Summary:

- Cisco announced to acquire Splunk for $28 billion in an all-cash deal.

- With a great balance sheet, Cisco is able to acquire Splunk and will keep on paying its dividends and repurchase shares with an even higher pace.

- The company also reported great fiscal 2023 results and assuming moderate growth rates, the stock is still undervalued.

Alexander Koerner

Yesterday, Cisco Systems, Inc. (NASDAQ:CSCO) announced the intention to acquire Splunk (NASDAQ:SPLK) and we will take a closer look at the $28 billion acquisition. We will look at the deal, its financing, the balance sheet and provide a short overview of Splunk.

And as my last article about Cisco was written in January 2023, it is time for an update anyway and we will also look at the results for fiscal 2023 and update the intrinsic value calculation. Additionally, we will answer the question if Cisco remains a buy after the Splunk acquisition.

Splunk Acquisition

Cisco is intending to acquire the cybersecurity company Splunk, which is producing software for searching, monitoring, and analyzing machine-generated data. The company is using machine data to identify data patterns and providing metrics and diagnosing problems. The company offers security platforms – including Splunk Security (helping organizations to fortify the digital resilience by mitigating cyber risks) and Splunk Observability (providing visibility across the full stack of infrastructure, applications, and the digital customer experience). Splunk is based in San Francisco, is generating almost $4 billion in annual revenue and has about 8,000 employees. The deal is expected to close in the third quarter of calendar year 2024.

Cisco Splunk Acquisition Presentation

Impact on Balance Sheet

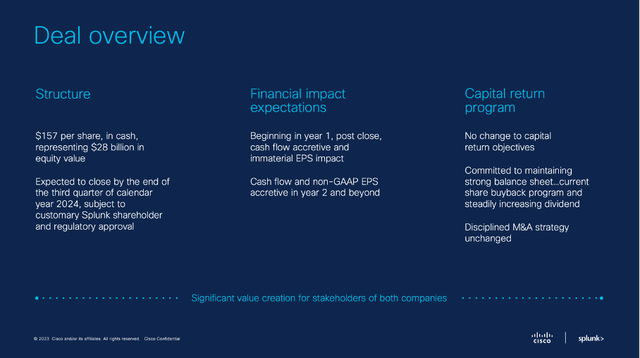

Cisco will acquire Splunk for $157 per share resulting in a total deal value around $28 billion. Cisco will pay in cash and when looking at the company’s balance sheet, it almost has enough cash to pay for Splunk. On July 29, 2023, Cisco had $10,123 million in cash and cash equivalents as well as $16,023 million in short-term investments. This leads to $26,146 million in very liquid assets, which is almost enough for the acquisition.

I don’t know where the missing $2 billion will come from. So far, I could not find any information about Cisco taking on additional debt. But maybe that will not be necessary. On the one hand, Splunk has currently about $1,524 million in cash and cash equivalents as well as $926 million in short-term investments, which Cisco will acquire as well (but it seems rather unlikely to use that cash to pay for Splunk). And it will take about two quarters before the deal is finalized. During that time, Cisco will generate probably $10 billion in free cash flow and while it will need about $3.2 billion in dividend payments and might spend about $3 billion on share repurchase (this number is in line with past quarters), about $4 billion in additional cash would remain.

And as long as we are talking about the balance sheet, it is worth pointing out that Cisco has a solid balance sheet (and the balance sheet will remain solid after the acquisition). On July 29, 2023, Cisco had $1,733 million in short-term debt as well as $6,658 million in long-term debt. Compared to a total shareholder’s equity of $44,353 million this is resulting in a D/E ratio of 0.19. And when considering that Cisco generated an operating income of $15,031 million in fiscal 2023 it would take a little over six months to repay the outstanding debt – a very low number.

The only problem in an otherwise solid balance sheet is the high amount of goodwill Cisco has. On July 29, 2023, Cisco already had $38,535 million in goodwill and the Splunk acquisition will add additional goodwill to the balance sheet. But as already mentioned, the balance sheet of Cisco is not a problem.

