Summary:

- Disney’s share price has been down over the last year but could be in for a price rebound soon.

- Disney halted its dividend in 2020 to conserve cash due to the pandemic.

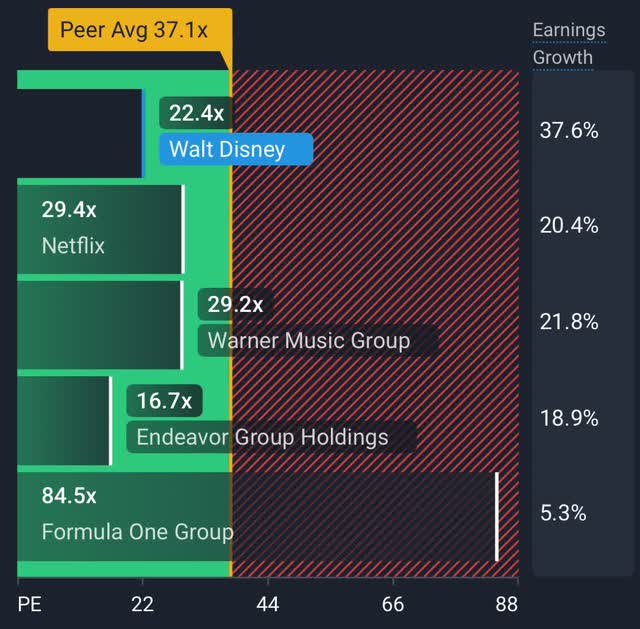

- The company has a forward P/E of 22.4x, indicating it could outperform the market in the coming months.

- Disney continues to grow its free cash flow and could reinstate a modest dividend by the end of the calendar year.

designer491

Introduction

As a dividend investor, I’m always searching for stocks that pay or could potentially pay dividends in the future. I have a mix of low-, medium-, and high-yielding stocks within my portfolio. All of them serve a purpose. Some are just for income and some I expect to continue growing their dividends over time. I call them dividend showers & growers. I mentioned this in my article I wrote on Starwood Property Trust (STWD). This helps me manage my expectations for my holdings.

As my name states, I enjoy investing in companies that pay me dividends. It gives me satisfaction knowing I will be getting a check every quarter or month for my investment in the company. It’s a simplistic, yet effective strategy that I just fell in love with. I completely understand growth investors holding stocks like META (META), Google (GOOG), and Amazon (AMZN) because some people prefer capital appreciation & growth over time instead of collecting a dividend.

To each their own as we all have our preferences when investing. But as a dividend investor, I don’t dislike nor overlook growth companies. But with my goal to live off my dividends in 5-10 years, I choose to focus on this primarily for now. But growth stocks are something I keep a close eye on and will most likely start to invest in the near future. With that, I’m always wondering if some of them will pay dividends in the future. Most growth companies don’t have the cash flow to pay a dividend because of their capital-intensive business models. But that doesn’t mean a dividend can’t be in its future.

Walt Disney The Business

I think it’s safe to assume most people are familiar with Walt Disney (NYSE:DIS) the company. After all, they’ve been around for what seems like forever. Most of us have probably visited their parks. Whether it was when we were kids or when we decided to take our kids on a trip there. Besides parks, another segment they operate in is media & entertainment. Their shows, their characters, their sing-alongs, I could go on and on. Disney is popular. Additionally, their movies are some of the highest-grossing of all time.

The company engages in film and episodic television content production and distribution activities, as well as television networks. These include ABC, Disney, ESPN, Freeform, FX, FOX, National Geographic, and Star brands. They have been around for a century as it was founded in 1923.

I often hear friends, family, and co-workers who are not savvy investors talk about investing in things they’re familiar with, or where they spend their money. And while I understand that logic, that doesn’t always equal a good investment decision. Especially if you invest in dividends for passive income. People who say this often get caught up in blindly investing their money into a company just because of their familiarity with the business.

But not all well-known businesses are good businesses or investments. And this strategy causes them to often overlook company finances. This leads to many investors getting burned. I have a good friend who actually hold shares in Disney. I asked him has he had ever taken the time to study the financials. His reply was “I’ve never looked at their finances, I just feel like they’re a good company and they’re never going anywhere.” Whether they admit it or not, many investors do this. And this is one sure way to lose money if you’re not careful. So as a person who loves dividends, let’s take a look at the former dividend payer Disney’s financials.

Dividend History

It’s quite possible many shareholders don’t invest in DIS for the dividend but for its growth potential. But some might not know the stock actually has a long history of paying dividends. While most dividend stocks pay on a quarterly basis, or 4 times a year, Disney pays out semi-annually, or twice a year. Their last payout was in January of 2020. The dividend was suspended due to the pandemic. This was so the company could conserve cash as many of its parks & businesses were affected by COVID. But their CEO stated that they would return to paying dividends in the future.

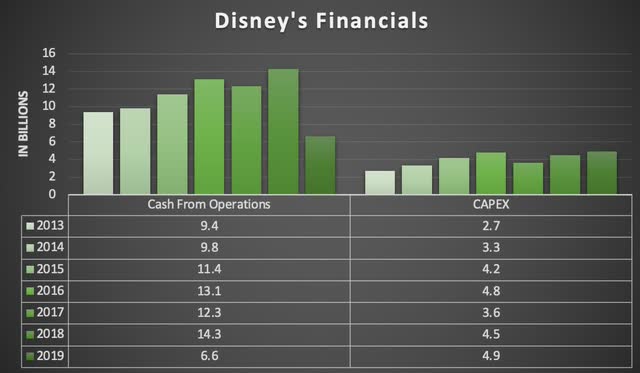

Below is a look at Disney’s cash from operations & capital expenditures 7 years prior to the dividend suspension. During that time the company averaged $6.98 billion in FCF and paid out an average of $2.27 billion in dividends during the same period. They experienced a drop off in CFO in 2021 by about $2 billion but it has since recovered.

