Summary:

- AT&T is trending higher in part due to focusing on debt repayment instead of blindly hiking dividends.

- The telecom announced another quarterly dividend of $0.2775, leaving the yield at 7.4%.

- The stock remains more of a short-term trade unless the company alters the business plan to where profits and cash flows return to growth.

jetcityimage

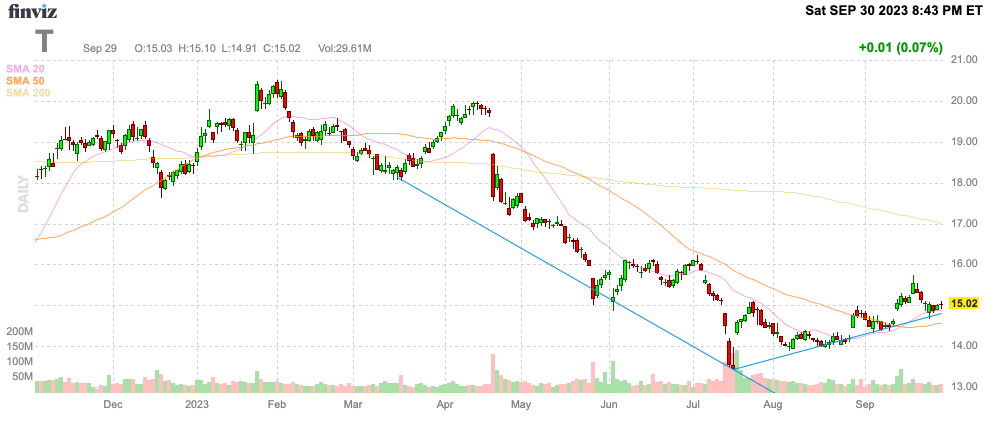

As highlighted a few months back, AT&T (NYSE:T) was beaten down to the point where the stock was more appealing. AT&T has now rallied off the late July lows as signs suggest the rally will continue. My investment thesis remains Bullish on the telecom stock for a short-term rally into year-end, but investors must not turn this back into a long-term investment due solely to the large dividend.

Source: Finviz

Smart Dividend Moves

On Friday, September 29th, AT&T announced the next quarterly dividend of $0.2775 for a dividend yield of 7.4%. Shareholders of record on October 10 get paid the large dividend on November 1.

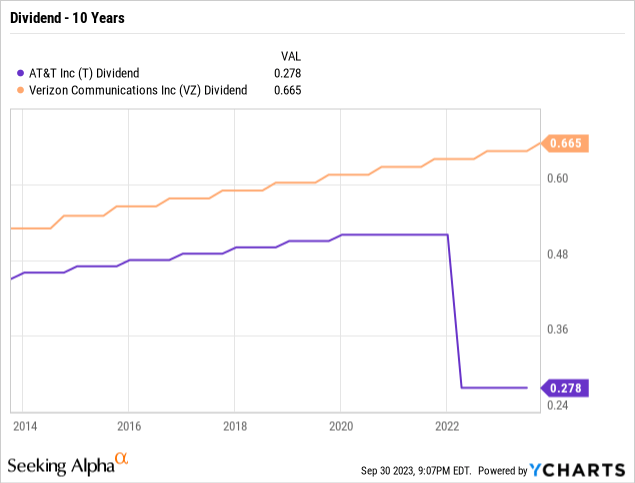

Of course, the dividend is only over 7% due to the stock price collapsing in the last decade. The good news is that AT&T isn’t blindly hiking the dividend anymore, unlike wireless peer Verizon Communications (VZ).

AT&T has now announced 7 straight quarterly dividend payments of $0.2775 per quarter following the dividend cut back in early 2022. The telecom giant used to hike dividends at the start of a new year, but the company appears to have finally realized that hiking the dividend payout makes absolutely no sense when the telecom giant has a huge debt load.

Verizon has taken the opposite approach and the stock hasn’t turned the corner. Our recent research highlighted how the BoD was making a mistake of increasing quarterly dividend payouts boosting the annual payout by $200 million each year. The stock trades at a decade low despite the constant hikes every year.

AT&T only faces annual dividend payouts of $9.3 billion now while the free cash flow targets for the year are up at $16+ billion. The telecom giant has far more cash to repay debt after the dividends.

