Summary:

- Thermo Fisher Scientific stands strong in the healthcare sector, prioritizing growth, innovation, and sustainability, justifying its valuation despite recent market challenges.

- TMO showcases resilience, leveraging long-term healthcare market trends, hinting at consistent annual growth potential despite the current stock price decline.

- TMO’s strategic strengths, including market localization in China and M&A proficiency, along with favorable valuation projections and a robust balance sheet, set the stage for continued outperformance.

marchmeena29

Introduction

It’s time to talk about Thermo Fisher Scientific (NYSE:TMO), a stock I haven’t covered since early July. Here’s a part of my takeaway I wrote back then:

TMO’s focus on secular growth factors, high-impact innovation, capital deployment, operational excellence, and ESG standards further reinforce its position as a leader in the healthcare sector.

While TMO’s valuation may not be cheap, its expected double-digit annual earnings growth justifies the price.

As an investor, I believe TMO has the potential for significant outperformance and would consider adding it to my portfolios if the price dips below $500.

Roughly three months later, the company is slightly below $500, which means I’ve started buying. For now, I have added the stock to a few portfolios that I advise that do not yet have significant healthcare exposure.

I’m also planning on adding TMO to my own portfolio as soon as I figure out how I’m going to structure my healthcare exposure. After all, I currently own Danaher (DHR), a company that is very similar to Thermo Fisher.

Having said that, it’s time for an update. Not only have three eventful months passed, but we’ve also gotten a lot of new data. For example, earlier this month, the company presented at the Morgan Stanley Annual Global Healthcare Conference, where it discussed ongoing headwinds pressuring its business, solutions to capture market share, and how it is positioning itself for a future with higher growth, and additional industry developments that put the company in a good spot.

Overall, I believe that the company keeps delivering what I expect from it, which is why I’m buying and averaging down as long as the market keeps offering opportunities.

So, let’s get to the details!

Between Headwinds And Tailwinds

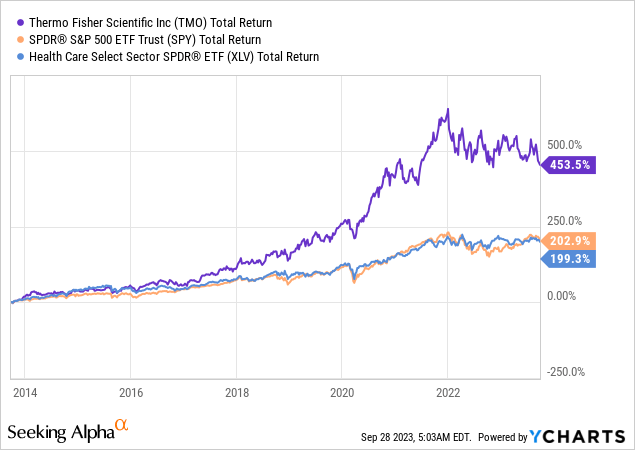

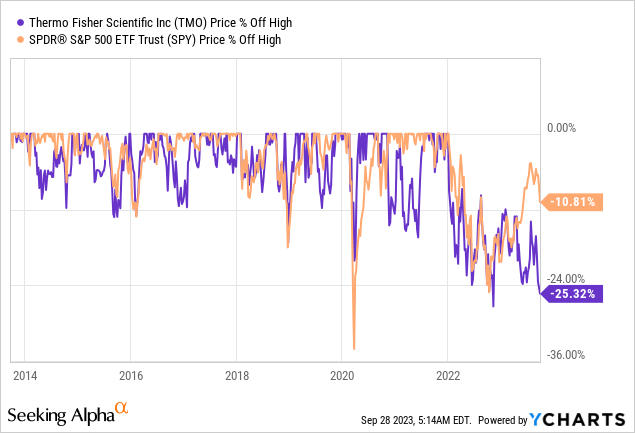

Over the past ten years, Thermo Fisher has returned more than 450%, outperforming the S&P 500 and SPDR Healthcare ETF (XLV) by a wide margin.

