Summary:

- PayPal’s stock has dropped more than 80% from its peak in July 2021, and there is uncertainty about its long-term prospects.

- The company’s revenue growth has been decelerating, and it is facing increased debt and competition in the payment processor industry.

- The appointment of a new CEO may provide a potential turnaround, but it is uncertain if they can overcome the challenges and generate a catalyst for the stock.

- We rate PYPL stock as a Hold.

Justin Sullivan

We rate PayPal (NASDAQ:PYPL) as a hold as, in our view, the company does not have a clear catalyst for the short term or middle term, making the long term even more uncertain; we think that an underweight would be a more exact rating. The stock price has dropped more than 80% from its peak in July 2021, and some investors consider the stock a strong buy given its supposed long-term perspectives, its new innovative projects, and the change in management with Alex Chriss, who worked previously in an important division of Intuit (INTU). In this article, we will assess why the stock has had a bad performance in the last few years and why we think that the stock might not have a clear factor that triggers its valuation in the middle term while the long term is still uncertain. Also, we will see the new CEO’s past performance in the small business and self-employed division from Intuit in order to guess if he might be able to make a company’s turnaround that may attract new investors. PayPal is a profitable company whose revenue growth has been decelerating in the last few years, but its main weakness may lie in its own business model and its industry.

Guidance for FY 2023

The management expects GAAP EPS to be between $0.85 and $0.87, with a growth rate of 8% for Q3 2023. Non-GAAP EPS is expected to reach between $1.22 and $1.24, which is growth of 13%-14%. For the overall year 2023, management expects the GAAP EPS to be around $3.49, compared to $2.09 in 2022. Also, it reiterates the non-GAAP EPS to grow around 20% to $4.95. The market, knowing this information, has not reacted in a positive way to the stock, so we will try to find out what is behind this bearish sentiment toward the stock.

Deceleration of important metrics in the last few years combined with higher debt

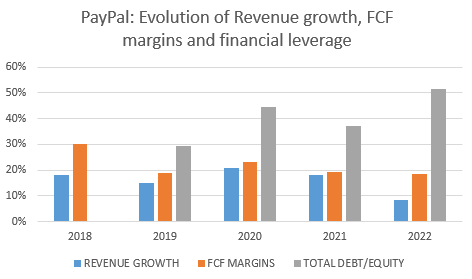

Most likely, several analysts are just considering the expected revenue growth for the next quarter and for the entire year of 2023 to infer that the market is wrong about PayPal. Nevertheless, we may start showing a first graph that portrays how PayPal is managing its capital while experiencing a deceleration in its revenue growth in the last few years:

Annual Reports, Author

In the graph above, we may see that the revenue growth shows a clear downward trend with decreasing free cash flow (FCF) margins while the total debt is increasing substantially. Probably, the debt factor might have gone unnoticed as the company generates a good FCF, so if we divide the total debt by the FCF in 2022, the ratio is 2.04x, which is manageable.

However, the graph might be telling us that the company could be desperate by building new growth avenues that support future revenue growth in an industry with low barriers to entry and low pricing power; in other words, a not-so-strong moat. A more acceptable chart would have been a flat total debt or even decreasing, while gradually increasing the FCF margins and revenue growth. We will have to wait in the next few years if this negative trend continues.

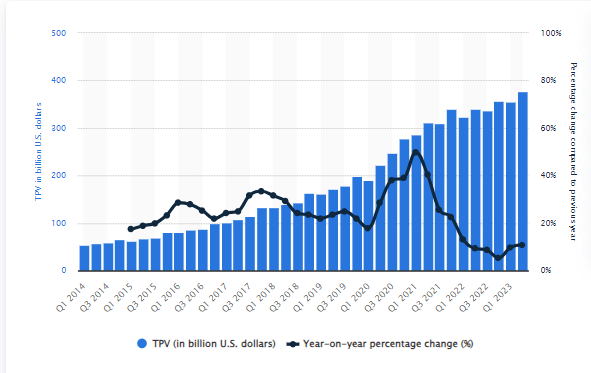

Another important metric is the value of payments processed (TPV), and here we can see its evolution from Q1 2014 to Q1 2023:

Statista

In the chart above, we can see that there has been a clear deceleration in the TPV in the last few years, as seen by the black line, which strongly influences PayPal’s revenue growth. This could be explained by a saturation in the industry combined with more competition that is offering similar services. Of course, the downward trend in the TPV’s growth could change if the economy gets into a strong recovery where consumption is triggered by a new economic cycle, but we would have to wait for that scenario for the next 2 or 3 or even more years, and even in that scenario, the other competitors might experience a similar recovery or even a better recovery.