Market Reaction

The stock market reacted in its typical way: Splunk as the business that is going to be acquired jumped about 20% and moved rather close to the expected buyout price and Cisco as the acquiring company declined as much as 5% intraday. It is also worth pointing out that Splunk is trading for about $144 right now and therefore still about 8% below the intended purchase price.

Investment firm Wedbush Securities is even predicting a “tidal wave” of mergers following the Cisco-Splunk deal. But overall, it seems like analysts saw the deal rather positive and see Cisco now as strong competitor to other cybersecurity companies like Palo Alto Networks, Inc. (PANW), CrowdStrike Holdings, Inc. (CRWD) or Microsoft Corporation (MSFT). It is also speculated that the deal might help Cisco in the next-wave of artificial intelligence, which is expected to move to software and cybersecurity – and Cisco is especially competing with Microsoft, Oracle Corporation (ORCL), Amazon.com, Inc. (AMZN) or Adobe Inc. (ADBE).

Risk of Major Acquisition

As I already mentioned above, it is not surprising for the acquiring business to decline in value after the announcement. Like the market, I also don’t like huge acquisitions as they often don’t work out as intended. And corporations are often overpaying for these major acquisitions and the expected synergies don’t materialize. Major acquisitions are often done for the completely wrong reasons – leading to higher revenue, higher income, and therefore higher compensation for management. But the question if the company is using its cash appropriate is often ignored. Sometimes share buybacks or many small acquisitions would be the better choice than a “high-profile” acquisition.

Assessment of the Deal

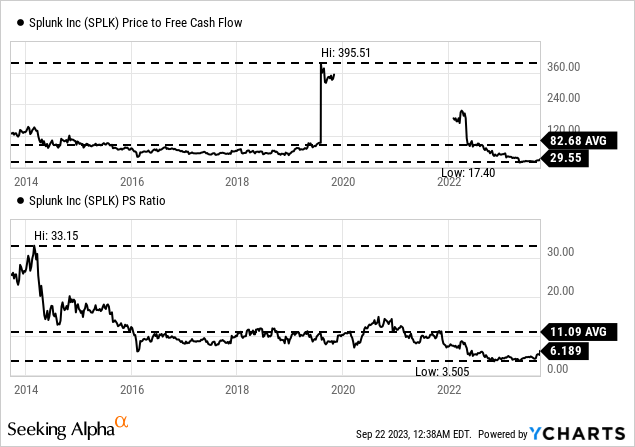

And Cisco is also facing the risk of overpaying for Splunk, and a $28 billion purchase price justifies the label “major acquisition”. When looking at the price-free-cash-flow ratio, Splunk is trading for almost 30 times free cash flow (and Cisco will pay even 32 times free cash flow). Usually, I would argue that 30 times earnings is rather expensive for a business, but such a valuation multiple can be justified by high growth rates over a long time. When looking at estimated earnings per share in the years to come, analysts are expecting adjusted EPS to grow with a CAGR of 19.08% in the next ten years. And if Splunk could actually grow with such a high rate, a price-free-cash-flow ratio of 30 could be justified and Cisco probably paid a fair price.

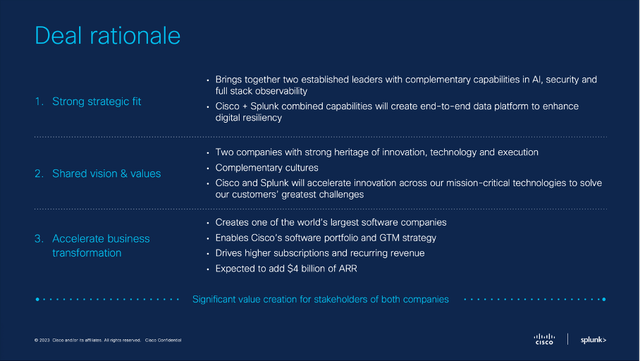

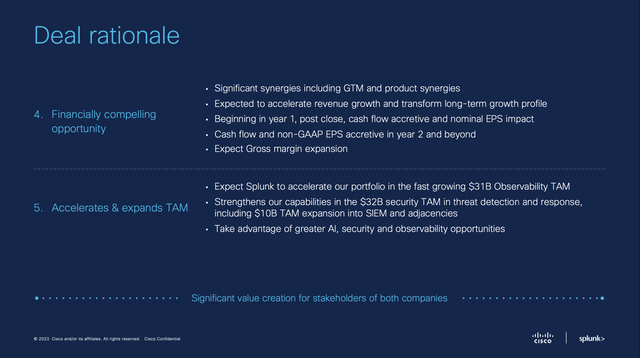

Management is very optimistic about the acquisition (which is not a surprise). Cisco CEO Chuck Robbins sees Splunk as a strong strategic fit – especially as both companies share the same vision and value.

