Summary:

- Block and PayPal are trading at exceptionally low levels and have the potential for substantial revenue and profitability growth.

- The drop in stock prices is due to overvaluation during the previous bull market, but the pendulum has swung too far in the opposite direction.

- Changes in leadership at both companies could lead to increased efficiency and profitability.

- The market should revalue SQ and PYPL much higher as economic growth improves and the Fed provides a more accessible monetary environment.

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

The market has finally lost its mind on Block (NYSE:SQ) and PayPal (NASDAQ:PYPL). These top players in the fintech industry are trading at absurdly low levels, have limited downside, and have substantial potential to increase revenues and improve profitability in the long run. PayPal was a $300 stock about two years ago. It’s trading around $63 here, roughly an 80% drop from its ATH. We see a similar phenomenon with Block. Its stock peaked at around $290 two years ago and is currently trading around $50, a whopping 82% drop.

What’s wrong with these companies? Are they going out of business? Are they on the verge of collapse? Are these two fintech giants under suspicion of faulty accounting practices? Are their revenues falling? Is their profitability about to drop?

No, the answer to all of these questions is no! The problem is that PayPal and Block became highly overbought and overvalued during the previous bull market’s bubble days. However, the pendulum has swung too far in the opposite direction, and these two companies are exceptionally oversold and undervalued today.

While there are concerns about the slow growth/high-interest rate monetary environment, increased competition, growth prospects, and other elements, the issues are transitory, and these two high-quality fintech stocks should stabilize, rebound, and move much higher in the coming years. Remember, it’s like Benjamin Graham said: the market is a voting mechanism in the short term, but it is a weighing machine in the long run. Therefore, these two industry leaders’ stocks should be weighed much higher in future years.

