Summary:

- We assess the key factors driving the persistent decline in the share price of Pfizer, one of the world’s leading biopharmaceutical companies.

- We think the stock deserves to trade at a much higher P/E multiple of 20x or more, given its healthy pipeline and industry-leading R&D capabilities.

- Based on our conservative annualized EPS target of $2.68 and a 20x P/E multiple, we expect Pfizer’s shares to outperform in the next 12 to 18 months.

- We initiate coverage of PFE with a “Strong Buy” rating.

Dan Kitwood

By now, investors should have become quite familiar with various commentaries criticising how the equity bull market has been lacking in breadth. While some investors may see this as a reason to stay on the sidelines, we prefer to stay invested in equities and to be more selective by looking for opportunities in value. The market’s recent obsession with a handful of big tech companies expanding into generative artificial intelligence has created opportunities for value investors to acquire undervalued and overlooked companies at attractive discounts.

In this article, we shall assess the key factors driving the persistent decline in the share price of Pfizer Inc. (NYSE:PFE), one of the world’s leading biopharmaceutical companies with cutting-edge research & development (R&D) capabilities and a market capitalization of above US$180 billion. We argue why the deep discount on Pfizer is unjustified, and how this presents a compelling opportunity to invest in the company’s healthy product pipeline, which should support above 15% return-on-equity (ROE) over the next couple of years.

Collapse In Revenue Not Indicative Of Trouble At Pfizer

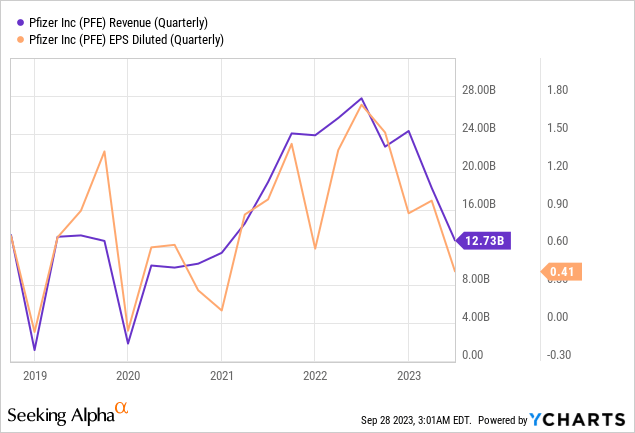

At first sight, Pfizer’s recent performance resembles that of a struggling company with revenues that have fallen off a cliff (Q2 2023 revenue down -53% from a year ago). Declining revenues are typically associated with companies that are rapidly losing market share to competition, or mature industries with saturated markets. However, neither of these conditions accurately depicts Pfizer’s current competitive landscape or the biopharmaceutical industry as a whole.

To explain why Pfizer’s revenues have collapsed, and why this is not indicative of trouble or mismanagement at Pfizer, we need to first appreciate the COVID pandemic’s outsized impact on the company.

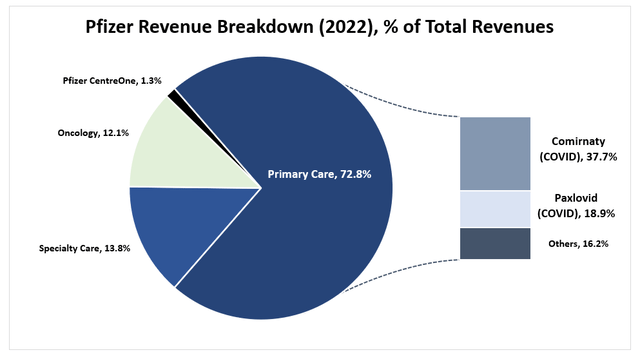

According to figures obtained from Pfizer’s 2022 Form 10-K (Note 17.C), COVID-related vaccine (Comirnaty) and treatment (Paxlovid) make up a combined 56% of the company’s total revenues in 2022.