Cisco Splunk Acquisition Presentation

Additionally, management is expecting Splunk to accelerate Cisco’s portfolio in the fast-growing observability market, which is estimated to have a TAM of $31 billion right now. The deal is also expected to strengthen Cisco’s capabilities in the $32 billion security market.

Bildschirmfoto 2023-09-22 um 04.58.59

And management is expecting Splunk to contribute to cash flow already in the first fiscal year and it will contribute to non-GAAP earnings per share in the second year. And as already mentioned, it will contribute to gross margin expansion and of course it will accelerate Cisco’s revenue growth.

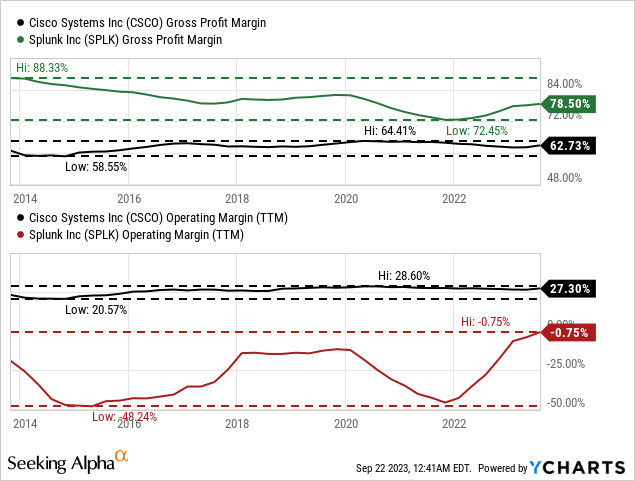

Splunk is reporting higher gross margins than Cisco and therefore we can assume that the acquisition will lead to a higher gross margin for Cisco. Right now, Splunk has a horrible operating margin (still negative) but over time, operating margin will most likely improve.

Dividend and Share Buybacks

Cisco also announced that the transaction will not impact the dividend program or the previously announced share buyback program. And when Cisco is paying for the acquisition by using cash on its balance sheet, it can continue to use the free cash flow the business generates for share buybacks, dividends (or even further acquisitions). During the last earnings call, management articulated its intention to increase share buybacks in the years to come and repurchased at least $5 billion worth of shares in the years to come. And at the end of the last quarter, Cisco had $10.9 billion remaining under the current share buyback program with no termination date.

Full-year Results

In the last few years, Cisco was not a high-growth business and while the company could still grow with a solid pace, revenue increased only with a CAGR of 1.61% in the last ten years while operating income increased with a CAGR of 3.25% and earnings per share increased 5.14% on average in the last ten years.

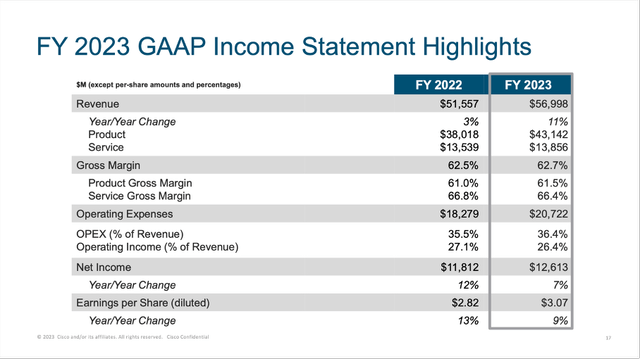

However, for fiscal 2023, Cisco reported much better results. Total revenue increased from $51,557 million in fiscal 2022 to $56,997 million in fiscal 2023 – resulting in 10.6% year-over-year growth. And while revenue from services increased only slightly from $13,539 million in the previous year to $13,856 million this year (resulting in 2.3% YoY growth), product revenue increased 13.5% YoY from $38,018 million in fiscal 2022 to $43,142 million in fiscal 2023.