It’s A Love-Hate Relationship

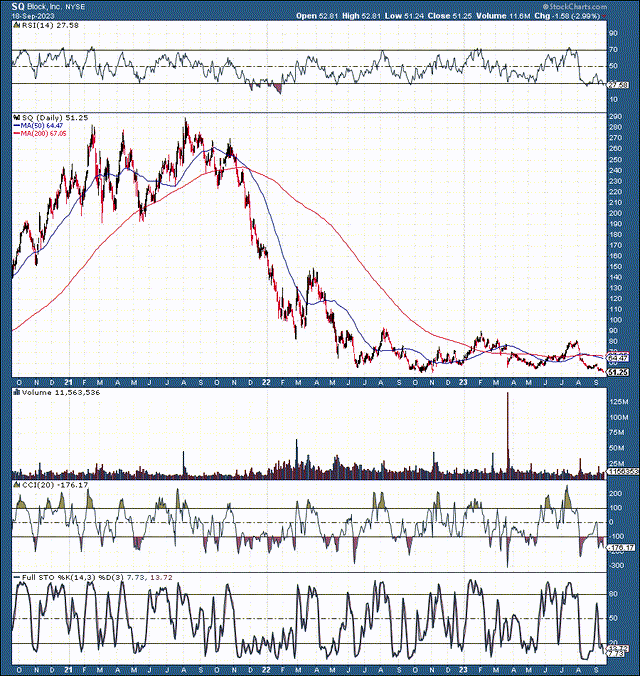

SQ: 3-Year Chart

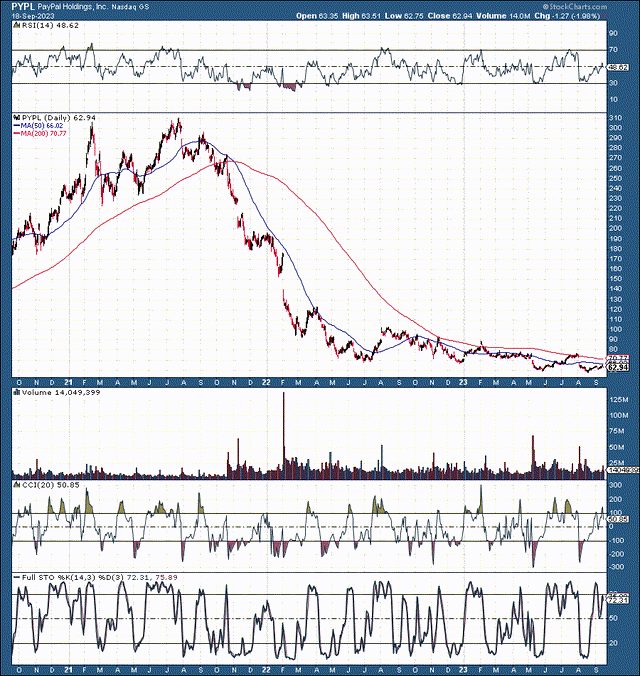

PYPL: 3-Year Chart

Technically, we see close similarities in the two charts here. Both companies exploded higher in the low-interest rate/high growth regime, becoming highly overbought. Now, we’re seeing the reverse effect happening. Both companies are being battered senselessly in a tight monetary/low growth environment.

Moreover, Block and PayPal were valued as high-growth tech companies when the times were good. Now that the market conditions have changed, they are valued as low or no-growth financial stocks. Therefore, the dynamic is perplexing: how can the market be “so wrong” about these firms? Nonetheless, I’m confident these companies will be revalued as growth tech stocks when the Fed adopts a more accessible monetary policy in future quarters and the coming years.

The New CEOs – A Welcomed Change

Note: Square is a significant portion of the Block fintech umbrella company.

While Alyssa Henry (Square CEO) helped transform Block into a software-led technology company, she is not the right person to lead Square. There are no structural issues at Block. The company’s business is sound. Moreover, Block has a healthy balance sheet, with about $5.8B in cash and short-term investments. Its gross profit and financial results are solid, yet its stock is down to levels not seen since 2018 (82% below its ATH).

This dynamic is mind-boggling, as Block’s revenues were around $3.3B in 2018 and $19.7B in its TTM. Its gross profit grew from $1.3B to $6.9B in the same time frame. However, its SG&A and R&D expenses have skyrocketed, with total operating expenses ballooning from $1.35B to $7.26B. That’s a problem, as Block should be much more profitable by now. Heads have to roll, and Square’s CEO is saying goodbye.

Jack Dorsey, Square’s co-founder, will take over as the CEO of Square. Jack Dorsey is Block’s largest shareholder, with about a 9% stake in Block. Other significant shareholders include Vanguard, Blackrock, and FMR. Block should become more efficient, and profitability could increase due to the management shakeup, which is ultimately constructive for Block’s stock.

In the case of PayPal…

After nearly ten years at the helm of PayPal, Dan Schulman is finally stepping down in about a week (September 27, 2023). Despite some noteworthy achievements by the soon-to-be “retired” CEO, this is an excellent time for shareholders. Schulman’s focus on political issues significantly disturbs PayPal’s business. PayPal is not a political arm and should not spend precious time and resources on political crusades. Instead, PayPal should focus on making money for shareholders, like a proper business. PayPal’s stock price has suffered badly in recent years, dropping to multiyear lows.

Therefore, Schulman’s departure from the lead role may not be a coincidence, and I look forward to the new CEO, Alex Chriss, taking the business in a different direction. Alex Chriss is a better fit to lead PayPal into its new age of growth and expansion. Alex Chriss comes from a leading position at Intuit (INTU), an innovative $150 billion IT financial services behemoth. Alex Chriss has impressive accomplishments and brings a great deal to the table for PayPal. There’s no doubt that Mr. Chriss has a challenging job ahead, but he seems fit for the task and, with time, should help turn PayPal around.

Which Valuation Do You Like Better? Take Your Pick

Block’s and PayPal’s valuations have become dirt cheap. Block’s valuation has dropped to only around $30 billion. This valuation suggests that Block is exceptionally undervalued, as it’s expected to provide around $21.5B in revenues this year. Moreover, Block has significant revenue growth potential, as its sales could come in at around $24-25B in 2024.

