Summary:

- AT&T stock has declined by 18% in year-to-date which has led to increasingly bullish ratings, which claim that the stock is now an ideal value bet.

- However, AT&T’s enterprise value declined by a mere 7% in YTD which shows that the massive gap between market cap and enterprise value is causing a bigger dip in the stock.

- Even 5-6% decline in enterprise value can now cause a 15% dip in the market cap causing the stock to decline below $12 and making it more volatile.

- The 7.5% dividend yield is not helping the stock and could lead to a vicious cycle of negative sentiment, causing further correction in the stock.

- There were some silver linings during the recent earnings call but the company is still a long way from a turnaround.

Brandon Bell

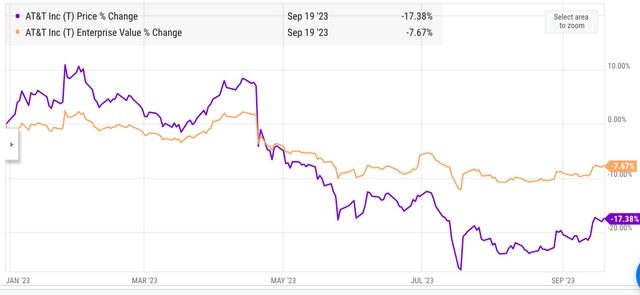

AT&T (NYSE:T) stock has declined by a whopping 18% in the year-to-date. On the other hand, S&P 500 has appreciated by 16%. This gap has led many analysts to claim that sentiment is overtaking the stock and the key metrics for AT&T are still quite good making it a value bet. However, we also need to factor in the impact of massive debt while looking at AT&T stock. This is the reason why the stock is not attractive even at a 7.5% dividend yield. In the year-to-date, AT&T’s enterprise value has declined by a mere 7%. This is due to the heavy debt load on the company. The 7% correction in enterprise value can be justified by the poor results in terms of churn rate, which has fallen behind T-Mobile (TMUS). The recent market cap decline has further reduced the ratio of market cap compared to enterprise value. AT&T’s market cap of $100 billion is only 40% of the $250 billion enterprise value.

Any further negative sentiment can lead to a massive correction in the stock. At the current stock price, a 6% decline in enterprise value will equate to a 15% dip in market cap which should push the stock below $12 per share. It should be noted that the dividend has not been able to provide a floor to the stock price. The stock is now giving close to 7.5% dividend yield which can increase the pressure on the management to right-size dividends and use the cash in other important areas. The recent earnings report did show some silver linings due to cost cuts and improved margins. However, it will still take a lot of work and a long time before there is a significant improvement in key metrics for the company. The stock can test the patience of most investors which makes it a sell at this point.

Headwinds for enterprise value

Investors and analysts have closely followed the recent decline in AT&T stock. The 18% decline in AT&T stock in 2023 might seem overdone. However, we also need to look at the larger picture. The decline in enterprise value has only been 7% which is not too big when we factor in the recent lead controversy, poor churn rate metrics, and the stagnant revenue base.

Figure 1: Different trajectories of enterprise value and market cap.

We can see from the above chart that a minor change in enterprise value can cause a much bigger fluctuation in AT&T’s market cap and stock price. Going forward, this volatility will increase if the enterprise value continues to decline. For example, a 20% dip in enterprise value will cause a 50% correction in the market cap and stock price.

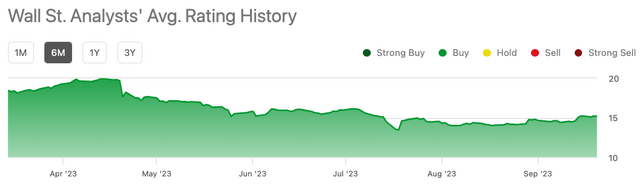

Figure 2: AT&T stock has not performed well despite a continuous Buy rating on the stock. Source: Seeking Alpha

Hence, it is vital for the management to show strong progress in terms of debt reduction. Without adequate debt reduction in the next few quarters, AT&T stock can face significant bearish sentiment.

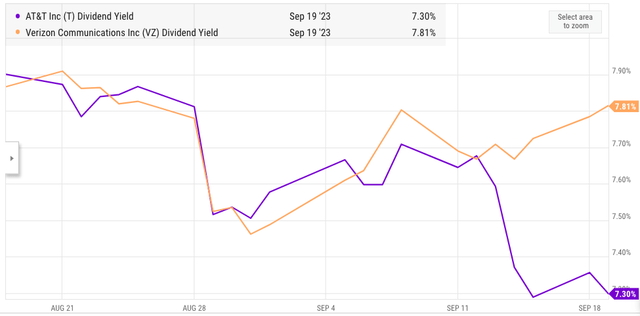

Dividend is not helping

AT&T’s dividend is now close to 7.5%. Back in Late 2021, I covered AT&T stock where it was mentioned that the stock price could continue to decline after the spinoff until the yield returns to over 6%. It was mentioned in the article that “the market will undervalue the shares given to AT&T investors in the new merged entity of Discovery, Inc. and WarnerMedia. This would require AT&T stock to further decline in order to get the dividend yield close to 6% or more.”

