Summary:

- AT&T’s stock has risen slightly off 30-year lows due to positive developments and addressing major issues.

- The company has stated that the lead pipe issue is not a concern and preliminary tests show no issues.

- AT&T’s CFO is confident in meeting the free cash flow guidance for 2023, but the final outcome is still unknown.

- In the following piece, I explain why I still wouldn’t buy in to the stock regardless of these developments.

Brandon Bell

AT&T (NYSE:T) remains a “No Touch” in my book

Some positive developments have come to light regarding AT&T’s prospects. The stock has risen slightly off the 30 year lows as of late.

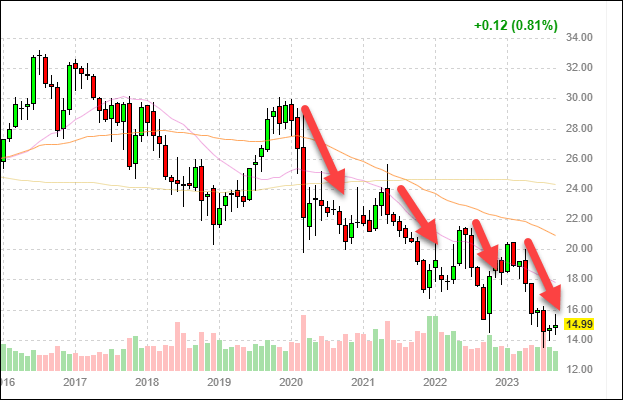

Current Chart

The company has addressed two of the major issues bearish investors, myself included, have been wary of as of late. The lead pipe issue and achieving the free cash flow estimate for 2023. Let’s take a deeper dive into the recent developments.

Lead pipe Issue Update

AT&T management stated recently that the lead cable problem brought up by the Wall Street Journal was not an issue. According to Reuters:

“Shares of AT&T rose on Wednesday July 19th, 2023, after the telecom company said lead cables made up only a small part of its wireline network, easing fears of an expensive clean-up.

Rival Verizon also rose by a similar margin, helping the companies rebound from a selloff sparked by a Wall Street Journal report on July 9 that several telecoms giants abandoned a sprawling network of underground toxic lead cables.”

Furthermore, on July 25, 2023, they released a statement saying the preliminary tests showed no issues with the lead pipes. According to AT&T:

“There is no higher priority than the health and safety of our employees and the communities where we live and work. To that end, although we believe that lead-clad cables pose no public health risk, we continue to test sites where lead-clad cables are in place. As part of our ongoing collaboration with the EPA, we will be proactively providing testing data to the agency as it thoroughly assesses the matter.

We will be releasing some additional testing results:

- A second test of the underwater cables in Lake Tahoe, performed by a different, prominent expert, found that the lead-clad cables in Lake Tahoe do not pose a public health concern and that no lead was detected leaching from the Lake Tahoe cables. This reaffirmed the findings of the tests conducted in 2021.

- Although the testing is ongoing, preliminary results of our aerial cable testing in the Detroit, Michigan, area confirm that those cables are not a significant source of lead exposure or a public health threat. There is no meaningful difference in measured lead levels between the soil directly below the cables and background levels in the same area (e.g., across the street where no cables exist). The lead levels in soil below the cables are less than the average household soil lead levels in the Midwest as reported by HUD and are far less than the EPA’s screening level for lead in residential soil.

And as we previously shared, we will provide free blood-lead tests, upon request, for all employees who work on or have contact with lead-clad cables. When it comes to the lead-clad cables in our network, we have always done, and will continue to do, the right thing.”

Regarding what I consider the most important piece of the puzzle, the 2023 $16 billion in free cash flow estimate, there was some positive movement as well.

AT&T will make free cash flow estimate

AT&T Chief Financial Officer Pascal Desroches stated recently that he was confident the telecom giant would meet their free cash flow guidance for the year. According to Seeking Alpha news:

“AT&T gained 2.8% by midday Thursday after the company expressed confidence in its forecasts and indicated that a back-end loaded year in free cash flow is still on target for $16B-plus – welcome news for the company’s dividend-focused investors.

“Yes, yes, yes,” AT&T (T) Chief Financial Officer Pascal Desroches said when asked about the $16B target at a BofA investor conference Thursday – despite the fact that, as with last year, the forecast depends heavily on the second half (AT&T marked $5B in free cash flow in the first half of this year).

“The first half of the year, you had a peak level of device spend, we had peak levels of capital and we had our annual compensation,” Desroches said. “If you normalize for those items, you can really get a sense for why we are so confident about the back part of the year.”

