Summary:

- NextEra Energy and the utility sector represented by the Utilities Select Sector SPDR Fund ETF have experienced large price corrections.

- Particularly, NEE’s stock price has dropped by about 15% in the past 5 trading days as NextEra Energy Partners lowered its growth outlook.

- However, NEE is still trading at a large premium.

- I also see possibilities that its specific business model and geographical exposure can make it more sensitive to rate and inflation risks than XLU.

NoDerog

NEE and XLU’s long-term growth outlook

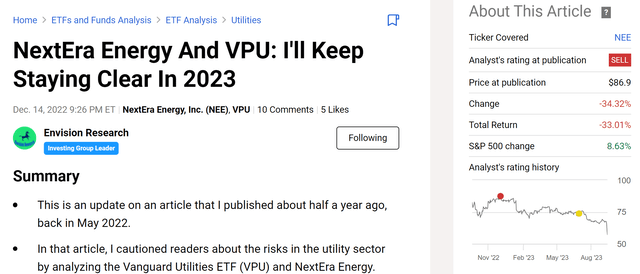

At the end of 2022, I published an article (see the first figure below) to caution readers about the risks behind both the utility sector and its leading stock NextEra Energy (NYSE:NEE). My main concern at that time was twofold. First, I anticipated the rising interest rates would pressure their profits. Second, I was very concerned about their valuation risks at that time. As a reflection of such risks, the utility sector’s yield spread against the benchmark 10-year treasury rates was close to the lowest level in at least a decade.

Fast-forward to now, interest rates did increase and the valuation multiples of both NEE and the sector, as approximated by the Utilities Select Sector SPDR Fund ETF (NYSEARCA:XLU), did suffer large corrections. Especially in the case of NEE, its stock price has dropped by about 15% in the past five trading days since NextEra Energy Partners (NEP) announced lower growth projections for the next few years. NEP is a limited partnership formed by NEE, and it now targets a growth rate of around 6%, about half of its previous guidance of 12%-15% growth rates. The reasons cited for such lowered projections are precisely higher interest rates and tighter monetary policy.

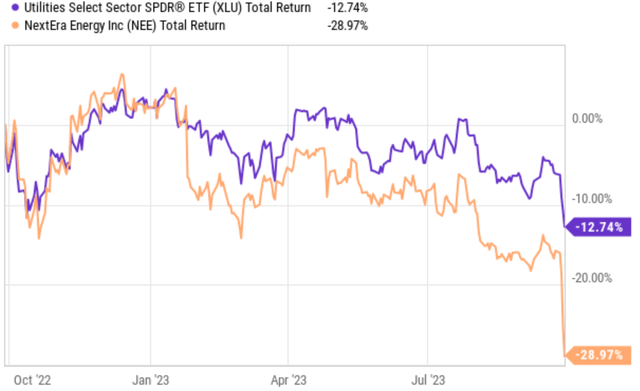

All told, the stock has not only lagged the S&P 500 this year but also lagged XLU by a large margin. As shown in the next chart, NEE has suffered a total loss of close to 30%, compared to a loss of “only” 12.7% from XLU.

As a result of such large price corrections, NEE now trades at a P/E of around 18x, about 1/3 below its P/E at the end of 2022 (around 29x). However, the thesis of this article is to explain why I still expect NEE’s underperformance relative to XLU to continue despite its more reasonable valuation. I will detail my arguments in the remainder of the article. As a summary, my top considerations are twofold. First, NEE’s valuation is still at a large premium compared to the sector average represented by XLU. Second, given NextEra Energy’s business model and geographical exposure, I also see it as more sensitive to interest risks than the average utility sector.

XLU and NEE – basic information

For readers new to NEE and/or the XLU fund, this section provides the key information needed for the remainder of the discussion.

XLU is one of the most popular sector funds issued by SPDR. As the fund description states:

XLU seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Utilities Select Sector Index (the “Index”). The Index seeks to provide an effective representation of the utilities sector of the S&P 500 Index.

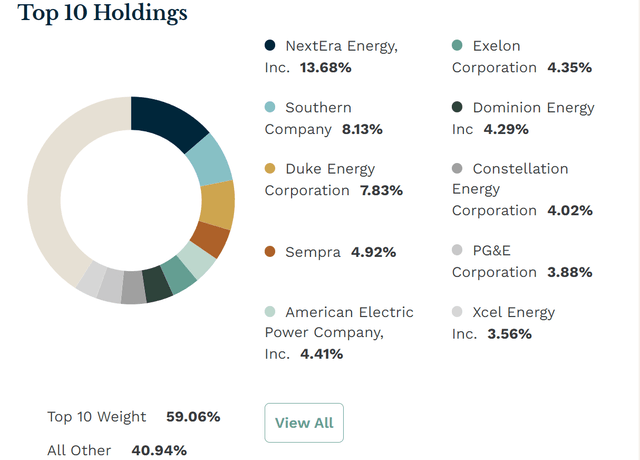

And indeed, as you can see from the chart below, the fund invests exclusively in companies in the utility sector. Although the fund provides a broad representation of the sub-sectors, including electric, water, independent power, renewable, gas, et al. It is quite a top-heavy fund, with its 10 holdings representing 59% of the total assets. You can see that NEE is by far its largest exposure, representing 13.7% of its total assets, more than 500 basis points above the second-largest exposure.

