Summary:

- Nvidia Corporation has been a prime beneficiary of the rise of generative AI, with its stock soaring in hyperbolic fashion.

- The company delivered impressive results in its most recent quarter, with revenue growth of 101% YoY and net income growth of over 200% YoY.

- Some may be calling the stock a bubble, but this is looking as significant as when iPhones were released and disrupted Blackberry’s business.

- The stock is offering considerable upside against ambitious targets – I am upgrading Nvidia Corporation stock to buy.

Antonio Bordunovi

Nvidia Corporation (NASDAQ:NVDA) is having an “Apple moment.” It has taken me longer than I’d like to admit, but it is finally clear to me why the stock has soared the way it has. The company has been a prime beneficiary from the rise of generative AI to a far greater extent than even close peers. It is now clear that the company has been preparing for such a moment, and it may not be so easy for competitors to catch up. Meanwhile, the company may benefit from its effective first mover advantage into generative AI as its codebase and community grow into real barriers to entry.

This is a stock that deserves to trade at a premium valuation even after growth slows down, not too dissimilar with that seen at Apple (AAPL). I am upgrading the stock from hold to buy, but caution that the elevated valuation most certainly guarantees volatile trading ahead.

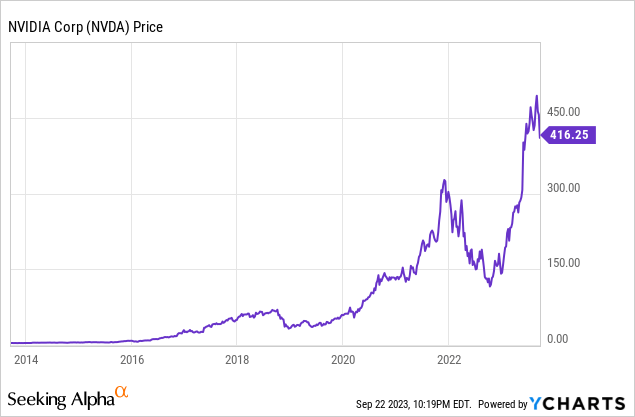

NVDA Stock Price

NVDA was already one of the top performers of the decade heading into this year, but the stock proceeded to trade up in hyperbolic fashion anyway. While I was initially a skeptic, I am finally of the opinion that this rally was well deserved and, more importantly, has more legs to run. Better late than never.

I last covered NVDA in July, where I rated the stock a hold based on my view that consensus estimates were aggressive and valuations were stretched. The stock has fallen a bit since then, but I now have a differing view that consensus estimates are not so outlandish and my assumed terminal valuations were too conservative.

NVDA Stock Key Metrics

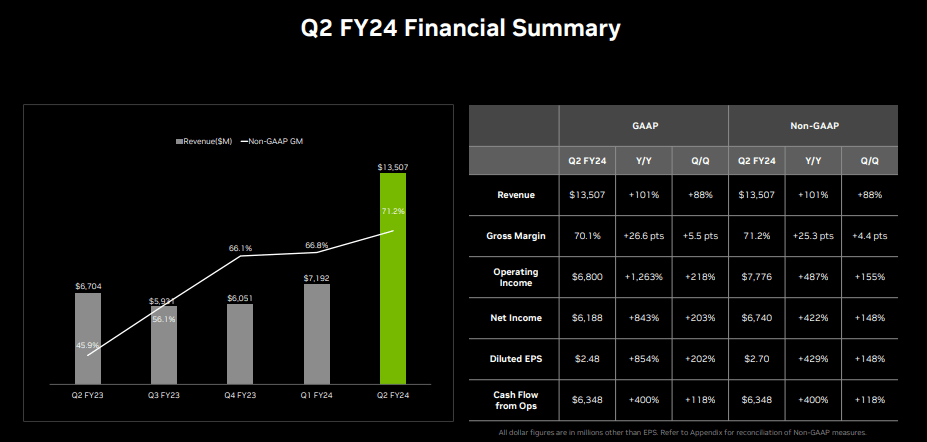

In its most recent quarter, NVDA delivered incredible results. Last quarter featured the “guidance of the century,” so the fact that the company delivered $13.5 billion in revenue, representing 101% YoY growth and surpassing guidance for $11 billion in revenue, is just incredible. NVDA also saw net income grow even faster at over 200% YoY.