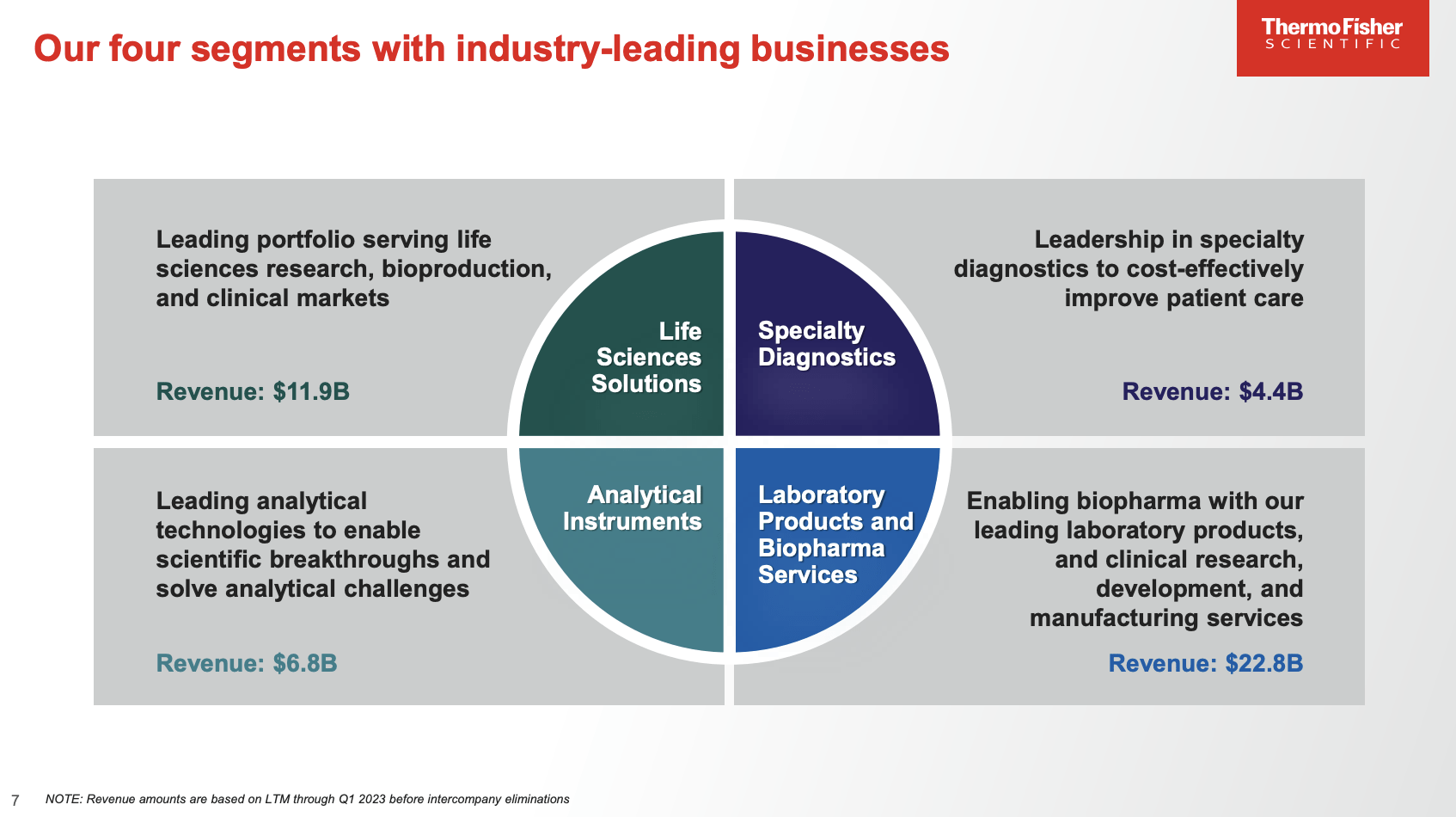

Outperformance was provided by a number of factors. One of them was (and still is) its fantastic business portfolio consisting of leading services and products that allow healthcare companies to conduct research and work on new healthcare solutions.

Thermo Fisher Scientific

Not only is this an anti-cyclical business, but it is also a business that comes with strong pricing power and secular tailwinds.