Focused On FCF Growth & Dividend Reinstatement

Most companies do one of four things with their free cash flow. Pay dividends, buy back shares, pay down debt, or invest back into the business. Or sometimes all four if they’re able. Many CAPEX-intense businesses don’t even consider paying dividends as they are focused on growth. And to grow it takes a lot of capital. When shareholders aren’t investing in a company for a dividend, they’re expecting growth.

But as a business that’s constantly making acquisitions and growing, this is still an important metric to look at. In the short term, it may not seem important, but negative cash flows can have a long-lasting effect on the business. During Q3 earnings they reported FCF of $1.6 billion, a 19% decrease from Q2, but up from $187 million a year prior. The company has been focused on growing its cash flows implementing cost-cutting initiatives across the enterprise and is on track to exceed the initial goal of $5.5 billion in savings.

They also improved operating income in just three quarters by $1 billion and have plans to continue to drive growth and value creation in the coming years. As Disney continues to prioritize free cash flow growth, they’re expecting to declare a modest dividend by the end of the calendar year. This is expected to increase over time as earnings and FCF growth are their main priority.

Since the dividend cut the company averaged $2.13 billion in FCF. This is in comparison to $3.6 billion in FCF YTD, so management’s cost savings efforts have been paying off. Hypothetically, Disney could reinstate its prior dividend of $1.76 annually and cover it just fine if free cash flow continues to grow, which I suspect it will. But as I mentioned earlier, management is looking to declare a modest dividend. In other words, start small and continue growing the dividend in the future.

Streaming Slowdown And The Way Forward

A huge factor that has been weighing on the company over the last year is its subscription service. It’s obvious the positive impact that COVID had on the streaming segment is now starting to fade. As a result of movie theaters continuing to remodel and adapt to changing consumer habits, I believe DIS will continue to face adversity in the coming quarters.

In Q4 of 2021, Disney had a total of 179 million total subscriptions compared to 179.2 million at the end of Q3. So growth in the streaming segment has been pretty much non-existent overall, although ESPN+ subscribers grew by almost 183% from 17.1 to 48.3 million subscribers in almost two years. A detractor was the enormous decline in Hulu subscribers. Since the end of ’21, they have experienced a 42.5% drop. To combat this, the company has been raising prices on its packages recently. On September 7th, they announced a change in bundle pricing to $18.99 a month, starting in October.

While the domestic segment of Disney+ saw a decline in subscribers, ARPU grew by $0.17 quarter-over-quarter due to higher per-subscriber advertising revenue. Additionally, international subscribers grew by over 1 million and ARPU increased by $0.08 over the same period due to a favorable foreign exchange impact. As summer comes to a close, they could potentially see a rise in subscribers over the next few quarters due to movie theater foot traffic slowdown in the winter months.

I suspect the company will continue to post some growth in the next quarter due to its cost-cutting initiatives and the remaining release of 8 movies slated for the rest of the year. By the 2H of 2024, I expect to see a rise in EPS and revenue due to the release of their two Pixar movies, Elio (March) and Inside Out 2 (June). These are normally hits with children and Inside Out will release just in time for summer. The first one also happens to be one of the highest-grossing Pixar movies of all time, only coming behind The Toy Story and Finding Nemo franchises, and grossing close to $1 billion.

And although many are expecting a mild recession in 2024, their parks should continue to perform well, although performance is softer than in 2022. One reason for this was pent-up demand. WHO also officially declared an end to the pandemic last year, and revenue and operating income remain above pre-COVID levels. With an expected cut in consumer spending, the company has been expanding access at their parks for annual pass holders. Now consumers can visit parks without a reservation as well as removing the need for an additional (reservation) for guests with date-based tickets. I think this is a smart move as it gives the consumer flexibility.

Furthermore, their cruise line continues to post strong segment growth with 98% occupancy at the end of Q3. Management also reported they will be expanding their fleet of 5 ships with two more ships by fiscal year ’25 and an additional one by fiscal year ’26, nearly doubling their worldwide capacity.

Undervalued

2023 has not been a good year for the share price. Since February, the price has dropped roughly 25% to its current share price and reached a 52-wk low of $79.75. Personally, I think the stock is oversold and currently undervalued. The company has a current P/E of 68.9x and a forward P/E of 22.4x. Earnings are expected to grow 37.6% over the next year. Furthermore, revenue is expected to grow roughly 5.5% from $89 billion to $94 billion by September 2024. During the same time, earnings are expected to double from $3.4 billion to $7.9 billion.

Risks

The biggest risk factor for Disney is a recession. With surging oil prices, CPI higher than expected, and rising interest rates, this could be the tipping point that pushes the economy into a recession. This would definitely have an effect on the company’s businesses as consumer spending becomes tight. With an average ticket price of $160 for one person, their parks would most likely suffer the most in the short term.

On a positive note, reinstating the dividend could also be the catalyst they need as the price has been suppressed over the last several months. Announcing a dividend could bring in like-minded investors such as myself, driving the stock closer to its price target of $109. But due to current economic uncertainty, people looking to invest in Disney should keep an eye on the company’s financials over the next few quarters.

Investor Takeaway

As the company continues to focus on optimizing its free cash flows, a dividend reinstatement could be the catalyst the stock needs to boost shareholder’s confidence back into the business. Although they suspended the dividend in 2020 due to COVID, Disney has been making concerted efforts to generate future growth while increasing shareholder returns. With a forward P/E of 22x combined with a dividend at the end of the year, DIS could be due for a rebound and outperform the market going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.