FY24 Q2 Presentation

These results are highly atypical, given that most peers are still seeing impact from the tough macro environment. NVDA was able to exert some pricing power with gross margin expanding to 70.1%, up from 59.2% in FY23 and 66.8% in FY22.

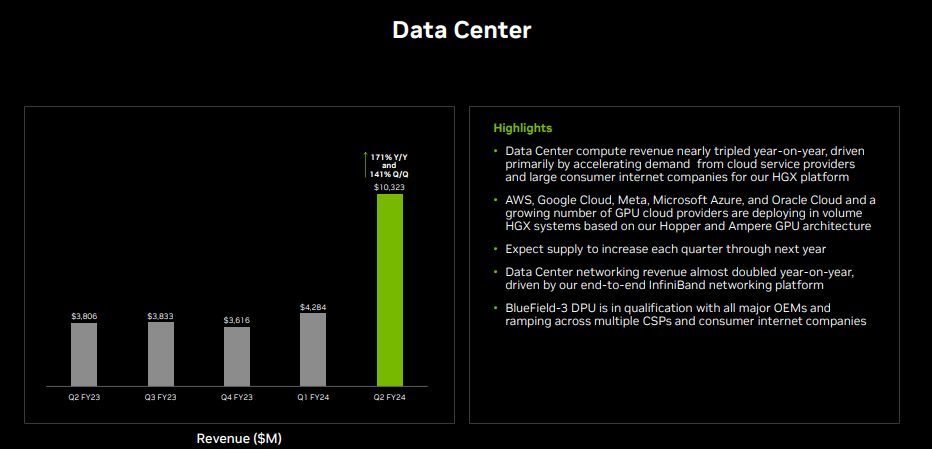

As expected, NVDA saw the strong overall results completely due to unusual strength in data center revenues as customers rushed to prepare for the generative AI wave. NVDA delivered 171% YoY growth in data center revenues, with the cloud providers being the largest customers. Even if it may take time for companies to fully understand how to utilize generative AI for their own use cases, it is clear that the cloud providers are preparing ahead of such demand. Management noted that 50% of their revenues are coming from these cloud providers, up from 40% in the sequential quarter.

FY24 Q2 Presentation

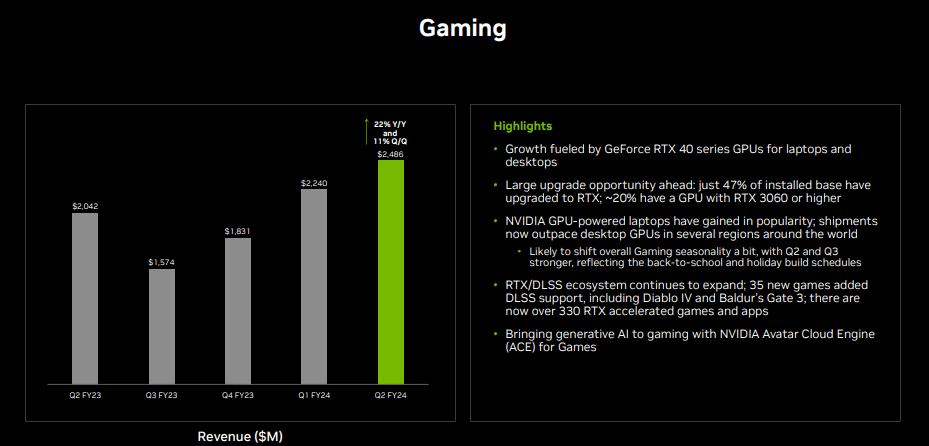

It is worth noting that accounts receivable jumped $3 billion QoQ as NVDA materially increased its backlog. NVDA also saw some strength in gaming revenues, which grew 22% YoY, but that was probably more due to the fact that the company is lapping easy comparables, as gaming revenues declined 33% in the same quarter last year.