NEE is a holding company for Florida Power & Light Company (FPL). The company mainly provides electricity services to about 5.8 million customers in eastern, southern, and northwestern FL. NEE has a significant investment in renewable energy generation, which is a capital-intensive business. Moreover, despite its presence in many states, NEE has a large presence in Florida. Later, you will see why such specifics about its business model and geographical exposure are important for my thesis.

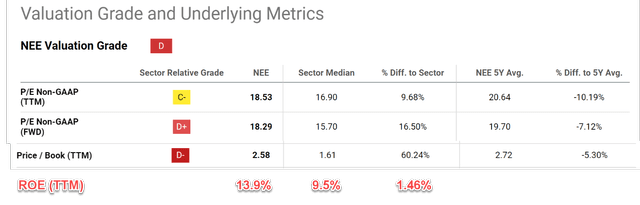

NEE: Valuation premium is still too large compared to XLU

As I previously mentioned, despite the large price corrections in NEE stock in the past 1~2 years, I still view its current valuation at a large premium compared to the sector average. As shown in the following chart, the company’s valuation grade is in the C to D range depending on which metric you look at. Take the FWD P/E as an example. NEE trades at an FWD P/E multiple of 18.3x, which is about 16.5% above the sector average of 15.7x. And in terms of the P/B ratio, the premium is even larger. NEE trades at 2.58x its book value, a whopping 60% higher than the sector average of 1.61x.

Of course, a higher valuation multiple can always be justified if the company features superb profitability and growth potential. However, I have difficulty seeing such justification in the case of NEE compared to XLU.

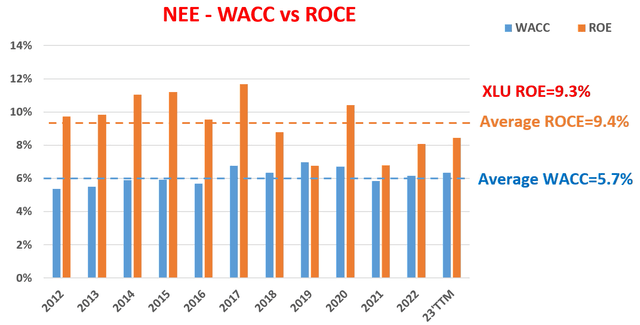

For XLU, its average ROE (return on equity) is about 9.5%, admittedly below NEE’s 13.9%. However, the difference in their ROE is about 46%, far lower than NEE’s valuation premium in terms of the P/B ratio. Furthermore, NEE’s actual return on capital is lower than its ROE by a good margin. As detailed in our earlier writings, I favor the use of ROCE (return on capital employed) as a more accurate profitability measure than ROE. My analysis of NEE’s ROCE is shown in the chart below. As seen, NEE was able to maintain a stable ROCE of around 9.4%, compared to its ROE of 13.9% mentioned above. Do not get me wrong – a 9.4% ROCE is very respectable for a utility company and is far above its cost of capital as seen (estimated by the WACC, weighted average cost of capital). However, I just do not believe the profitability is enough to justify the large valuation premium.

NEE can be more sensitive to interest risks than XLU

Besides the valuation risks mentioned above, I also see reasons for NEE to respond more sensitively to interest risks than the average utility sector due to its specific business model and geographical exposure.

As aforementioned, NEE has a significant investment in renewable energy generation, which requires intensive capital investment, especially at this early stage. As a result, the company has to rely on debt financing more heavily than the average company in the XLU. Such reliance poses additional risks given current interest rates and the inflation environment.

