Summary:

- Disney’s operating losses in its Media and Entertainment segments have led to a shrinking margin, but if margins improve, it could be a good investment opportunity.

- Disney dominates the box office and holds a significant market share in the entertainment industry.

- The streaming boom presents a potential for Disney to increase its margins, and the expansion of in-person experiences like theme parks and cruises can contribute to its growth.

Michael M. Santiago

Thesis

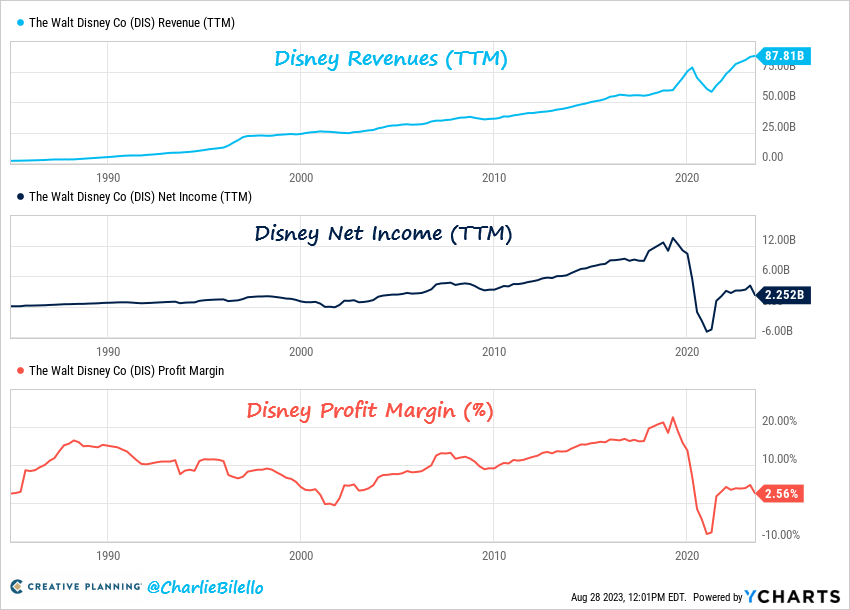

The Walt Disney Company (NYSE:DIS), aka Disney, is a massive media/entertainment behemoth known for making some of the most recognizable characters in pop culture. With their amusement parks being world-renowned, the pandemic put a halt to this lucrative part of their business. This led to Disney entering the race for streaming services, Disney+, and with their large library of intellectual property, people stuck at home were hard-pressed to find a service that could compete with all these classic movies and new shows. As of right now, Disney is at a 52-week low largely due to its shrinking margin that has not recovered to pre-pandemic levels. If Disney is able to bring their margins more in-line with their past performance, Disney could be an opportunity to add a household name to your portfolio at a reasonable price.

Company Overview

The Walt Disney Company contains 5 segments that make up their core business: Media & Entertainment, Parks, Experiences & Products, Linear Networks, Direct-to-Consumer, and Content sales/Licensing.

Media & Entertainment is the umbrella combining their Linear Networks, Direct-to-Consumer and Content sales/Licensing. Linear Networks are their television programs. Direct-to-Consumer is their streaming platforms. Content sales/Licensing is their revenue generated from allowing other companies to use their intellectual property.

Disney’s Parks, Experiences & Products is a culmination of all their in-person attractions (amusement parks, cruises, vacations) and sales they make on physical products in stores.