Pfizer 2022 SEC Form 10-K, Stratos Capital Partners

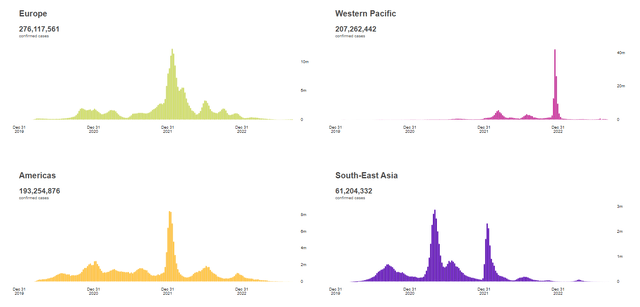

Given that COVID-19 infection rates have plummeted since the peak of the pandemic, it is no surprise that Pfizer’s COVID-related revenues have collapsed. As the accompanying chart shows, weekly cases of new COVID-19 infections across all major geographical regions tracked by the World Health Organization have dropped sharply in recent months.

World Health Organization COVID-19 Dashboard

This decline in demand for Comirnaty and Paxlovid as global inventories are being utilized more slowly than in 2022, pretty much explains the decline in Pfizer’s revenue. Unless there are reasons to expect another surge in infections, it is only reasonable that Pfizer’s current share price adequately reflects permanently lower COVID-related revenues going forward.

Pfizer At What Price?

Now that we have established the outsized impact of COVID-related revenues on Pfizer’s financial performance, we are in a better position to decide if Pfizer’s share price has been adequately discounted, or potentially over-discounted.

Firstly, we can assess Pfizer’s value through earnings multiples. Given that Pfizer’s earnings per share (EPS) and revenues have already fallen back to pre-COVID levels (see first chart), we can safely assume that P/E multiples based on the latest Q2 EPS would adequately reflect a deep discount from much lower earnings coming from COVID-related businesses.

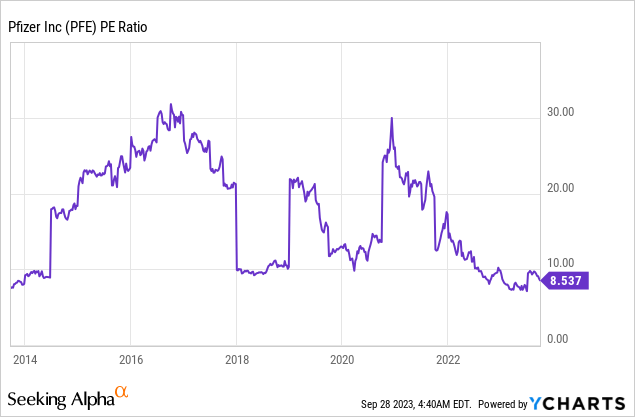

Based on Pfizer’s Q2 EPS of $0.67 ($2.68 annualized) and current share price of $32.10, we arrive at a P/E multiple of just 12x. Remember that this is a conservative valuation of Pfizer, assuming that COVID-related earnings will remain depressed for the foreseeable future. Compared to Pfizer’s P/E multiples over the last 10 years as shown in the chart below, our conservative P/E multiple of 12x suggests current pricing is extremely attractive and well below the historical average.

If we consider Pfizer’s balance sheet alone, the company is trading at an undemanding P/B multiple of 1.85x.

The management team at Pfizer also shared during its Q2 2023 earnings call transcript that non-COVID revenues are up 5% from a year ago and guided for 6% – 8% growth for the year. So in essence, Pfizer is still witnessing decent growth for its non-COVID business segments.

Pfizer’s Value Lies In Its Healthy Pipeline

Conservative investors would agree that we should value Pfizer’s business without COVID-related earnings due to the uncertainties associated with predicting future infections. Besides, we believe that Pfizer’s value today should be based on the company’s ability to continue to sustain its industry leadership in the R&D of new medicines and vaccines.

In this respect, Pfizer enjoys significant economies of scale and the company has continued to invest heavily in developing its R&D capabilities. According to Pfizer’s 2022 annual review, management shared that the research team has shortened the development timeline for new medicines and vaccines from nine years in 2019 to just five years by 2022. Pfizer has also improved the end-to-end success rate to 18%, which is nearly 10 times that of 2010. More importantly, Pfizer has managed to achieve a durable success rate of 60% on Phase 2 approvals for New Molecular Entities, compared to the industry median of just 37%.

