Summary:

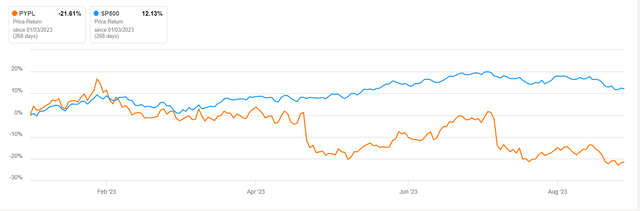

- PayPal’s stock has underperformed the market this year, down 22% while the S&P500 is up 12%, causing valuation to become attractive.

- PayPal is trading at 12.5x EV/FCF and 11.8x P/E based on non-GAAP EPS guidance for 2023.

- Despite a decelerating growth in active accounts, PayPal’s business performance remains strong, with growth in TPV supporting future revenue and earnings growth.

- Selling BNPL receivables should provide a boost to FCF, with incremental capital going to share repurchases.

naphtalina/iStock via Getty Images

PayPal Holdings (NASDAQ:PYPL) is an established fintech company that has not received any love from Mr. Market this year, as the stock is down 22% while the S&P500 is up 12%.

My argument is that PayPal’s underperformance provides a compelling investment opportunity due to two major reasons:

- A long track record of growth and strong business performance should cause the stock to rebound over the medium to long term. My bet is that the best is yet to come, as stock performance is not following business performance. That is the opportunity.

- The underperformance led to a highly attractive valuation. PayPal is trading at 12.5x EV/FCF based on adjusted TTM free cash flow, and 11.8x P/E based on guidance for non-GAAP EPS of $4.95.

This article analyzes PayPal’s business opportunities and challenges. My approach to investing is to focus on businesses, and thus the analysis will be focused on PayPal’s business. The thesis is the business has been performing well, and PYPL stock will eventually catch up to business performance.

Without further ado, let’s dive in.

Business Performance Year-to-Date

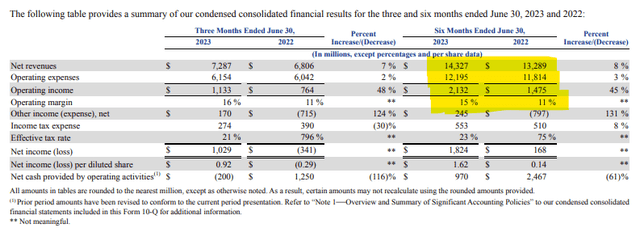

PayPal’s net revenues grew by 8% in the first half of the year and operating income grew by 45%. The meaningful rise in operating income is driven by cost cutting efforts that reduced operating expenses related to sales, G&A, and customer support.

Managing the cost structure has been an effort the executive team started last year, and it seems to be working as one can see it through the reported results.

Operating margin was 15% in the first half, improving by 400 basis points over last year. Further improvement may be difficult to achieve from here, but the stock has not responded to such improvement.

The table below shows revenues and operating performance:

Total Payment Volume Growth

TPV (total payment volume), a key performance indicator that reflects the net value of payments processed by PayPal’s platforms, grew by 10% in the first six months of the year to $731 billion in the first six months. Growth in TPV tells me that active accounts are increasingly relying on PayPal’s platforms to complete payments.

TPV is a key driver of the business, and seeing TPV growth keeps me optimistic about PayPal’s performance.

Part of the reason for higher TPV is the high inflation environment, as TPV is reported in nominal terms (as opposed to real terms). I see that as an advantage because it makes PayPal resilient to highly inflationary environments. Because PayPal’s TPV rises alongside inflation, PayPal’s revenue should rise alongside inflation as well.

Active accounts – is there a growth problem?

PayPal defines an active account as “an account registered directly with PayPal or a platform access partner that has completed a transaction on our platform, not including gateway-exclusive transactions, within the past 12 months”.

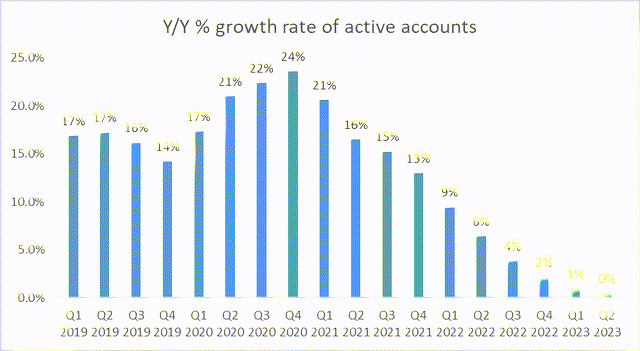

It seems like a major reason for PYPL stock to underperform is the decelerating growth rate in active accounts, illustrated below.

