Summary:

- Merck’s strong performance in the past two years, driven by Keytruda and Lagevrio, has outperformed the market by an impressive 52%.

- MRK’s acquisition of Prometheus Biosciences signals its effort to diversify beyond Oncology and Vaccines, strategically preparing for the Keytruda patent expiration in 2028.

- The company is set to achieve a 5% annualized EPS growth, maintaining stable profitability, and offering a secure 2.71% dividend, with dividend annual growth of 5-6%.

- Based on my analysis, MRK’s stock is projected to reach $189 by 2032, implying a potential annualized return of 7.5% – 8.5%, including dividends.

Erik S. Lesser

Investment Thesis

Merck (NYSE:MRK), a prominent multinational pharmaceutical and life sciences corporation with a robust portfolio of pharmaceuticals, vaccines, and healthcare solutions. In 2023, Merck truly made its mark by ascending to the 4th position among the pharmaceutical industry’s most valuable brands. Its brand value increased to an impressive $5.8 billion, marking a remarkable increase of $1.2 billion compared to the prior year. This remarkable rise from 7th to 4th place underscores Merck’s undeniable success and prominence in the industry.

Most Valuable Pharma Brands (Brand Finance Healthcare)

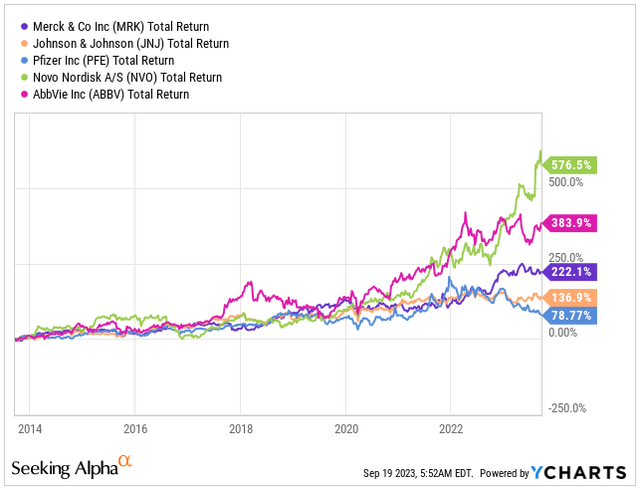

Merck has demonstrated consistent performance over the past decade. In terms of total returns, the company has delivered results that surpass some of its peers, although it falls short of the performance achieved by companies like Novo Nordisk (NVO) or AbbVie (ABBV). Nonetheless, Merck has managed to outpace the broader market by an impressive margin of 12.8% during the same period, which is certainly admirable.

Over the past four years, MRK has exhibited robust growth both in terms of top-line and bottom-line performance, primarily driven by its blockbuster oncology drug, Keytruda. Keytruda has been growing at a rate of over 20%, even as it now contributes more than 35% to the company’s overall revenue. Additionally, the successful launch of the antiviral pill, Lagevrio, has significantly bolstered the company’s stock performance over the past two years.

Merck’s recent acquisition of Prometheus Biosciences in Q2 further enhances its strategic positioning by diversifying away from its core oncology business. This diversification is expected to facilitate a smooth transition once the Keytruda patent expires in 2028. With these factors in mind, the company is poised for mid-single-digit EPS growth, suggesting a reasonable total annualized return in the range of 7.5% to 8.5% over the next decade.

Total Return (Seeking Alpha / YCHARTS)

Business Update

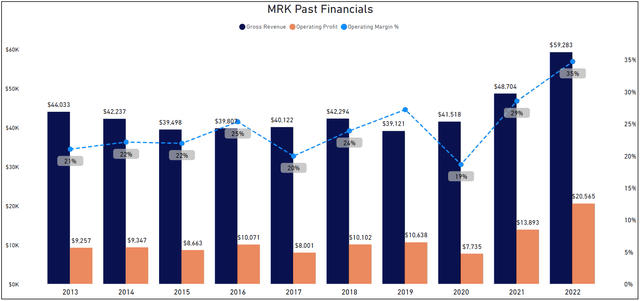

Let’s kick off the business update by taking a closer look at Merck’s financial history and growth. Over the last decade, MRK has experienced a somewhat modest annualized growth rate of 3.46% in its top-line revenue. To provide some context, this growth is comparable to that of Johnson & Johnson (JNJ), a well-established industry leader during the same period.

