Summary:

- Johnson & Johnson’s strategic transformation, marked by the split-off of its consumer health division, is a significant shift in its corporate strategy.

- The company aims to streamline its operations, boost margins, and reintroduce growth. However, there are some concerns to discuss.

- While JNJ stock may not offer substantial potential for equity appreciation, it remains an attractive choice for income-seeking investors. There are also some implications from the Kenvue deal.

- The transformation brings its share of challenges, including potential threats to revenue from expiring drug patents and increased competition.

Justin Sullivan

Introduction

Johnson & Johnson (NYSE:JNJ) is in the midst of a transformation. The recent split-off of its consumer health division signifies the company’s effort to simplify its operations and boost its financial performance. With 135 years of history behind it, the company is striving to stay competitive in today’s market. Many investors have long regarded it as a dependable source of income through its dividends. However, the decision to part with a portion of its revenue-generating assets raises concerns about the stability that shareholders have come to expect.

This transformation aims to revitalize the company’s growth, particularly by focusing on the higher-margin pharmaceutical segment. Yet, this probably also means relying more on the success of new medication products in the pipeline and dealing with the expiration of patents on key medications, which have been crucial sources of revenue for Johnson & Johnson. This introduces an element of uncertainty.

In this article, I will explore the implications of the recent consumer health split-off, now known as Kenvue Inc. I’ll also examine the company’s ongoing strategic plans to reshape itself, assess its current valuation, and discuss why, regardless of my personal views about the operational side that are somewhat mixed, Johnson & Johnson’s stock is likely to continue to appeal to dividend-seeking investors in the future.

The Split-Off

In May this year, Johnson & Johnson made significant strides by first ever selling shares of its consumer health segment, Kenvue Inc., which houses familiar brands such as Band-Aid and Tylenol, through an initial public offering. This move netted Johnson & Johnson about $3.8 billion in proceeds. Subsequently, in late August, Johnson & Johnson divested approximately 80% of its remaining Kenvue shares in a split-off valued at around $40 billion. This strategic action allowed some investors to exchange their J&J shares for Kenvue shares.

The exchange offer was oversubscribed, with about 800 million tendered shares. Ultimately, Johnson & Johnson accepted about 191 million shares in exchange for roughly 1.5 billion shares of Kenvue common stock. This transaction amounted to a $33 billion share repurchase, promising annual savings exceeding $900 million in dividend payments for Johnson & Johnson.

Furthermore, Johnson & Johnson currently maintains a 9.5% equity stake in its former consumer health segment. The company is contemplating selling this stake in the near future, potentially yielding around $4.2 billion in cash. The timing of the sale is being considered in part because it would be tax-free if completed within the next year.

Such a monumental corporate maneuver obviously comes with some financial cleanup. Johnson & Johnson is actively eliminating certain stranded costs, referring to specific corporate overhead expenses that were previously absorbed by some of its consumer sales. This process is expected to conclude ahead of schedule by the middle of the following year.

I expect the completion of the split-off is expected to materialize within 18 to 24 months.

Rationale for the Split-Off

The completion of this significant split-off, involving the divestiture of the company’s slowest-growing business line, marked the culmination of a multiyear strategic effort to drive higher margins and growth for the remaining company. The primary objectives of this separation, both for Johnson & Johnson and Kenvue, obviously include achieving a sharper focus on core businesses and gaining greater agility in corporate decision-making.

This strategic shift also addresses a historical competitive disadvantage faced by the Consumer Health division, which lagged behind specialized companies like Haleon (HLN) or Reckitt Benckiser (OTCPK:RBGPF).

Additionally, this strategic separation serves to limit litigation risks, particularly those related to alleged asbestos contamination in baby powder. While Johnson & Johnson retains litigation risks in the USA and Canada, all risks and lawsuits outside these regions will now fall under Kenvue’s purview.

