Summary:

- The writer and actor strike has been going on for several months, hindering the production and release of new content.

- Streaming platforms are slowing down their new release rate and it becomes harder for them to keep their subscribers engaged.

- Entertainment demand will shift towards other streaming content and sports.

- YouTube is set to benefit from this situation thanks to its ongoing production of new content and the NFL Sunday Ticket.

tsingha25/iStock via Getty Images

Introduction

It’s been all over the news for months that actors and writers are striking in Hollywood. Recently, new headlines were coming out about resuming talks between writers and studios, after more than 140 days of strike. We will see how this ends. But what I think has not been considered enough is the impact this strike could have not only on traditional media companies, but on Google (NASDAQ:GOOG, NASDAQ:GOOGL), as I will try to explain in this article. Google is usually looked at as an advertising business and it is. However, one of its ads businesses is YouTube. This platform, in order to be effective, needs to find ways to engage more and more viewers and increase their view time. With streaming companies hindered, in the next few months consumers will have less content released to them, freeing up time that they would like to spend being entertained. YouTube is set to catch at least some of this demand that streaming platforms will not fulfill.

Summary of previous coverage

Though I am long Google, it is not one of the stocks I cover the most. The reason is simple: a lot of content is available and most of it covers what I see, too. When I write about Google, therefore, it is because I haven’t come across an article on SA pointing out what I want to.

In the past, I dealt with Google covering three main topics:

- Forecasting from other companies’ earnings call what advertising spending Google is going to see in the coming quarters. It often happens that during an earnings call, a company’s management talks about upcoming ad spending and what channels are going to be used. It is an easy way to feel the pulse of how Google’s core business is going to fare next.

- The issue of stock-based compensation eating away a lot of free cash flow. I showed why Google has this issue while Apple (AAPL) doesn’t. A few months ago, after Christopher Hohn asked Google to reduce its headcount, I updated my take to factor in Google’s efforts to target better efficiency.

- As the beginning of this year saw the AI-frenzy shaking the market, there was much writing about who would win between the two tech behemoths Google and Microsoft (Satya Nadella, Microsoft’s CEO, said about Google that “we made them dance”). Well, going into some numbers and understanding how both companies were developing their products, my take was a little different: both companies are going to win, creating what may be a new duopoly.

I have explained in this article (“Why I Bought More Apple At the Close Of 2022”) that when I write about huge companies such as Google or Apple, my approach is not to cover the whole business and all its segments. Rather, I prefer to use what I call the fractal analysis method, a fractal being a geometrical figure in which similar patterns recur at smaller scales (a snowflake, for example). What this means is that I try to look into one aspect of the company at a time, assuming that understanding one particular segment or issue can make me understand similar patterns that may be taking place all over the company. For example, if I come across a well-managed segment with lots of efficiency, chances are the whole company may be managed in the same way. Of course, it is an assumption, but it is the method I find most adequate with big tech in particular.

The Writers Strike

Back to our topic. We all know about the ongoing strike. It has become such a meaningful even that Wikipedia has now this page: “List of productions impacted by the 2023 Writers Guild of America strike”. Just to get an idea of the impact, we see that Netflix (NFLX) has 30 productions either delayed or indefinitely postponed; Disney (DIS) has 25; Apple TV 13; Paramount (PARA) 12, Warner Bros (WBD) 9, and Amazon (AMZN) 4.

Netflix has already written in its last shareholder letter what investor may be expecting as a result:

Our updated expectation reflects lower cash content spend in 2023 than we originally anticipated due to timing of production starts and the ongoing WGA and SAG-AFTRA strikes. While this may create some lumpiness in FCF from 2023 to 2024, we plan to deliver substantial positive FCF in 2024.

In other words, all the above companies will see higher free cash flow this year. But this must be correctly understood as the result of lacking capex. In its Q2 2023 earnings call, Ted Sarandos, Netflix’s Co-CEO, was asked about how much content the company has in its pipeline before running out. He didn’t give a precise answer, replying Netflix simply has still a lot of content.

While Netflix, spending the most in the industry for new content, may run out of new content later compared to its competitors, the issue and the threat is real. The media industry is gradually slowing down new content release to endure this situation until the strike ends. But we all know that, once the strike is over, it will take time to finish what had been interrupted and start new shootings. Therefore, assuming the strike will end soon, we will see at least a few months of less content. Unfortunately for the industry, these months are winter months, when people stay more at home and usually watch more TV.

The pandemic has all taught us a lesson. When people can’t do something they are used to, they will do something else. This is what made pandemic stocks skyrocket (remember Zoom?).

Now, we can ask ourselves the same question. What are people going to do when they can’t be entertained by movie makers? How are people going to spend this time?

Why YouTube Will Benefit

First of all, a bit of history. Google bought YouTube back in 2006 for the hefty sum of $1.65 billion. At that time, it seemed like Google was overpaying. Fast forward to 2022 and YouTube ads alone is generating $29.2 billion, not counting YouTube subscription revenue. By now everyone admits this acquisition has delivered a lot of value for Google and its investors. But what is worthy of consideration is that YouTube seems to be in its early innings as it is still developing to be as engaging as possible.

Now, back to the strike and YouTube. The two major beneficiaries of this situation will be sports and YouTube. With sports I mainly mean sports broadcasters, such as ESPN, but not only. Amazon and Apple are betting big on sports. But in this article I want to look at YouTube. In fact, I think it may benefit in two different ways. The most obvious is that people will watch more videos on YouTube, thus generating more ads revenue. The other could be an increasing production of new content as a form of entertainment. It should not a change as big as the one happened in the pandemic, but if millions of Americans are without TV entertainment, it might be in any case a sensible change.

