Summary:

- Disney plans to invest $60 billion in its Parks, Experiences and Products segment over the next decade, double the amount spent in the previous 10 years.

- The segment accounted for 36.7% of Disney’s revenue but 77.3% of its profits, making it crucial for the company’s success.

- The investments will focus on expanding the physical footprint of the segment, introducing new rides and experiences, and targeting a large addressable market of potential customers.

Wirestock

September 19 ended up being a very interesting day for shareholders of The Walt Disney Company (NYSE:DIS). Shares of the company pulled back, closing down 3.6%, after news broke that management is now planning to significantly ramp up investments into the company’s parks and other related assets. The pessimism centered around this decision almost certainly stems from the fact that the company already has a hefty price that it will have to pay soon in order to acquire the rest of Hulu that it does not own, as well as because this runs counter to the company’s decision to cut costs and reduce debt. Although problematic from that perspective, management has demonstrated time and time again that these investments generate fantastic returns. So while the company’s balance sheet might not look the best in response to this change, the long-term picture for the business is undeniably attractive.

A Massive Announcement

On September 19, the management team at Disney announced that, over the next decade, the firm plans to spend approximately $60 billion in the form of capital expenditures on its Parks, Experiences and Products segment. To put this in perspective, this particular segment, typically abbreviated as DPEP, has spent only around $30 billion on capital projects over the prior 10-year period. For context, this particular segment includes some of the most valuable assets that the company has. Examples would be its domestic and international parks, as well as its cruise lines. Under this segment, the company even has some islands that it leases out, plus other resort and vacation destinations. Merchandise, licensing, and other assets and activities are also included under this segment.

In fact, I would go so far as to say that this part of the business is the most vital to the company and its success in the long run. Even though, during the first three quarters of the current fiscal year, this segment accounted for only 36.7% of the company’s overall revenue, it also accounted for 77.3% of the firm’s profits. So making sure that appropriate investments are made is of the utmost importance. Should this segment flounder, the company itself would be under significant pressure and would lose much of what makes it one of the best enterprises on the planet.

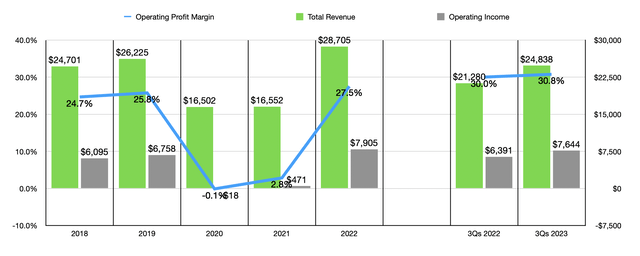

Before we dig into management’s plans, it might be helpful to provide some context regarding how this company has performed in recent years. Just like almost every company out there, Disney was negatively impacted by the COVID-19 pandemic. And this segment definitely took a beating. From 2018 to 2019, segment revenue jumped from $24.70 billion to $26.23 billion. In 2020, global lockdowns and a push to engage in social distancing, caused revenue to plunge to $16.50 billion. By 2021, the segment was already posting some signs of recovery, with revenue inching up to $16.55 billion. But it wouldn’t be until 2022 that a full recovery was achieved. That year, revenue totaled $28.71 billion.

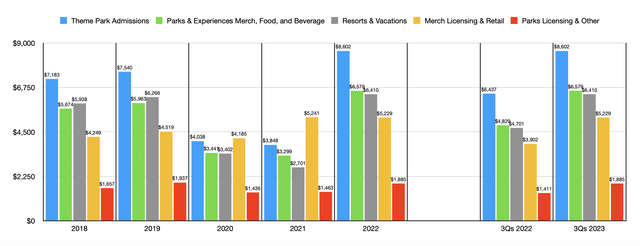

There are multiple working parts that comprise this segment. The largest, by means of revenue, involves its theme parks and the admissions sales associated with them. Theme park admissions revenue for the company totaled $8.60 billion last year. This marked an amazing recovery from the $3.85 billion reported one year earlier and it handily surpassed the $7.54 billion that the company achieved in 2019. There have been a couple of different drivers behind this fast rebound. For starters, high occupancy rates at both its parks and its hotels turned out well for the company. Management does not provide specific data regarding attendance. But the Themed Entertainment Association and AECOM do come out with data regarding some of the largest theme parks on the planet each year.