This is exactly what has happened since the spinoff. There has been over 50% correction in Warner Bros. Discovery (WBD) stock since the spinoff. AT&T stock has also declined since the spinoff and the yield has again increased to close to 7.5%. This shows that AT&T’s dividend is not able to give a decent floor to the stock price. There is a negative cycle associated with this. If the stock price declines, it increases the dividend yield which makes Wall Street more nervous about the future ability of AT&T to continue with this massive yield. This again leads to further running away of dividend investors and puts downward pressure on the stock price.

As mentioned above, the enterprise value decline has a much bigger impact on the stock price. We have seen this in the recent lead cables controversy. A further 8% drop in enterprise value will reduce the market cap by 20% and increase the dividend yield could go into double digits. It seems impossible that the management will be able to maintain the current dividend payments at this level of yield.

As mentioned in the previous article, both AT&T and Verizon (VZ) are paying $8 to $10 billion in dividends annually while T-Mobile does not have this expense. This leaves T-Mobile with a massive advantage where it can invest billions of additional dollars in network, subscriber growth, debt reduction, and even buybacks.

Silver lining in the earnings

While AT&T is still facing massive headwinds, it showed some silver linings in its recent forecast discussion. The management has been able to keep its promise of delivering $16 billion in FCF. It is also making very strong cost reductions. There are only a few options with the management in order to save resources. It includes a dividend cut, which is not on the table currently. Another option is to cut investment in the network, which would hurt the company in 5G era. And finally, it is to cut costs as much as possible.

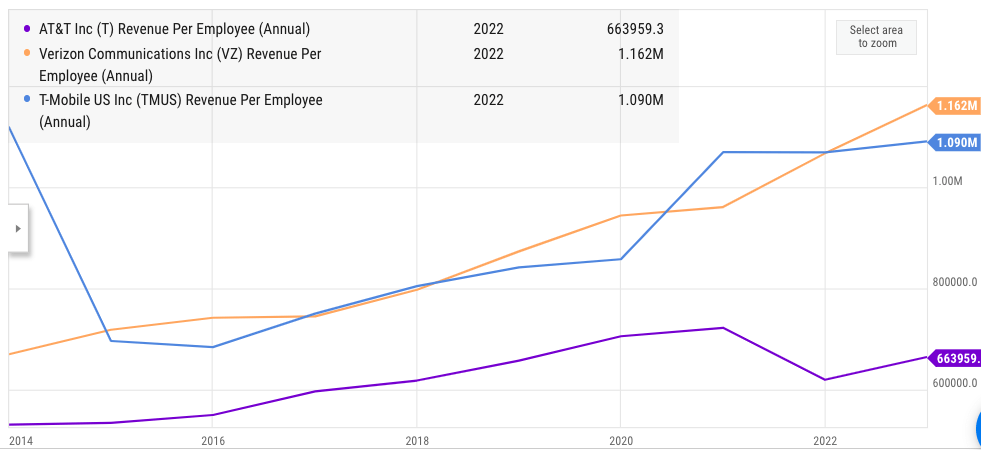

YCharts

Figure 3: Comparison of revenue per employee in the big three telecom companies.

AT&T’s revenue per employee is 45% lower than that of Verizon and 40% lower than T-Mobile. There are slight differences in operation but we can see that both Verizon and T-Mobile have done a better job at increasing revenue per employee. As the focus of AT&T’s management moves to cost saving, we could see better margins in the company over the next few quarters. This could be enough to stem the decline and reduce the bearish sentiment around the stock.

Future AT&T stock trajectory

Most analysts point to the mere $100 billion market cap of AT&T as a possible value bet in the stock. We know that AT&T’s business is rock solid and it can weather most economic storms better than other companies. However, AT&T’s enterprise value is still a massive $250 billion due to the huge debt load taken by the company. Every percentage point move in enterprise value impacts the market cap 2.5 times.

Figure 4: Dividend yield of AT&T and Verizon. Source: YCharts

AT&T is spending over $8 billion in dividends which are adequately covered by the FCF. However, these payments also put the company at a massive disadvantage compared to T-Mobile. Another big controversy like the lead cable issue could easily cause 8% to 10% erosion in AT&T’s enterprise value. This would lead to a 20% dip in AT&T’s market cap pushing the dividend yield higher. This is one of the key reasons why Wall Street is not betting on AT&T’s dividend and these dividends have failed to provide a floor to AT&T’s stock price.

Investors looking for an entry should wait for some more time. Once strong progress is made in debt reduction and cost cutting, only then can a sustainable bullish momentum reappear in AT&T.

Investor Takeaway

AT&T stock suffers from negative sentiment which is leading to further decline despite a massive dividend yield. Most of the Wall Street Analysts have had a Buy rating on AT&T throughout the year. However, AT&T has declined by 18% in YTD which is one of the worst performance in the current bull run within the broader market. AT&T’s performance is also the worst among the Big Three telecom players.

This sentiment is unlikely to change despite massive yield and a steady FCF. AT&T’s management will need to prove that the cost-cutting measures are working and they provide a big enough increase in margins. At the same time, the company could ramp up debt reduction to allay the fears of Wall Street. These challenges make AT&T stock a Sell at the current point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.