Summary:

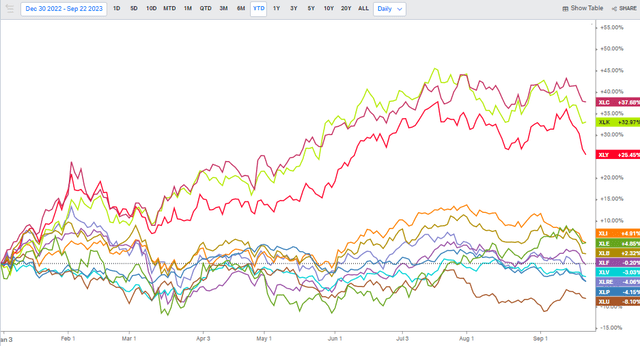

- The utilities sector is the worst-performing area of the S&P 500 this year but has shown recent relative strength.

- NextEra Energy is the sector’s biggest component and has a buy rating due to its growth story and appealing dividend strength.

- NEE reported strong Q2 results, with net income doubling and operating revenue jumping 42% from the same period last year.

- Technical risks are clear and present, though, and I highlight key price levels to watch ahead of earnings next month.

pidjoe

The Utilities sector is the worst-performing area of the S&P 500 so far this year. The Utilities Sector ETF (XLU) is down more than 8% YTD, but this rate-sensitive niche has actually outperformed this month after enduring a drubbing a year ago when Treasury yields were also on the increase.

I have a buy rating on the sector’s biggest component – NextEra Energy (NYSE:NEE). I believe in the growth story and see its dividend strength as quite appealing. There are both fundamental and technical risks to consider, however.

Utilities Showing Some Recent Relative Strength Amid a Risk-Off Trading Environment

According to Bank of America Global Research, NEE consists of two main business operating segments: the Florida regulated utilities (primarily Florida Power & Light) and NextEra Energy Resources, a deregulated generator of predominantly wind, natural gas, nuclear, and solar powered assets in North America. It also holds an ownership position in the YieldCo NextEra Energy Partners (NEP). Other businesses include gas pipelines, electric transmission, and other energy businesses.

The Florida-based $137 billion market cap Electric Utilities industry company within the Utilities sector trades at a modest 16.7 trailing 12-month GAAP price-to-earnings ratio and pays an above-market 2.75% dividend yield. Ahead of earnings next month, shares feature a muted 21% implied volatility percentage while NEE’s short interest is low at just 1.2%.

Back in July, NextEra reported strong Q2 results, driven by continued expansion in its renewable energy unit. Net income doubled on a year-on-year basis to $2.8 billion, with operating revenue jumping 42% from the same period in 2022. Overall, non-GAAP EPS verified at $0.88, a 6-cent beat, while top-line results also handily bettered the Wall Street consensus.

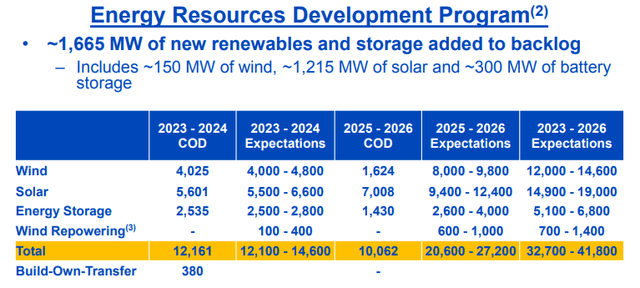

NextEra Energy Resources, its renewable energy unit, saw its net income surge to $1.46 billion, primarily due to adding about 1.7 GW of new renewables and storage projects in the quarter. Renewables and storage backlog (pictured below) reached nearly 20 GW. Moreover, growth in the Florida market, as seen in Florida Power & Light’s (FPL) $1.15 reported earnings was driven in part by robust new solar power installations, though regulations in that market are a key risk. These were impressive results, in my view, and the stock has only gotten much less expensive since mid-July.

