Summary:

- Walmart has maintained healthy earnings despite high inflation and a turbulent macroeconomic environment.

- The company’s stock price has continued to rise – as interest rates should raise investors’ required return, WMT may be overpriced according to a discounted cash flow model.

- Insiders have sold significant amounts of Walmart stock, indicating a potential risk for investors; I have a sell-rating for the stock.

bgwalker

Walmart (NYSE:WMT), the well-known supermarket chain based in the United States, has maintained a healthy earnings level through high food inflation and a turbulent macroeconomic environment. At $161.40 a share, though, I believe Walmart is a quite expensive pick for investors, which is why I currently have a sell-rating for the stock.

The Company & Its Financials

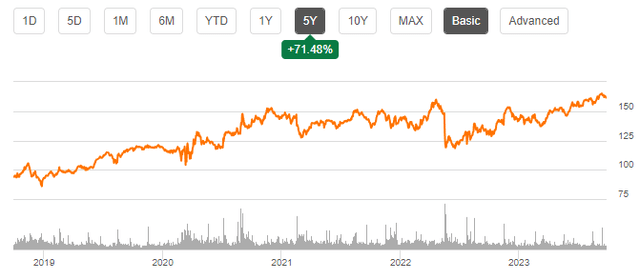

Walmart, the retail chain most known for its Walmart brand, is an established supermarket chain in the United States. The company also holds Sam’s Club, a wholesale retailer. Walmart’s stock has continued its steady climb in recent times, even though rising interest rates should increase the required rate of return from the stock, declining the stock’s current price.

5-Year Stock Chart (Seeking Alpha)

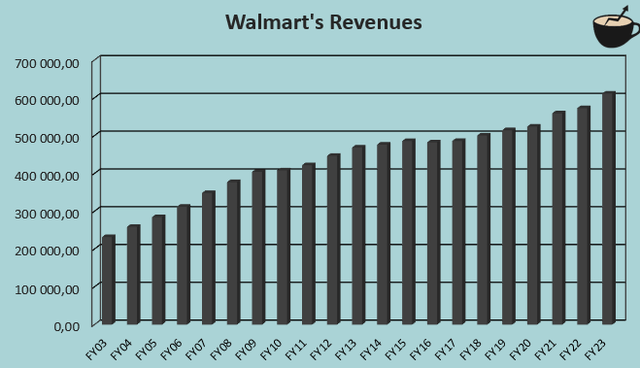

The steady stock price rise is representative of the company’s steady financial performance, though. The company’s revenues have climbed steadily in spite of an economy with high inflation and a weakening consumer purchasing power:

Author’s Calculation Using TIKR Data

In the last ten years, Walmart’s compounded annual growth rate has been 2.7%, of which the overwhelming majority is organic – the company’s acquisitions from the period amount to less than $20 billion, compared to the entire company’s market valuation of around $500 billion. The company should continue to grow by a modest amount, as the company has seen good growth for example in Mexico, Central America, and Canada, as told in the company’s Q1 earnings call:

“From an international perspective on marketplaces, we continue to see SKU growth across Mexico and Canada, but both of those marketplaces are quite nascent in their development and provide a lot of opportunity for the future. Walmex added 50% of SKUs in Q1 versus the same time in the previous year.”

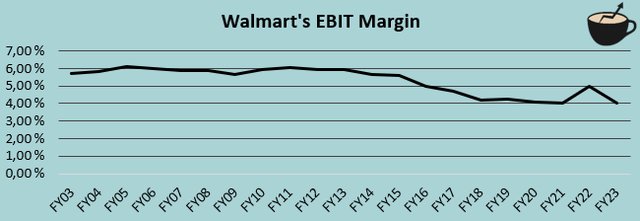

On the other hand, Walmart’s operating margin has been on a slow decline in the long-term, as the company’s margins were constantly around six percent in the early 2000s, but have declined towards the current trailing margin of 4.1 percent:

Author’s Calculation Using TIKR Data

The margin decline hasn’t been seen in the very recent past, as Walmart’s Q2 operating margin was 4.5% compared to last year’s similar margin; a harder economic environment doesn’t seem to pressure the company’s margins, as the margin has stayed constant in the recent times, even jumping by a percentage point in FY22 temporarily.

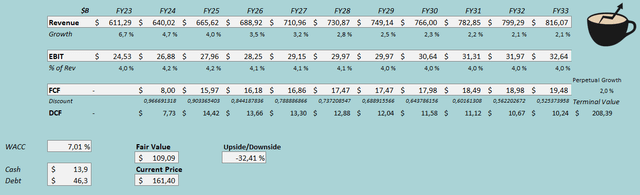

Walmart holds interest-bearing debts totaling around $46 billion, mostly in long-term debt, and a small portion in short-term borrowings and current portions of long-term debt. This amount of debt is in my opinion a very healthy amount for Walmart, as its earnings are stable in most environments, and the total debt level represents around 3 years of the company’s free cash flow in my estimation. The company also holds $13.9 billion in cash.

