Summary:

- All eyes are on Tesla, Inc.’s ability to solve Full Self-Driving, but the underlying AI can be difficult to understand for better investment decision-making.

- In this article, we break down in a simplified manner Tesla’s approach to self-driving technology, and how it compares to competitors’ approaches.

- While investors are mainly excited about the potential ride-hailing service enabled by Tesla’s autonomous vehicles, the monetization opportunities go beyond this.

Bill Pugliano

Tesla, Inc. (NASDAQ:TSLA) stock has more than doubled so far this year amid the artificial intelligence (“AI”) mania. Tesla has proven its leadership in electric vehicle (“EV”) technology, though now the most important driver of Tesla’s stock performance has become its AI innovations, more specifically its self-driving technology. In fact, CEO Elon Musk has said numerous times that Tesla’s market capitalization is directly correlated to its ability to solve autonomous driving.

While the company is currently selling Beta versions of its Full Self-Driving [FSD] software, Tesla vehicles are not yet fully autonomous given that human supervision is still required. While the revenue opportunities through FSD are promising, Tesla also faces various challenges. Nexus Research assigns a “hold” rating to Tesla stock.

Given that FSD is such an important determinant of the future stock price performance, it is imperative for investors to gain a more comprehensive understanding of Tesla’s approach to self-driving, and how it compares to competitors’ self-driving technology, in order to make more well-informed investment decisions.

Tesla’s Full Self-Driving

Tesla recently introduced version 12 (“V12”) of its FSD software, and CEO Elon Musk emphasized repeatedly that FSD V12 uses an end-to-end neural network approach, striving to almost eliminate the need for software code to set specific driving instructions. What is an end-to-end neural network?

Let’s start by understanding what neural networks are. Perhaps the best way to understand neural networks in this context is by contrasting them against software codes. Software code is a set of instructions that tells the system exactly what to do. Consequently, software codes ensure that the system always produces the same output for the same input, and therefore allows for better predictability.

On the other hand, a neural network is a type of machine learning algorithm that strives to emulate a human brain. Neural networks are trained on massive amounts of labelled data to perform a variety of tasks, such as image recognition and natural language processing. In the context of image recognition as an example, the neural network learns to associate the data with the labels, and can eventually make predictions on its own on new data.

A key thing to note is that while software code tells the computer exactly what to do on a step-by-step basis, neural networks learn to perform tasks by example. As a result, there is also a certain level of uncertainty as to how a neural network will respond to unseen data or new objects, whereas with software coding there is more certainty that the system will or will not do certain things based on how it has been instructed.

So now that we better understand what neural networks are, let us understand Tesla’s end-to-end neural network approach. In previous versions of FSD, Tesla used a combination of software codes and neural networks to enable autonomous driving. But in the latest version, Tesla is shifting away from software codes, and instead just relying on a single, large neural network responsible for all aspects of driving. This large end-to-end neural network has actually been built up using numerous smaller neural networks and then stacked together into a single network.

For example, one neural network could be responsible for object detection, while another would be responsible for path planning. Strong signals, which are essentially videos of correct and high-quality driving behavior/ decisions, are fed to these smaller neural networks during the training processes. Subsequently, these neural networks are stacked together and trained cohesively again as a single neural network.

Essentially, the goal here is to better emulate how the human brain makes driving decisions, giving FSD the ability to make supposedly better driving decisions in a more holistic manner, carrying out all tasks related to driving (e.g., recognizing objects, planning/ deciding the best path forward, and executing the driving decisions through its control over the steering/ brakes) in a more adhesive manner.

Tesla has a few million vehicles which have various sensors and 8-9 cameras installed within them to collect enormous amounts of data and video feeds about the cars’ environments and the drivers’ driving decisions. This data is subsequently used to train FSD. The self-driving system makes decisions based solely on what it has learnt from millions of videos of real humans driving cars in various scenarios. Thereby it strives to eliminate the need for software code lines written by humans that instruct the system how to handle certain situations. An example of such a software code would be instructing the car to stop at a red signal, and move at a green signal.

One the key advantages of relying less on software code and more on an end-to-end neural network is the improved potential for faster decision-making by FSD. Quick decision-making is indeed a crucial element of high-quality driving, hence if Tesla can successfully offer superior performance through its end-to-end neural network approach, it could indeed translate to higher sales of its FSD software, as well as better pricing power, both conducive to stronger revenue growth for Tesla shareholders.