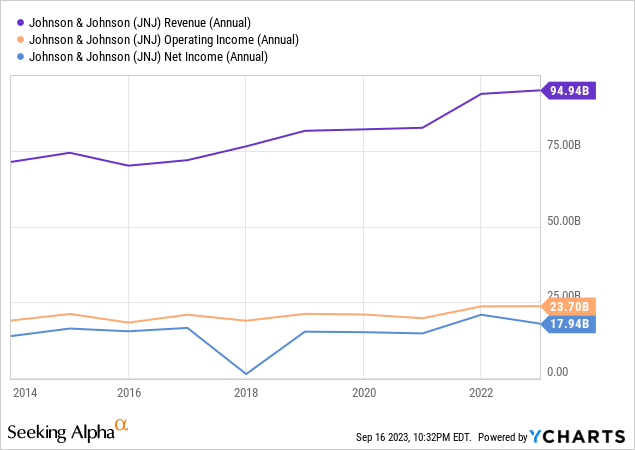

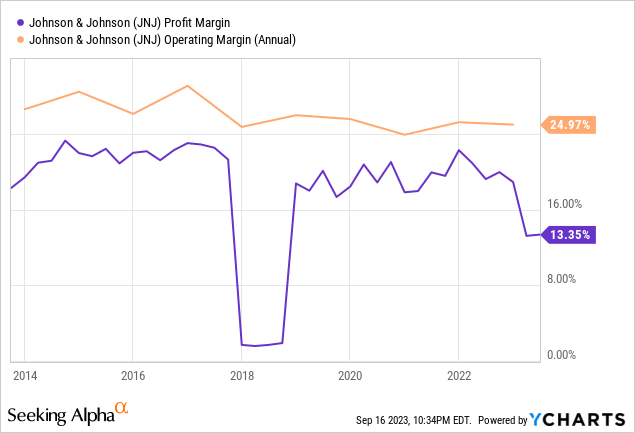

Impact on Growth and Margins

Consumer health brands in general, with end-market growth of just approximately 3% to 4%, have historically lagged behind the pharmaceutical and device groups, which can usually be expected to achieve higher growth rates in the range of 5%.

Thus, the separation of the consumer group is very likely to contribute to improved margins for Johnson & Johnson, as the unit has historically diluted overall operating margins. Consumer health typically operates in the teens range, while pharmaceuticals and medical devices deliver peak margins in the high-20s and low-30s. The absence of the lower-growth consumer business will likely result in consistently higher top-line growth for the new Johnson & Johnson. I am eager to see the effects of that in the company’s upcoming financial reports.

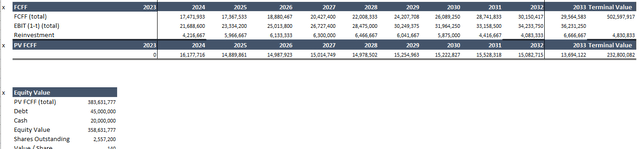

Financial Guidance

As Johnson & Johnson transitions into a standalone pharmaceutical and medical device company following the split-off, the company recently released its first earnings forecast for the year. It anticipates double-digit earnings growth for the current year.

For 2023, excluding the consumer health business, Johnson & Johnson expects full-year sales of $83.2 billion to $84 billion, reflecting a 7% to 8% increase compared to the previous outlook that included Kenvue.

In this previous outlook, sales ranged from $98.8 billion to $99.8 billion, with year-over-year growth of 6.5% to 7.5%. Adjusted earnings per share are projected to range from $10.00 to $10.10. This slightly revised estimate, down from the previous range of $10.70 to $10.80, is still expected to maintain an appealing quarterly dividend of $1.19 per share, representing year-over-year growth of approximately 12.5%.

JNJ – FY23 Guidance (Johnson&Johnson)

While these numbers appear solid, the company is under markets scrutiny to fulfill its promises of achieving sharper top-line growth and improved margins.

Johnson & Johnson – Business Streamlining; Hope, and Risk

As part of its transformation, Johnson & Johnson has unveiled a new logo. However, it’s obvious that underlying challenges persist, extending beyond the logo change.