Such performance not only demonstrates Pfizer’s ability to sustain its industry leadership in R&D but also highlights the reality that smaller pharmaceutical companies with limited R&D budgets are likely to struggle to catch up to Pfizer’s R&D capabilities.

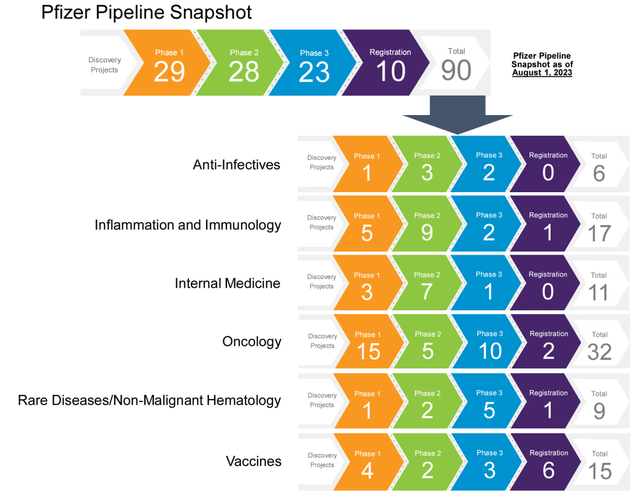

Pfizer’s scale also allows it to pursue a large number of discovery projects at a time. Unlike investing in smaller pharmaceutical companies, which often amounts to taking all-or-nothing bets on a single blockbuster drug, Pfizer’s ability to pursue a larger pipeline of discovery projects provides investors with the benefit of diversification. As the accompanying diagram shows, Pfizer continuously pursues a steady stream of development projects across various approval phases. The company also has the added option of acquiring small competitors at an early stage if it sees potential in a novel drug or vaccine.

www.pfizer.com/science/drug-product-pipeline, Stratos Capital Partners

Stable Track Record On ROE Suggests Pfizer Is Undervalued

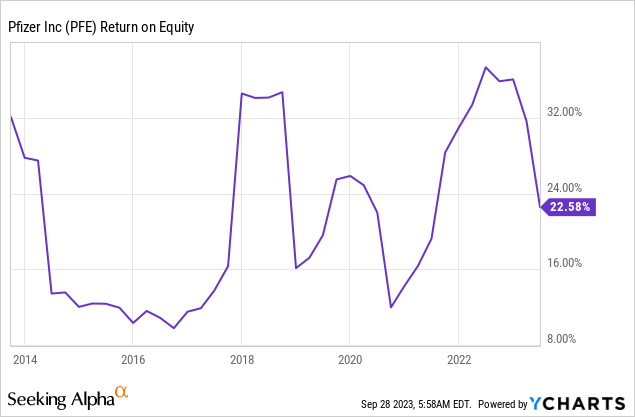

Finally, Pfizer’s historical track record of regularly producing above 15% ROEs would suggest the company is undervalued right now. As the chart below shows, apart from periods when Pfizer’s ROE fell under 15% due to large capital expenditures and acquisitions, the company has delivered spectacular ROEs for its shareholders over the years.

If we consider Pfizer’s track record of delivering above 15% ROEs, we think the stock deserves to trade at a much higher P/E multiple of 20x or more. A P/E multiple of 20x would translate into a potential share price of $53.60 based on our conservative annualized EPS of $2.68 EPS, or a potential share price upside of 67%.

In Conclusion

We believe that Pfizer’s long-term prospects are fundamentally robust despite a collapse in COVID-related revenues and that the company is currently undervalued. Based on our conservative annualized EPS target of $2.68 and a 20x P/E multiple, we expect Pfizer’s shares to outperform in the next 12 to 18 months, with the potential for a 67% gain.

Accordingly, we initiate coverage of PFE with a “Strong Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE, XLV, IHE, XPH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.