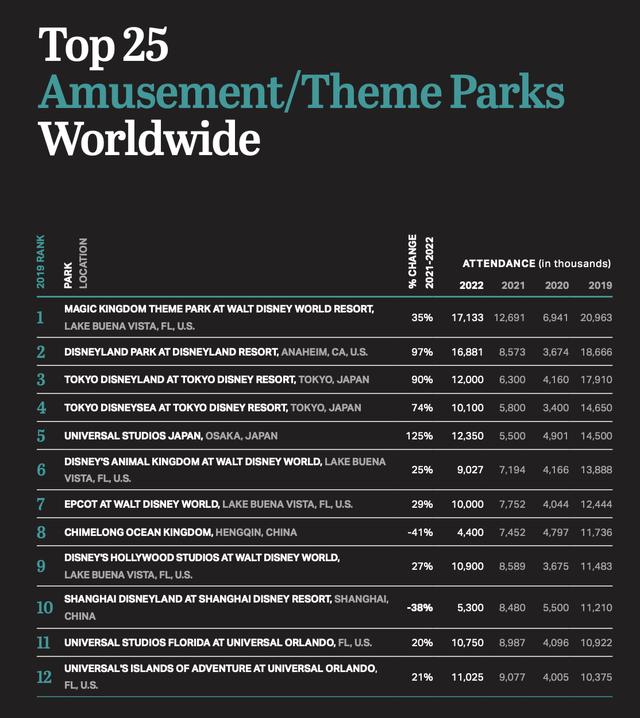

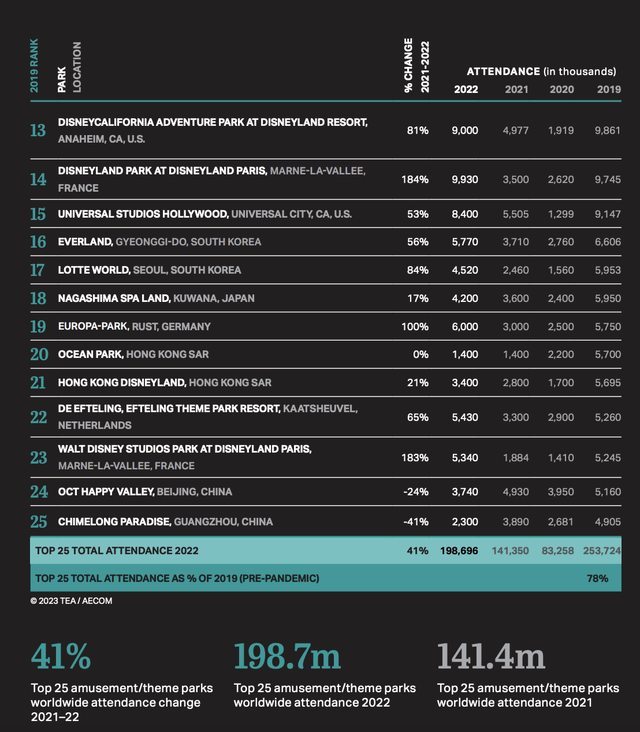

According to their report for 2022, total attendance at Disney’s Magic Kingdom came in at 17.13 million in 2022. That was, admittedly, still lower than the 20.96 million seen in 2019. But it marked a massive turnaround compared to the 6.94 million reported for 2020. In fact, four of the top five largest theme parks on the planet are either entirely owned by Disney or partially owned by it. These include not only the Magic Kingdom but also Disneyland Resort, Tokyo Disneyland, and Tokyo DisneySea. Even more impressive is the fact that eight of the top 10 largest theme parks on the planet, as measured by attendance, are affiliated with Disney. While some might lament at the fact that Disney attendance is still lower than it was in 2019, much of the pain in the aggregate has been driven by the attendance in Shanghai and Hong Kong. And that was due, it appears, to extended lockdowns that have only just, in the past year or so, eased up.

It’s also worth noting that Disney makes up all five of the top five largest theme parks in North America, as measured by attendance, and it makes up six of the top 10 on the continent. When it comes to water parks in North America, the company also makes up the two largest players throughout North America, with a combined attendance in 2022 of 2.02 million. I consider this impressive because, at its core, Disney never really positioned itself in a big way in the water park space.