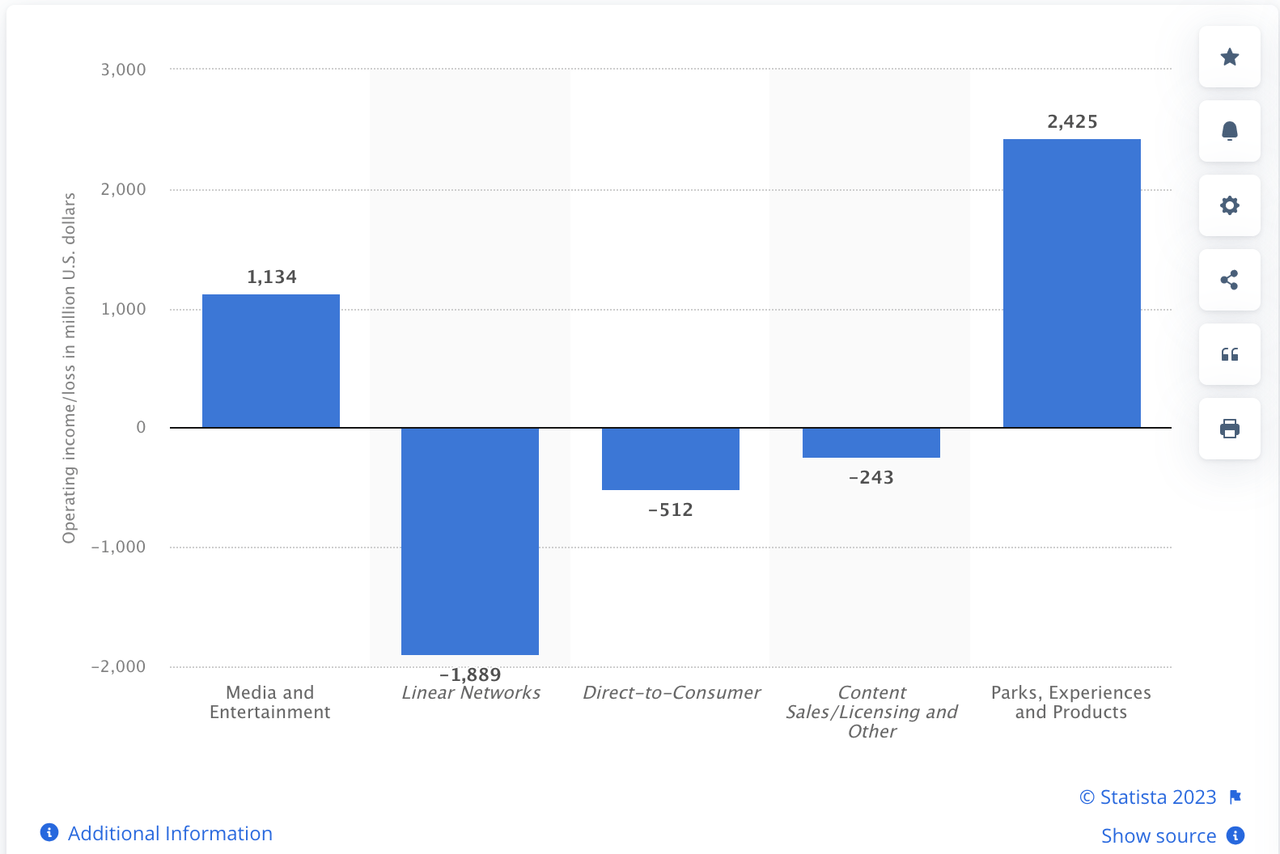

Operating Income/Loss by Segment Q3 FY2023

Operating Income by Segment Q3 FY2023 (Statistica)

As seen in the graphs, Disney’s major fault is their operating losses in their Media and Entertainment segments, leading to a roughly 8% margin compared to 28% with their Parks Experiences and Products.

Disney Historical Revenue, Income, Profit Margins (Twitter)

Industry Overview

The global entertainment market is expected to grow at a 8-10% CAGR [Yahoo Finance, 2023] [Statista, 2023]. Advertising spend is also projected to grow by over 5% each year [PwC, 2023]. With so many streaming services detracting from the subscription business model, those who have the customer base and can shift focus to ad revenue will be the models that prevail. Disney has positioned itself well for this shift by having multiple options for consumers to save on their subscription that include ads. Below is a table of their options and the new price increases for this fall [Business Insider, 2023]

Disney Plus price options

|

Disney Plus plan |

Price |

Price starting October 12 |

|

Disney Plus with ads (monthly) |

$8/month |

$8/month |

|

Disney Plus ad-free (monthly) |

$11/month |

$14/month |

|

Disney Plus ad-free (annual) |

$110/year |

$140/month |

|

Disney Plus (ads) and Hulu (ads) |

$10/month |

$10/month |

|

Disney Plus (ads), Hulu (ads), and ESPN Plus |

$13/month |

$15/month |

|

Disney Plus (ad-free) and Hulu (ad-free)* |

$20/month |

$20/month |

|

Disney Plus (ad-free), Hulu (ad-free), and ESPN Plus |

$20/month |

$25/month |

|

Disney Plus (ads), Hulu + Live TV (ads), and ESPN Plus |

$70/month |

$77/month |

|

Disney Plus (ad-free), Hulu + Live TV (ad-free), and ESPN Plus |

$83/month |

$90/month |

*Plan launches on September 6.

Source: Disney Plus price: How much each plan costs and what different ad tiers offer