However, Merck has truly excelled in the last four years, achieving an impressive annualized top-line growth of 12.8%. This remarkable performance is a testament to the company’s overall improvement. During this same four-year span, Merck also managed to boost its EPS by an annualized rate of 23.3%. This surge was largely driven by the success of Lagevrio, an antiviral oral pill developed to combat COVID-19, which contributed over $5.68 billion in revenue in 2022, as well as the continued growth of its blockbuster drug, Keytruda.

Ultimately, these strong growth figures in both revenue and earnings have had a notable impact on the overall performance of MRK’s stock. Since the beginning of 2022, the stock has seen a remarkable return of more than 48%, including dividends. In comparison, the S&P 500 (SPY) index only managed a return of -4.01% during the same period, highlighting Merck’s impressive outperformance relative to the broader market index.

Past Financials (Author’s Graph (Data SA))

Looking forward, Merck’s future growth can be driven not only by its own drug success but also by its recent successful acquisition of Prometheus Biosciences. This acquisition enhances Merck’s research capabilities and bolsters its pipeline with a promising candidate for conditions like ulcerative colitis and Crohn’s disease.

Under the agreement, Merck acquired all outstanding Prometheus shares for $200.00 per share in cash, totaling approximately $10.8 billion. Notably, Merck’s initial financial outlook for the year did not consider this acquisition.

Due to its treatment as an asset acquisition, Merck has recorded a charge of about $10.3 billion, equivalent to around $4.00 per share. This charge has impacted both Q2 and full-year 2023 GAAP and non-GAAP results. Additionally, the transaction is expected to reduce EPS by roughly $0.25 in the first 12 months post-closing, mainly due to investment in pipeline assets and financing costs, with about half of this impact occurring in the second half of 2023.

I’d like to highlight that due to this transaction, the company’s cash reserves on the balance sheet have decreased significantly, from $12.69 billion at the end of 2022 to $5.66 billion in Q2 2023. Meanwhile, the long-term debt has risen from its previous level of $28.75 billion to $34.01 billion. Interestingly, despite these changes, Moody’s has maintained an A1 rating for the company, indicating a stable outlook.

Now, let’s shift our focus to the broader issue of drug patent expirations, which is not unique to MRK. However, the timing of this deal holds particular significance for MRK, given that its cornerstone cancer drug, Keytruda, is set to lose patent protection in 2028. Currently, a significant portion of Merck’s revenue comes from oncology and vaccines, accounting for 44% and 21% of the company’s total revenue in 2022, respectively.

In light of these considerations, I believe the acquisition of Prometheus strategically positions Merck to diversify its revenue streams and expand its near-term catalyst pipeline beyond the realm of oncology. With the acquisition now finalized, Merck and Prometheus will face competition from players like Pfizer (PFE) and Roivant Sciences (ROIV).

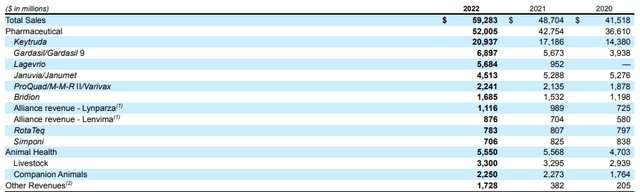

As previously mentioned, the success of MRK hinges significantly on its oncology drug Keytruda. By the close of 2022, this drug accounted for a substantial 35% of the company’s total revenue, and its sales experienced a notable growth of nearly 22% from 2021 to 2022, underscoring its pivotal role. Furthermore, in Q2 2023, the company reported a remarkable 21% increase in sales compared to the same quarter the previous year.

In 2022, another significant contributor to MRK’s results was Lagevrio, the antiviral drug. However, with the COVID-19 pandemic largely receding, the company can no longer rely on this product. Nevertheless, any decline in Lagevrio sales is expected to be mostly offset by the growth in other drugs within the company’s portfolio.

