Summary:

- AT&T stock has benefited from an uplift in September, but continues to underperform broader markets.

- However, preliminary outperformance on iPhone upgrades kicks off a strong 2H seasonality environment. Paired with AT&T’s disciplined approach on promotional activities, we expect a net tailwind to full year FCF.

- Anticipation for stronger-than-expected 2023 FCF performance will also help cushion any incremental industry-specific headwinds (e.g. lead-clad crisis), without compromising AT&T’s dividend payout.

- This is likely to keep AT&T’s 7%+ dividend yield at current levels intact, and lift sentiment for the stock in the near-term.

Justin Sullivan

AT&T’s stock (NYSE:T) has benefitted from an uplift in September. Much of its ~8% gains over the past month came after the iPhone 15 (AAPL) “Wonderlust” launch event last week. This is in line with anticipated market optimism over the beginning of the annual seasonality-driven demand environment, but also marks a stark reversal from the stock’s historical curse in which it declines in tandem alongside Apple following its biggest device launch of the year.

AT&T’s recent gain is likely driven by expectations for a blockbuster upgrade cycle with the iPhone 15’s arrival, as the iPhone 12 – one of Apple’s bestselling iPhone series – nears the end of its average three-year lifespan. While device promotions have historically been a headwind to telco profitability, we expect the iPhone 15’s strong take-rates, as observed through positive preliminary demand trends, to be a net tailwind for AT&T’s full year cash flows. We believe the iPhone 15 promotional cycle this time around will lessen concerns over the durability of AT&T’s dividends, making its 7%+ yield (NYSE:T.PR.A: +6.3%; NYSE:T.PR.C: +6.3%) at the stock’s current levels an attractive income investment.

The Great Apple Upgrade Cycle

The iPhone 12’s launch in late 2020 had single handedly helped Apple reverse multi-year declines in its revenue-driving segment. In addition to the integration of new Apple silicon, the iPhone 12 was Apple’s very first to be fitted with 5G technology. The 2020 model was marketed as “ushering in a new era” for the smartphone industry, and coincided with major U.S. wireless networks’ – including AT&T’s – transition to 5G connectivity. iPhone 12 sales drove record-setting quarterly growth for Apple’s smartphone segment through fiscal 2021, likely coupled with a robust consumer spending environment flush with pandemic-era stimulus. Similar strength was observed in wireless demand across the big three U.S. networks when the iPhone 12 family was introduced – AT&T posted 800,000 post-paid phone net adds in 4Q20, representing more than half of its full-year 2020 net adds, while also maintaining record low churn.

As the record volume of iPhone 12 sales at launch approach the end of their average three-year useful life (the phone likely works for much longer, though the technology may have become significantly obsolete), the ensuing upgrade cycle is expected to be a strong tailwind for the iPhone 15. Recent concerns raised over the iPhone 12’s radiation levels is also likely to bolster the upgrade cycle, instead of turning users away from Apple altogether (there’s been no issues raised on the immediately preceding iPhone 13/14 line-up, after all).

The iPhone 15 line-up itself also makes an enticing upgrade on its own – especially the higher-tier Pro series. In addition to the integration of an all-new A17 Pro chip, the iPhone 15 Pro also features a titanium exterior, upgraded from the standard aluminum glass back. The Dynamic Island – a core selling feature of the iPhone 14 Pro last year – is now found as a standard, with the iPhone 15 Pro boasting thinner screen borders as well. Taken together, the iPhone 15 series – particularly the Pro series – is expected to defy the smartphone market slump this year, with preliminary resilience in U.S. market demand a potential tailwind to AT&T’s wireless business.

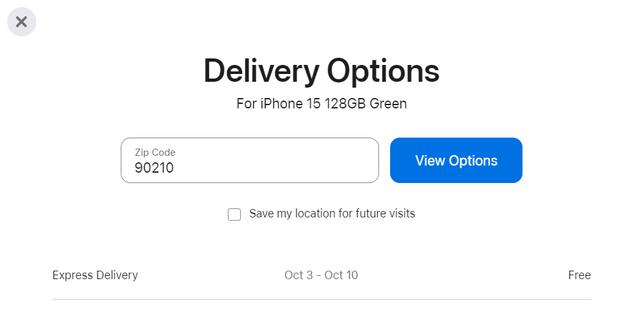

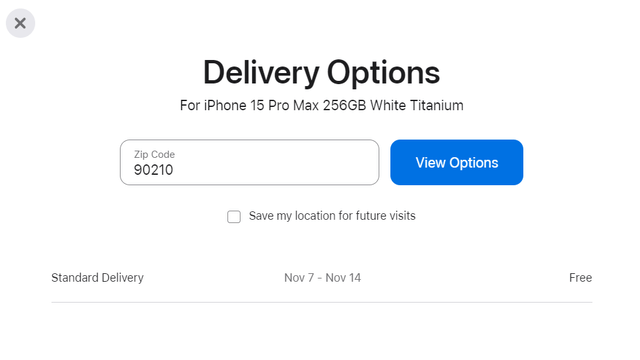

Specifically, iPhone 15 Pro and Pro Max deliveries have already been extended to as late as mid-November in the U.S., while some colours of the standard iPhone 15 are seeing delivery delays out to October – or at least two weeks longer than initial availability starting September 22.

apple.com

apple.com

The extended delivery times underscore strong demand (barring inventory shortages / supply chain bottlenecks) for the newest iPhones, despite a mixed consumer spending backdrop. Shortages at Apple could potentially incentivize incremental unlimited plan purchases from mobility network partners such as AT&T, as consumers look to get their hands on the latest and greatest iPhone. AT&T is currently offering new and existing customers up to $1,000 off any iPhone 15 Pro (starts at $999) or Pro Max, or up to $830 off any standard iPhone 15 (starts at $799) or Plus with an eligible trade-in and subscription to a “qualifying unlimited voice and data wireless service” of at least $75 per month. This is similar to an offering by rival T-Mobile (TMUS) extended to both new and existing customers, and a potential market share-grab from Verizon’s (VZ) relatively restricted offering of similar discounts to new customers only.