“We said at the very start of the year, first quarter was going to be the lowest followed by second quarter, followed by third quarter, and fourth quarter. It is playing out exactly as we thought,” he added.”

So two of the big issues for AT&T seem to be resolving in their favor. That’s great. I’m not short the stock. I’m actually rooting for AT&T’s stock to go higher. It’s a hometown stock for me. I have several friends that work for AT&T who have a lot of their 401Ks invested in the company. Even so, at this point, I say “don’t drink the Kool-Aid!” Let me explain why.

Don’t Drink the Kool-Aid

For those of you unfamiliar with this saying, I have provided the Wikipedia explanation of the expression. According to Wikipedia:

“Don’t Drink the Kool-Aid” is an expression used to refer to a person who believes in a possibly doomed or dangerous idea because of perceived potential high rewards. The phrase typically carries a negative connotation. It can also be used ironically or humorously to refer to accepting an idea or changing a preference due to popularity, peer pressure, or persuasion.”

What I mean by saying, don’t drink the Kool-Aid, is the fact that AT&T is going to have to “show me,” not “tell me,” at this point the proof regarding these issues. I understand they did some preliminary tests and the CFO thinks they will hit their cash flow target. Yet, AT&T is in the proverbial “doghouse” with me. Yes, yes, I heard the company say the “preliminary” tests show no issues. Nonetheless, that doesn’t mean the issue is resolved or the fact that some politician will demand some type of fine. It’s good news, but the final outcome is still unknown.

The same goes for the CFO coming out and stating he feels confident about the free cash flow. That’s great. Nevertheless, at this juncture, they’re going to have to “show me the money” first, as Tom Cruise so eloquently stated in Jerry Maguire. What’s more, there are much bigger fish to fry. The primary issue is the fact it appears we’re heading for a recession of some magnitude. The US consumer is getting hit hard. Let’s dig into this a little deeper.

Consumer on the brink of being broke

The American consumer has shown quite a bit of resiliency over the past year. However, the strength and confidence of the US consumer has begun to wane substantially. According to a recent APNews report:

“Americans are feeling less confident financially as summer comes to a close and high prices and interest rates weigh on their willingness to spend.

There were also signs Tuesday of cooling in what has been a very resilient U.S. jobs market.

The Conference Board, a business research group, said its consumer confidence index tumbled to 106.1 in August from a revised 114 in July. Analysts were expecting a reading of 116.”

Moreover, there are several other factors coming into play regarding the financial health of the US consumer. According to a recent report by Fitch:

“Fitch Ratings expects a marked slowdown in spending from 4Q23 as the labor market cools, wage growth slows, the boost to consumption from excess savings wanes, and the lagged effect of the Fed’s aggressive tightening cycle bites even more, according to Fitch’s new report. “Strong income growth has been largely responsible for the recent strength in consumer spending. However, wage income – the dominant driver of household income dynamics – looks set to slow as employment and wage growth weaken,” said Olu Sonola, head of U.S. regional economics. “Debt service is expected to trend higher in the coming quarters as student loan payments resume and higher financing costs take hold for much longer. ”Real consumer spending, which has grown at an annualized rate of 4.3% in 1Q23, 1.7% in 2Q23 and likely 3% in 3Q23, is expected to slow to an annualized rate of 1.2% in 4Q23 – and contract by 0.8% in 1Q24 and 3% in 2Q24. The resumption of student loan payments in Q423 is likely to dampen consumption. Fitch estimates the resumption of student loan payments amounts to between $5.5 billion to $8.2 billion monthly, if all 27 million people in forbearance resume payment – which is expected to reduce real consumption growth by an estimated 7 bps-10 bps. Student loan delinquency rates are expected to quickly trend higher, to pre-pandemic levels or above, given anticipated challenges borrowers will have returning to repayment when forbearance ends in October 2023.”

US households are getting hit hard. Why do you think there are so many strikes happening in every sector of the market? Labor markets are cooling, wage growth is slowing, household savings are drying up, and the Fed’s aggressive tightening cycle continues to bite down on consumer wallets even harder as rent and gasoline prices continue to rise. Not to mention the fact that student loan payments are due to start back up on Oct. 1, 2023. Additionally, consumer weakness is exactly what AT&T has blamed their earnings misses on several times in the past. The fact of the matter is AT&T has been basically in a freefall since 2020 as well. See chart below.