One of these challenges I see is the looming threat of lower-cost competition for some of its highest-selling prescription drugs. For instance, Stelara, a treatment for gut and skin disorders that generated around $10 billion in revenue last year, is expected to face increased competition as it loses patent protection by early 2025.

As for MedTech, the surge in medical-device sales fueled by post-Covid procedures may be at risk of plateauing as postponed surgeries are completed.

The shift from a conglomerate structure to a more focused approach also removes some of the safety net of diversification. Consequently, J&J becomes more vulnerable to downturns if, for instance, the research and strategic acquisition efforts they bet on don’t yield successful new prescription medicines and devices.

Also, the success of its pipeline assets becomes crucial for consistent contributions.

And while J&J has a substantial financial reserve of about $20billion, partly as a result of the proceeds from the Kenvue IPO, strategic M&A decisions are not a no-brainer and hold a reasonable uncertainty.

However, it also might turn out brilliant.

While in the pharmaceutical and MedTech domains, research and M&A as key drivers are both intensive and costly endeavours.

The horizon is worth it. The portfolio for J&J includes high-selling products like blood-cancer drugs that could land multi-billion dollars in sales, artificial knees, surgical products, and Acuvue contact lenses, aiming for higher profit margins.

J&J is also expanding into new treatments for solid tumors, including an experimental lung cancer treatment that holds significant sales potential. The company anticipates pharmaceutical sales to reach $57 billion in 2025, up from $52.6 billion in 2022.

In the medical-device business, while it has lagged behind pharmaceuticals in recent years, a rebound in sales has been observed as hospital procedures recover from the pandemic. The company plans to maintain this growth through internal product development and external acquisitions.

The rebranding initiative underscores J&J’s commitment to innovation in medicine and surgery, differentiating it from the consumer brands it was once associated with. The new logo, featuring plain red print letters instead of cursive penmanship, symbolizes this shift.

JNJ – Logo Change (The Wall Street Journal)

Under the leadership of Joaquin Duato, who has a proven track record within J&J, having led the successful turnaround of the pharmaceutical business in the early 2000s, and John Reed, former CEO of the Sanford-Burnham Medical Research Institute, where he established therapeutic area-aligned research centers, the company embarks on this new direction with a focus on innovation, progress, and growth.

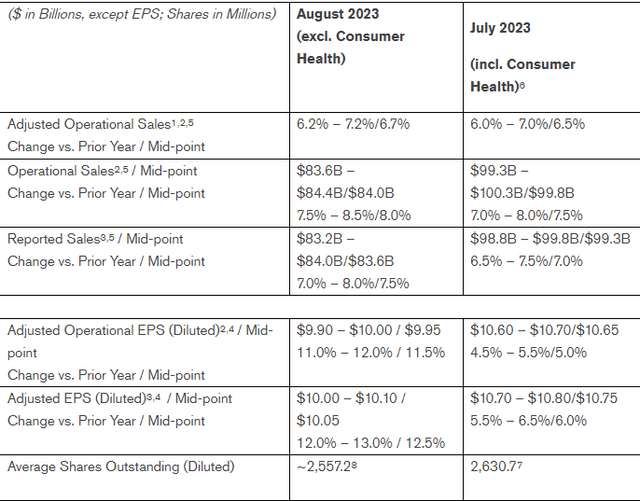

Valuation

With this new plan in its arsenal, Johnson & Johnson is expected to demonstrate elevated top-line growth compared to previous years, as well as margin improvements. I factored these elements into a Discounted Cash Flow (DCF) analysis of the company to derive a fair equity value. It’s important to note that my primary objective in this article does not revolve around determining a precise share price for Johnson & Johnson. Given the transformative nature of the company at this juncture, arriving at reasonable assumptions can be challenging. Nevertheless, this simplified DCF represents my own perspective. Please feel free to reach out, and I will gladly provide you with the model, so you can input your own assumptions.