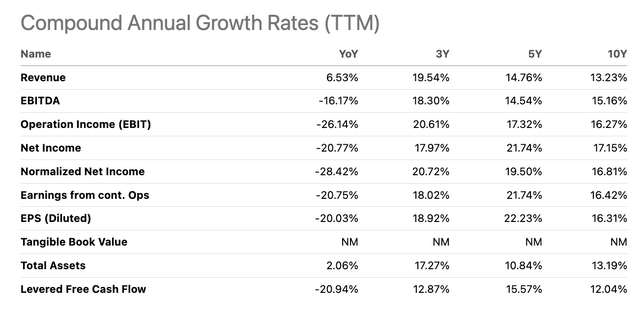

Over the past ten years, the company has compounded its revenue at 13.2% per year. Higher margins allowed the company to grow net income by 17.2% per year.

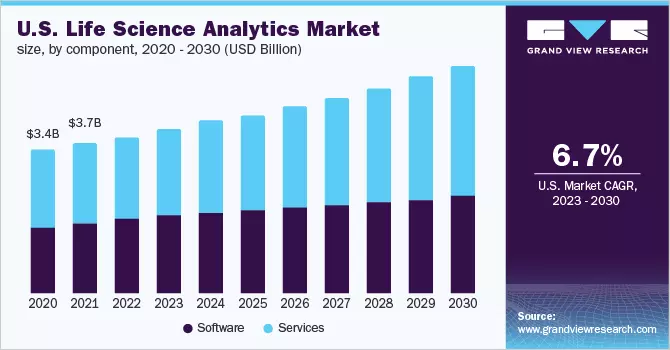

Grand View Research estimates that the U.S. Life Science Analytics market alone has the potential to keep growing at 6.7% per year between 2023 and 2030. An aging population, new healthcare risks, and new capabilities stimulate long-term growth in advanced healthcare solutions and biotech.

Grand View Research

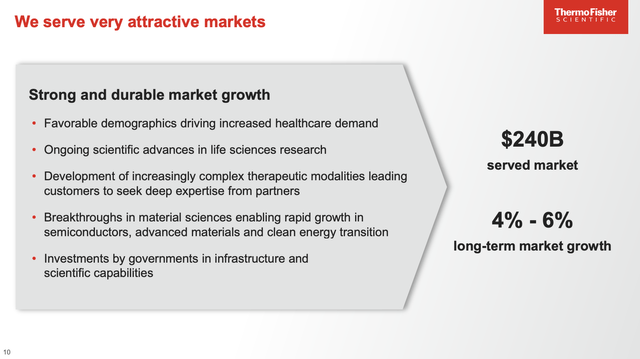

In July, I wrote that Thermo Fisher is serving a $240 billion market that is growing between 4% and 6% per year, driven by some of the aforementioned factors.

Thermo Fisher, however, is targeting 7% to 9% annual growth, using its strategy and efficient M&A synergies to gain market share in one of the most advanced industries in healthcare.

So far, so good.

Despite these good numbers, TMO shares have lost a quarter of their value, making this the worst (and longest) sell-off of the past ten years.

What we’re seeing is that the market is pricing in some weakness in what is still a strong market.

During this month’s annual Morgan Stanley Healthcare Conference, the company discussed industry dynamics. The company characterized the life science tools industry as one that thrives in periods of transition and change, which is true due to anti-cyclical demand.

It emphasized the unique opportunities that emerged during these dynamic times. Importantly, it touched on the significant impact of the COVID-19 pandemic, which influenced both the global economy and the life science sector. After all, it came with a wave of funding and a new focus on the importance of readiness to fight emerging healthcare risks.

With regard to the company’s current stock price decline, the company also acknowledged that the pandemic’s aftermath created challenges, such as higher interest rates and a less certain GDP growth environment, leading to customer caution.

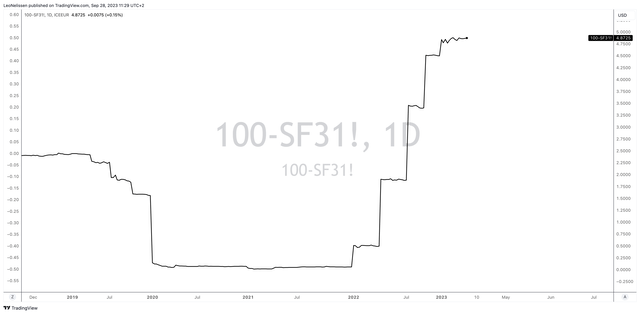

After all, R&D is highly capital-intensive. There’s a huge difference between funding research when central bank rates are close to zero compared to >5% rates.

