Summary:

- Nvidia Corporation’s strong quarterly results did not lead to a bullish rally in the stock, as most of the future growth has already been priced in.

- Big Tech companies, including Google and Amazon, are increasing their chip development efforts and could pose a challenge to Nvidia’s dominance in the AI chip market.

- Nvidia stock is currently trading at a high valuation compared to its projected revenue in 2030, making it difficult for the stock to outperform in the near term.

Justin Sullivan

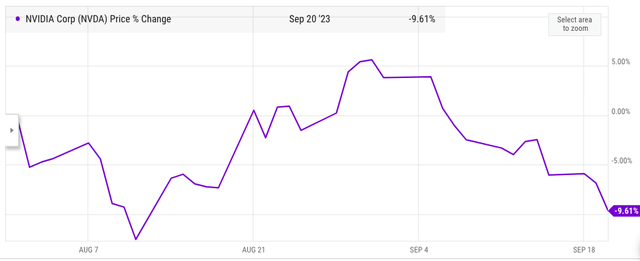

Nvidia Corporation (NASDAQ:NVDA) posted blockbuster results in the recent quarter, but this did not lead to a bullish rally in the stock. NVDA stock is a classic example of an excellent company at an unacceptable price. Since the previous Sell rating, Nvidia stock has dropped by 10% despite the bullish price targets announced by many leading analysts. This was expected, as most of the future growth has already been priced in. We could see a similar trend in the next few quarters where robust results by Nvidia do not move the stock price. Investors should closely look at this trend and gauge the future returns potential within Nvidia stock.

Nvidia’s recent march to over a trillion-dollar market cap has been staggering. It shows the potential of the AI industry and the high valuation multiple given by Wall Street to these stocks. However, this bull run will also likely lead to a further increase in chip development efforts by Big Tech companies. Back in April, Alphabet (GOOG) aka Google announced that its AI chips could beat Nvidia’s A100 chips. Investment firm Baird has recently mentioned that Alphabet’s counteroffensive is already “taking shape” and the company could surprise Wall Street in terms of the progress within AI chips.

Amazon (AMZN) has rejected Nvidia’s DGX Cloud platform as it favors more flexibility and wants to build its own servers. Tesla (TSLA) is also going to launch its own supercomputer to cut reliance on Nvidia. Besides the Big Tech, Advanced Micro Devices, Inc. (AMD) is trying to close the gap with Nvidia in its next flagship called MI300.

In the past 10 years, Nvidia’s revenue base increased from $4 billion to $25 billion which is equal to a 20% CAGR. Even if we estimate a 40% CAGR in the next few years, Nvidia’s revenue base will be less than $200 billion by 2030. In this growth scenario, Nvidia’s stock is trading at 6 times its revenue in 2030 which is more than the current P/S ratio of Alphabet. The rapid growth in AI chip competition is likely to pull down Nvidia’s bullish momentum. The stock can still maintain the current valuation due to the hype around AI, but the long-term growth potential is low.

Correction phase in the stock

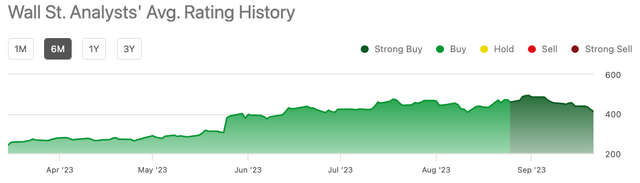

Nvidia is facing multiple headwinds which will make it difficult for the stock to outperform the broader index. The company is facing competitive challenges, geopolitical issues, AI overhype, and above all a very pricey valuation. Despite these challenges, Wall Street analysts have increased their consensus rating for Nvidia stock to a Strong Buy in the last few weeks.

Figure 1: Consensus Wall Street rating history for last few months.

It was mentioned in the earlier article that the massive bull run in the first half of 2023 will make it difficult for Nvidia to maintain a bullish momentum. We have seen that despite a very strong earnings report, the stock did not budge. The stock has dropped by 10% since the last Sell rating in late July. We could see the correction phase of Nvidia continue for a few more months as AMD prepares to launch its own AI chip and the company starts facing tougher comps in the next few quarters.

Figure 2: Correction in Nvidia stock in the last few weeks.

Increase in competition

It is generally believed that companies chase profits. However, most of the pay of top management is linked to the performance of their stock. This focuses the management to improve the market cap. Nvidia’s trillion-dollar market cap has given a strong signal to the management of Big Tech that Wall Street is likely to reward AI chip development with a better valuation multiple. We are likely to see billions of dollars invested in chip development from most of the Big Tech companies.

Some of the bigger players are already showing good results. Alphabet had earlier mentioned that its AI chips were outperforming Nvidia’s A100 chips. The test did not compare the latest flagship H100 chips of Nvidia but we can say that Alphabet would be close to Nvidia’s performance. After the recent hype of AI, Alphabet and other major tech companies would be looking to get a slice of this industry.

Amazon has also rejected Nvidia’s DGX Cloud platform as it favored building its own servers. This would give the company greater flexibility and it might also be able to sell the AI services to other clients at more attractive prices compared to cloud companies which are using more pricey Nvidia chips.

It should be noted that most of the Big Tech companies also have a strong cloud service. This allows them to instantly monetize services based on new AI chips. Hence, Alphabet’s AI chips would instantly provide the company with an advantage in the cloud industry. This will help Alphabet increase the sales of its new AI chips and also improve its market share within the cloud industry. The dual benefit gives Alphabet a massive motive to ramp up R&D investment in new AI chips.