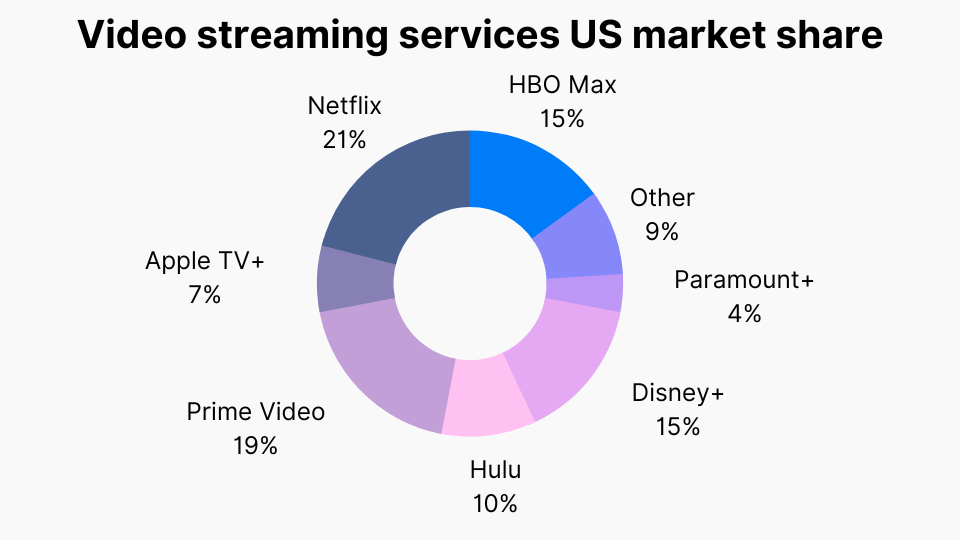

Streaming Service Market Share (Headphones Addict)

Additionally, according to Data Bridge Market Research, the global amusement park market is expected to grow at a 4.97% compound annual growth rate between 2022-2029, providing Disney with another avenue of growth: “The Walt Disney Company is developing plans to accelerate and expand investment in its Parks, Experiences, and Products segment to nearly double capital expenditures over the course of approximately 10 years to roughly $60 billion, including by investing in expanding and enhancing domestic and international parks and cruise line capacity.”

Competitive Advantage

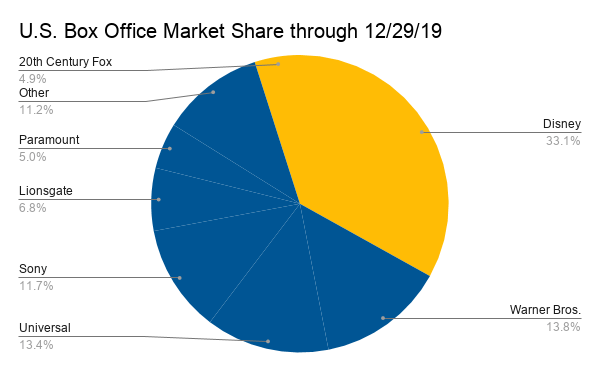

Disney dominates the box office

Box Office Market Share 2019 (CNBC)

Going back to 2019, Disney brought in nearly 40% of box office revenue in the US. Big brands like Marvel, Pixar, and Lucasfilms (all owned by Disney!) have a loyal fan base, shown by Disney taking 7 out of the top 8 grossing movies in the US during 2019 (Box Office Mojo, 2019). With the addition of Fox, creators of “The King’s Man” and “Free Guy”, under Disney’s umbrella, it would be no surprise to see Disney continue to hold their command over the media entertainment market.

Streaming Boom → Bigger Margin Business (Potentially)

In less than two years of starting Disney+, they had over 100 million subscribers [Statista, 2023]! Being that streaming services have shown to be a profitable business [Netflix current at 13% net margin, Macrotrends, 2023], if Disney can figure out the right ratio of content-costs to box-office to home entertainment, Disney could stand to push their total net margins higher than they were before COVID [~20%, Macrotrends, 2023]. Currently they are not making profit from their streaming service. They have seen a bit of tapering from the consumer as their subscriber count has fallen slightly over the last quarter but that is primarily due to international subs leaving after Disney did not renew rights to the Cricket Tournament (Disney, 2023). On the surface this seems like a big hit but this segment is the lowest in terms of revenue per subscriber at $0.59 [Disney, 2023]. Looking forward, it is a competitive space many services will be competing for consumers. With Disney’s library, it will be hard for other competitors to bring the same fire power Disney has built in its intellectual property.

Expansion of In-Person Experiences

12 Theme Parks, 5 Cruise ships [Disney, 2023]

With multiple of the most popular amusement parks in the world: Magic Kingdom, Tokyo Disneyland, Disneyland Anaheim, Shanghai Disneyland, Disney continues to hold dominance with roughly 23% of the market share and the next largest competitor only around 11% [Global Newswire, 2023]. Many of these parks are still seeing attendance down 50% [Statistia, 2023] from pre-pandemic levels which is contributing to the much lower net income on the Disney income statement. With the strict international policies finally being eased, and the market projected to grow at a CAGR of 11% [Global Newswire, 2023], Disney is in a great place to capitalize on this growth and turn it into cash flow.

Disney was also rated as being one of the top five cruise line experiences in 2022 [Statistia, 2022]. While discretionary spending will be a key indicator of how well Disney’s growing fleet will perform, cruises can be more affordable options for consumers looking for vacation time. Disney will stand out from the rest as the choice for family vacations.