Furthermore, this end-to-end neural network approach enables greater adaptability to new surroundings and environments through self-learning, instead of relying on hard-coded rules which may not necessarily be applicable to all sorts of scenarios. This greater adaptability and the system’s ability to learn on its own means that human engineers do not have to hand-code and update specific rules for each new scenario encountered by autonomous vehicles. This could potentially lead to faster advancements in Tesla’s FSD over competitors’ offerings, possibly leading to better sales revenue growth for shareholders.

However, the elimination of hardcoding and relying solely on stacked neural networks making up an end-to-end system also comes with major challenges.

Smaller neural networks may not be able to achieve the same level of performance as larger networks, due to fewer parameters and hence lower capacity to learn complex patterns in the data. This may undermine the performance of these smaller neural networks to collectively enable a robust end-to-end system.

Furthermore, while the end-to-end neural network approach is expected to potentially offer better adaptability to new scenarios through self-learning, there could indeed be cases where the way the self-driving system handles certain unseen situations is potentially unsafe, putting people’s lives at risk and inviting regulatory scrutiny. In order for Tesla to correct the driving decisions of FSD in such instances, it would need to fine-tune the system using massive amounts of video data displaying correct actions to take. This could be more easily said than done, and may even lead to customer dissatisfaction while Tesla resolves the issues.

Furthermore, an end-to-end system also incurs lack of transparency into how decisions are made, making predictability more difficult. Hence when the system makes driving mistakes, it can be complex to determine the underlying causes. This is particularly concerning considering that people’s lives are at stake via the system’s driving decisions. Hence, in certain circumstances, it could be more ideal to be able to give certain direct instructions to the system through software code for better safety controls.

Acknowledging these challenges, rivals in the autonomous vehicles space like Mobileye Global (MBLY) and Aurora Innovation (AUR) are opting for a hybrid approach to building self-driving software, using a combination of hardcoding and data-driven methods, such as machine learning and deep learning.

The substantial inclusion of software code in the training and inferencing of self-driving systems allows for greater transparency into the decision-making processes, as well as more direct controllability of the overall system to more easily adjust the way the autonomous vehicles navigate various safety-critical situations.

Hence, the hybrid approach still allows these rivals to benefit from the greater adaptability and self-learning advantages through the neural network/ machine learning elements, while the hardcoding side of the system enables more control over safety issues, allowing for adjustments to be made in an easier and more cost-effective manner.

The reason why all this is important from an investor’s perspective is because if Tesla wants to succeed in self-driving, it will need to overcome various regulatory hurdles. Tesla will need to prove to regulators that its end-to-end neural network approach is sound for the public roads and can safely navigate new scenarios that it has not been trained on. Simultaneously, it will also need to convince consumers that its FSD offers high-performance and adequate safety measures, in comparison to the autonomous driving solutions offered by competitors, as this will be key to sales revenue growth.

Even if it successfully acquires regulatory approval, there is still the risk of Tesla’s FSD failing to safely handle unimagined and untrained environments. These would not only invite legal problems, but given the nature of end-to-end systems, it may be difficult for Tesla to resolve underlying issues effectively. These difficulties could even translate to lower sales of Tesla’s autonomous vehicles while the company resolves its issues, to the benefit of competitors.

All bets are off over which approach to self-driving will ultimately succeed over the long term, whether it is Tesla’s end-to-end neural network approach, or Mobileye/ Aurora’s hybrid approach. Nonetheless, what is visible are the business opportunities arising through self-driving technology.

Tesla’s business opportunities through FSD

Now that we have established a more solid understanding of Tesla’s approach to self-driving and how it compares to competitors, let’s delve into the revenue generation opportunities through this technology.

Tesla has outlined two main ways in which it expects to monetize FSD. The main and obvious monetization will be through selling FSD software with Tesla vehicles. The second way is to license FSD to other automakers.

This second approach considerably expands the total addressable market for Tesla’s autonomous driving technology, as it essentially aims to serve the entire self-driving vehicle market. Though the question is, how likely are other automakers to adopt Tesla’s FSD?

As discussed earlier, Tesla’s end-to-end neural network approach has both benefits and drawbacks, and there is no guarantee it will prove to be superior to competitors’ technology.

While Tesla plans to license its FSD technology in the future, keep in mind that rival Mobileye already licenses its Mobileye Drive software to more than 30 partners in the automotive industry, including companies like Stellantis (STLA) and Volkswagen Group (OTCPK:VWAGY).

Moreover, considering that Tesla would be a competitor to these other automakers, they may indeed be reluctant to license self-driving technology from the EV giant, as they may not want to create a growing revenue stream for its own competitor. If autonomous vehicles are indeed the future of driving, it would not be prudent to become heavily reliant on a competitor for critical technology over the long term.