Implications for AT&T

The annual device launch is always accompanied by promotional activities and discounts across the big-three U.S. mobility networks, and the near-term implication is nothing but headwinds to the bottom-line. Early-on device inventory procurement has historically been a pressure point to free cash flows as well. This is largely in line with significant device spend in 1H23, as well as management’s expectation for second half estimated free cash flows of $11 billion to be Q4-weighted (~$4.5 billion to $5 billion in Q3; ~$6 billion in Q4).

However, we remain confident that AT&T’s prudent execution of new device and seasonal promotions in recent years will prevail as a net benefit to its fundamentals. Management has also recently reaffirmed observations of healthy and rational competitive dynamics this time around, with the extent of industry promotions offered on the new iPhones largely unchanged from previous years, despite a price increase for the device itself.

This is in line with consistently robust subscription adds at AT&T over the past year, despite becoming less active in offering promotions relative to peers in the industry, even as consumers are becoming increasingly price sensitive under tightening financial conditions. This continues to underscore effectiveness in the company’s increasing focus on improving value proposition in the market.

There was a little bit of shift that occurred in the second quarter. Part of it was new account, part of it was new offers in the market. We’ve seen a normalization. And we think what we have out in the market is performing very well. And I go back to comments I’ve made repetitively in previous quarters. We’ve been very focused segment wise around where we’re choosing to get our activity. And I don’t know that broad promotions is necessarily been the primary or by any means, the exclusive means of us getting customers.

From a longer-term perspective, strong iPhone 15 demand paired with AT&T’s disciplined, yet competitive, promotional offering is expected to be a net tailwind for its fundamentals. We expect AT&T’s iPhone 15 promotion cycle ahead of 4Q seasonality to reinforce multi-year subscription volumes on the higher-margin unlimited mobility plans. This will bolster positive fundamental performance metrics observed in AT&T’s wireless segment during Q2 – low post-paid churn and increasing ARPU to drive margin expansion – and support “growing revenues, growing earnings, [and] growing cash flows” at scale. This is consistent with CFO Pascal Desroches recent commentary that Q3 is on track to incremental postpaid phone net adds, despite normalizing demand in the consumer end markets, which continues to highlight the value in AT&T’s measured, yet sustainable, go-to-market strategy.

The company’s profit and cash flow improvements observed in recent quarters also corroborate management’s purpose-driven pricing strategy, which is aimed at “driving up lifetime values” for both AT&T and its customers. Taken together, we expect the combination of near-term seasonal and upgrade cycle tailwinds, alongside AT&T’s disciplined promotional activities to be a favourable contribution towards the return case for its yearslong 5G investments. The strategy is expected to sustain the ensuing increase to wireless ARPUs and lengthened customer lifecycles, bolstered by improved service quality and value proposition.

We’ve been really deliberate…I feel like our tactics continue to be durable and they’re performing well. We have been very focused on insuring that we’re getting the right kind of growth. I don’t want empty calorie growth. We want customers to come in and pay good recurring rates that are going to stay with us a long period of time. We have opportunities where we can co-market multiple products into a customer, which makes them even stickier and drives up lifetime values.

Source: AT&T 2Q23 Earnings Call Transcript

Final Thoughts

AT&T’s stock has staged a resilient surge over the past week, keeping gains of ~5% at the $15-range since the launch of the iPhone 15. Yet, its dividend yield is still setting well above the 7% mark at current levels. The stock’s underperformance in recent months is likely a result of investors’ wariness over potential repercussions of AT&T’s lead-clad cable public health crisis, as well as the broader impact of increasing consumer price sensitivity and industry competition.

But strong preliminary demand for device and service upgrades are reinforcing AT&T’s full year outlook. With the company guiding more than $16 billion of free cash flow for 2023, AT&T is well positioned to fund its annual dividend expense of about $8 billion, alongside debt costs of about $7 billion while also leaving a safety margin of more than $1 billion. This is likely to cushion some of the potential impact from near-term industry-specific and macroeconomic headwinds, without impacting AT&T’s dividend payout – a key focus area for the stock’s income-heavy investor base.

We view the iPhone 15’s outperforming demand trends as a net positive to AT&T’s near- and longer-term cash flows, given the company’s disciplined, yet competitive, promotional approach to gain and retain market share. Since related device inventory procurement and promotional costs would have already been considered in management’s guidance earlier on in the year, recent reports of better-than-expected iPhone 15 demand suggests an incremental tailwind to purchases made through wireless plan subscriptions. Taken together, the robust upgrade cycle propelled by the iPhone 15 release is expected to mitigate concerns that near-term weakness in consumer spending could disrupt AT&T’s full-year revenue and cash flow outlook, reinforcing its dividend prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!