Total Sales by Product (MRK IR)

Outlook

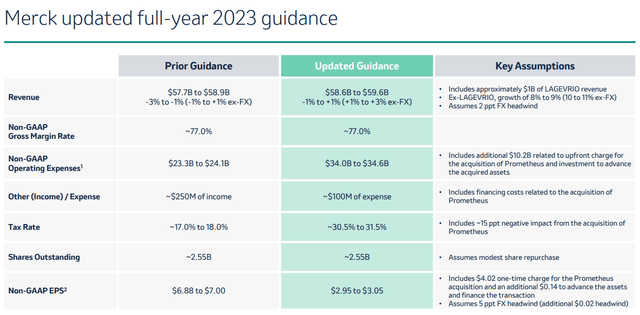

Following the successful acquisition of Prometheus, the company has revised its guidance in its Q2 earnings release. As of now, the company anticipates achieving a revenue range of $58.6 billion to $59.6 billion by year-end. This projection essentially implies no change in revenue compared to the previous year. This scenario is partly attributed to the challenging comparison with 2022, primarily due to the declining sales of Lagevrio.

In addition to this, as I already mentioned, there will be a one-time charge of $4.02 associated with the Prometheus acquisition and an extra $0.14 impact due to financing the transaction. As a result, the company expects a substantial 57% decrease in EPS YoY.

Guidance (MRK IR)

When we look beyond 2023, it’s reasonable to expect that the company will experience solid growth. This growth will stem from the successful acquisition, as well as the continued expansion of Keytruda’s sales. Additionally, there’s the promising potential for around 20% annualized growth in drugs like Lynparza, which is currently small but rapidly expanding, and the vaccine Gardasil. In Q2, Gardasil achieved sales of $2.5 billion, marking an impressive 53% YoY increase, primarily driven by strong global demand, particularly in China.

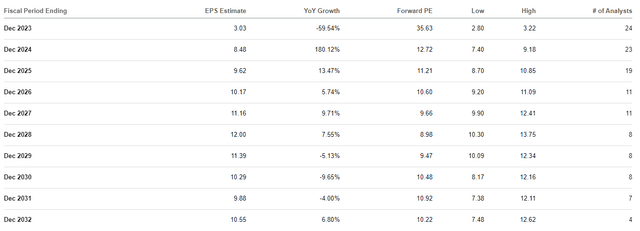

That being said, analysts foresee an EPS growth rate of 4.6% annually from 2024 to 2028. The challenge arises after 2028 when the expectation is for EPS to decline due to the patent expiration of Keytruda. In my view, it’s reasonable to anticipate that this will indeed lead to a slowdown in growth. However, the company is well-positioned to counteract this trend through strategic acquisitions, which could sustain at least mid-single digit growth rates.

Simultaneously, considering the pharmaceutical industry’s projected CAGR of 5.80% from 2023 to 2030, I believe it’s prudent to expect that MRK can achieve at least a 5% annualized EPS growth rate from today until 2032.

EPS Growth Projection (Seeking Alpha)

Shareholder Return

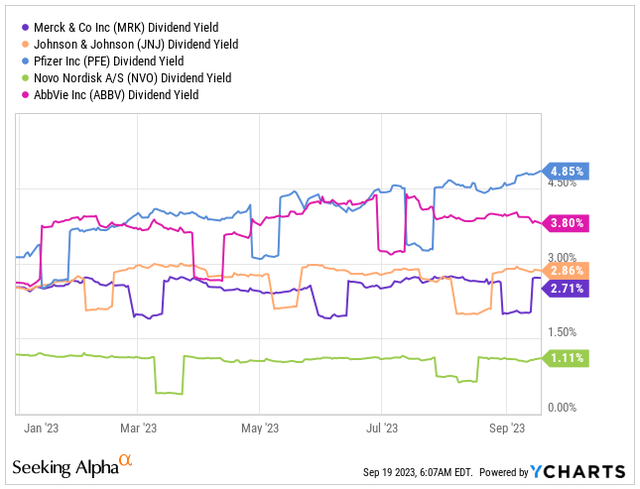

I’m sure that many readers, myself included, view MRK as a solid income-generating investment. The company is presently offering a dividend yield of 2.71%. While this figure may not be the highest among its peers, it’s still competitive when compared to other pharmaceutical giants. For instance, Pfizer boasts a yield of 4.85%, c offers 3.80%, Johnson & Johnson provides 2.86%, and Novo Nordisk offers a lower yield of 1.11%.

I’d like to mention that the current dividend payout ratio stands at 101.7%. However, it’s important to note that this high ratio is due to the one-time charge associated with the Prometheus acquisition in Q2. Typically, the company maintains a safe payout ratio of around 60%.