FY24 Q2 Presentation

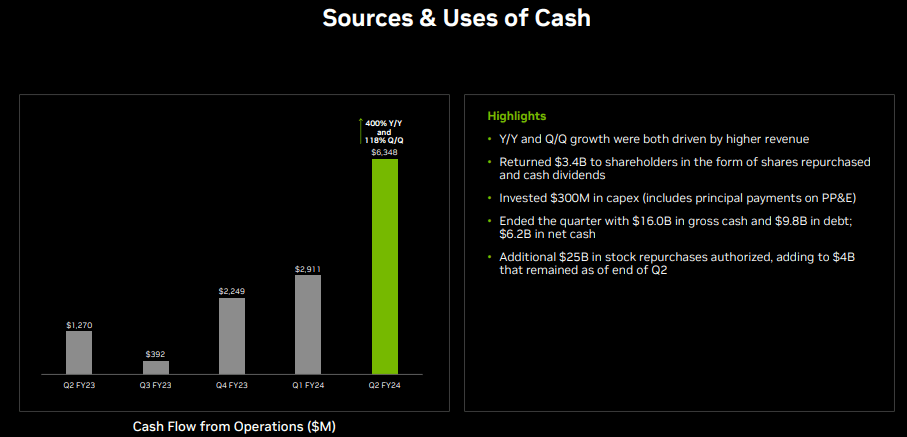

NVDA generated over $6 billion in cash from operations and spent $3.4 billion on share repurchases and dividends. I have been previously critical of the decision to repurchase shares, but given the dramatic shift in the story, repurchases make sense as management is likely quite invested in continuing that transformation.

FY24 Q2 Presentation

NVDA has authorized an additional $25 billion in share repurchases. The setup here is not quite the same as AAPL back in 2011, when AAPL had a large net cash position. That said, NVDA has developed into a cash cow with strong barriers to entry, which may help drive strong growth in the coming years, at which point these repurchases look far more reasonable in terms of valuation.

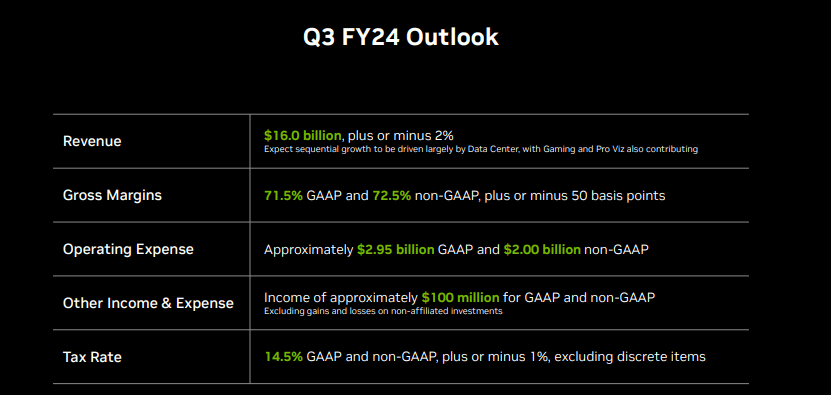

Looking ahead, management has guided towards 170% YoY revenue growth to $16 billion with continued operating leverage.

FY24 Q2 Presentation

On the conference call, management outlined expectations for supply to increase in each subsequent quarter – that should help with the accounts receivable component. There has been speculation that increasing geopolitical tensions between the U.S. and China may negatively impact NVDA’s growth prospects (which is especially important given the valuation). That said, management once again reiterated their view that additional export restrictions would be unlikely to have material impact on their results. At this point, I am interpreting this verbiage to imply that the generative AI opportunity is just so large even excluding that market.

Is NVDA Stock A Buy, Sell, or Hold?

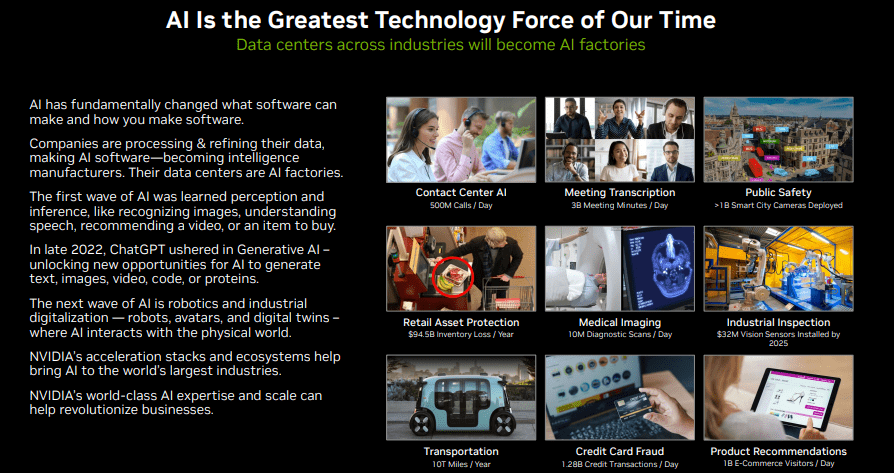

Management once again explained that there is roughly $1 trillion worth of data centers installed in the world, which are in the process of transitioning “into accelerated computing and generative AI.” This is a hardware issue – if companies want to use generative AI in an optimal manner, then they will have to use NVDA chips. AI, while hyped to the max, has the potential to fundamentally change industries across the world.