Valuation with a 40% CAGR

In the previous quarter, Nvidia shocked analysts and Wall Street by projecting 64% YoY growth in Q2. The company has delivered better than the projections and reported 101% YoY growth. The management expects sales of $16 billion in Q3 which is significantly above the $12.5 billion expected by analysts. This sales number would equate to 160% YoY growth rate. Even this projection did not help the stock price as Wall Street is worried about the long term runway for the company and the higher competition.

This growth rate would be due to the fact that some major players are experimenting with new AI chips and tools. Nvidia also had easier comps due to a lower revenue base in the year-ago quarter. Over the last ten years, Nvidia has delivered CAGR revenue growth of 20%.

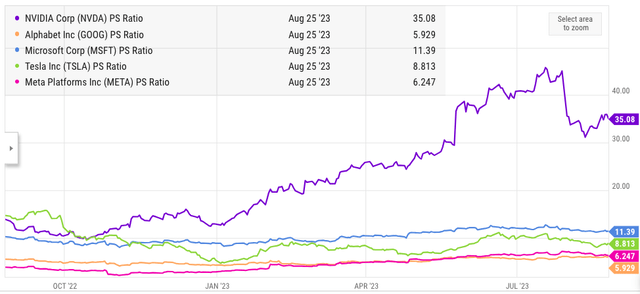

If the company is able to deliver a CAGR of 40% over the next few years, its revenue base will still be less than $200 billion in 2030. Due to a higher revenue base and increase in competition, it would be difficult for Nvidia to maintain a YoY growth rate of 40%. However, even if we assume that Nvidia is able to deliver a CAGR of 40% till 2030, its stock is currently trading at 6 times the projected revenue in 2030. This is more than Alphabet’s current P/S ratio. It can be said that Alphabet has a better moat compared to Nvidia due to its dominance of search engine market for over a decade. Alphabet also has other high-growth segments like cloud, subscription, hardware sales, and more.

Flexibility and pricing

Nvidia’s bullish analysts point to the full-stack service offered by Nvidia which combines hardware and software solution. However, this full-stack service can also be a headwind in getting new clients. Very few bigger clients would want to get permanently tied to an ecosystem which puts them at a pricing disadvantage in the future. This is one of the reasons why Amazon rejected Nvidia’s DGX Cloud platform. AMD offers customers greater flexibility with chips that are “good enough.”

Recently, MosaicML published a report that found AMD’s MI250 performed within 80% of Nvidia’s A100 chips. Both chips used in this study were one iteration behind the flagship products. But we can assume that AMD will be able to deliver reasonable quality chips in the next few iterations. AMD offers chips at lower prices and they have greater flexibility. It is likely AMD will be able to corner a significant market share within AI chips over the next few years.

The competition for Nvidia will only increase in the future. Besides AMD, there are a number of Big Tech companies that are looking to get a big slice of the AI chip market share. In this scenario, it would be impossible for Nvidia to defend its turf and deliver similar YoY growth rate and margins in the future.

Impact on stock price

Nvidia will face intense competition over the next few years, especially now that it is in the trillion-dollar market cap. Wall Street was surprised when Nvidia’s management projected a 64% YoY growth rate in Q2 which led to a big bull run. Nvidia delivered a bigger beat by reporting 101% YoY revenue growth in Q2 but this did not lead to any further bullish run in the stock. Most of the near-term growth of Nvidia is already priced in and Wall Street is more interested in the long-term moat of Nvidia.

Nvidia would need to deliver a CAGR of at least 40% in the next few years to reach $200 billion in revenue by 2030. There will be a lot of challenges facing the company in the next few years and the moat for its products is not very strong. Despite the massive AI boom, it is not possible to say with a margin of safety that Nvidia will be able to deliver 40% or higher YoY growth for the next few years.

Figure 3: Comparison of Nvidia’s P/S ratio against other Big Tech players.

We can see from the chart that Nvidia’s PS ratio has raced ahead of Big Tech companies in the last few months. Alphabet’s P/S ratio is less than 6. As mentioned above, even if Nvidia reaches $200 billion in revenue by 2030 with a CAGR of 40%, the stock is already trading at over 6 times the revenue base in 2030.

The recent earnings result is a perfect example of what we can see in the next few quarters. Excellent quarterly numbers and future growth projections by management will not be able to deliver a strong bullish run in Nvidia stock due to the current pricey valuation. It could take another year or two before the valuation multiple becomes more acceptable and Wall Street gets a clear view of the competitive headwinds of Nvidia. At the current price levels, it is difficult to see how Nvidia stock will be able to beat the broader tech index in the near term.

Investor takeaway

Nvidia reported strong numbers in the recent quarter and made future growth projections which beat analyst estimate. However, this did not result in a bull run in the stock price as most of the growth has already been priced in. Nvidia will face significant competitive pressures from Big Tech companies in the next few quarters as they launch their own AI chips. It is easier for Big Tech companies to launch and monetize these chips as most of them have a strong cloud business.

Nvidia reported 20% CAGR over the last ten years. Even if the company reports a 40% CAGR in revenue by 2030, its revenue will be less than $200 billion by 2030. This shows that Nvidia stock is currently trading at 6 times the revenue projection of 2030. On the other hand, Alphabet is trading at a P/S ratio of less than 6 for its current revenue base. Alphabet is also launching its own AI chips which have shown good results. It is unlikely that Nvidia stock will be able to gain another bull run in the near term due to its current pricey valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.