Catalysts

Loosening Restrictions on In-person Experiences

With parks, experiences, and products being the second largest operating segments for Disney ($28.7 billion in 2022) and most parks’ attendance being below 50% of pre pandemic numbers, the easing of restrictions or growing attendance rates are massive opportunitites for Disney to return to their previous stronger margin business [Statistia & Disney, 2023]. In addition, Disney has continued to make investments into their cruise experiences which have seen positive feedback as one of the top five cruise lines last year. As restrictions ease and people are looking to get away, Disney’s ticket sales would be a good indicator of what success to expect in their quarterly reports.

Regaining Profit Margin

Disney, among many other large businesses, has turned their attention towards optimization during the pandemic slowdown and recovery. This often led to large layoffs. In the first half of this year, Disney has already laid off 7,000 employees [Variety, 2023]. While this is not always an encouraging sign, the positive outcome of these events is Disney’s return to profitability from the large fall in 2020. As Bog Iger (CEO) continues to slim down Disney’s operations, it could lead to large shifts in their profit margin when their business returns to pre-pandemic levels.

Financials

Revenue for Q3 2023 is $22.3 billion, up 4% YoY but slightly under expectations of $22.5 billion. This increase was due primarily to a 13% increase in their parks, experiences, and products segment. Disney posted an operating loss of ($134) million, which was influenced by the ($512) million dollar loss in their direct-to-consumer streaming segment. This is showing improvement from their loss of ($1) billion last year. Earning per share from continued operations in Q3 was ($0.25) while last year’s Q3 was an income of $0.77. The loss was primarily due to the large $2.65 billion dollar restructuring and impairment charge from removing content from its streaming platform. [Disney 10-K & 10-Q, 2023]

While Disney has lost subscribers since its peak, a majority of those subscribers were a part of Disney+ Hotstar. This segment is their lowest revenue per subscriber of $0.59 per user and accounts for 12 million of the lost subscribers from Q2 to Q3. Disney did not renew their rights to the cricket tournaments which causes many of these subscribers to leave..

Disney’s current liabilities are $20.2 billion and cash/cash equivalents are $11.6 billion. Disney has 57% coverage of their current liabilities and can generate revenue of over $20 billion in less than 3 months given their current pace. Total current liabilities sit at $29.07 billion while total current assets sit at $29.1 billion which have slightly declined YoY.

Valuation

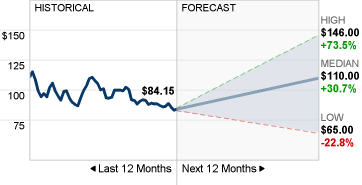

Given analyst estimates, Disney sits with a median expectation of $110, ranging from $65 to $146. The current uncertainty around when Robert Igar’s efficiency will lead to pre-pandemic margins is a big question mark. Rest assured, this will be a challenging time for Disney as their two largest segments are in major transformations (streaming and park/experiences) as we transition out of the pandemic shutdowns. If you are in this investment for the long term (5+ years) and Disney aligns with your investment portfolio, you may be in for some volatility but also get a household name for a great price.

Disney Price Forecasts (Money CNN)

Risks

If Disney is not able to return to pre-pandemic margin levels (~20%), then the potential upside of Disney from this point will be greatly diminished. With Robert Igar (CEO) at the helm and honing in on making Disney efficient for the long-term, this risk seems unlikely to be the case when taking a long term horizon of 5+ years.

If amusement parks and in-person experiences do not return to previous attendance/sales then that would weigh down the second largest revenue segment of Disney. While this is unlikely given the trends and projected CAGR for this market, it is something to be aware of.

If they are unable to find the balance in their cost of content production to box office and streaming service, their streaming services will be a losing business for them. One of the crunches dealt with is the advertising costs. Advertisers are looking for major customer penetration and that is a tad more difficult to come by with the plethora of streaming services that arose in the last few years. There is also concern over consumer spending which has dissuaded advertisers from spending more money for ad time. This seems to be a temporary issue that came from the rapidly changing market conditions. With a long-term focus, I imagine that Disney will be a major player in the streaming market and they will figure out what ways work best to make it a consistent cash flowing segment.

Conclusion

Disney is navigating multiple storms (how to be the best streaming platform, getting in-person experiences back to pre-pandemic levels, optimizing to stay cash flow positive) and while their revenue is growing, their profitability is still well below previous highs. This will probably continue to be the case until major increases in sales are made in their in-person experiences like cruise lines and parks or when they hit profitability in their streaming service. With the large moat that Disney holds in intellectual property, customer base, and infrastructure, it is difficult to see how Disney would not be able to return to pre-pandemic profit margins, eventually. The big question then will be how long does it take? If you are in it for the long term (5+ years) then I think it would be hard to bet against the Walt Disney Company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.