For example, the SOFR rate (the new LIBOR) is now close to 5%.

TradingView (3M SOFR Futures – Rate In %)

The key question asked during the conference was whether the current industry dynamics represented a structural shift or a short-term disruption.

The company responded by praising the positive developments in the industry, citing the approval of new classes of medicines and their potential impact.

It described these changes as structurally positive, emphasizing the long-term benefits they would bring, even if they didn’t immediately manifest in quarterly results.

You’re seeing new classes of medicines get approved, right, whether it’s for obesity. You’re seeing progress on Alzheimer’s. You’re seeing vaccines for RSV. When that happens, there’s more revenue for our client base that gets reinvested in R&D. Investors get interested in funding the newest and latest ideas and creates the positive momentum. That doesn’t show up in the next quarter. But it’s why we’re so excited about what’s going on long term in the industry, why we feel so good about it.

However, the company didn’t ignore the short-term challenges, as it discussed the deviation from original growth assumptions and offered insights into the market’s slower-than-expected performance.

And when I think about it, our original assumptions for this year was a 4% to 6% market growth, right? And when we came out of Q2, we said that the market growth is likely this year to be in the 0% to 2% range. And when I look at it, even six weeks after the guidance that we gave at our earnings call and read through all of the different analyst reports and so forth, I would say, at least six weeks later, you’re probably trending at the lower end of that market range. And we won’t know until December 31st, about year-end spend. That’s probably the single biggest factor, whether you get higher in the range.

Having that said, the company remains very upbeat about the market in general. It noted a strong order book and the ability to have the advantage to cater to very specific customer needs. I believe that this quality puts it in a great position to strengthen customer relationships in a somewhat challenging time, which could benefit its future growth tremendously.

Furthermore, TMO could be one of the few companies that actually benefit from the GLP-1 medicine trend. This is the trend of weight loss medicines that are currently doing a number on companies that benefit from illnesses related to obesity.

As TMO’s products cover a wide variety of research, it benefits from accelerating research in the area of GLP-1s.

So when I think about the class of medicines the GLP-1’s on obesity and diabetes, huge need across society. That will generate substantial revenue for the pharmaceutical industry. That revenue gets reinvested, if you will, into the ecosystem, which is why I’m so excited for the long-term. It’s one class of medicines that will be significant and there’ll be a number of others. For us, just that cycle of reinvestment in R&D benefits our tool business, the bioscience reagents, our lab products. It benefits our instrument business, it benefits the Fisher Scientific channel.

Furthermore, with regard to its Chinese business, China accounts for 8% of its revenues. Right now, this Chinese giant is struggling with economic challenges.

The good news is that Thermo Fisher has a strategy that sets it apart, as the company manufactures products in China specifically for the Chinese market.

Approximately 40% to 50% of Thermo Fisher’s production occurs locally in China, which has proven to be a successful approach, according to the company.

This localization enables the company to cater to the unique needs and demands of the Chinese market effectively.

The company estimates that this strategy allows it to outgrow its industry thanks to exposure in the fastest-growing country in its industry, paving the road for consistent annual growth of close to 10%!

