Summary:

- Mastercard operates a duopoly alongside Visa in the payment processing industry.

- I expect the company to benefit from the continued shift from cash to card payments, particularly in emerging markets.

- Mastercard’s partnerships with major banks position it to dominate the competitive market and continue growing.

- My 10-year DCF implies a value per share of $429, translating to a 7% return from the current price.

jbk_photography

Investment Thesis

Mastercard (NYSE:MA) operates one of the best businesses in the world. The company is a prime beneficiary of something that people will always do: spend money. MA is the world’s second-largest payment processor after Visa. Despite growing in the double digits for the past five years (excluding 2020 due to COVID-19), I believe the firm can still deliver high single-digit growth rates, driven by a secular shift to electronic payments, higher spending volume, and increased credit card penetration. My valuation implies a value per share of $433, which translates into a 7% upside from the current price of $402.

In 2022, cash transactions totaled more than $7 trillion. This means the adoption of cards is still ongoing and perhaps in the early stages, especially in emerging markets. In India, credit card transactions are expected to reach 46.5 trillion rupees, up from 14.3 trillion in 2023 (a 225% increase). There were 25.85 billion payment cards in circulation globally in 2022, and that number is expected to reach 28.44 billion in 2027. Although Mastercard operates in a competitive market, the company won’t be able to keep all this growth to itself. I believe it should be a prime beneficiary due to its partnerships with some of the major banks in the world, enabling a leading position in the industry.

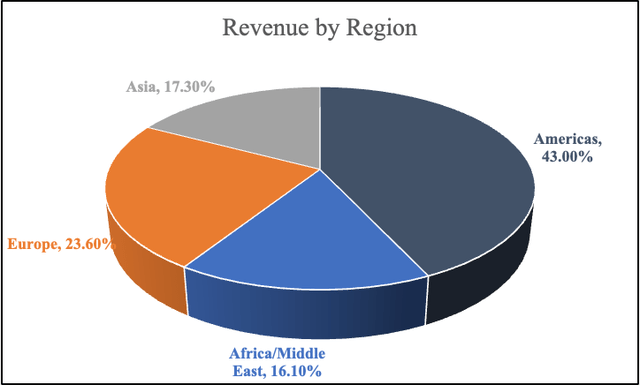

I believe Mastercard‘s exposure to emerging markets such as Africa and the Middle East won’t only boost future earnings power, but it can also serve as a hedge if growth in developed regions slows down. Mastercard’s revenue increased by ~4% in Africa and the Middle East in 2022, compared to a decline in other regions such as Asia and Europe.

Company Description

Mastercard Incorporated is a leading global payment provider. Through its network, Mastercard provides customers such as consumers, financial institutions, merchants, and others with a form of electronic payment that enables an efficient and easier way of sending and receiving money. The company is able to make more than $22 billion in net sales (2022) by charging customers a fee to use their network or through its value-added services solutions, including data analytics, consulting, loyalty and rewards programs, and more. MA operates under three brands: Mastercard, Maestro, and Cirrus.

With over $8 trillion in transactions in 2022 and operations in over 200 countries with over 150 currencies, the company’s business is very hard to replicate. The company mainly competes with its peer Visa (V), which is the largest payment processing company in the world. However, MA has been able to grow revenue and EPS at a much faster pace than Visa in the past seven years. 67% of revenue is derived from outside of the United States.