Company Filings, Author Calculations

PayPal used to be a growth story based on the rapid (and accelerating in 2020) growth of active accounts, but that trend is coming to an end with the most recent quarter showing a mere 0.47% Y/Y growth in active accounts, which it doesn’t even round up to 1%.

When looking at the active accounts trend, the natural conclusion is that PayPal is no longer attracting new users to the platform, and perhaps will soon see a decline in active accounts.

So, why bet on PayPal after seeing this trend? A few reasons:

- The number of payment transactions is still growing on the platform. On a year-to-date basis, PayPal reported 11.9 billion total payment transactions, a +12% growth on a Y/Y basis. That tells me the users that are on the platform are using PayPal more often, so PayPal doesn’t necessarily need new active accounts to keep growing revenues. All it needs is to make sure existing accounts are increasingly using it, which seems to be the case.

- Higher number of payment transactions is fueling TPV growth. As long as PayPal’s existing active users are relying on the platform to complete their payments, and if PayPal can improve its services with new products such as BNPL, then existing accounts should drive TPV growth.

In my opinion, one of the fears that Mr. Market is pricing into PYPL stock is the idea the lack of active account growth will ultimately crush revenue growth. However, if PayPal’s existing active accounts increasingly use the platform to complete their payments, that shouldn’t be the case.

PayPal and KKR Partnership Is a Good Move

In late June, PayPal announced a multi-year partnership with KKR to sell up to ~$42 billion (40 billion Euros) in BNPL (buy-now-pay-later) receivables originated in Germany, France, Italy, Spain, and the U.K. Said another way, for the next few years, KKR will purchase PayPal’s BNPL receivables in Europe. KKR will purchase the receivables on the balance sheet today, and future receivables generated by PayPal’s BNPL service.

I view this as good news for a few reasons:

- It should free up PayPal’s capital, which the executive team has already earmarked for share repurchases. Given the attractive valuation of PYPL, I applaud the share repurchases.

- Given KKR’s enormous size and established platform, the partnership should allow PayPal to grow the BNPL offering. This transaction is also a win for KKR because it allows them to put capital to work and streamline access to consumer credit at scale, which is not easy. Thus, the deal is a win-win for all parties involved.

This deal should allow PayPal to repurchase $1 billion more than it was planning at the beginning of the year, taking the total stock repurchase to approximately $5 billion this year. With a market cap of ~$64 billion as of this writing, I believe PayPal could potentially repurchase approximately 8% of its market cap this year.

Balance Sheet Analysis

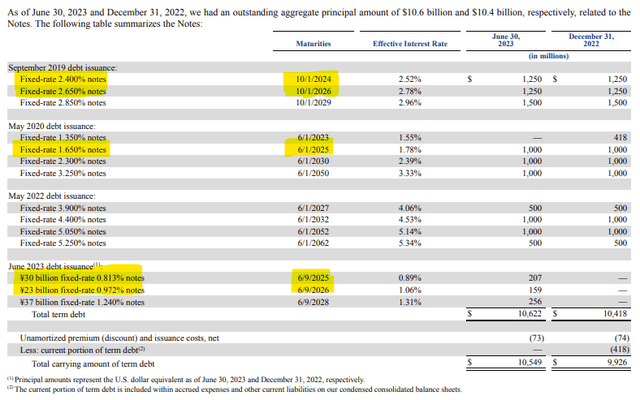

PayPal’s balance sheet could be better, as it carries approximately $10.6 billion of debt. I think it would be better if it had zero debt.

However, I am also not concerned about the balance sheet given a high cash position and consistent free cash flow generation. PayPal holds ~$9.9 billion in cash and short-term investments. That takes the net debt number to just ~$700 million, a small proportion of its market cap and enterprise value.

The sizable cash balance provides a nice cushion to withstand the debt load, and reinvest accordingly if business performance deteriorates.

