Summary:

- PepsiCo passed on acquiring Hostess Brands, a move that I believe was the right decision.

- PepsiCo’s highlights include reliable dividend growth and its position as a Dividend King.

- I am waiting for a more attractive entry point to invest in PepsiCo and prefer other companies with lower valuations.

PM Images

PepsiCo (NASDAQ:PEP) is an iconic American company that continues to sit on my watchlist. I would love to be a shareholder of one of the greatest companies in the consumer staples sector, as an overwhelming percentage of the population enjoys its products daily. It doesn’t matter if a bull or bear market is occurring or what external factors are impacting society, PEP will continue to generate billions in profits, just as they have over the last decade. At the end of August, it was rumored that PEP was among the companies expressing interest in acquiring Hostess Brands (TWNK), and quite frankly, I think it’s better that they passed. Eventually, I will add PEP to my income-producing portfolio and enjoy reinvesting the ever-growing dividend. Until the value proposition is more attractive, I’ll continue to stay on the sidelines and wait for a more attractive entry point to this iconic American Juggernaut.

Seeking Alpha

I think shareholders of PepsiCo should be glad that J.M. Smucker is acquiring Hostess

Hostess Brands (TWNK) is a staple in every supermarket as it produces Twinkies, Hostess Cupcakes, Mini Muffins, and many other items found in the snack isles. While TWNK would have expanded PEP’s food portfolio, from the outside looking in, I don’t think this was the best use of PEP’s capital. J.M. Smucker (SJM) will acquire TWNK for $34.25 per share, a total transaction value of $5.6 billion, including the assumption of debt. I don’t think shareholders at PEP should feel as if they missed out, because the numbers don’t make sense.

In the trailing twelve months (TTM), TWNK has generated $1.38 billion in revenue, produced $169.9 million in net income, and $111.8 million in free cash flow (FCF). Over the past year, TWNK generated its largest level of FCF in 2021, with $142.2 million, and on a net income level, its best year over the past decade was 2017, with $223.9 million. PEP has $6.45 billion in cash on hand, with another $3 billion in long-term investments, so they could have paid $5.6 billion for TWNK in cash and not diluted shareholders or tapped the debt markets. I think shareholders should be happy that PEP didn’t pursue the deal.

Based on the current level of FCF, it would have taken PEP 50.09 years to generate $5.6 billion in FCF, and based on TWNK’s net income, it would take 32.06 years to generate $5.6 billion in net income. Depending on the synergies and cost benefits, maybe PEP could shave some time off of these numbers, but even if they got the breakeven down to 25 years to break even from net income and 40 years on FCF, PEP would have allocated a large amount of capital that would require decades to make back. Adding TWNK into the fold also doesn’t do much for PEP’s EPS. PEP has generated $7.9 billion in net income and generated $5.74 in EPS over the TTM. On the filing date, PEP had 1,376,600,000 shares outstanding ($7,900,000,000 net income / 1,376,600,000 shares outstanding = $5.73 of EPS). In the TTM, TWNK had generated $169.9 million in net income, and when this is added to PEP’s income statement, it would have increased its EPS by 2.15% or 12.34 cents per share.

The deal didn’t make sense to me because PEP could have taken that $5.6 billion and repurchased 31,387,790 shares in a massive buyback and increased their EPS to $5.87, which would have been almost $0.01 more than adding TWNK’s net income to PEP’s bottom line. The buyback would have also decreased the amount of capital allocated to the annual dividend by $157.56 million, which could be used to increase the annualized dividend increases. PEP could have also purchased risk-free assets at a 5% yield, generated $280 million in interest this year, and then implemented the buyback I outlined above. I think PEP made the right move, passing on TWNK.

Why I want to own PepsiCo and what it will take for me to start a position

I prefer drinking an icy cold Coke to a Pepsi, but I still want to be a shareholder in PEP. In addition to being one of the most recognized companies with an array of iconic brands, the food and beverage industry is basically recession-proof. No matter what occurs, people need food and water to survive, and you can cut every streaming subscription and stop going on vacation, but you won’t be able to avoid going to the supermarket. I love the idea of being invested in a company where a large percentage of supermarket isles is home to their products. This has allowed PEP to become a Dividend King, and generate value for its shareholders.

Seeking Alpha

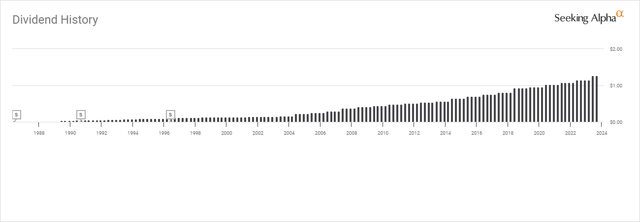

PEP has established one of the most reliable dividends in the market and is one of the 29 companies that have earned the right to be called a Dividend King. PEP has provided investors with 50 consecutive years of dividend growth; over the previous five years, its dividend has an average growth rate of 6.87%. Today, the yield is 2.81%, and its payout ratio is 65.21%, leaving much room for future dividend increases. While I can’t predict the future, I can imagine PEP continuing its string of dividend increases and celebrating its 75th year of annualized dividend increases and then its 100th year. PEP is in a great position to continue being a dividend growth machine for its investors, and I am just looking forward to an attractive entry point to join the party.