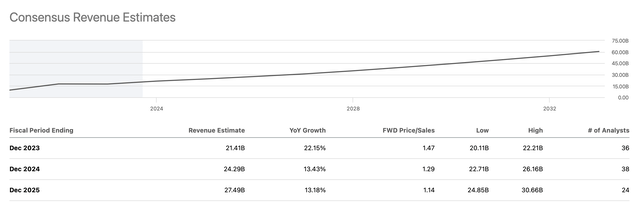

Block’s Double-digit Revenue Growth to Continue

Sales growth (SeekingAlpha.com )

Therefore, Block is a growth company, and the market values it at 1-1.5 times forward sales, which is remarkably cheap. Typically, we see at least a 2-3 times sales valuation with a company like Block. Moreover, during the previous bull market, its valuation stretched much more, implying that its market cap may increase to $50-75 billion in the next 1-2 years. This dynamic suggests a 75-150% (roughly) upside from its current stock price.

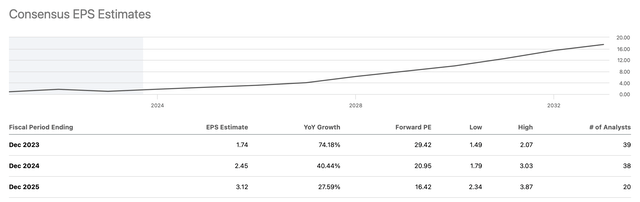

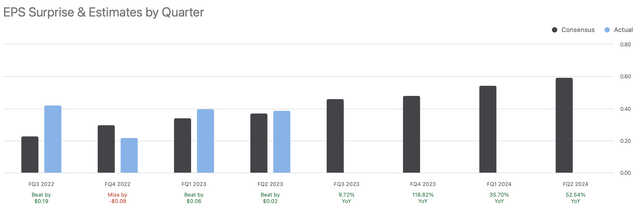

EPS Should Increase Rapidly

EPS growth (SeekingAlpha.com )

Block should focus on cutting costs and improving profitability in the coming quarters and years. Therefore, we should see substantial EPS growth, with EPS of around $2.50-3 next year. Block’s stock is around $50, illustrating this growth stock is trading at a meager 16.5-20 forward P/E ratio. Moreover, Block typically surpasses revenue and EPS estimates and should continue outperforming as we advance.

EPS Projections vs. Actual

EPS projections (SeekingAlpha.com )

While Block’s TTM EPS was expected to be $1.24, the company produced $1.43, a beat rate of 15%. Also, please consider that these results were achieved during a highly challenging and slow macro environment with the highest interest rates in decades. Block’s earnings should improve considerably as the economy returns to growth and rates decline in future quarters and the coming years. The next twelve months’ consensus estimates EPS projections are for $2.07, and if Block puts up a similar 15% beat rate, we could see its next four quarters’ EPS come in at around $2.40. Again, we’re looking at a growth stock likely to achieve 30-40% EPS growth in future years, trading at only about 20 times forward earnings here.

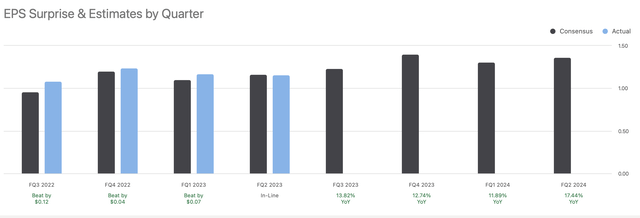

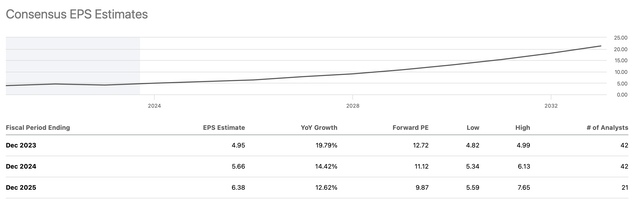

PayPal is Dirt Cheap

PYPL EPS estimates (SeekingAlpha.com )

PayPal has a different growth potential than Block but should become more efficient and increasingly profitable. PayPal’s TTM consensus EPS estimates were $4.42, but PayPal delivered $4.65. While this beat rate is only about 5%, this dynamic occurred during a highly challenging macro environment and a low point for PayPal as a company.