A growing number of automakers have already been partnering with Tesla to establish the company’s supercharging technology as the standard for the EV charging in North America, which will already create a growing revenue stream for Tesla. Competitors are of course aware of this financial advantage for Tesla, and will want to mitigate becoming overly reliant on Tesla for all forms of new-age technology. Hence, these other automakers may indeed continue licensing self-driving technology from companies like Mobileye, which are not considered as competition. Therefore, investors should moderate their expectations for revenue growth through FSD licensing in the future.

Coming back to Tesla’s main business of selling cars and software directly to consumers, the current FSD beta is available to Tesla users through two ways. The first way allows the Tesla owner to pay an outright fee of $12,000 to have FSD enabled for their Tesla vehicle. However, if they sell this FSD-enabled vehicle in the future, they won’t be able to transfer FSD to a new Tesla vehicle. The second option is a subscription-based model where the Tesla owner pays a monthly fee of either $99 or $199. Given that FSD can’t be transferred to new vehicles, Tesla users could be more inclined towards the monthly subscription-based model.

For context, Tesla had allowed the transfer of FSD to a new vehicle before 30th September 2023, but no longer allows this for new vehicles.

The inability to transfer FSD could have a big downside for Tesla. If FSD were transferrable, it would increase the probability of these users buying another Tesla as their next new vehicle in the future, enabling Tesla to keep these customers entangled within the Tesla ecosystem. However, inability to transfer FSD would leave the door open for these Tesla users to explore other brands when they buy a new vehicle.

The market often compares Tesla’s software opportunity to that of Apple Services (AAPL). But what underpins Apple’s success is the transferability of Apple Services usage from one device to another. That way, Apple device users don’t lose any services they have paid for (nor their data) when they buy a new device. Not only does this enable Apple encourage users to regularly upgrade their iPhones, but it also enables them to cross-sell more devices such as MacBooks and Apple Watches, tightly entangling users into the ecosystem. This is how software should typically be leveraged to build an ecosystem that is conducive to both hardware and software sales revenue growth through growing pricing power.

However, in the case of Tesla, the inability to transfer FSD to new vehicles could be a lost opportunity to keep consumers knotted to the Tesla ecosystem.

Nevertheless, Tesla certainly has plenty of opportunities to monetize FSD through additional software services. The most prominent opportunity highlighted by Tesla is a ride-hailing service, which could gain more traction once Tesla is able to offer truly autonomous cars without human supervision. Tesla could indeed produce self-driving robotaxis specifically intended for facilitating such transportation services, enabling them to pocket 100% of the fare charged to riders.

Aside from its own fleet of robotaxis, Tesla can also allow FSD-enabled vehicle owners to deploy their autonomous vehicles to be used for ride-hailing services when they don’t need their cars for personal use. The company already offers the Tesla App to Tesla users, through which the EV giant should also be able to offer a ride-hailing program to its installed base.

This would enable Tesla to earn commission revenue from the fares charged to riders, akin to how Uber generates money.

Keep in mind that tech giants like Google (GOOG) (GOOGL) and Apple also plan to enter the ride-hailing industry through their own autonomous vehicles. These rivals have more well-established platforms and larger user bases that they can leverage to encourage usage of their prospective ride-hailing services in the future. Therefore, Tesla will face intense competition in the ride-hailing space, undermining pricing power.

Nevertheless, there are various additional monetization opportunities available to the EV giant. As Tesla builds out a commercial ecosystem around the Tesla App, the company also has the opportunity to expand into fintech services to monetize the payment flows happening through the Tesla app. For instance, assuming that Tesla successfully rolls out a ride-hailing service that Tesla owners can participate in, Tesla could pay Tesla owners their share of the ride-hailing fare within the Tesla App through a supposed ‘Tesla Wallet’ section, for example. Furthermore, Tesla could encourage users to pay for goods and services using potential in-house Tesla payment solutions, such as for supercharging. This would enable Tesla to generate transaction fees on such payment flows, the way fintech apps like PayPal and Cash App do.

In fact, ride-hailing giant Uber (UBER) already offers drivers the Uber Wallet service through its app, as well as Uber-branded debit and credit cards, including the Uber Card Pro. “Built for drivers and couriers, the Uber Pro Card offers customized perks including up to 10% cashback on gas and up to 12% on EV charging.” Similarly, Tesla could offer cashback rewards or other perks at supercharging stations for Tesla app users, thereby encouraging more people to buy Tesla vehicles and use its suite of software services, ingraining them into the Tesla ecosystem.

To be clear, Tesla has not announced any plans to launch a Tesla-branded payment/ fintech service, but the point that Nexus Research is trying to make is that, as the Tesla ecosystem expands, it will open the door for new revenue opportunities. After all, let’s not forget that Elon Musk was one of the founding members of PayPal (PYPL).

