Summary:

- Intel is betting on growing its foundry business in order to drive future revenue and margin growth.

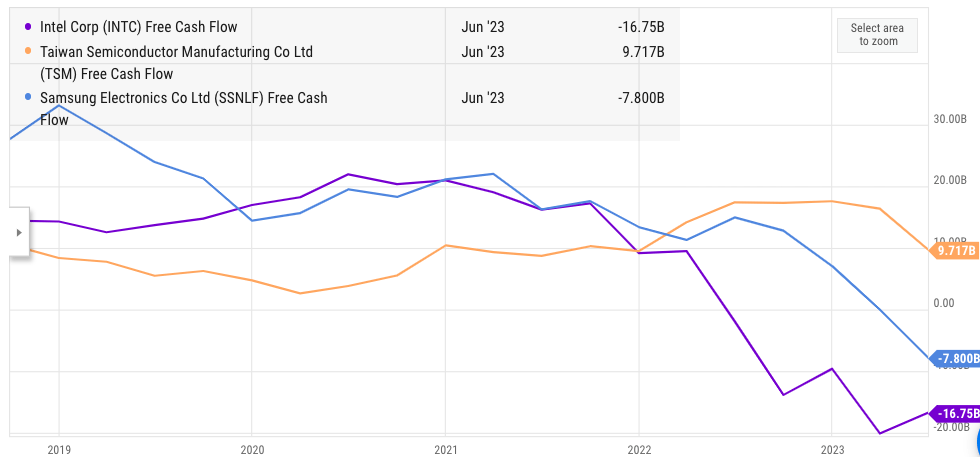

- Massive investments in foundries have turned Intel’s FCF from a positive $20 billion in 2020 to a negative $17 billion in the trailing twelve months.

- TSMC is also making big investments which can cause a glut in the chip production capacity which will lead to shrinking of margins.

- Intel will need to hit a home run in terms of execution in order to build a successful foundry business.

- The stock is not cheap when we look at the risk associated with the management’s strategy which can lead to the stock underperforming the broader index.

hapabapa

Intel’s (NASDAQ:INTC) recent quarterly beat should have helped the stock, but we saw a very minor improvement in sentiment towards the stock. One of the reasons why Wall Street is very cautious about Intel stock is the massive investments that the company is making in order to build its foundry business. We have been hearing about several multibillion-dollar investments by Intel to set up foundries in U.S., Germany, Poland, and other countries. Despite the massive subsidies, Intel’s FCF has seen a big decline. Intel’s FCF was close to $20 billion in 2020 and this has dropped to negative $17 billion in the trailing twelve months. It has announced investment of $33 billion in Germany, $4.6 billion in Poland, $25 billion in Israel and several other multi-billion dollar projects.

Intel’s main competitors in foundry business are goliaths like TSMC (TSM) and Samsung. We have heard big investment announcements by TSMC as well as Samsung which run in tens of billions of dollars. All these big investments can lead to a glut in the industry, causing margins to shrink. The biggest challenge will be for Intel, which is trying to grow market share and will likely have to give big discounts to its clients. In a recent report, Intel published lofty goals in terms of revenue and cost-savings it will get from its foundry business. In the previous article, it was mentioned that investors should be very cautious about these goals, as any misstep can derail the plans.

A counter-argument can be made that there is upside potential in Intel stock due to the massive demand increase for chips because of rapid growth of AI tools. Another strong reason supporting the bullish case for Intel is the geopolitical risk faced by TSM. However, it is likely that most of upside due to AI could go to fabless chip designers like Nvidia (NVDA) and AMD (AMD). In the year-to-date, TSM stock has seen a growth of 15% compared to 200% for Nvidia and 60% for AMD. Betting on geopolitical tensions around Taiwan to improve the bull case for Intel looks like a long shot. We have already seen that massive subsidies offered to Intel by U.S. and European governments have not delivered a bullish run in the stock.

In recent days, Intel has already suffered a setback as its acquisition of Tower Semiconductors was canceled, causing Intel to pay a hefty $353 million termination fee. The stock is fairly valued when we look at the risk to the current strategy of the management. Future competitive headwinds could cause the stock to underperform the wider index, making the stock less attractive at the current point.

