Summary:

- Disney stock is substantially underperforming the broader market this year due to fears regarding the ability of the company to successfully execute its transformation.

- Recent trends in financial performance suggest that the management is on the right path to making a stellar comeback for this iconic company.

- My valuation analysis suggests a massive upside potential for the stock price.

Drew Angerer

Investment thesis

Disney (NYSE:DIS) stock experiences hard times while the company undergoes inevitable transformation initiated by Bob Iger, the company’s iconic CEO. My previous bullish article about the stock did not work well because the current macroeconomic uncertainty does not help to execute the company’s transformation plans rapidly. However, despite the harsh environment, I have seen many positive trends in the company’s financial performance since the transformation commenced. I think that the management will be able to achieve the critical strategic goals of the turnaround, which will return the company to its stellar profitability path in the foreseeable future. While all major transformations are very risky ventures, the wide variety of offerings to customers, together with massive brand recognition, makes transformation risks much lower for a company like Disney. My valuation analysis suggests the stock is massively undervalued. All in all, I reiterate the stock a “Strong Buy” rating.

Recent developments

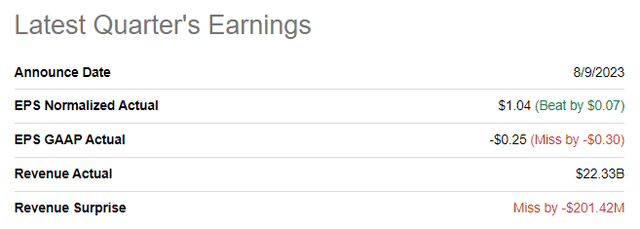

Disney reported its latest quarter’s earnings on August 9, when the company missed consensus estimates. Revenue grew 3.8% YoY, while the adjusted EPS shrank slightly. The management’s cost-efficiency initiatives started working as the operating margin expanded YoY from 11.4% to 12.2%.

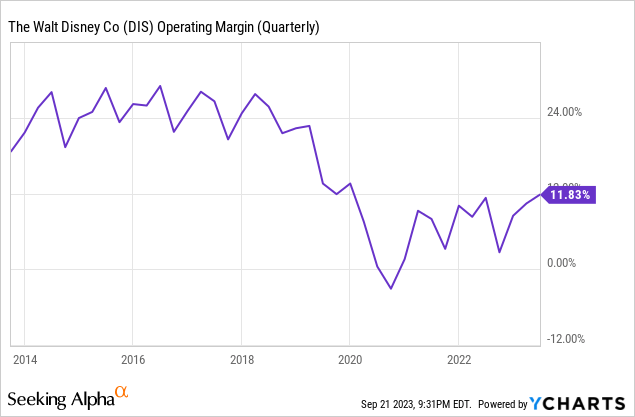

I will not go into much detail regarding the latest earnings performance because I think that other authors have already provided readers with strong coverage of the latest figures. Instead, I would like to focus on the company’s transformation, which was announced in February 2023. I think that Disney already demonstrated the first signs that the right direction was selected despite only two quarters having passed since the transformation commenced. The operating margin returned to double digits in the last two quarters and is heading toward the pre-pandemic level. As you can see below, there are still many jobs to be done to return to the highest levels of the past decade, but the transformation has just started recently, and there is still room for operating margin expansion.

During the latest earnings call, the management noted that they are on track to exceed the initial $5.5 billion goal in savings. While the operating margin is still much lower than five years ago, I am highly convinced that the restructuring plan will let the company substantially expand profitability. Plans look very sound to me, which include pursuing only profitable content, potential partnerships for critical assets like ESPN, and possible divestiture of unprofitable units. Since the restructuring plan commenced, the management has already demonstrated that they are ready to make bold and unpopular decisions to improve the company’s operating efficiency. I like the management’s strong commitment to improving the company’s profitability.

The company’s streaming DTC business looks the most promising to me, but it has been profitable since it commenced. Since Bob Iger returned to the company, the strategic approach to DTC has changed, and now subscribers’ growth at all costs is not an option anymore. Despite losing many subscribers in the latest quarter due to price increases, the business unit’s profitability has improved. According to the latest earnings call, DTC’s operating income improved by almost $1 billion in three quarters. The management reiterated its goal to achieve DTC profitability by the end of fiscal 2024. I support the management’s view that growth at all costs is not sustainable, and it is better to focus on quality content, which will eventually attract more subscribers who will be ready to pay a premium for superior content.

The upcoming quarter’s earnings are scheduled to be released on November 9. Quarterly revenue is expected by consensus at $21.4 billion, indicating a 6% YoY growth. The adjusted EPS is expected to expand notably from $0.30 to $0.76.

Overall, I am optimistic about the company’s future prospects. For sure, the company’s financial performance now is much worse than five years ago, but this occurred due to the combination of weak management before Bob Iger and the massive disruption to operations due to the pandemic. But the pandemic is in the past, and the management is moving fast to fix the mistakes of the past leadership, which means Disney is highly likely to return to its stellar profitability path. The company owns dominant networks like ESPN and Disney Channel and has an extensive portfolio of offerings to entertain its customers. This diversification, together with the company’s massive brand strength, are great assets to help the management in its bold plans.