Outside of theme park admission revenue, other aspects of the company have also performed incredibly well. 2022 saw the highest revenue on record when it came to parks and experiences merchandise, food, and beverage revenue. That number totaled $6.58 billion. Resorts and vacation revenue also hit an all-time high of $6.41 billion, while merchandise licensing and retail revenue had its second-best year at $5.23 billion. Parks licensing and other revenue also experienced the second-highest revenue on record at $1.89 billion. That’s down slightly from the $1.94 billion reported in 2019. This growth in revenue pushed operating income for the segment as a whole up to $7.91 billion. That’s 17% higher than the $6.76 billion in operating profits reported for 2019. The overall growth in revenue and profits also can be chalked up to continued price increases. In fact, this year alone, the company has raised pricing at its parks on two occasions. And I wouldn’t be surprised to see a lot of its other activities hiked from a pricing perspective in order to offset inflationary pressures.

Financial performance for the current fiscal year looks set to come in even higher than it did in 2022. With the exception of merchandise licensing and retail revenue, all sales categories are up year over year. The segment as a whole has reported revenue of $24.84 billion during the first three quarters of 2023. That is an astounding 16.7% increase over the $21.28 billion reported the same time last year. And with that rise in revenue has also come higher profits. Operating income of $7.64 billion translated to a 19.6% increase over the $6.39 billion reported last year.

Big Changes

I think one of the reasons why investors might be concerned about a ramping up of investments into the DPEP segment is that the company currently has a lot going on for it in a positive way. I have often struggled with the question of what the company should do about its extreme popularity. On the one hand, a tempting route is to just put in capital expenditures for some new rides from time to time and to keep the park running in tip-top shape. As the brand becomes even more popular with consumers, management can hike prices and reap massive margins in response. On the other hand, at some point, this risks pricing out a good portion of the company’s fans. And in the long run, that could cause the brand to deteriorate.

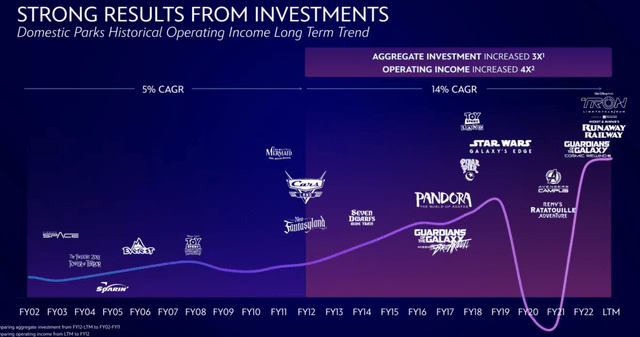

It would appear as though management is opting for additional significant investment aimed at growing the physical footprint of this unit as opposed to trying to squeeze every spare dollar it can out of those customers that can pay for the Disney experience. If we believe that profitability is the most important end goal, management has provided enough data to make me feel comfortable in significant additional investments. As you can see in the chart below, the company has significantly ramped up its investments in recent years compared to what the company had seen in the 10 years ending in 2012. As a result of growing aggregate investment by a factor of three, operating income quadrupled.

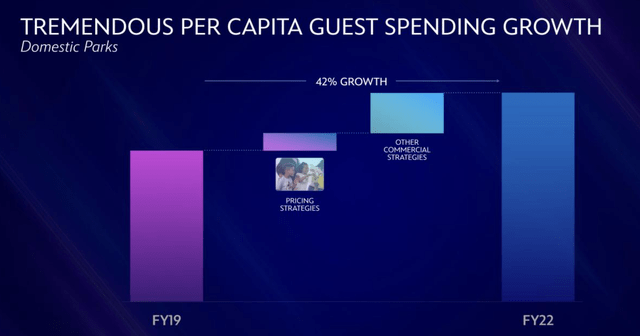

Interestingly, from 2019 through 2022, when it comes to the company’s domestic parks, the 42% increase in per capita guest spending was not driven largely by pricing strategies. Though specific numbers were not included in the chart below, it is clear that introducing new commercial strategies outside of higher pricing accounted for the lion’s share of this increase. A good portion of the investments that the company makes will inevitably be focused on introducing new rides, new products, and new experiences. But management also indicated that growing the company’s physical footprint is also on the table. They outlined, for instance, that they have over 1,000 acres of land for possible future development spread across its global operations. While this may not sound like much, it’s important to note that the Magic Kingdom sits on just 142 acres of land, which is more than double the size of the original Disneyland. The largest of the company’s theme parks is the Animal Kingdom at 500 acres. So we could be talking about the addition of multiple parks if management decides to move in that direction.