Staggering investments

Intel is trying to turn a big ship and there are many icebergs in its path. The management announced the current foundry business strategy in early 2021. Back then, TSM stock was at its all-time high of over $120 per share, with a market cap of $700 billion. Back in early 2021, Intel’s new CEO believed that the foundry business would be the best bet for Intel, as it could allow the company to gain some of the bullish momentum that was seen in TSM.

Intel has invested massively in its current foundry strategy with multibillion-dollar investments in U.S., Europe, and other regions. However, TSM and Samsung are also increasing their investments, which can quickly cause a glut in the chip production capacity. The impact of Intel’s massive investments can already be seen on the FCF as new plants are set up.

Ycharts

Figure 1: Intel’s FCF compared with TSM and Samsung. Source: Ycharts

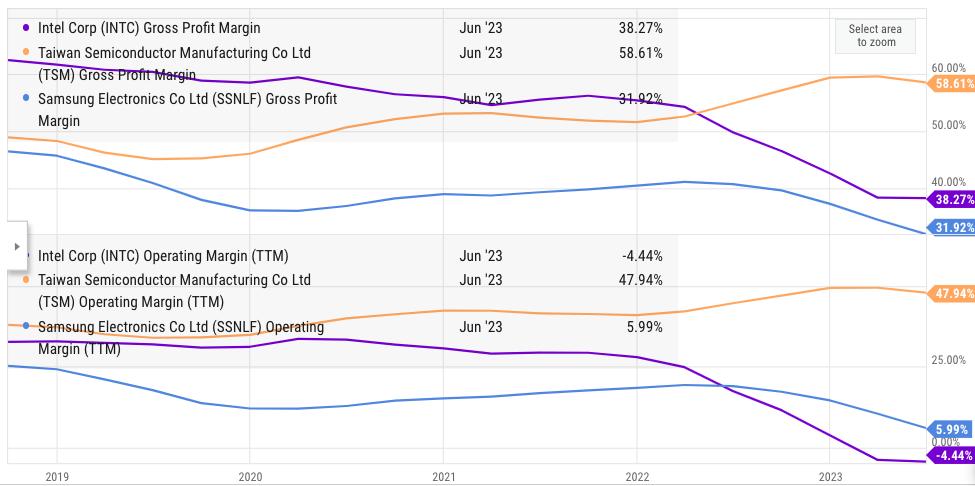

Threat to margins

Intel has set very ambitious goals in terms of executing the foundry business. It has also mentioned that it will soon reach non-GAAP gross margin of 60% and an operating margin of 40%. This is unlikely to happen anytime soon. As mentioned above, there is likely going to be a glut in chip production capacity. The only way to gain market share in this industry is to give better pricing or better production capability. Intel had seen delays for 7nm process which has hurt its reputation. Recently, it has announced delays for Falcon Shores to 2025. Hence, in order to gain new clients, Intel will need to offer massive discounts compared to the pricing of TSM and Samsung.

Ycharts

Figure 2: Gross margin and operating margin of Intel, TSM, and Samsung. Source: Ycharts

In the Q2 quarterly earnings, Broadcom’s (AVGO) CEO Hock Tan mentioned “And put it simply, we don’t move just because of prices.”

Broadcom is a major client for TSM, and it is feeling some of the pricing pressure due to annual hikes in the chip cost. However, it has not announced any major move to shift production to any other alternative producer. Intel will certainly find it difficult to take away loyal customers from TSM. Any incremental revenue from foundries is likely to be slower than expected and will come at a big cost to margins.

A lot of uncertainties

There are a lot of uncertainties within the foundry business of Intel. We have seen an example of this in the recent canceled deal for Tower Semiconductors. A single regulator can cause a major deal to go awry. Intel has to pay a hefty termination fee of $353 million. There are a lot of geopolitical risks and a single regulator can lead to a major setback for Intel. This will need to be priced into the stock price.

Intel already faces massive competitive pressure within the foundry business. It is uncertain if the company will be able to execute according to the schedule. Past delays have already cost Intel significantly, and Wall Street will be very cautious about any bold announcement from Intel’s management.

Counter-argument to Sell Thesis

It is important to look at the upside arguments for Intel stock. Two main reasons put forward to support a Buy rating for Intel are the rapid growth of AI and a hedge against geopolitical risk in Taiwan.