Valuation update

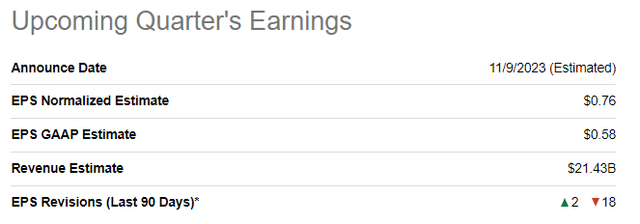

The stock is down about 9% year-to-date, significantly underperforming the broader U.S. market. Seeking Alpha Quant assigns the stock a low “D” valuation grade. Multiples are high compared to the sector median but way lower than historical averages. When discussing companies like Disney with a massive brand, comparison with historical averages is more critical. That said, from the multiples perspective, I consider DIS to be substantially undervalued.

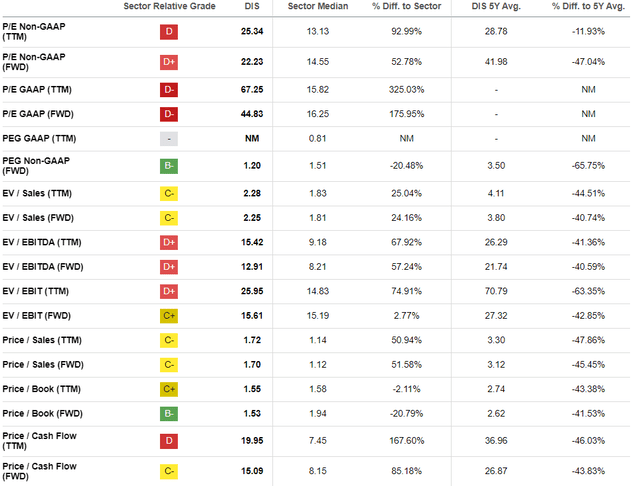

I will use the discounted cash flow [DCF] simulation to get more conviction. I use a 10% WACC for discounting. The TTM FCF margin is 5%, and I use it for my base year, assuming further yearly 100 basis points expansion. Revenue consensus estimates project a 4.9% CAGR up to 2030, and I incorporate a 5% CAGR for the years beyond.

According to my DCF simulation, the business’s fair value is $217 billion, which means the stock has about 44% upside potential. That said, the stock’s fair price is about $120.

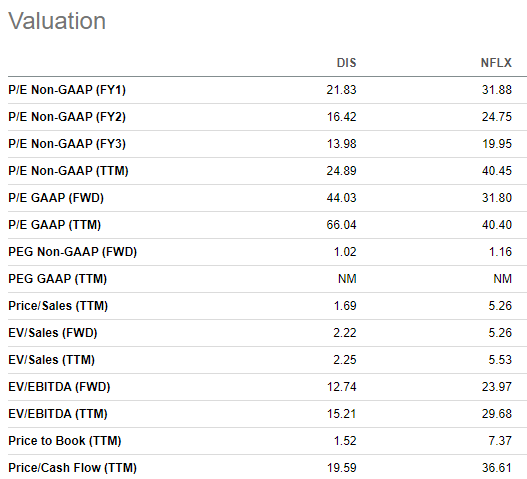

In my opinion, it is also crucial to underline that Disney’s valuation looks more attractive than its closest competitor’s. While Netflix (NFLX) competes with Disney only in the streaming business, I think it would be fair to look at how the multiples of these two giants compare to each other. Many people might say that Netflix’s substantial premium compared to Disney is fair, given the high profitability of its business, and I am not arguing. However, Disney has a much more diversified entertainment business, which is also a massive competitive advantage. I am not saying that Netflix is overvalued. What I am saying is that this comparison underlines the massive upside potential for Disney’s stock.

Seeking Alpha

Risks to consider

Being an entertainment company means that Disney is vulnerable to economic cycles. Last year’s record-high inflation and the current environment of high-interest rates drained consumers’ pockets, meaning people have less money on discretionary spending. The latest inflation report suggests that the Fed still has room to continue monetary policy tightening, and Jerome Powell’s recent press conference suggests that rates will remain high in the near future. The longer the tight monetary policy is implemented, the more pressure it will have on consumer spending.

The fact that Bob Iger extended his contract with Disney for two more years is good, on the one hand. But for me, it also indicates that the deepness of the company’s struggles was initially underestimated when the iconic CEO returned back in 2022. The extension of Bob Iger’s contract also could mean that the board does not see strong candidates to be the next CEO. The company’s previous history of CEO selection was not perfect, softly speaking. That said, there is the risk that the CEO transition in 2026 might not be smooth again.

Bottom line

To conclude, Disney’s stock is a “Strong Buy”. While the market looks pessimistic about the pace of transformation execution, I see several positive trends in the company’s financial performance in recent quarters. I like the management’s strong commitment and bold decisions to improve the company’s profitability. The company’s vast portfolio of entertainment products and services, together with its strong brand, are great assets that will be a big support to finalizing the transformation successfully. The stock is massively undervalued, and the upside potential outweighs all the risks and uncertainties.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.