The Dividend Channel

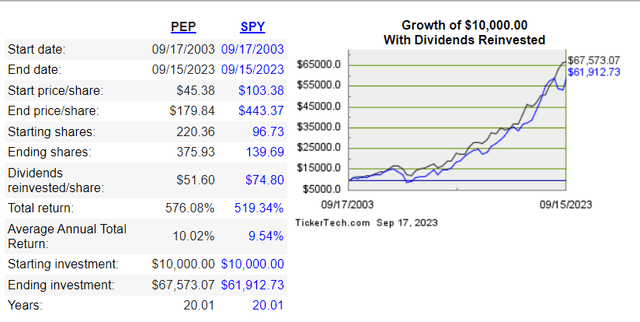

Over the past 20 years, PEP has outperformed the market, which I use the SPDR S&P 500 Trust (SPY) to track. An investment of $10,000 has grown into $67,573.07, a 576.08% return for shareholders by investing in PEP compared to $61,912.73 by investing in SPY. In September 2003, PEP had a quarterly dividend of $0.16, placing its annualized dividend at $0.64. An investment of $10,000 on 9/17/03 would have purchased 220.36 shares of PEP. Over the next 20 years, PEP generated $51.60 worth of dividend income, which, if reinvested, would have increased the total share count by 155.57 (70.6%) to 375.93 shares. Over this period, the annual dividend increased by $4.42 (690.63%) to $5.06, and the amount of annualized dividend income increased by $1,761.75 (1,248.79%) to $1,902.21 compared to $141.03 at the start of the investment. Over the years, PEP has outperformed the market and generated additional value by growing its income stream. I think PEP will continue to increase its annualized dividend, and if PEP continues to sell off from its highs, I would be very interested in starting a position.

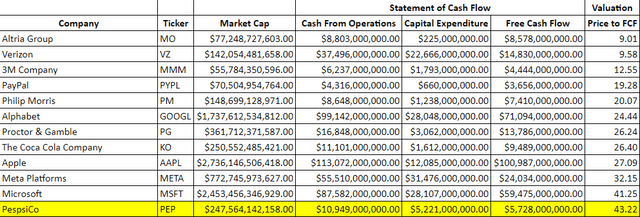

While I have tremendous respect for PEP and admire what it’s accomplished from a dividend perspective, I am not willing to pay 24x earnings or 43.22x their FCF, which is where PEP is currently valued. I compared PEP to the following companies:

- Verizon (VZ)

- Altria Group (MO)

- 3M Company (MMM)

- PayPal (PYPL)

- Philip Morris (PM)

- The Coca-Cola Company (KO)

- Meta Platforms (META)

- Proctor & Gamble (PG)

- Alphabet (GOOGL)

- Apple (AAPL)

- Microsoft (MSFT)

I selected these companies because I wanted to see how PEP was valued compared to similar staples and big tech.

Steven Fiorillo, Seeking Alpha

I use the price-to-FCF metric because FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This also is the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions. I like to see how much I am paying for a company’s cash flow.

Based on the TTM numbers, PEP is trading at 43.22x its FCF, which is the largest valuation in the peer group. KO generates significantly more FCF and trades at 26.4x its FCF. I could also invest more capital into AAPL, GOOGL, META, or PYPL at a lower price to FCF multiples than where PEP trades.

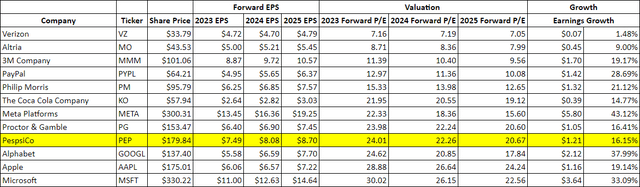

Next, I look at the forward P/E for the remainder of 2023, then for 2024 and 2025. PEP is currently trading at 24.01x its 2023 earnings, 22.26 2024 earnings, and 20.67x 2025 earnings. It’s hard for me to justify investing when KO trades at 21.95x 2023 earnings, and this number goes to 19.12x 2025 earnings. It’s also hard for me to justify paying around the same amount for PEP’s earnings as GOOGL’s when GOOGL is expected to grow its earnings from the end of 2023 to the end of 2025 by 37.99% and pay 17.84x 2025 earnings when PEP’s earnings are expected to grow by 16.15%.

To start buying PEP shares, I would need its current year’s P/E ratio to be under 20x with future EPS growth or its price to FCF to be under 30x.

Steven Fiorillo, Seeking Alpha

Conclusion

PEP has been on my watchlist and will continue to remain on my watchlist until there is a better entry point. I want PEP to be part of my income-producing portfolio, but I also don’t have a fear of missing out and I am willing to never add shares if a valuation I am willing to pay doesn’t occur. I think management made a wise choice passing on TWNK as buying back shares would have added more to PEP’s EPS than rolling TWNK’s net income into its financials. I think PEP will continue to be a dividend growth machine for shareholders and generate future value, but I’d rather buy KO here than PEP, given the valuations. Hopefully, later this year, or sometime in 2024, I can write an article about finally investing in PEP, but until then, I will be watching from the sidelines.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO, AAPL, META, GOOGL, PYPL, MO, VZ, MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.