Summary:

- Google is a cash cow and could offer investors a dividend in the future.

- The company has a forward P/E of 22.5X and offers investors upside to its current price target.

- GOOG has shown exponential growth in its financial metrics over the last decade and YouTube and Google Cloud continue to be strong growth drivers for the company.

- GOOG has an AA+ credit rating with $118 billion in cash on hand.

Olivier Le Moal

Introduction

There are several stocks that are considered cash cows. But just because they are cash flow machines, that doesn’t mean they share that cash with their shareholders. These include some of the most well-known companies in the world and I’ve written a few articles on some who could potentially pay a dividend. Of course this is all speculation, neither I nor anyone else for that matter knows what a stock’s management team is thinking. But just because a company is not known to pay dividends, that doesn’t mean one can’t be in its future. Especially if they’re a business used to generating enormous amounts of cash. One company known for this is none other than Alphabet Inc better known as Google (NASDAQ:GOOG). Who knows maybe one day Google’s management will read this article and decide to reward its shareholders with a dividend LOL.

Google The Business

This company needs no introduction. We’ve all used their services in one way or another. Some of us use them daily. Whether that’s searching the Internet, looking for directions, or using their apps or phones. Similarly to Apple (AAPL), it’s one of the few companies with a market cap over $1 trillion. Normally companies with market caps this large are cash-flow machines or what we call “cash cows”. And most of these use that cash to invest back into its business to continue growing.

Many have very high capital expenditures. And while this amount changes, depending on what the company is investing in or acquiring, I’m always wondering the same thing. “Will they ever reward shareholders with a dividend?” This could be wishful thinking. Some said Microsoft (MSFT), another cash cow, would never pay a dividend. But almost 30 years after IPO, the company paid its first dividend in 2003. So saying a dividend is not in the future of some of these companies is not unreasonable. And if one day they decide to, you all can thank The Dividend Collectuh haha.

Astronomical Growth

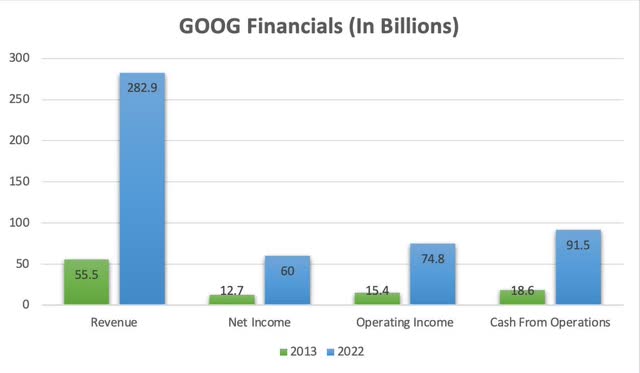

Over the last decade GOOG’s financials have grown astronomically. Revenue grew a whopping 409% while net income grew 372%. Both operating income and cash from operations grew 386% and 391% respectively. To put this into context I compare them to AAPL, Warren Buffett’s favorite, and largest stock by market cap currently.

During the same period Apple grew its revenue by 130.5% and net income by 170%. Both operating income and cash from operations grew by 144% and 128% respectively. To note, AAPL currently pays a quarterly dividend of $0.24 while Google does not.

Continued Growth in 2023 & Beyond

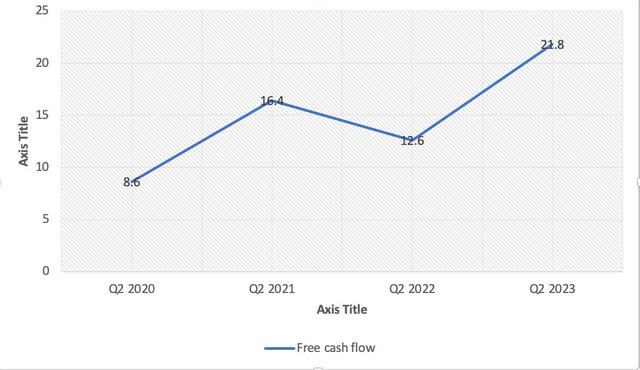

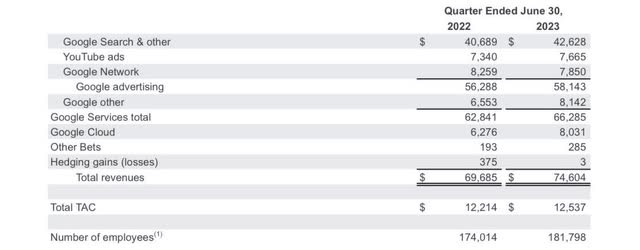

During Q2 earnings GOOG’s astronomical growth continued posting impressive numbers quarter-over-quarter and YOY. Revenue grew to $74.6 billion from $69.8 billion in Q1 while net income & operating income grew 22% & 25% respectively. Since its stock split in 2022, FCF has continued to grow exponentially, posting growth of more than 73% year-over-year, growing from $12.6 billion to $21.8 billion. Since Q2 of 2020, FCF grew 153% from $8.6 billion to its current. There was a slight decline in cash flow last year but that was due to increased CAPEX, where the company invested heavily into servers, data centers, and office facilities.