One really great thing about this is that the company is not worried about running out of fans. In its investor presentation announcing this ramp-up and spending, the company said that for every one park guest that it has today, there are more than 10 consumers who have what it considers to be Disney ‘affinity’ but that who do not currently visit its parks. This translates to a roughly 700-million-person addressable market when looking at the regions in which it already operates.

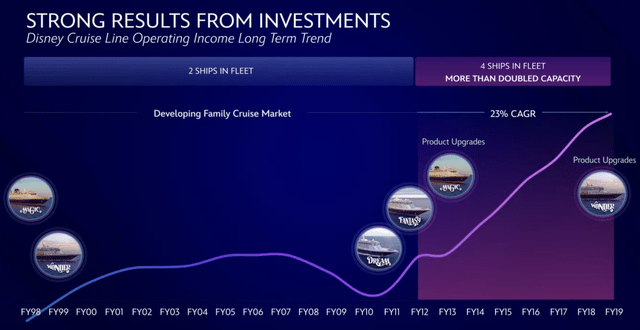

Some investments could also go in the direction of the company’s fleet of cruise ships. Initially, from 1998 until 2012, the company had just two ships in its fleet. However, operating income associated with its cruise ships skyrocketed 23% per annum from 2012 through 2019 as the company added two additional ships. This was accompanied by product upgrades that brought in additional revenue also. Sticking with the idea of vacations, management is already making some interesting investments. The Disney Vacation Club, for instance, is set to see 360 keys come online next year at Fort Wilderness. Also next year, another 270 keys should be opening at the Polynesian Villas. And all of this will follow the opening of 340 additional keys later this month at The Villas At Disneyland Hotel.

With the exception of the acreage that I mentioned, none of this has touched on the company’s international operations. But those have, for the most part, been a tremendous success. Even though the international theme parks and other assets were much slower to recover from the COVID-19 pandemic, the company boasted a 69% increase in per capita guest spending at these locations between the third quarter of 2018 and the third quarter of this year. It would be surprising if the company does not make major investments on this front. Management’s plans also don’t seem to be stopping at the theme parks and other related assets. They also seem to be focused some on certain product lines. For instance, the company was keen to point out the fact that its Duffy and Friends franchise, which is incredibly popular throughout the company’s Asian operations, has reported over $500 million in overall revenue since the franchise’s inception. Further merchandising opportunities are highly probable.

Of course, this is not going to be an easy road to travel. Previously, management had said that they were planning to cut expenses by $5.5 billion. The company seems to be moving well on that path. However, this significant increase in spending will likely offset some of this. For those wanting the company to further pay down the $35.73 billion in net debt that’s currently on its books, this might be an undesirable path to take in the near term. We also need to keep in mind that Disney has already begun the process of moving forward with its purchase of the rest of Hulu that it does not currently own. The current owner of the 33% stake is NBCU, which is a wholly-owned subsidiary under Comcast (CMCSA). Years ago, it was agreed that Hulu would be valued at the greater of its equity fair value and a floor of $27.5 billion. As of the end of the most recent quarter, the stake that Disney does not own had an estimated fair value of $8.9 billion. But it is highly probable that the ultimate buyout price will be higher than this. That will mean the assumption of additional debt to absorb the rest of that asset as well.

Takeaway

At this point in time, I can understand why some investors may be a bit concerned about the announcement that Disney made. However, the way I see it, this is an investment in long-term growth. I don’t think anybody could find a brand that is higher quality and more widely respected than the Disney brand at this time. And by continuing to invest in that brand in ways that open up the company to more consumers, management believes that additional revenue and profits will be the end result. We don’t yet know what kind of return these investments might have on the company. In fact, it will probably be a few years before we find out how things are going. But in the meantime, I intend to sit back with my current holdings and enjoy the ride. And depending on how things go, I could even see myself adding onto my position thanks to this maneuver.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!