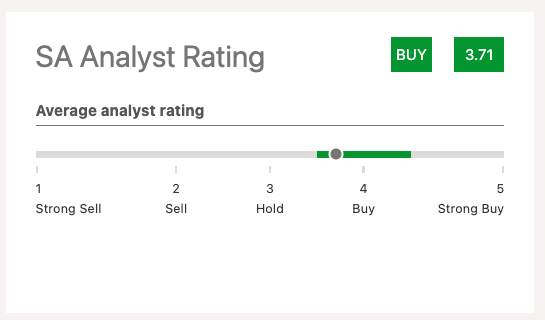

Seeking Alpha

Figure: Average analyst rating has a buy rating for Intel stock. Source: Seeking Alpha

Most of the bullish momentum due to new AI tech has gone to chip designers like Nvidia and AMD. Many big tech players who are investing heavily in AI have also seen a better bullish sentiment. On the other hand, chip producers like TSM have not seen a big jump this year due to AI hype. In the year-to-date, TSM stock has increased by 15% compared to 60% for AMD and over 200% for Nvidia stock. Intel is also building its AI chips, but it is significantly behind market leader Nvidia.

Intel is also seen as a hedge against geopolitical tensions around Taiwan, which affects TSM significantly. However, this would be betting on a worst-case scenario for TSM. The massive subsidies offered to Intel have not been able to deliver a big bullish sentiment to the stock. Intel has received a subsidy of over $11 billion from Germany alone. It has been over two months since this announcement and the stock has maintained its sideways momentum with a price of $35.

Overall, it is likely that the downside challenges will eclipse any upside potential for Intel in the near term.

Impact on Intel stock

Intel has been able to beat consensus earnings estimates in the recent quarter. This would have helped any other tech company gain a strong bullish momentum. However, Intel’s stock price has not seen any bullish run. The stock is stuck in sideways movement in the $30 to $35 range. The stock is unlikely to see a major change until the company can show some definite progress. The 18A process is expected to be launched by late 2024 and if the management is successful in this schedule it could bring some bullish sentiment towards the stock.

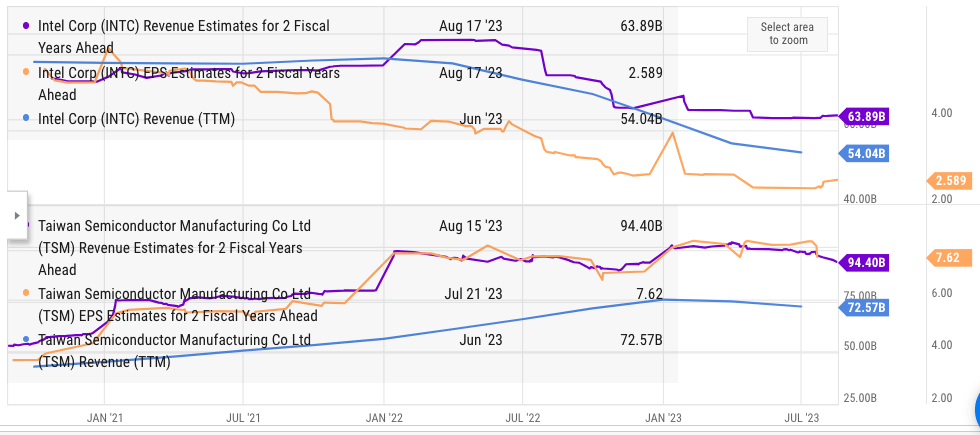

Ycharts

Figure 3: Comparison of key metrics for Intel and TSM. Source: Ycharts

Intel is estimated to report $64 billion in revenue two fiscal years from now, which would be a 20% growth for the company. During the same time, TSM is expected to report 30% revenue growth. On the other hand, Intel’s EPS for two fiscal years ahead is $2.5 and the current stock price is 13 times this metric. TSM’s EPS for 2 fiscal years ahead is $7.6 and the current stock price is 11 times this metric.

When we look at most of the forward metrics, Intel stock does not appear to be a value bet.

Investor Takeaway

Intel is investing billions of dollars in building a strong foundry business. Both TSM and Samsung are also ramping up their investments, which can cause an oversupply in the chip production capacity. In this scenario, Intel will be at a disadvantage as it does not have the economies of scale and will need to give massive discounts in order to grab customers away from the competition.

Intel’s margin squeeze could be significant if there are any future setbacks in the foundry business. The forward EPS estimate shows that the stock is not at a discount and is trading at a higher ratio compared to TSM when we look at EPS for 2 fiscal years ahead. It would be very difficult for the stock to outperform the broader index in the near term, making it less attractive for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.