YouTube and Google Cloud both continue to be big growth drivers for the company. The introduction of YouTube Shorts has paid off. Channels that uploaded to Shorts daily grew 80% and they’re also seeing stellar growth internationally. Logged-in users grew to 2 billion, up from 1.5 billion a year ago, and revenue across products totaled nearly $40 billion.

Furthermore, Google Cloud revenue grew to $8 billion, up 28%, and operating profit grew $395 million. Additionally, as AI continues to grow, GOOG is continuing to incorporate this into their products. To note, this is Google’s 7th year as an AI-first company. In Q2 the company launched the Search Generative Experience, which uses the power of AI to make search more natural and intuitive.

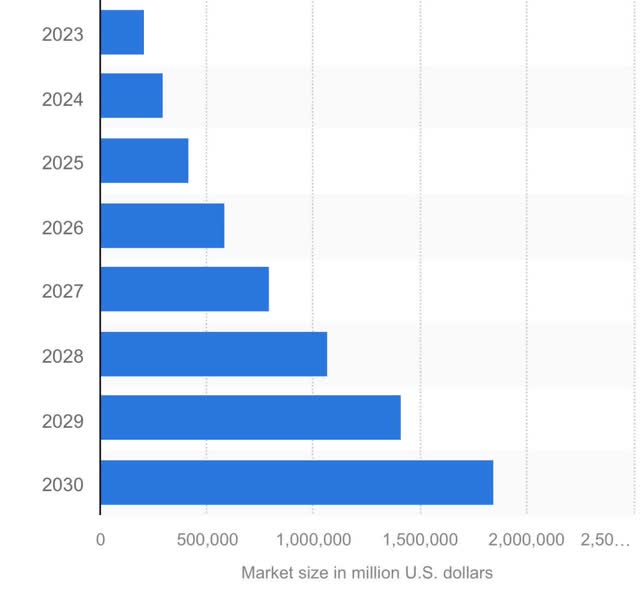

As AI continues to take the world by storm, GOOG will continue to benefit greatly from this. The market is forecasted to show strong growth in the coming decade. With the release of ChatGPT by OpenAI last year, this introduced us to the realm of possibility with artificial intelligence. This is apparent as many companies have incorporated it into their business models.

Balance Sheet

Another thing the company continued to grow was their cash on hand. GOOG ended Q2 with $118 billion in cash, up from $115 billion in Q1. To put this into perspective, GOOG has enough cash on hand to buy 2 of the 5 largest banks in the U.S. by assets, U.S. Bancorp (USB) and Citigroup (C). Additionally, the company only has a minimal amount of debt with $11.9 billion so as you can see they have plenty of cash to cover it. This has decreased from $13.82 billion in 2020. Did I also mention they have one of the highest credit ratings at AA+? So shareholders shouldn’t have the slightest worry about high interest rates with this company.

So Is It A Buy?

GOOG has a current P/E of 29x and a forward P/E of 22.5x. Earnings are expected to grow 27% in the next year indicating the stock is currently undervalued. They’re current P/E is also lower that its peer Meta Platforms (META) who has a P/E of 35x. From here it offers investors some upside to its current price target of $148. With the emergence of AI and the expected growth, I think GOOG will continue to exceed analysts’ expectations in the coming years and therefore think it is a buy.

Risks

One of the good things about GOOG is they don’t face many risks in my opinion. The company recently reached an agreement for $93 million with the state of California for allegations that the communications giant used consumer profiling and advertising purposes without consent. As the company continues to incorporate AI into its products, this could potentially lead to more lawsuits as they become heavily dependent on artificial intelligence. They were also ordered to pay out more than $391 million to 40 states, but the company has since made significant improvements to its location tracking disclosures & user controls. Additionally, GOOG lost a patent lawsuit again Sonos (SONO) for wireless speakers.

Conclusion

GOOG is a cash flow machine that continues to grow it’s financials in every metric. They also have an ample amount of cash on hand and low debt which is impressive for a company as large as them. The company has been cash flow positive for years and with AI expected to grow twentyfold by 2030, maybe a dividend could be in the company’s future. As mentioned earlier, MSFT was public for 17 years before it paid its first dividend in 2003. So a dividend could be in the company’s future in the coming years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.