“Energy Resources now has roughly 20 GW in its backlog”

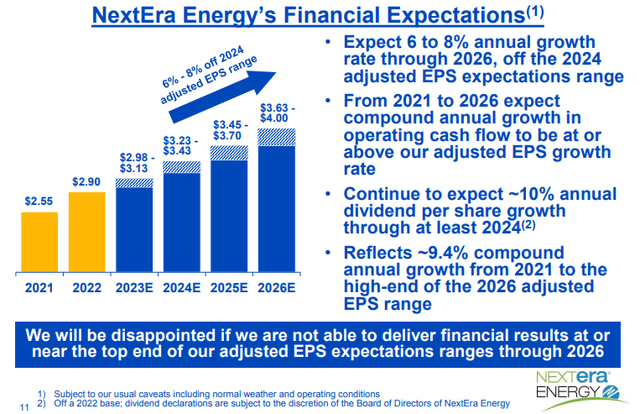

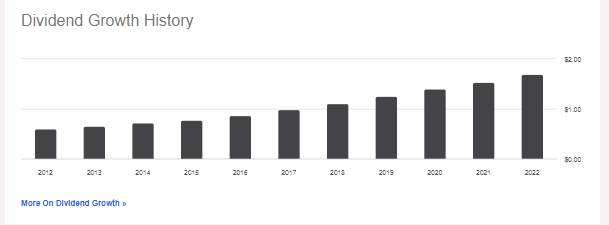

Looking ahead, the management team reiterated its guidance for FY 2023 adjusted EPS of $2.98 to $3.13 and FY 2024 adjusted EPS of $3.23 to $3.43, with plans to grow dividends per share at about a 10% annual rate through at least 2024 based on its last year’s performance. The company expects to continue growing EPS by 6% to 8% in 2025 and 2026, and that might be conservative.

On the conference call, the team expressed keen interest in the green hydrogen market and advocated for favorable regulations. Hydrogen-related renewables post-2026 will play a vital role in their future plans. The company also discussed progress in selling the Texas Natural Gas Pipeline portfolio. I see that as a positive given the value of transmission assets in that region.

“NEE remains well positioned to continue strong adjusted earnings and dividends per share growth”

NEE: A Strong Dividend Aristocrat

Seeking Alpha

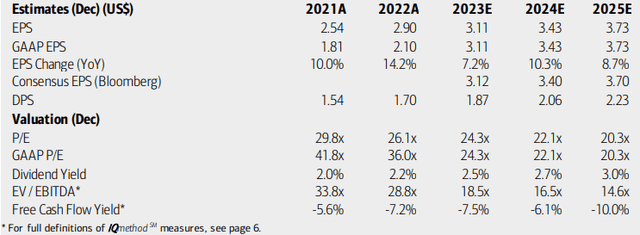

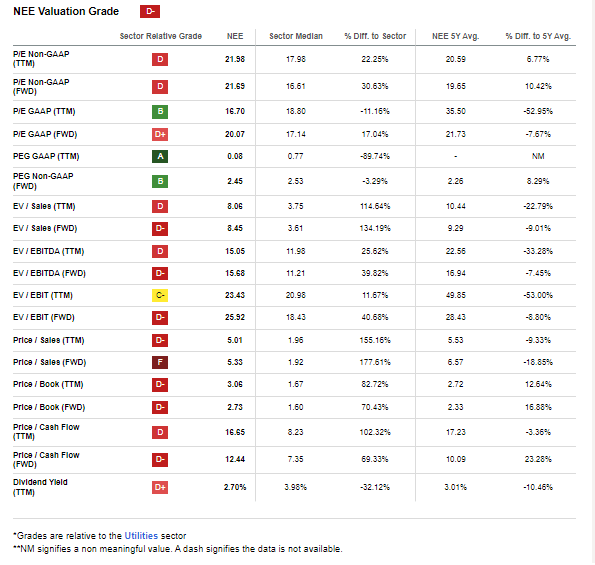

On valuation, analysts at BofA see earnings rising at a steady clip in the out year, all the way through 2025. The Bloomberg consensus forecast is about on par with what BofA projects, and the latest check on 2024 estimates reveals $3.41 of per-share profits. With strong dividend growth anticipated and valuation multiples that are currently in the low 20s, there are mixed signals. Moreover, NEE has an EV/EBITDA ratio that is slightly above the average on the S&P 500.

NextEra: Earnings, Valuation, Dividend Yield Forecasts

It’s rare to see such strong EPS growth in the stable Utilities space. The forward PEG ratio is about 2.5 while NEE’s forward operating PE is at a discount to its 5-year average. If we apply a 20 P/E on the ’24 EPS figure, then the stock should be $74, making it a modest buy today. Given strong dividend trends and an insulated and commanding presence in its sector, a further valuation premium is deserved.

