 80% that the Fed Funds rate will be above 4.50% on September 18, 2024.

CME Group

I do not believe that the Fed can protect debt quality in such a scenario.

Hence, I’m extremely careful when it comes to banking stocks. I would make the case that BAC is still one of the best banks on the planet but not a no-brainer stock – especially because I can get a similar yield by just investing in a high-yield ETF.

There’s no need to own banks in this environment.

I’m obviously not making the case that people need to dump their BAC stock, but I also cannot make the case that BAC needs to be bought despite its valuation and stellar performance.

Takeaway

Fifteen years after the Lehman Brothers collapse, Bank of America has shown resilience, with a 136% return since 2010. Unfortunately, it lags behind the S&P 500, as banks often have poor risk/rewards, thanks to every economic hiccup having a major impact on banking stock prices.

The good news is that the bank’s recent insights suggest cautious optimism, with clients in good financial shape, although economic indicators raise concerns.

The bank is addressing challenges like declining net interest income and adapting to changing capital requirements. While it’s well-protected against commercial real estate weakness, upcoming debt refinancing could be a key test.

BAC’s current valuation and consensus price target show potential, but the path forward is uncertain. Inflation and Fed policies pose risks, making banking stocks a cautious bet with strong alternatives that I tend to prefer in this environment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.