Therefore, as PayPal’s turnaround process continues, the transitory economic slowdown concludes, and the monetary environment becomes more accessible, PayPal’s growth should improve, and its earnings should increase. The next twelve months’ EPS estimates (consensus) are for $5.30, and if we apply a similar, conservative 5% beat rate, we arrive at an EPS of $5.57 for the next twelve months. Also, 2024 consensus estimates are for $5.66, illustrating that PayPal has a rock bottom forward P/E multiple of around 10-11 here.

PayPal – EPS Should Continue Higher

EPS growth (SeekingAlpha.com )

PayPal isn’t dead. On the contrary, its revenue and EPS growth could increase. As we advance, we should see annual EPS growth of around 15-20%, suggesting that PayPal’s EPS should be about $7 in 2025. PayPal’s stock is hovering around $60 here, illustrating a 2025 P/E ratio of around 8. PayPal’s current depressed stock price is not sustainable, and its share price should go much higher in the future.

Where Block and PayPal Could Be in Future Years

Block’s Financial Projections

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $25 | $29 | $33 | $37 | $42 | $47 | $53 |

| Revenue growth | 14% | 15% | 14% | 13% | 13% | 12% | 12% |

| EPS | $2.75 | $3.50 | $4.48 | $5.69 | $7.17 | $8.96 | $11.11 |

| EPS growth | 38% | 27% | 28% | 27% | 26% | 25% | 24% |

| Forward P/E | 25 | 27 | 28 | 28 | 27 | 26 | 25 |

| Stock price | $88 | $121 | $160 | $201 | $242 | $289 | $340 |

Source: The Financial Prophet

Block – This is a relatively modest outlook, considering an annual revenue growth of 15% or less. Moreover, the EPS growth projections of 30-20% in 2025 and beyond are relatively modest. Growth could be higher if Block fires on all cylinders. Furthermore, the estimated forward P/E of 28 and lower could expand beyond 30, resulting in a substantially higher stock price than my estimates predict.

PayPal’s Financial Outlook

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $33 | $36.5 | $39.8 | $43.4 | $47.3 | $51.5 | $55.6 |

| Revenue growth | 10% | 10% | 9% | 9% | 9% | 9% | 8% |

| EPS | $6 | $7.20 | $8.50 | $10.03 | $11.73 | $13.61 | $15.65 |

| EPS growth | 20% | 20% | 18% | 18% | 17% | 16% | 15% |

| Forward P/E | 15 | 17 | 19 | 20 | 19 | 18 | 17 |

| Stock price | $108 | $145 | $191 | $235 | $259 | $282 | $305 |

Source: The Financial Prophet

PayPal – I’m using very modest projections, implementing a sales growth rate of 10% or less. The company could provide 10-15 % revenue growth in a slightly more bullish case scenario. Additionally, PayPal could provide EPS growth of 20-25% instead of the modest 20-15% projected EPS growth. Furthermore, I’m implementing a low forward P/E ratio of 15-20. In a more bullish case scenario, PayPal’s forward P/E could expand to 25-30 or higher, resulting in a much higher stock price than my projections predict.

Risks to Block and PayPal

Despite my bullish long-term outlook, both companies face challenges in the near term. The economy could remain sluggish for longer than expected, leading to depressed stock prices for longer than I expected. Also, there is a risk of increased competition for both companies, and these firms must continue innovating to maintain significant market share. There are also risks of a longer-than-expected turnaround for PayPal, and Block’s profitability could continue to struggle if expenses remain high. Due to lower-than-anticipated growth and lower-than-expected profitability, these companies may not achieve the projected price levels in the suggested time frames in the tables above. Investors should consider these and other risks before committing capital to an investment in Block or PayPal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!