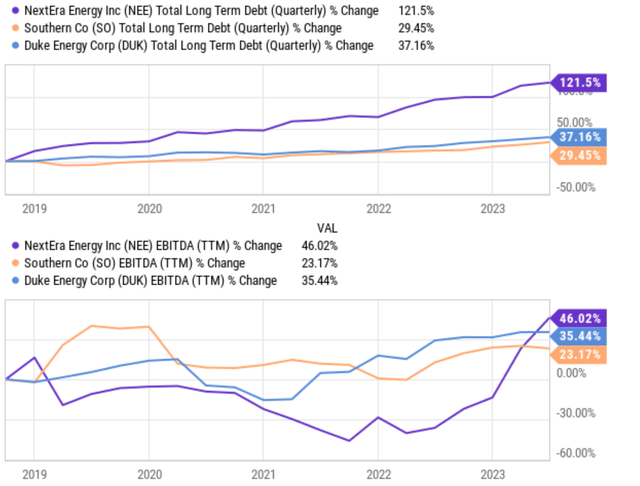

More specifically, as you can see from the top panel of the chart below, NEE’s total long-term debt has increased by more than 121% in the past five years (from 2019 to 2023). In comparison, other leading peers in the XLU fund, such as Southern Company and Duke, have seen their total long-term debt increase at a much slower pace. Duke’s debt increased by 37% and Southern’s by 29% only in the same period. Of course, the increase in debt won’t be a problem if earnings have increased in tandem by the same amount. But sadly, this is not the case here as you can see from the bottom panel of the chart. As seen, the EBITDA earnings from NEE are indeed higher than Southern and Duke, but nowhere near the pace of its debt increases.

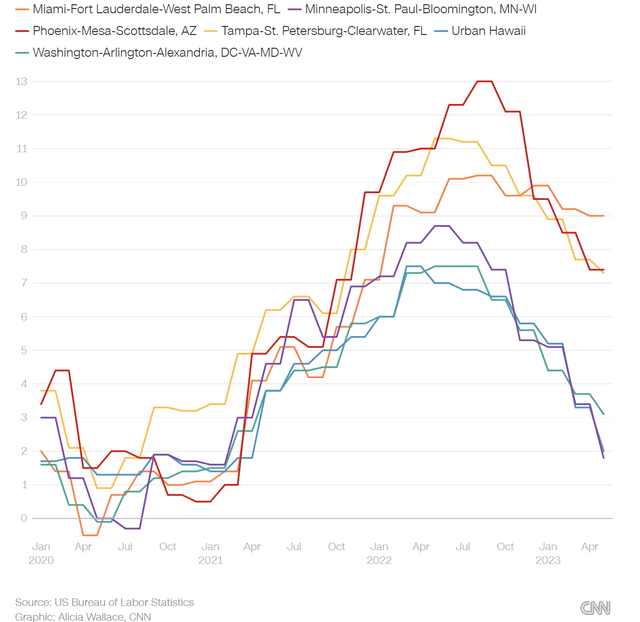

Furthermore, NEE’s large presence in Florida, which used to be a positive thanks to the state’s low unemployment rate and robust growth, could be another headwind going forward. The state is now the hotspot of inflationary pressure according to data from the U.S. Bureau of Labor Statistics (see the next chart below). Such pressure could lead to relatively high-interest rates in the state and further compound the interest rate risks. As such, NEE can suffer more sensitively to changes in interest rates than average utility companies in the XLU fund whose operations are in states with lower inflation rates and interest rates.

Source: U.S. Bureau of Labor Statistics

Final thoughts and takeaways

To recap, both NEE and XLU have suffered large price and valuation corrections since my last article in December 2022. In that article, I cautioned investors to steer clear of both NEE and the utility sector in 2023 due to their valuation risks and interest rate concerns. Fast-forward to now, both NEE and XLU are trading at a more reasonable valuation. However, I still see too much risk in NEE. Its valuation is still at a large premium compared to XLU. It is true that NEE’s profitability is better than the sector average. However, I do not see the difference being large enough to justify the valuation premium. Second, NEE’s rapid debt increase (relative to its earnings) and geographical exposure could cause extra risks in the current rate and inflation environment.

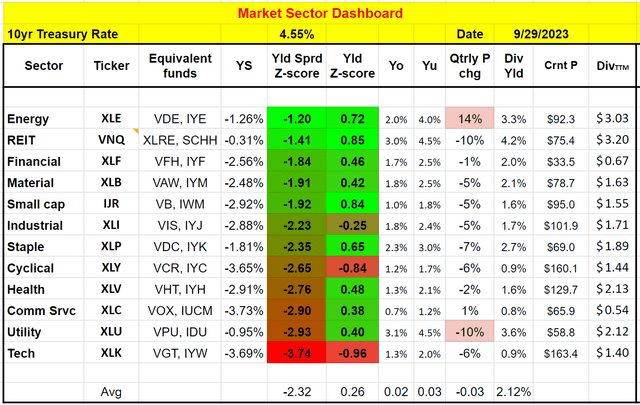

Finally, just to be perfectly clear, I am NOT suggesting you buy XLU either. My argument is that NEE’s performance will lag XLU due to the issues mentioned above, which does not mean that XLU itself is a good investment now. As our sector dashboard shows below (BTW, downloadable as a Google sheet), XLU currently is the second most expensive sector itself when measured by the yield spread against 10-year treasury rates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.