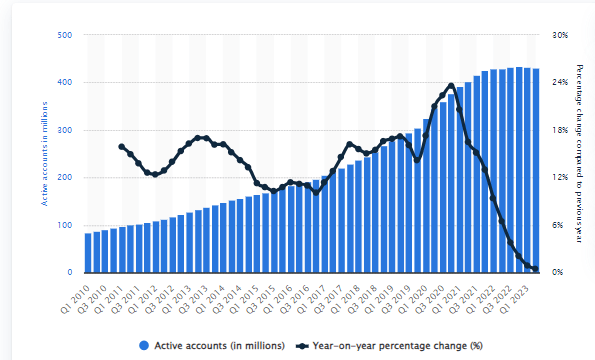

Another interesting metric is the global user number of PayPal from the 1st quarter of 2010 to the 2nd quarter of 2023:

Statista

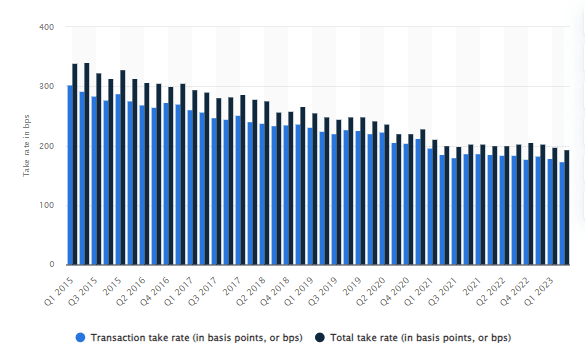

The deceleration of the TPV is reinforced by the deceleration in the growth of the number of accounts, which has been clear since 2021. The company’s strategy should be clearly focused on how to attract more new accounts, not only from consumers who are not using any platform but also from consumers who might be using the competitor’s platforms. Nevertheless, if the company does not have a strong moat, it means that it would need to substantially increase its R&D expenses to achieve an important differentiation. More expenses combined with a not-so-strong pricing power would result in lower future net margins. This relatively weak pricing power could be seen through the transaction take rate of PayPal across the world from the 1st quarter of 2015 to the 2nd quarter of 2023:

Statista

There could be many factors that are causing the downward trend in the take rate, but the chart above basically shows that the portion that is charged by PayPal from the total transactions managed through its platforms is declining, which confirms the relatively low pricing power aforementioned. A lower take rate is a way to gain market share in a very competitive market as the value of payments processed and the number of transactions are increasing on the company’s platforms. But, in a low-barrier-to-entry industry, the company cannot keep doing this as competitors are doing the same to retain their respective market positions, so the company needs to continuously reduce the take rate over time, as shown in the chart above.

PayPal is taking care of its operating costs as the company has improved its operating margins by 50% in the first half of 2023 YoY. However, this policy of cost reductions is not sustainable in the long term as a CEO cannot keep reducing costs year by year, so the only sound strategy to keep margins stable is through pricing power, which is strongly related to a company’s moat, or by adding new innovative services that prove to be successful in a sustainable way.

The last strategy is what PayPal is trying to do, such as the implementation of the buy now, pay later solution and the development of digital wallets, among other different products that are in the pipeline. Nevertheless, this is a very challenging strategy for the company because it implies that most of these new innovative services must really contribute to generating more profitable growth, which is not guaranteed, at least in a very consistent way, adding to the higher R&D expenses needed to launch those new initiatives. With restrictions on raising its fees and a limited room to reduce costs, there will be pressure on the margins over the long term.

In addition, this strategy should be reinforced with new acquisitions that are really focused on the core business. Any acquisition that is not clear or might avert the company from its core business can be taken as a very bad sign by the market, punishing the stock price significantly; a clear example was the news about a potential acquisition of Pinterest by PayPal in 2021.

The acquisition of Honey, which was PayPal’s largest transaction in its entire history, involved the payment of $4 billion for a company whose revenues were around $200 million annually and with only 17 million monthly active users. These are the kinds of mistakes that a company like PayPal could make in a desperate move to keep its competitiveness in an extremely competitive industry with not so much room to be unique.

Payment processor industry: hard industry to build up a moat

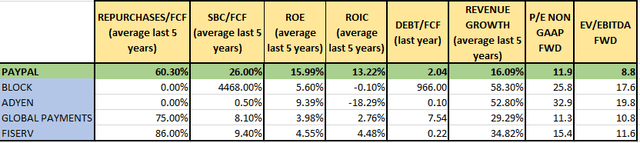

We collected some data from PayPal’s closest competitors, and it seems that we were on the right track when we mentioned that the payment processor industry is a very difficult industry for all the players, but apparently, PayPal has made efforts to offer good ROE and ROIC over the years:

In the table above, we may see that all of PayPal’s competitors show good revenue growth on average, though all of them experienced a deceleration in revenue growth in the last 2 years. However, the quality of that growth is relatively poor, as all of them show a very low return on their capital, given their low ROE and ROIC.