In addition, YouTube grabbed NFL Sunday Ticket for seven years, starting 2023. YouTube will play around $2-2.5 billion per year, compared to the $1.5 billion DirectTV paid. YouTube streams NFL Sunday Ticket on YouTube TV and YouTube Primetime channels. This is also a new source of revenue that will impact the next quarterly report for the first time, having the NFL just started. The strike could actually lead more Americans towards sports and the NFL is surely an attractive and entertaining option. YouTube could thus receive a further help in establishing itself as a broadcaster in sports.

Now, while the first tailwind could actually be temporary, in the sense that once streaming companies will resume releasing content they may take back the entertainment time they had lost to YouTube, the second tailwind may actually be a long-term one. In fact, becoming a well-known sports broadcaster can help YouTube lock in new viewers.

As Alphabet explains: “YouTube provides people with entertainment, information, and opportunities to learn something new”. It generates revenues primarily through advertising. However, Alphabet is also focusing on generating growing revenues beyond advertising. In fact, YouTube generates subscription revenues through two main services: YouTube Premium and YouTube TV. These revenues are probably still not as meaningful as others, since they are all reported under the item “Google other”. In fact, Alphabet itself explains that these “revenues from ads on YouTube and Google Play monetize at a lower rate than our traditional search ads”. YouTube ads, on the other hand, is an item on its own.

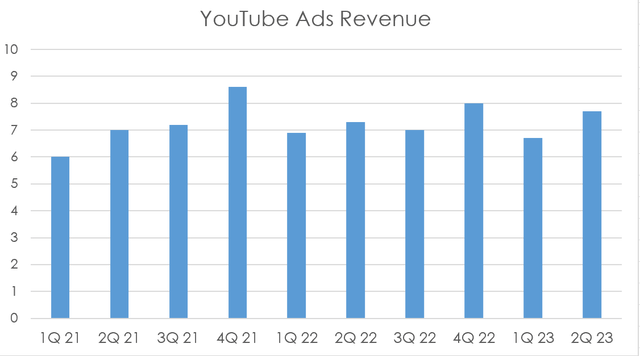

Now, let’s take a look at the quarterly revenues from YouTube ads.

Author, with data from Alphabet’s quarterly reports

From the graph above, we can easily outline three facts:

- YouTube Ads is generally growing. From Q1 2021 to Q1 2023, there is a 12% growth in ads revenue.

- We also see how, usually, the fourth quarter is the strongest.

- However, in 2022 it was weaker than the prior year

- In 2022, YouTube ads grew only slightly compared to 2021, with $29.24 billion in ads revenue compared to $28.84 (+1.3%)

What does this mean? In 2021, YouTube was still seeing a big boost from the pandemic and the habits it created. In 2022, things normalized and ads revenue stagnated.

Now, we clearly are before a so-called Fermi problem. That is, an order-of-magnitude problem. In other words, it is an estimation problem to make good approximate calculations with little data. In this case, we don’t really know how many streaming hours will be lost by the main industry players.

On the other side, the average weekly time spent with online video worldwide is estimated to have been 19 hours in 2022. This means around 2 hours 40 minutes per day. The average time spent per day on Netflix is around 60 minutes.

Let’s assume the data available for Netflix is more or less the same for its competitors.

Let’s assume that, due to a slower content release this time is reduced by 25% (of course if no new series come out, then this time goes directly to 0). This leaves around 15 minutes per day free. Most YouTube videos are around that length.

Considering YouTube streams about 7 billion hours per quarter, each streamed hour generates more or less $1 in revenue.

So each streaming subscriber could have for some months around 7 hours and change of free time that could actually be easily directed to YouTube. This means it will bring an extra $7 bucks a month in revenue to the platform.

Now, in the U.S. alone there are 246 million unique YouTube users. In the best case scenario, each of these will bring in an additional $7 per month in revenue. Let’s imagine this will last about six months, enough time for the industry to recover and for winter season to be almost over.

We have up to $10.3 billion of additional revenue.

Of course, this is the best case scenario. Things won’t go exactly this way. Probably we could cut this estimate in half. But still, these rough calculations have one purpose: showing that a considerable opportunity is opening up for YouTube. So far, I haven’t read anything about it and thus I felt it was worth it to bring it up and discuss it with the SA community.

Risks

The first risk is within the fact we are dealing with a Fermi problem. Therefore we have to make educated guesses on many numbers, with little data available. As a result, I may have gotten wrong some estimates.

But aside from this, I think it is reasonable to look at YouTube as a real beneficiary from the strike. So, the real risk is that, once the strike is over, YouTube won’t be able to maintain part of the new traffic it came across. Losing traffic means losing ads revenue. Yet, the chart with YouTube ads revenues shows how, after the pandemic, YouTube did have some slower growth. At the same time, it did keep on growing. In other words, it seems like YouTube is able to retain its viewers.

Conclusion

YouTube is in the right spot to capture some entertainment demand that will shift away from streaming platforms as less content is released in the upcoming months. Its bet on the NFL Sunday Ticket will help it, too. This is an opportunity that could create a couple of billion of extra revenue, which will enhance YouTube’s value. Though we may think this will only be a temporary tailwind, it is not to be underestimated YouTube’s stickiness once new users start increasing their time on the platform. For all these reasons, I confirm my buy rating on Google as a whole, expecting at least $2-3 billion of additional revenue (around 1% of the company’s revenue) in the next two quarters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.