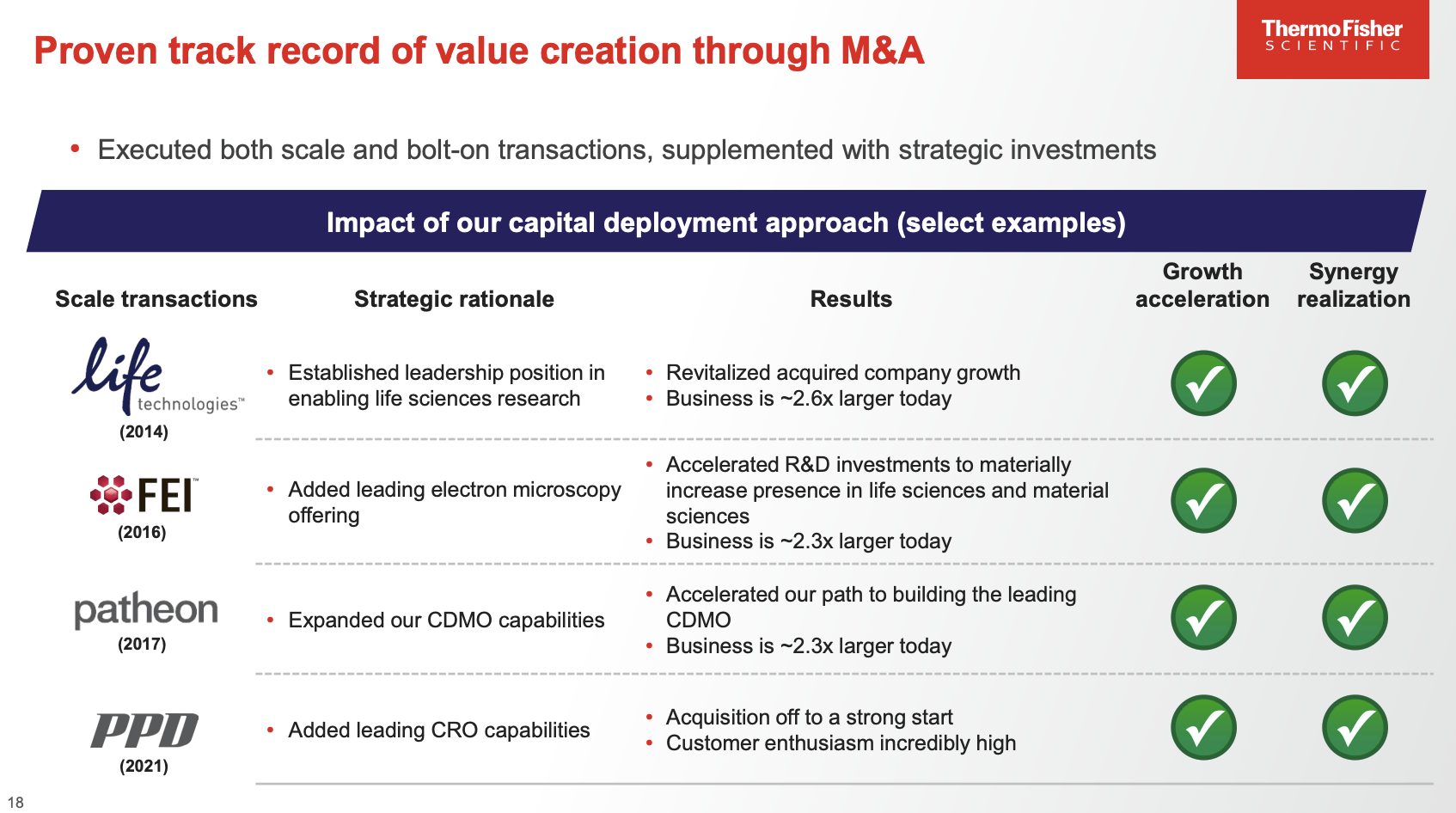

Last but not least, the challenging M&A environment is not a turnoff for TMO for two main reasons.

- Thermo Fisher is a giant with a huge M&A track record. It knows how to execute deals, even in challenging environments.

Thermo Fisher Scientific

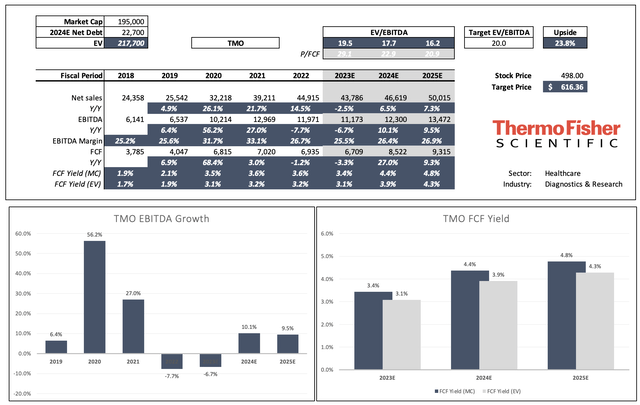

- The company has a healthy balance sheet, which allows it to take on debt in less favorable conditions compared to peers who do not have that benefit. This year, the company is expected to end the year with $25.1 billion in net debt. This is just 2.3x expected EBITDA. The company has an A3 credit rating.