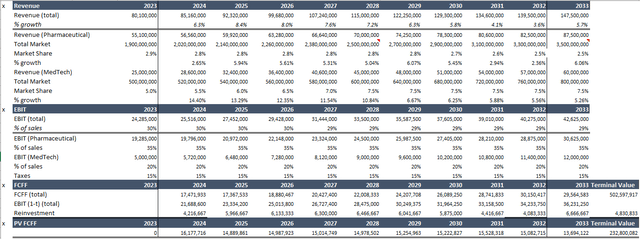

JNJ – Model at a Glance (Author)

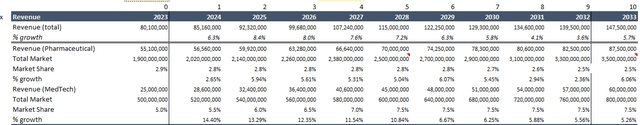

Key assumptions for my projection include the market sizes for Pharmaceuticals and MedTech, from which Johnson & Johnson will now exclusively derive its revenue. Data suggests that the total market size for Pharmaceuticals is likely to surpass $3.5 trillion by 2033, while MedTech is projected to reach total sales of $500 billion by 2033, representing Compound Annual Growth Rates (CAGR) of approximately 6% and 4%, respectively. I have used Johnson & Johnson’s own forecast for total revenue, which is around $80 billion for full-year 2023, implying that pharmaceutical revenue will make up about 65% and MedTech the remaining 35%.

JNJ – Model Revenue Inputs (Author )

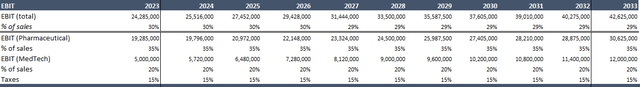

I also assume Johnson & Johnson will achieve an overall operating margin of 30%, with pharmaceuticals reaching a margin in the mid-30s and MedTech achieving a margin of 20%, in line with industry averages.

JNJ – Model Margin Inputs (Author)

I acknowledge that these statistical assumptions are simplified, but as I mentioned, the purpose of this model is to provide a rough directional estimate.

Ultimately, I derive Free Cash Flow by subtracting reinvestments from EBIAT (Earnings Before Interest after Taxes). The reinvestment projection for the upcoming years is calculated using a static Sales-to-Capital ratio of 1.2, which is slightly above the industry’s historical average and therefore reasonably optimistic in my opinion.

Moreover, I factor in a Return on Invested Capital (ROIC) assumption of 15%, which is more or less in line with the company’s historical data in that respect. Additionally, I apply a discount rate of 8% as well as a terminal growth rate of 2% beyond FY2033. Considering Johnson & Johnson’s debt and cash, I arrive at an equity value, resulting in a fair value per share of $140. This suggests that the shares are approximately fairly valued; however, there is no fundamental upside either.

Dividends

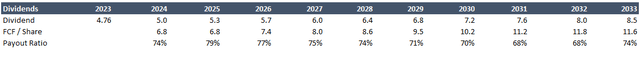

While the valuation I presented may not appear overly promising in terms of share price gains, it’s important to recognize that many investors primarily hold Johnson & Johnson for its reputation as a reliable cash distributor. Johnson & Johnson is a Dividend Aristocrat, having consistently distributed dividends to its shareholders for more than 60 years. If we expect them to continue doing so, even without the steady income from its consumer health segment, the stock would be a solid BUY in that respect.

As mentioned earlier, the company is saving approximately $900 million annually through the retirement of its shares in the context of the Kenvue deal. This not only provides them with more room to explore M&A opportunities, as discussed previously but also allows for potential increases in dividend payments per share, or at least a cushion to maintain their expected payments.

For 2023, Johnson & Johnson is expected to pay out approximately $4.79 per share in dividends, resulting in a dividend yield of about 2.9% based on JNJ’s current share price of about 160$. To assess the future of their dividend payments, I have created the following table, which includes metrics such as Free Cash Flow per share and the resulting payout ratio based on my own FCF projections.

JNJ – Future Dividends (Author)

I have assumed an annual dividend growth rate of 6%, aligning with the average dividend growth over the past 3 years. With that, despite reasonable concern about the company’s transformation in terms of stability without a black swan event happening, the dividends should be fairly safe.