The maturity schedule is well laddered with ~$1.25 billion maturing next year, ~$1.2 billion maturing in 2025, and ~$1.4 billion maturing in 2026. That means there is enough liquidity to repay debt with cash on hand and free cash flow. And given the higher interest rate environment, I sure hope that PayPal chooses to repay debt as opposed to refinancing it.

Unless PayPal spends its huge cash balance in an unproductive way, the debt should not be a problem over the next three years.

PayPal’s debt details are shown in the table below:

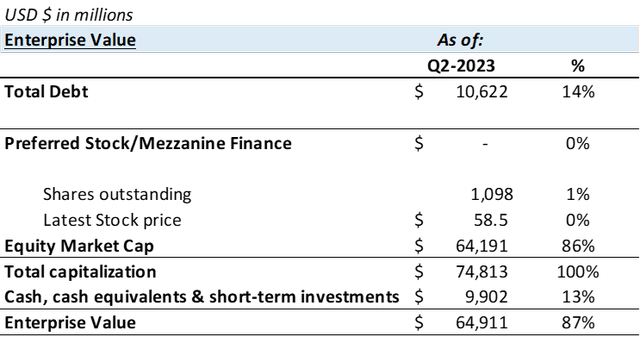

Enterprise Valuation

I calculate PayPal’s EV (enterprise value) at ~$64.9 billion, comprised mainly of equity market cap of ~$64 billion and net debt of ~$700 million. The calculation is shown in the table below:

PayPal Filings, Author Calculations

Given that PayPal generated ~$5.2 billion of FCF (free cash flow) over the TTM (trailing twelve months), adjusted for the sale of BNPL receivables that temporarily reduced FCF in the last quarter, I see PYPL trading at ~12.5x free cash flow, an attractive as it implies an FCF yield of ~8%.

For a company that is growing revenues and operating income by growing TPV, a pristine balance sheet, and the potential to generate even higher free cash flow from selling future BNPL receivables, 12.5x free cash flow looks compelling.

Risks To Consider

Every reader should keep in mind that investing in PYPL carries important risks, and companies that have underperformed the S&P500 by this much are particularly risky, as Mr. Market is already implying PYPL is not a great investment. In this section, I will outline some major risks that I see in PYPL.

I believe the most important risk factor is competition, both in the P2P (peer-to-peer) payment process as well as merchant businesses. PayPal’s active accounts includes both consumers and merchants, and there is competition on both sides. Examples are Zelle, Square (including Cash App), Facebook Pay, Stripe, Ayden, Samsung Pay, among others. Even the Federal Reserve is attempting to provide a faster and better payment service (FedNow) than the current options, including PayPal.

I believe that competition is the main reason for PayPal’s decelerating active account growth, though it is yet to meaningfully impact TPV growth. Time will tell whether competition can take enough market share from PYPL to cause meaningful TPV declines.

About a month ago, PayPal has hired Alex Chriss as the new CEO. While the new CEO looks promising and has had a successful career at Intuit, this is a new challenge and environment for him. Leadership changes always bring risk, and it is yet to be seen how the new CEO will impact PayPal’s business performance. The new CEO took his role on September 27th, and Mr. Market is yet to see his next big move. Could it be a big acquisition? Could it be a big capital allocation shift? We shall see.

Additionally, a slowing rate of inflation is a risk factor to keep in mind for PYPL. Recall that TPV growth is driven by inflation. A slowing rate of inflation could mean slower TPV growth.

Investor Conclusion

After carefully considering the opportunities and challenges of the business, coupled with valuation and risk factors, PYPL looks compelling. PayPal’s business is performing well, and I expect the existing user base to support growing TPV, operating income, and free cash flow.

I also think that PayPal is undergoing a shareholder-base transition. On the one hand, growth investors exit the stock for fear of dissipating growth trends, especially because of active account growth (or lack thereof). On the other hand, value investors are becoming increasingly interested after PYPL came back from ultra-high valuations. Recall PYPL was a $300+ stock a few years ago.

PayPal is trading at 12.5x EV/FCF, which translates to an ~8% FCF yield. On a P/E basis, PayPal is trading at 11.8x based on its non-GAAP EPS guidance of $4.95. The combination of an attractive valuation and still growing business looks compelling in PYPL.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.