NEE: High & Steady Growth Warrants a Premium Valuation

Seeking Alpha

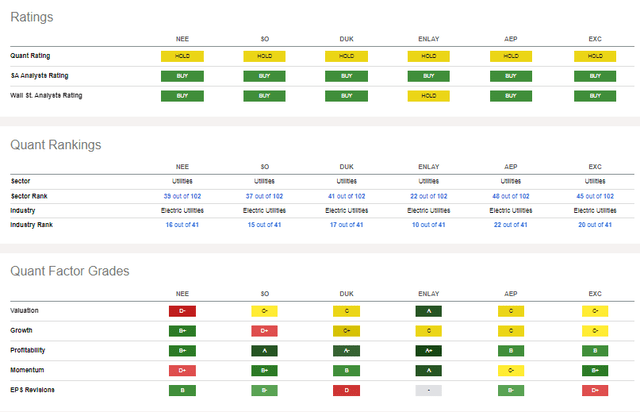

Compared to its peers, NEE features the best growth and strong profitability, but the valuation remains high. But after a more than 25% fall from its late 2021 peak, I assert that the higher interest rate regime has been discounted. Unfortunately, NEE’s technical momentum is poor right now (I will detail that later) but EPS revisions are actually on the good side.

Competitor Analysis

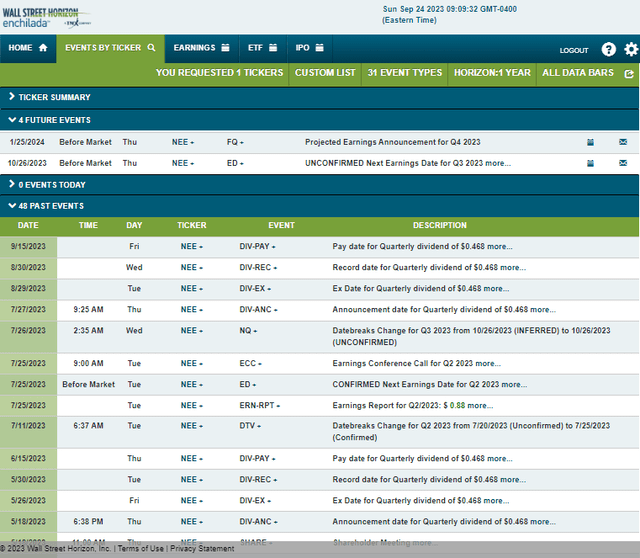

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q3 2023 earnings date of Thursday, October 26 BMO. No other volatility catalysts are seen in the near term.

Corporate Event Risk Calendar

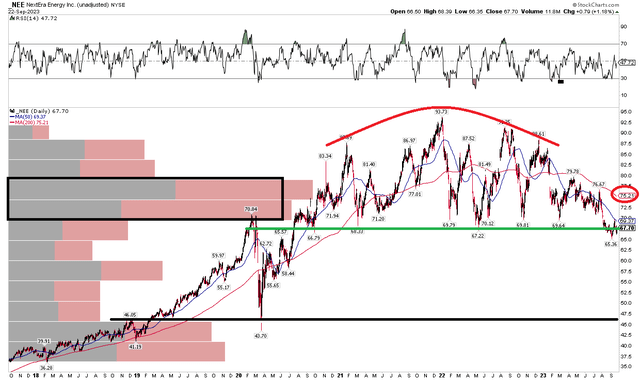

The Technical Take

With a solid growth-adjusted valuation in my opinion and a robust dividend, the technical picture is precarious. Notice in the chart below that shares hover at a critical level. The $67 to 71 range has been a key point of polarity – a battleground between the bulls and bears. With shares probing under the low end of the range lately, I see enhanced risks of a bearish breakdown. If the mid-$60s should fail as support, then a bearish measured move price objective to the upper $30s would be in play. I see that as an aberration, though.

More likely, support is in the mid-$40s (the late 2018 peak and March 2020 nadir). What’s problematic here is that there is quite the air pocket of volume from the mid $60s down to the mid-$40s, as seen in the volume by price indicator on the left side of the chart. After putting in a bearish rounded top pattern, the bears are in control – further evidenced by the falling long-term 200-day moving average. I would like to see shares climb back above the 200dma as well as the late July peak just shy of $77.

Overall, long here with a stop under the September look could work, but the technical momentum and trend situation favor the bears.

NEE: Bearish Topping Pattern, Mid-$60s Key Support

The Bottom Line

I have a buy rating on NextEra. This is a tough one since the valuation and growth narratives are compelling to me, but the chart is risky. I will be watching NEE into and through the upcoming earnings report while keeping my eye on crucial technical support currently in play.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.