FY24 Q2 Presentation

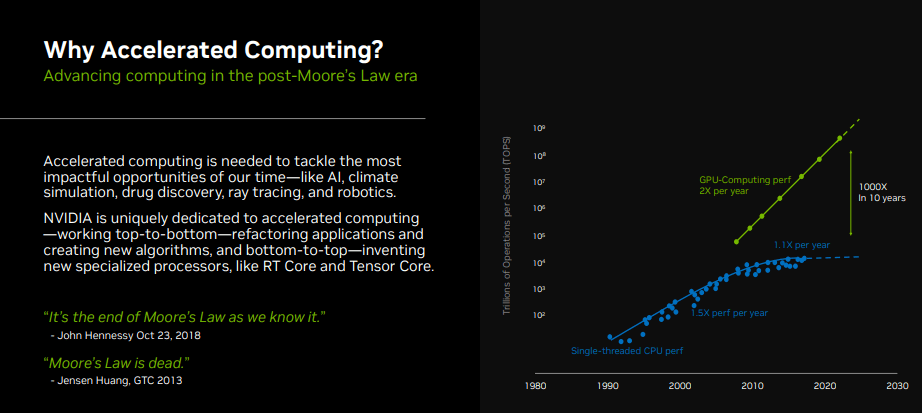

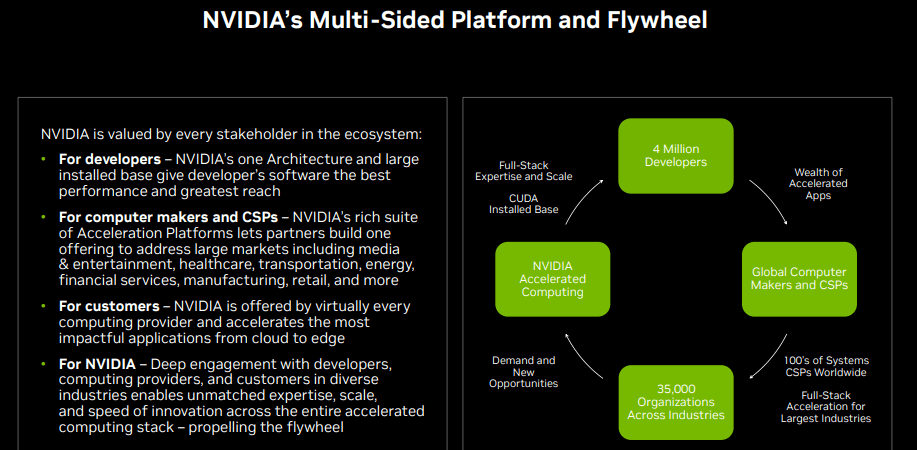

Those tailwinds are crucial for NVDA because the company specializes in accelerated computing. Prior to accelerated computing, “Moore’s Law” stipulated that the speed and capability of computers can double every two years. That law has fizzled out as semiconductor companies pushed the physical limits of what can be placed on each chip. But accelerated computing aims to supplement hardware chips with software to boost performance, with the most famous example being through the use of parallelization (multi-tasking for computers).

FY24 Q2 Presentation

NVDA is the most renowned company in the accelerated computing field, but that gap was simply not as important in the past due to there not being as urgent of a need for such intense processing. Generative AI has changed the narrative and suddenly NVDA has positioned itself as being in the right place, at the right time. At a high level, NVDA’s competitive advantage can be described as follows. Not only does it possess a large lead in terms of hardware capabilities, but its historical status as the leader in accelerated computing has earned it the largest developer ecosystem in the space. Think about it from the customer’s point of view – if they want implement generative AI and accelerated computing for their use cases, then they will have to employ engineers to do this – the vast majority of these engineers would have proficiency in NVDA’s CUDA architecture.

