Summary:

- Intel’s financial turnaround is showing positive signs, with an uptrend in share price and a recovery in revenue and earnings.

- The success of Intel’s plan to achieve 4 nodes in 5 years will determine its ability to compete with TSMC and regain its strength.

- The key factor to watch is whether Intel can meet its targets, as failure to do so could negatively impact its core business and foundry plans.

hapabapa

Intel (NASDAQ:INTC) is a multinational technology company with a market capitalization of more than $160 billion. The company was one of the earliest major semiconductor companies but its fall from grace has been noted by the company’s ruined 10 nm node and TSM’s pull ahead. That coordinated with other items such as Apple, one of its largest customers, leaving it.

The company didn’t fall as far back as some others, such as Global Foundries, which no longer works to remain competitive. However, as it invests $10s of billions into catching up with its 4 nodes in 5 years target, the question becomes, can it succeed.

Intel’s Financial Turnaround

Intel has recently announced that the company is trending above its guidance for Q3. That statement helped the company’s share price and showed that it’s on an uptrend.

The company was once a low value company, as concerns about its long-term cash flow, gave it a P/E of ~10. A downtrend in the market dropped the company’s margins. In a high-fixed-cost environment, a small drop in margins resulted in a much larger drop in profits and the company’s positioning.

The company’s second quarter results above highlight that effect. The company’s revenue dropped 15% YoY, which caused margins to drop 5% YoY as fixed costs were less spread out. The net result, the company’s EPS dropped by a massive 54% YoY. It’s worth noting that a year ago wasn’t peak strength for the company either.

On the flip side, it means a recovery can happen much faster. Only a small recovery in revenue leads to a much faster recovery in earnings. The company expects revenue for the 3Q to be down only 13% YoY, but more importantly, it expects margins to recovery back towards 43%. leading to a recovery in EPS to $0.20 / quarter.

Still not where we want to see it at but a strong recovery.

Intel’s 4 Nodes In 5 Years

The crux of Intel’s ability to succeed depends on whether it can accomplish its plan to achieve 4 nodes in 5 years.

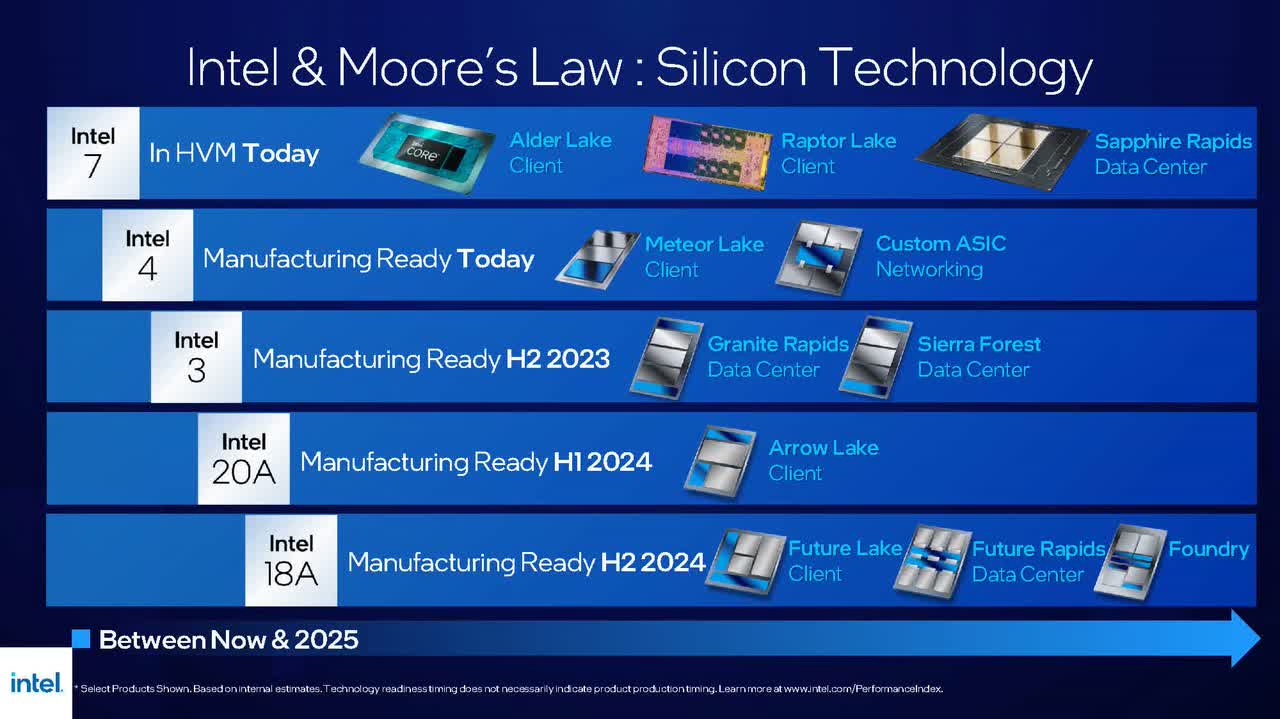

The company’s target is to hit 4 nodes in 5 years, potentially the most aggressive targets in the history of silicon manufacturing. The company’s goal is to hit 18A by the end of next year, and Intel 3 by the end of the year. This benchmark is manufacturing ready, so there’s a delay for the chips to be sent on customers.

Intel 3 is a strong improvement in terms of the company getting closer to parity with TSMC but 20A is when the company truly becomes on parity with TSMC. That’s something worth paying close attention too.

Intel – What To Pay Attention To

For Intel there’s really only one thing to pay attention to. As much as it might sound like a big deal, it’s actually quite simple.

The thing to pay attention to is: does the company meet its targets? The company’s targets are cautious in that the company puts its targets as manufacturing ready instead of actually shipping it to consumers. Some weakness in manufacturing might result in processors only showing up for laptops.

For example, the company hasn’t yet said why Meteor Lake isn’t coming to Desktops. Next year is the singular big year. Can the company successfully roll out Intel 3 to consumers and then have a steadfast target on customers receiving high volume Intel 20A. Should the company manage to do so, and incorporate it into its foundry business as well, it’ll be back on track.

That helps to indicate Intel’s strength.

Thesis Risk

On the flip side, the risk here is quite clear. If the company doesn’t manage to meet its targets, then not only does its core business struggle, but so too does its idea for a foundry business. Computing is a tough business and it’s tough to remain competitive when your technology doesn’t line up. That’s a continued risk for the company.

Conclusion

Intel has been through an incredibly tough time. The company made the wrong call with EUV and Intel 10nm was a disaster, arguably one of the worst disasters for the company in its history. It entered with a massive amount of strength, strength so strong that it fell behind, but fortunately it wasn’t completely wiped out.

The company is now looking to not only regain that advantage but use its foundries to make a foundry for customers’ businesses. Being able to do that is incredibly important for the company. We think they’ll succeed, but it’s a tough business. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.