Created by the author

Valuation

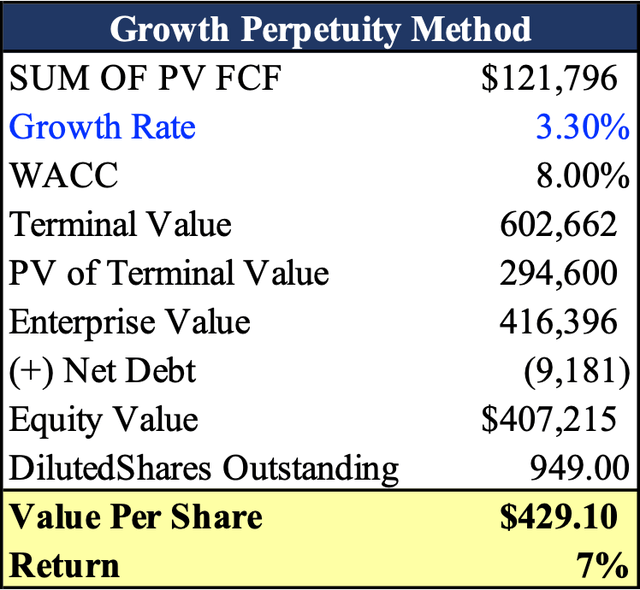

I used discounted cash flow to value Mastercard. My assumptions are as follows: net revenues will grow at a CAGR of 10% over the next ten years, driven mainly by the continued shift from cash to cards and increased consumer spending volume. I believe this growth is achievable because cash is still widely used as the main payment method in many parts of the globe.

I used a terminal growth rate of 3.3%. My growth rate is higher than the GDP in most developed countries because Mastercard is also exposed to emerging markets. Using a WACC of 8.00%, I discounted the future cash flows and terminal value back into the present. I arrived at an equity value of $407.2 billion. My fair value per share is $429.10, which equates to a 7% upside from the current price of $402.

I assign a buy on MA because 7% is attractive when it comes to a high-quality business like Mastercard. It’s highly unlikely for the business to trade at a 20% or 30% discount because investors are willing to pay a premium to own such an exceptional company. Mastercard does trade at a premium when compared to Visa because they have been able to grow revenue and EPS (driven by aggressive buybacks) at a faster rate.

Created by the author

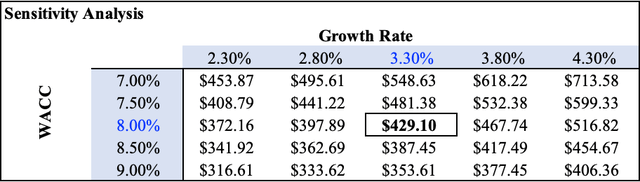

Below is a sensitivity Analysis, illustrating how a different growth rate and WACC affect the value per share.

Created by the author

Recent Developments

MA shares have risen by 16% YTD, compared to 15% of the S&P 500 (SPY) at the time of this writing. The company reported second-quarter earnings on July 27th, with an ADJ EPS of $2.89 (a beat by $0.06) and a revenue of $6.27 billion (a beat by $96 million). Cross-border volume has been a key driver for Mastercard as travel has normalized since the coronavirus decline. Despite adjusted operating expenses increasing by 12%, the company’s ADJ operating margin was 58.6%, up from 57.9% a year earlier. Net income increased by 10%, and shares outstanding declined by 3%.

Mitigants/Risks

There are three main risks that I believe are associated with Mastercard: regulations, data breaches, and a slowdown in consumer spending. If I had to pick, regulations are the bigger risk when it comes to MA because, along with its peer Visa, MA operates as a duopoly in payment processing. If a particular government were to pass legislation to limit its reach and give merchants a broader choice when choosing other payment processing providers, that could hurt the company.

Mastercard is trusted by billions of people, which means it handles a lot of data, and in the essence of a breach, the trust between the consumer and MA can deteriorate, or the company can even get sued and have to pay damages. A slowdown in consumer spending could also hurt the company’s top line, considering MA mostly thrives on consumer spending.

Bottom Line

All in all, Mastercard operates a high-quality business, providing a service that is in high demand, low-cost to operate, and has substantial room for growth. I believe the company is well-positioned to benefit from the continued shift to electronic payments, underpinned by its leading positions in the industry. Using a 10-year DCF, I get a value per share of $429, which implies a 7% return from the time of this writing. Mastercard reported strong second-quarter earnings, beating bottom- and top-line estimates. There are risks to consider, just like with any other business, but for now, I assign a buy due to the market position and nice tailwinds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a qualified financial advisor or investing professional. My content and analysis are based on my opinion and are intended to be used and must be used for educational purposes only. No content or analysis constitutes or should be understood as constituting a recommendation to enter into any securities transactions or to engage in any investment strategy. It is very important to do your own analysis before making any investment based on your own personal circumstances. Readers should always seek the advice of a qualified professional before making any investment decision. Past performance is not indicative of future performance. A reader should not make personal financial, or investment decisions based solely upon this analysis.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.