Additional Risks on the Horizon

This section outlines some additional key concerns on the horizon that I deem necessary to address.

Drug Price Negotiations

One of the notable factors affecting pharmaceutical stocks, including J&J, is the ongoing debate surrounding drug price negotiations in the United States. In an effort to curb healthcare spending, the government has set its sights on the pharmaceutical industry, a sector that represents a significant portion of healthcare expenditure.

Recent developments have revealed a list of the first ten drugs slated for negotiations, and among them are some of Johnson & Johnson’s significant revenue generators, including Imbruvica, Stelara, and Xarelto. Collectively, these three drugs raked in a substantial $16 billion in sales in 2022. While any pricing actions resulting from these negotiations won’t take effect until 2026, investors remain wary of the potential scope and consequences of these discussions on pharmaceutical companies’ bottom lines. Some major players in the pharma industry have even filed lawsuits, arguing that lower drug prices could have adverse effects on research and development initiatives.

Lawsuits: A Persistent Concern

Johnson & Johnson has been no stranger to legal disputes, and one recurring risk is the potential settlement amounts the company might be compelled to pay. The ongoing “baby-powder” litigation serves as a prominent example, with plaintiffs alleging that the company’s talc-based products, including baby powder, have been linked to cancer.

In April, a proposed settlement emerged, outlining a payout plan spanning 25 years through a subsidiary. In this arrangement, a $8.9 billion trust would be established, pending approval from a bankruptcy court, which would effectively resolve all existing and future claims pertaining to Johnson & Johnson products containing talc.

With the recent split-off of the consumer health business, Johnson & Johnson has outsourced some of these litigations. However, the United States remains a primary focal point in this context, especially concerning the potential settlement amounts.

Navigating these risks and uncertainties will be pivotal for Johnson & Johnson as it moves forward in its transformed state, emphasizing innovation, progress, and growth.

Conclusion

In conclusion, Johnson & Johnson’s ongoing transformation represents a significant shift in its strategic direction. While the path ahead is not without its challenges and uncertainties, particularly in the face of drug price negotiations and lingering legal disputes, the company’s decision to streamline its operations is aimed at achieving higher margins and more agile decision-making, which holds potential.

From a valuation perspective, Johnson & Johnson’s shares appear to be approximately fairly valued; however, this means that there isn’t much potential for significant equity appreciation without a significant fundamental change. Nevertheless, for investors seeking a reliable source of dividend income, this stock continues to hold appeal. With a history of more than six decades as a Dividend Aristocrat, Johnson & Johnson has consistently rewarded its shareholders, and even if the company loses some of the safety net of diversification and steady income without a black-swan event, those dividends should continue.

Personally, my focus isn’t much on dividends, so while I may not be actively buying the stock today, I’ll be closely monitoring the company’s transformation and the outcomes of its strategic initiatives. Regardless, I would still recommend it as a “BUY” for those investors who prioritize dividend income in their portfolios.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer: Equity Analysis Articles

The information provided in this equity analysis article is for informational purposes only and should not be construed as financial or investment advice. The author of this article (hereinafter referred to as "the Author") is not a licensed financial advisor or registered investment advisor.

The Author has prepared this article based on publicly available information, financial data, and their own research. While the Author strives to provide accurate and up-to-date information, they make no representations or warranties of any kind, express or implied, regarding the accuracy, completeness, or reliability of the information presented in this article.

The Author disclaims any liability for any investment decisions made based on the information provided in this article.

Conflict of Interest Disclosure: The Author has no conflict of interest in writing this equity analysis article. At the time of writing, the Author does not own any shares, derivatives, or any other financial interest in the equity of the company under analysis. Additionally, the Author has not received any compensation from any individual or entity for writing this article, other than Seeking Alpha.

Forward-Looking Statements: This article may contain forward-looking statements and projections based on the Author's assumptions and beliefs. Such statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. The Author is not responsible for any reliance placed on such statements.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.