Long-term Chart

Finviz

Here’s the deal. I’m a contrarian at heart. I believe the time to buy is often when others are selling. Yet, sometimes a stock is down for good reason. I see that as the case with AT&T. I have done well with my investments over the years. At 60, I’m more in the “capital preservation” camp than the “capital appreciation” or “high-yield chaser” camp. Let’s take a look at the current yield, which many are touting as a reason to buy.

AT&T’s Current Dividend Yield: 7.44%

AT&T’s current 7.44% dividend yield would normally be very enticing to me. In fact, many are touting it as the sole reason you should put your hard earned money at risk by buying the stock. Well, as I’m sure you already know, I beg to differ once again! I feel many investors believe the Fed will eventually revert back to the Zero Interest Rate Policy, or ZIRP, of the past. They must be, in order to get that excited about AT&T’s 7% yield with substantial risk of downside attached.

The fact of the matter is you can get a 5%-plus risk free return on short duration treasuries right now. It just doesn’t make any sense to me to stick my next out for AT&T’s current dividend payout. The risk/reward equation just doesn’t add up.

Now, I could go on and on about several other issues. Other major AT&T is facing presently include the massive debt load, management’s past failures, the fact the business is commoditized, and cable companies are starting to take market share. AT&T does not have pricing power. I believe most are fully aware of these issues. I feel I’ve made my case as to why AT&T is a no touch for me. Now let me wrap this up.

The Wrap Up

It’s good that AT&T has shared some positive news regarding the recent issues regarding the lead pipes and the cash flow target. All the same, I feel it’s going to be the forward guidance when they announce earnings on Oct. 19 before the market opening that causes the stock to sell off once again. I just can’t see AT&T management being willing to stick their necks out and paint a rosy picture for everyone based on the current macroeconomic environment we are in. I feel they are going to go with the “under-promise and hopefully over-deliver” scenario.

On top of this, the stock is basically a falling knife at this point from a long-term perspective. It’s in a steep downtrend. If I had courage in my conviction that AT&T’s long-term growth story was intact, I would buy it now. I feel it may be at the “point of maximum pessimism” as we speak, as Sir John Templeton would say. Yet, I don’t. I need to see a trend reversal prior to stock making it back on my watchlist. I would rather miss out on the first 10% upside than lose the next 20% to the downside. This mindset is reinforced by the fact I can get a 5%-plus risk free return presently as well. There’s no reason to make a “hero call” and buy AT&T prior seeing the “proof in the pudding,” so to speak. If you do decide to start a position in the stock, I would definitely layer in over time. In this scenario, I would do it in thirds. One tranche prior to earnings, one after, and one to keep in the chamber as dry powder in case the stock drops further or starts to take off.

Those are my thoughts on the matter. I look forward to reading yours.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

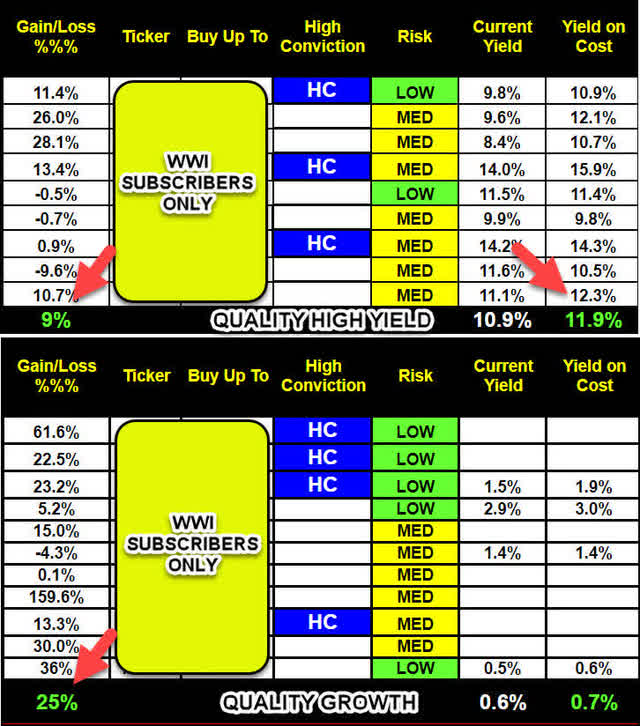

Join the #1 fastest growing new Income Investing Group! It’s our 1 Year Anniversary! We are offering 50 Charter memberships at a 30% discount! Memberships are going fast! We have 28 FIVE STAR reviews in the first few months! Price increases to $749 per year on Oct 1st.

~ Quality High Yield Income – Current Yield – 11.9%

~ SWAN Quality Income – Current Yield – 9.1%

~ Quality Growth – Up 25%

1 Year Total Return 24%. As of July 31st.

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).