Coming back to the potential ride-hailing service enabled by FSD, a Tesla ride-hailing app aimed at consumers of such services (or “riders”) would also open the door to advertising revenue. ChatGPT-style chatbots or virtual assistants can be deployed within the app or even within robotaxis to gain a better understanding of riders’ interests and preferences, conducive to targeted advertising. Advertising solutions also tend to be higher-margin services, and, therefore, would help Tesla improve profit margin expansion for shareholders.

Tesla Financials & Valuation

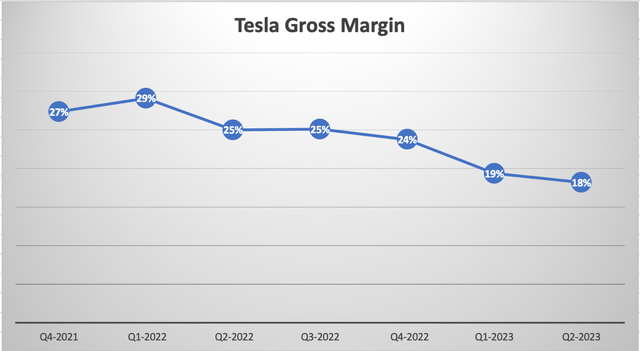

Tesla’s gross margin has been notably declining over the last several quarters as the EV giant engages in a price war with other EV automakers.

Nexus Research, data compiled from company filings

In fact, Tesla has been cutting prices of both its EV vehicles and FSD beta to encourage more adoption and sustain market share leadership. This has raised questions among the investment community over whether Tesla holds any meaningful pricing power, whether that is in the EV market where Tesla boasts an early-mover advantage, or in the autonomous vehicle space as investors look to AI advancements as the next growth driver.

The narrowing profit margin is indeed concerning, though this pricing strategy also brings advantages to Tesla beyond increased vehicle sales.

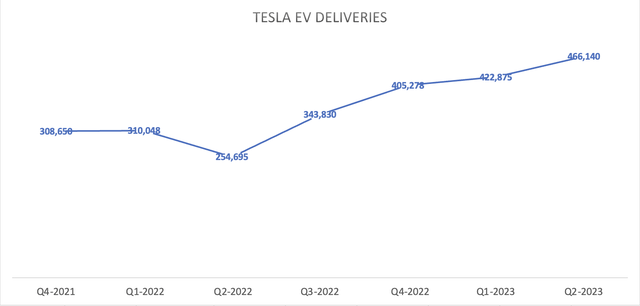

Note: Deliveries is the best available approximation for total vehicle sales (Nexus Research, data compiled from company filings)

Keep in mind that each vehicle sold is installed with 8-9 cameras that enable Tesla to collect massive amounts of video feed, which subsequently is used to train FSD. The more data FSD is trained on, the better its performance is likely to be (up to a certain extent).

Hence, while Tesla recently cut the price of the FSD beta to encourage greater adoption, the key underpinning strategy is to eventually build a more superior self-driving technology using a growing dataset for training, which should yield Tesla better pricing power over the long term.

That being said, whether Tesla’s FSD will actually become the best self-driving technology available in the market is still up for debate, as per the challenges discussed earlier. Moreover, while there is a lot of optimism surrounding Tesla’s future software revenue opportunities, Nexus does not believe the company’s current strategy for FSD monetization is ideally designed for the build-out of an ecosystem.

While the growth opportunities are plentiful, Tesla still has a lot to prove to justify the current valuation of over 84x forward earnings (as per Seeking Alpha data). Nexus Research does not believe the stock is worth buying here, as the valuation is not appropriately reflective of the challenges Tesla faces alongside its opportunities. Nexus Research assigns a “hold” rating to Tesla stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While Nexus Research has assigned a ‘hold’ rating on Tesla stock, readers deserve to know why Nexus does not own the stock. Nexus refuses to invest in Tesla due to various unethical business practices. For instance, Tesla’s current FSD Beta program is a dangerous method for data collection, as the current imperfect system endangers people’s lives on public roads. Furthermore, Tesla factory workers face harsh working conditions which enable Tesla to keep costs low and boost profits. Nexus refuses to profit from such practices, due to certain ethical and religious values.

Current and future ratings on the stock simply reflect whether Nexus believes the stock will go higher or lower based on business developments and growth prospects.

That being said, Nexus Research aims to continue offering simplified insights into Tesla’s technology and an unbiased assessment of Tesla’s business in all future articles to enable Seeking Alpha readers to make well-informed investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.