Under these financial targets, AT&T has ~$6.7 billion to repay debt after paying annual dividends. A 2% annual dividend hike would’ve increased the payouts ~$186 million for 2023 leading to $372 million in additional dividend payouts for 2024. Suddenly, the available cash flow after dividend payouts would shrink to unsustainable levels.

Prime Example

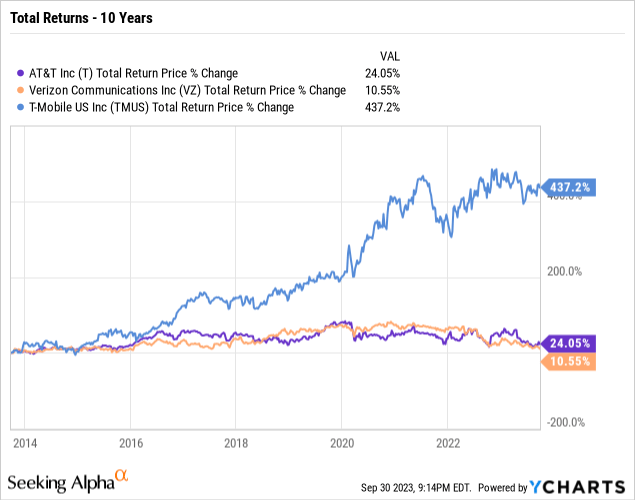

As we’ve tried to inform dividend investors in this space over the last several years, dividends alone aren’t a reason to invest in a stock. T-Mobile (TMUS) hasn’t offered investors a dividend, yet the stock has a total return of 437% in the last decade while both AT&T and Verizon have only produced minimal 20% returns despite large dividend payouts.

AT&T has smartly pulled away from focusing on dividend hikes for the sake of the company remaining a dividend aristocrat. On the Q2’23 earnings call, CEO John Stankey had this to say about the dividend:

As Pascal will discuss, we’ve addressed a number of one time and discrete items and now expect to use an increasing amount of our free cash flows after dividends to accelerate our debt reduction efforts.

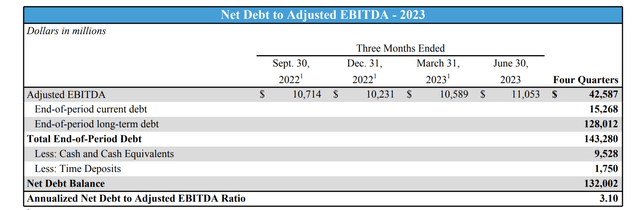

The telecom giant ended June with a net debt of $132 billion. The company has made several non-recurring payments this year and still has to pay another $2 billion for spectrum before debt repayments will start. After that, AT&T will start repaying debt and target reaching a leverage ratio goal of 2.5x EBITDA.

Source: AT&T Q2’23 earnings release

At current EBITDA levels of $42.6 billion, AT&T would cut the debt to $106.5 billion to hit the 2.5x leverage ratio. Based on the current debt levels, the telecom company hitting this ratio by 2025 would appear very aggressive.

Investors should realize that a goal of hitting a 2.5x net leverage ratio in over 2 years from now still leaves AT&T with over $105 billion in net debt. Investors should really question why the company would want to continue carrying debt knowing the top-performing tech stocks generate excessive returns in part to not becoming heavily indebted.

AT&T is set to report Q3’23 results on October 19. The consensus analyst estimates are for revenue to be mostly flat at $30 billion with the EPS falling nearly 9% to $0.62.

The biggest fear is that financial results won’t hit targets. Another issue, AT&T could end up facing major lawsuits and potential liabilities of the toxic lead cable issue.

Takeaway

The key investor takeaway is that AT&T has turned the corner with the company now focused on repaying debt versus hiking the dividend. The telecom giant still has to solve issues with the struggling business, but the stock offers less risk when repaying debt to better position the company for a rainy day. Besides, current investors still get a large dividend yield of 7.4%.

AT&T isn’t a stock to own for the long term unless the business magically returns to growth mode, but investors should collect a nice rally to $20 while collecting the large dividend over the next year. Investors just shouldn’t become married to the stock or the dividend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.