Valuation

The company currently has a trailing price-to-earnings ratio of 31.38 – a very high ratio in my opinion, as the United States’ 10-year bond yield at 4.62% is higher than the company’s earnings yield of 3.2%. The company does have moderate growth adding to the expected rate of return, though, and the company’s earnings are likely to be highly resilient in an economic downturn, as the company’s earnings grew both in 2008 and 2009 demonstrating the company’s resiliency.

In my usual manner, to do a further evaluation of the company’s current valuation, I constructed a discounted cash flow model. In the model I expect a growth of 4.7% for the current year of FY24, with further growth being four percent in FY25 and slowly slowing down into a perpetual growth rate of two percent.

The revenue estimates are coupled with a decently stable operating margin – for the current year I estimate an operating margin of 4.2%, slightly above the previous year. Going forward, I believe the company’s margin should decline only very slightly into 4.0% – a decrease that shouldn’t significantly affect the stock’s estimated fair value. This decrease is below the company’s historical rate of margin decline, but I do believe the company’s maturity should somewhat stabilize its margin. The company’s free cash flow should be at a healthy level – only reduced by a slightly increasing net working capital, and capital expenditures that exceed the company’s depreciation and amortization by a bit.

These estimates coupled with a weighted average cost of capital of 7.01% craft the following DCF model with an estimated fair value of $109.09 for the stock, 32% below the current price:

DCF Model (Author’s Calculation)

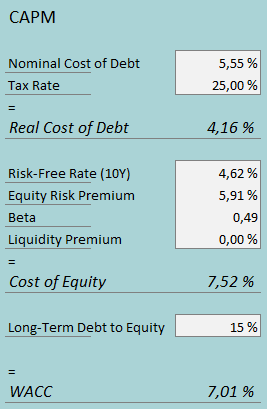

The used cost of capital of 7.01% is derived from a capital asset pricing model with the following assumptions:

CAPM (Author’s Calculation)

The company paid $0.64 billion in interest expenses in Q1 – annualized, this represents a 5.55% interest rate for the debts of $46 billion. I believe the company’s long-term debt-to-equity should be at around 15 percent – the company doesn’t quite leverage debt to its full extent to keep a low risk profile for shareholders.

I use the United States’ 10-year bond yield as the risk-free rate – the yield currently stands at 4.62%. The used equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the United States, updated in July. Yahoo Finance estimates Walmart’s beta to only be 0.49 – the company is very resilient in tough times. Finally, I believe Walmart’s stock is very liquid, which is why I don’t add any liquidity premium to the stock, as I often do for stocks.

These assumptions craft a cost of equity of 7.52%, and a WACC of 7.01% that is used in the DCF model.

Insider Sales

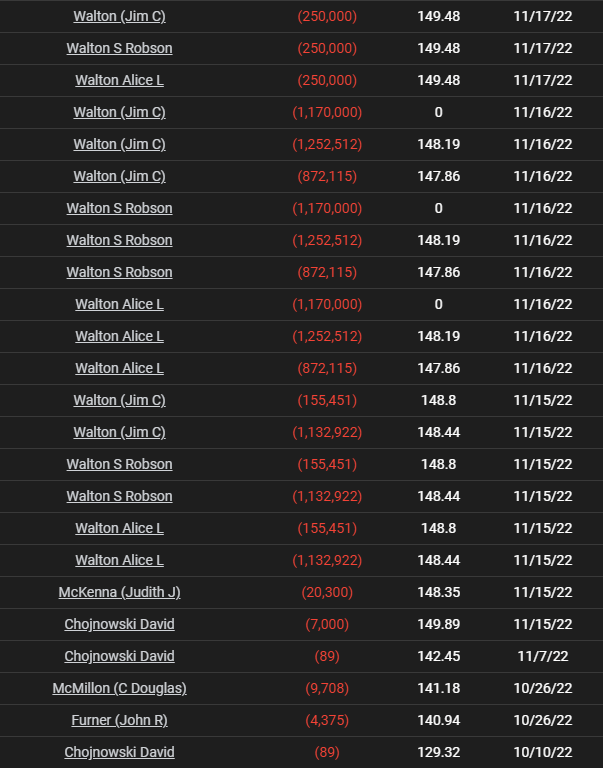

To add to the downside represented in my DCF model estimates, insiders have sold massive amounts of Walmart stock in late 2022 at prices that are lower than Walmart currently trades at:

Insider Sales (TIKR)

The combined insider sales add up to well over a billion dollars. Often large insider sales signal a bad time for the stock – I believe the stock sales represent a risk as the company’s valuation seems a bit stretched to me.

Takeaway

Although a fantastic company, I believe Walmart is currently overpriced by a modest amount – the DCF model shows a downside of 32%. I expect the company to continue its resilient financial performance, but the expected rate of return does not impress me at current stock prices. I’m alongside insiders, as I have a sell-rating for the stock at the current price of $161.40.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.