Operating income increased 7.6% YoY from $13,969 million in the previous year to $15,031 million this year. And finally, diluted net income per share grew 8.9% YoY from $2.82 to $3.07. When looking at adjusted, non-GAAP earnings per share, Cisco reported an increase from $3.36 in fiscal 2022 to $3.89 in fiscal 2023 – resulting in 15.8% YoY growth.

Intrinsic Value Calculation

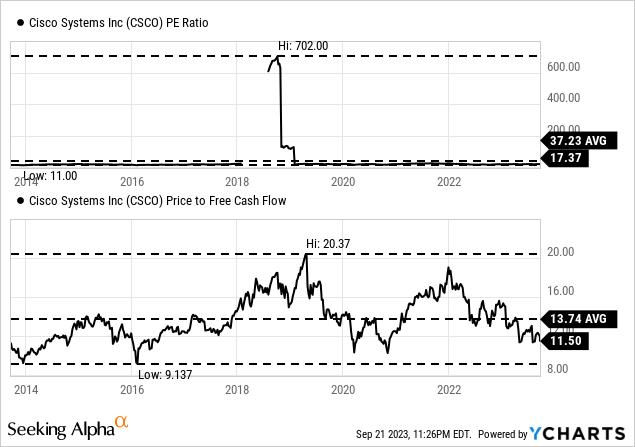

Aside from the discussion if Cisco used its cash in a reasonable way, I would still see Cisco deeply undervalued. We can start by looking at the price-earnings ratio right now and Cisco is trading for 17 times earnings, which is a reasonable number for a solid business. A price-free-cash-flow ratio of 11.50 however is indicating that Cisco could really be a bargain.

The statement of Cisco being a bargain can be backed up by using a discount cash flow calculation to determine an intrinsic value for Cisco. As always, we are calculating with a 10% discount rate and the current number of diluted shares outstanding (4,093 million right now).

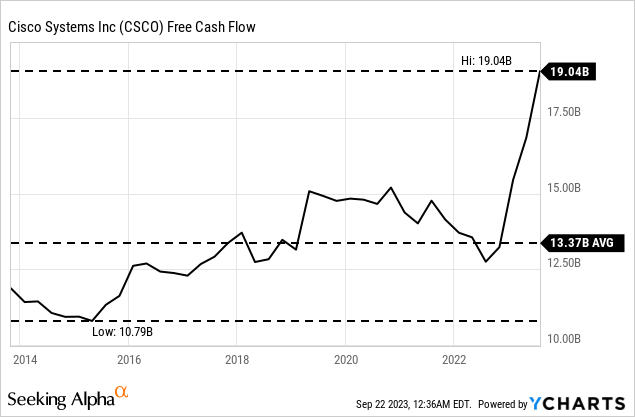

As basis for our calculation, we could use the trailing twelve-month free cash flow of Cisco and Splunk. While Cisco generated $19,037 million in free cash flow in the last four quarters, Splunk generated $814 million in FCF. And despite the acquisition, I still don’t think Cisco will suddenly start growing with a high pace. But assuming 5% annual growth from now till perpetuity seems realistic (I already used this growth assumption in my last article about Cisco) – especially as Splunk might lead to higher growth rates with operating margin for Splunk improving over time.

When calculating with these assumptions, we get an intrinsic value of $97.00 for Cisco and the stock would be deeply undervalued. Now we can make the argument that the free cash flow in the last few quarters might rather be an outlier for Cisco and that we should take a lower number. But even when being rather cautious and calculating only with $15 billion in free cash flow (and all other assumptions the same) we get an intrinsic value of $73.30, and Cisco would still be undervalued at this point.

Conclusion

Cisco is still a solid buy in my opinion and when calculating with moderate growth assumptions, the stock is still undervalued. And only time will tell if Splunk was a great acquisition (if the deal is not blocked in any way). But with the company’s solid balance sheet and no additional debt necessary I am not worried about the acquisition. And Splunk could be a great fit for Cisco and probably has the able to grow with a high pace justifying the 30 times free cash flow multiple for the business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.