Looking at their valuations by multiples, we may see that investors in these companies, in general, are rewarding the higher revenue growth regardless of the quality of that growth; that is not a good strategy since if we follow it, we could experience further declines in the stock price as the multiples might keep declining if those companies continue showing more slowdown in their lower-quality revenue growth in the next quarters.

PayPal has the lowest non-GAAP PER and EV/EBITDA compared to its main peers, so most investors looking at these metrics might conclude that PayPal is cheap, so they should buy its shares.

In our view, it’s not good enough that a stock is cheaper than its peers; the company should show a strong moat and a clear and strong catalyst in the short term or middle term; PayPal does not show any of the two factors right now. We guess that most institutional investors do not have a clear picture of PayPal’s long-term situation, given the strong competition within the industry and the low barriers to entry. In that scenario, it would be a sound strategy to look into other industries whose companies show more resilient business models, particularly in this scenario when we are in the middle of macro headwinds.

The new CEO might or might not be a catalyst: the reason for a hold rating

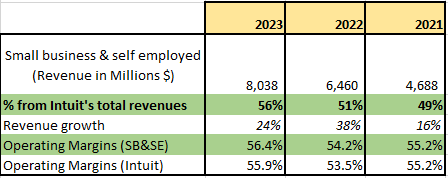

Alex Chriss is taking over as a new CEO in September 2023, and some analysts see this change as a potential turnaround for PayPal. We’ve collected some of the data that shows Chriss’ performance leading Intuit’s most important division since 2019, the small business and self-employed division (SB&SE):

Intuit Annual Report

In the table above, we can see that the proportion of revenues of the SB&SE division over the total Intuit’s revenues has been increasing since 2021, which means that Chriss’ division has been growing faster than the overall Intuit’s revenues in the last 3 years. In addition, SB&SE’s operating margins were higher than those of Intuit. These numbers show that Chriss will look for more profitable growth in PayPal through the development of new innovative services and acquisitions.

Chriss led a successful acquisition in the SB&SE division, buying Mailchimp for $12 billion, or around 12x sales in 2021, which is a decent multiple for a company that has been profitable since day one. Given his background, the new CEO would focus his energy on the further development of the small and medium-sized businesses (SMBs) sector, a segment where PayPal might develop new avenues for growth.

With all these numbers and performance in the SB&SE division, you would be tempted to say that there is a great chance that Chriss will be able to make a successful turnaround in PayPal. Nevertheless, we should ask ourselves: how much of those good numbers are a result of Chriss’ leadership and ability, and how much is the result of Intuit’s strong moat? We have evidence about Intuit’s moat, but we do not know how Alex Chriss’ performance would change if he worked for a company with a weaker moat.

On the other hand, under Chriss’ tenure, PayPal would need to surpass analysts’ expectations quarter by quarter in a consistent way to generate a catalyst for the stock price in the short term and middle term. The fierce competition within the industry combined with the macro headwinds and the not-so-strong moat of the company make it very difficult for any CEO who is conducting a business like PayPal. However, there could be a possibility that Chriss might surprise the market and generate the catalyst so much expected by PayPal investors.

This is the reason why we rate the stock as a hold and not a sell, given its huge decline from its peak in 2021 and the possibility that the new CEO will make a very hard turnaround. Anyway, PayPal investors could adjust the weight of PayPal within their portfolios depending on their own expectations related to the new CEO. In our particular view, we are very conservative, and we prefer to look for opportunities in other industries.

Valuation

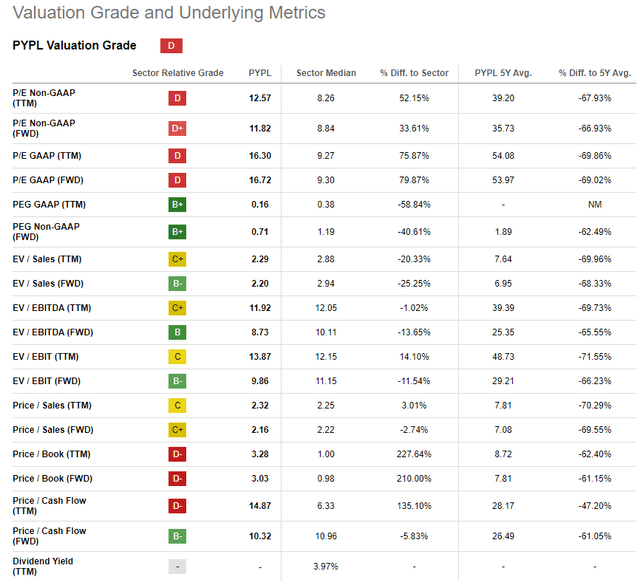

Looking at the different multiples, we see different situations, as in some multiples PayPal is cheaper and in others it is more expensive than its peers:

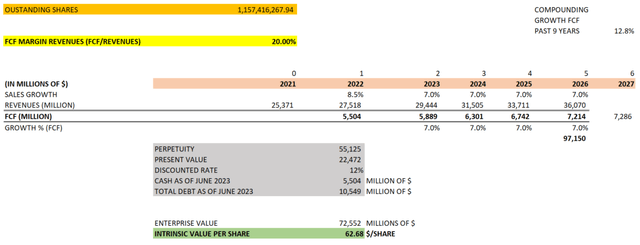

We would need to use a discounted cash flow method to see if the stock is cheap or not, based entirely on PayPal’s ability to generate future FCF while making certain conservative assumptions:

Assumptions

- Outstanding shares from 2022: 1,157,416,267

- FCF margins: 20% (even when PayPal had FCF margins of 19% in 2021 and 18.56% in 2022).

- Annual revenue growth of 7% beyond 2023

- Discounted rate of 12% (a discounted rate that shows a not-so-strong moat)

- Cash as of June 2023: $5,504 million

- Total debt as of June 2023: $10,549 million

- FCF growth of perpetuity: 4.5% (the past CAGR of FCF in the last 9 years was 12.8%).

To find the perpetuity, we used the formula:

Perpetuity = FCF 2026/(discounted rate – g)

where g = FCF growth in perpetuity, which was assumed to be 6% annual

With perpetuity, we calculate the present value of all the FCFs beyond 2026. Then, we calculate the enterprise value using the following:

Enterprise Value = Present Value of FCF (from 2023 to 2027) + Perpetuity + Cash – Total Debt

Finally, the intrinsic value is calculated by taking the enterprise value and dividing it by the outstanding number of shares. In this way, we could get $62.68 per share under the assumptions presented. The current stock price is fluctuating around $58 per share, so there is not a sufficient margin of safety.

Of course, we can make certain changes in our assumptions; for example, you can reduce the discounted rate from 12% to less than 10%, increase the revenue growth expected to 10% or more in the next few years if you trust so much in the new CEO, expect a reverse in the economic cycle, or maybe you want to increase the growth of FCF in perpetuity to a rate higher than 4.5% annually. With all those changes, you would get a higher intrinsic value than $62 per share.

However, it depends on how comfortable you feel about holding the stock for the next few years. In our own particular view, a discounted rate of 12% combined with 7% of revenue growth represents our vision about the difficulties of making a turnaround in a company like PayPal while facing strong macro headwinds. Apparently, the market is making similar assumptions about PayPal’s future as the stock price is close to our intrinsic value.

Risks

The biggest risk to our thesis is that PayPal recovers gradually over the next quarters while consistently building up a stronger moat, which would be reflected by higher pricing power and the launch of several new successful innovative services that contribute to more revenue growth and higher margins.

Another risky scenario for our thesis is that the new CEO ends up building a very strong moat through a brand similar to Apple or Coca-Cola. For example, we could imagine a scenario where PayPal is such a trusted and loved brand that most people and companies would not even consider any other brand. At that level of emotional attachment to its consumers, PayPal could develop strong pricing power and a solid moat.

Nevertheless, we know that both scenarios are unlikely given the nature of the industry and PayPal’s business model. Just ask yourself if you would feel an emotional attachment to a payment processor. On the other hand, it’s really hard, in a very competitive industry with not-so-much room to stand out, to launch many successful innovative services consistently over the years when your competition is doing exactly the same.

Final Thoughts

As the stock price has been falling substantially in the last two years, some investors think that the stock is cheap and deserves to be bought. However, it’s important to buy not only because the stock is relatively cheap compared to its main peers but also because the company offers a clear catalyst that might boost the price.

Here, we assessed certain potential catalysts mentioned by some analysts, such as a new CEO developing new ways to build more innovative services or a positive change in the macroeconomic situation in the next few years that might boost the consumption and usage of payment processor services. However, in our view, the first step to take is to be aware of how strong the company’s competitive advantages are that harness the most of a rebound in the economy or that make it easier for the management to achieve a successful turnaround.

We like to assess a business from a very long-term perspective, and we do not see a clear picture of PayPal’s business model in the long haul given the very strong competition in its industry and its low capacity to raise fees when competitors could still offer innovative services at lower fees. In addition, this process of constant innovation would gradually increase the R&D expenses, combined with a low pricing power, which might end up putting much pressure on the margins over the long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.