So, what about the valuation?

Valuation

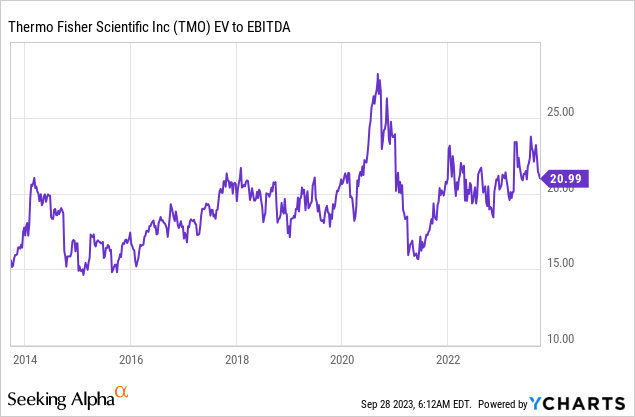

Historically, TMO has traded close to 20x EBITDA.

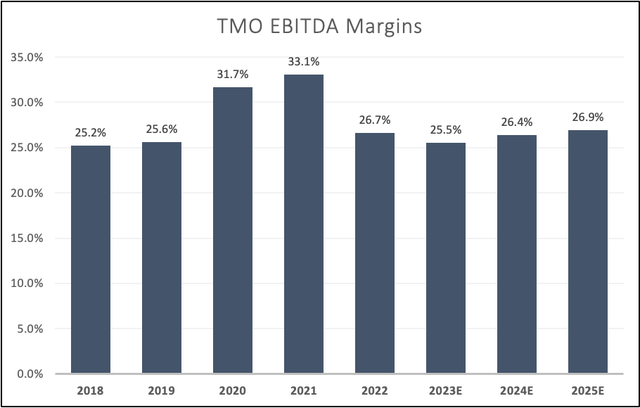

One argument for a 20x valuation multiple on a prolonged basis is the good margin outlook. While pandemic margins won’t be repeated anytime soon, analysts see a path to 26.9% in adjusted EBITDA margins by 2025, which is reasonable given its pricing power.

Leo Nelissen (Based on analyst estimates)

Furthermore, free cash flow growth is expected to average 18% over the next two years, with EBITDA growth expected to rebound to 10% next year.

Leo Nelissen (Based on analyst estimates)

If we apply a 20x multiple, the stock has a fair price of roughly $616, which is 24% above the current price.

The consensus price is much more bullish at $670 (+35%).

While I expect the stock to reach the $670 target over the next 2-3 years, I cannot make the case that TMO is in for a sudden rally. Although I give the stock a Buy rating, we need to be aware that inflation is rising again. The Fed will likely be hawkish for longer, putting pressure on the funding environment in biotech and related industries.

Although I prefer quick gains (who doesn’t?), I am not complaining. I’m using market weakness to add to/buy my favorite positions. This includes TMO. For now, it is a part of some of my family’s portfolios, and some private clients own it.

As I already briefly mentioned, the only reason why I do not own it is because I own DHR, which is highly correlated to TMO. Depending on how I structure my portfolio, I may add TMO as well.

Takeaway

Despite a temporarily suppressed stock price, TMO’s long-term prospects remain promising. The company’s strategic positioning within the healthcare industry, coupled with its ability to navigate challenging market dynamics, underscores its potential for significant outperformance.

While the recent sell-off may seem discouraging, it’s essential to view it as a momentary dip in the trajectory of a fundamentally strong company. TMO’s strategic localization in the Chinese market, an impressive track record of M&A execution, and a robust balance sheet give it a competitive edge.

Regarding valuation, TMO’s future looks bright, with the potential for substantial growth. Analysts foresee expanding margins and strong free cash flow, hinting at a fair price well above the current level.

In a world where market conditions can be unpredictable, TMO stock represents a steady and reliable investment opportunity. While I anticipate its stock reaching new heights, it’s crucial to remain cautious due to rising inflation and evolving economic forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.