Dividend Yield (Seeking Alpha / YCHARTS)

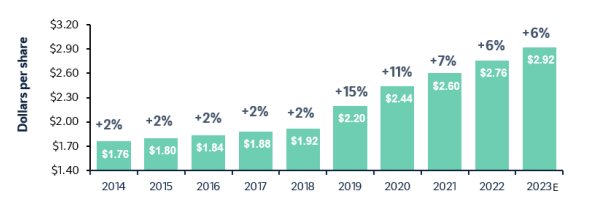

What’s quite noteworthy is the dividend growth rate. While it might not be the highest, the company has consistently increased its dividends at a steady rate of 5.5% over the past decade. It’s evident that this growth rate has picked up momentum in recent years, and looking ahead, I believe we can anticipate a reasonable annualized dividend growth of 5-6%.

Dividend Growth (MRK IR)

Valuation

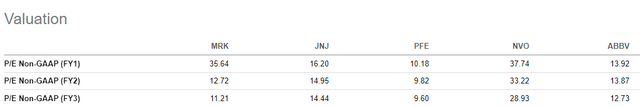

In terms of valuation, the robust stock performance of the past two years, coupled with the negative impact on adjusted earnings from the Q2 acquisition, has temporarily inflated the PE ratio. Currently, the PE ratio stands at 35.64x. However, as we look ahead, even with the projected FY24 earnings, we anticipate the PE ratio to decrease significantly to 12.72x, and further to 11.21x in the following year. When we extend our outlook beyond FY23, this compares favorably to more expensive peers like Johnson & Johnson, AbbVie, and Novo Nordisk.

Valuation (Seeking Alpha)

Considering the company’s solid growth potential, a reasonable expectation is for EPS to increase at a 5% annualized rate over the next decade. Additionally, MRK’s 5-year average Forward PE ratio has stood at 15.21x, and I anticipate that the company will maintain a similar valuation going forward. This implies that any increase in the stock price will predominantly result from the growth of EPS rather than a valuation expansion.

With this in mind, we can project the company’s share price to reach $189 by the end of 2032, translating to an average annualized growth rate in stock price of 5.2%, compared to today’s price of $107.8. Simultaneously, if the company continues to offer a similar dividend yield of around 3%, we can anticipate a total annualized return in the range of 7.5% to 8.5%. While this falls short of the historical return of S&P 500 at 10.2% since its inception, it still surpasses the expected performance of many other pharmaceutical companies, for example, JNJ, on which I recently wrote an article.

| Fiscal Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

| Revenue ($b) | 62.5 | 66.6 | 69.3 | 72.8 | 75.6 | 74.4 | 72.3 | 75.1 | 76.5 |

| Revenue Growth | 5.5% | 6.5% | 4.1% | 5.0% | 3.8% | -1.5% | -2.8% | 3.8% | 1.9% |

| EPS | 8.5 | 9.6 | 10.2 | 11.2 | 12.0 | 11.4 | 11.8 | 12.3 | 12.6 |

| EPS Growth | 179.9% | 13.4% | 5.7% | 9.7% | 7.5% | -5.1% | 4.0% | 4.0% | 2.3% |

| Forward PE | 15 | 14 | 14 | 15 | 14 | 14 | 15 | 15 | 15 |

| Stock Price ($) | 129.0 | 134.7 | 142.4 | 167.4 | 168.0 | 159.5 | 177.7 | 184.8 | 189.0 |

Conclusion

Merck has been on an impressive streak over the past two years, showcasing remarkable stock performance that easily outperforms the market. This growth has been underpinned by the continued success of its flagship drug, Keytruda, and the significant achievement with the antiviral pill, Lagevrio, for COVID-19.

The recent and successful acquisition of Prometheus Biosciences represents a strategic move for MRK to diversify its portfolio, extending beyond oncology. This diversification also serves as a lifeline for the company, especially when Keytruda’s patent expires in 2028.

With the continued growth of its existing drug portfolio and a focus on M&A, MRK is poised for mid-single-digit EPS growth. This positions the company to deliver a total annualized return in the range of 7.5% to 8.5% over the next decade, a performance that outpaces many other pharmaceutical firms, however, falling short of the SPY performance. Additionally, the company’s reliable and steadily growing dividend, also in the mid-single-digit range, further strengthens its appeal. In light of these factors, I recommend a BUY rating for MRK at its current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.