FY24 Q2 Presentation

This means that even if competitors like Advanced Micro Devices, Inc. (AMD) catch up from a hardware point of view, customers are not going to be so keen on revamping their entire code base built on NVDA’s software architecture just to save a few bucks (refactoring code at such scale is notoriously excruciating if not impossible). The longer it takes for competitors to catch up from a hardware and software point of view, NVDA is able to entrench itself deeper and deeper into its customers’ software stacks. While this space has historically seen NVDA and AMD be able to both operate successfully in a large market, this is increasingly looking like a “winner takes most” market. We are witnessing something similar to what Apple did to Blackberry when it released its iPhone – except it may be even more dramatic, given that the switching costs are even higher.

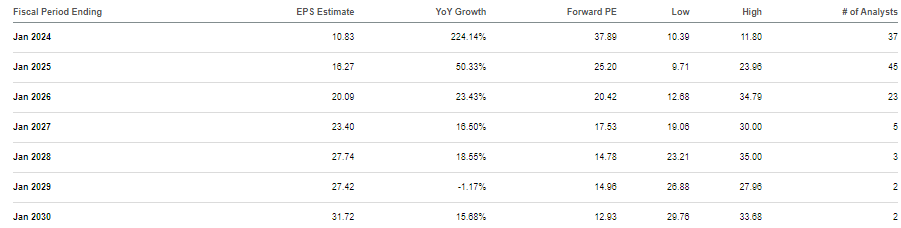

With that context in mind, we can now turn our attention to the valuation. NVDA recently traded hands at a blistering 37x earnings.

Seeking Alpha

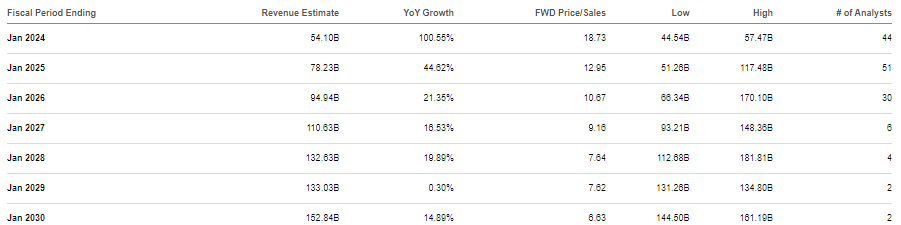

The rich valuation is even more apparent when looking at revenue multiples. NVDA was trading at just under 20x sales – an incredible multiple though its valuation is expected to come down rapidly due to torrid growth.

Seeking Alpha

It’s quite possible that NVDA ends up disappointing on consensus estimates – that wouldn’t be a crazy result given the bubbly characteristics of the generative AI hype. But the key idea here is that NVDA is likely to retain a premium valuation even as growth slows, similar to what has happened at AAPL. Assuming NVDA trades at 30x earnings in 2030, the stock might trade at $951 per share by then, implying around 14% annualized returns through then. Throw in the earnings yield and that return potential may hover around 16% to 17%. Perhaps the growth assumptions are too ambitious for many investors’ appetites, which may mean that this falls into the “too hard” pile due to valuation. But NVDA is looking more like a conviction long (conviction being defined by the prevalence of ownership) than a conviction short, and this story may become more apparent as the company continues to execute against the generative AI opportunity.

What are the key risks? I see two clear risks here. First, consensus estimates are possibly, if not likely, too aggressive. NVDA stock has soared in part due to management having raised guidance several quarters in a row and in huge fashion. It is unclear if Wall Street will be so forgiving if the company ends up seeing more lumpy results. Another risk is if the quality thesis does not play out as expected. Perhaps AMD (or others) is able to create a formidable competitive product with lower switching costs than expected. In this case, I would expect NVDA to greatly underperform the broader market, as its terminal multiple is more likely to be closer to 15x than the 30x multiple assumed above. With the stock having already priced in many years of growth, NVDA must deliver against these expectations to justify its valuation, let alone beat the market. We mustn’t forget that the macro environment remains difficult, which may hold back growth rates even in spite of generative AI interest.

I am upgrading NVDA from hold to buy given my view that the company is benefitting from competitive barriers that will be difficult to overcome, making it possible for the company to perform strongly against already-high expectations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!